Bitcoin and Ethereum price: New higher high

- The price of Bitcoin yesterday formed a new higher high at 32,415 dollars.

- Ethereum continues yesterday’s bearish consolidation after climbing to $ 2,000.

- The U.S. Federal Reserve is beginning to shrink its $ 9 trillion balance sheet that has grown in recent years in a move called quantitative tightening (QT).

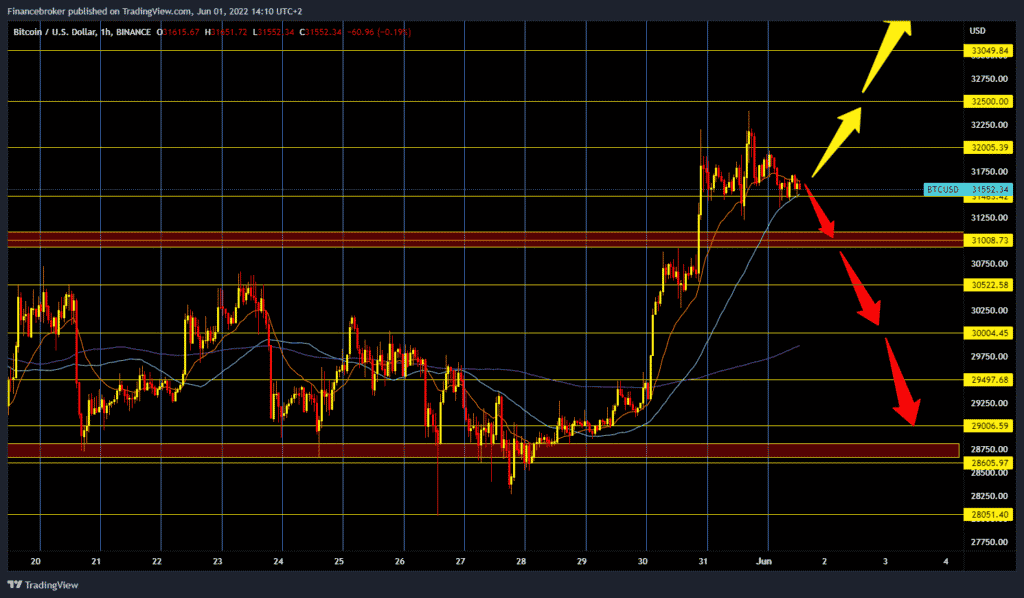

Bitcoin chart analysis

The price of Bitcoin yesterday formed a new higher high at 32,415 dollars. A new pullback quickly followed this to $ 31,450, and we are now consolidating in the $ 31,600 zone. The previous four days were very bullish as the price rose from $ 28,500 to $ 32,415. Today is a day for consolidation and a certain accumulation, and for the price of bitcoin, it is important to stay above the $ 31,000 level.

Additional support at our current level is the MA20 and MA50 moving averages. For the bullish option, we need positive consolidation and a return on prices above $ 32,000. Then, with the continuation of the bullish impulse, the price could continue towards $ 32,500, then the $ 33,000 level. For the bearish option, we need negative consolidation and new support testing at $ 31,000. Break prices below would increase bearish pressure, which would lead to a further drop in prices. First down to $ 30,000 support, and then to the May support zone at $ 29,000 prices.

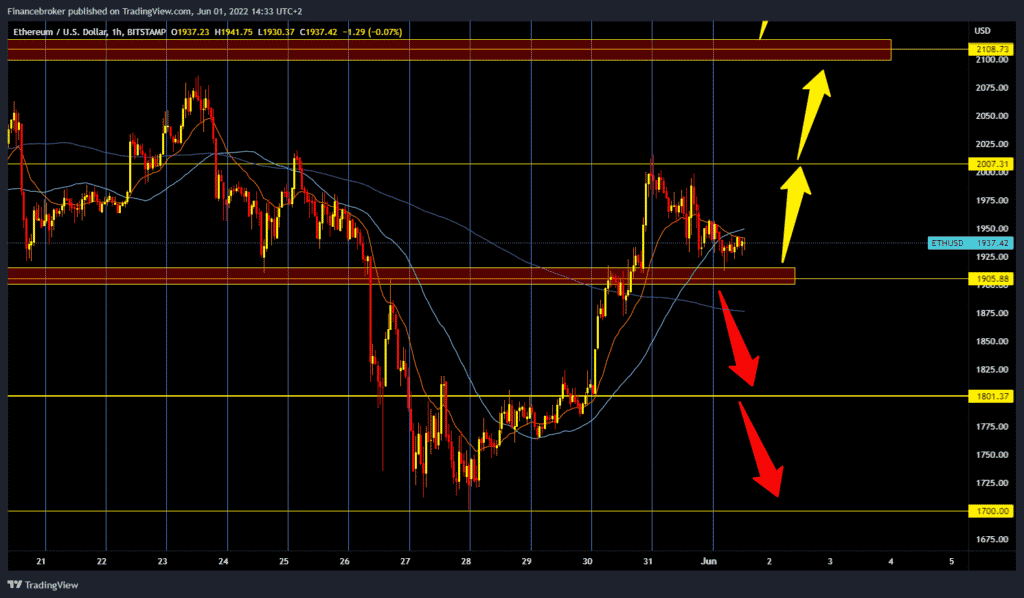

Ethereum chart analysis

Ethereum continues yesterday’s bearish consolidation after climbing to $ 2,000. We are now at $ 1930 and again seek support in the $ 1900 zone. If Ethereum finds support, here again, we could see a new bullish impulse. We need a jump above 1950 dollars and MA20 and MA50 moving averages for the bullish option. After that, the price would rise again to $ 2,000 prices on new resistance testing. The price could continue to a large resistance zone of the $ 2100 level with further positive consolidation. For the bearish option, we need continued negative consolidation and a break below $ 1,900. Potential lower bearish targets are $ 1,875, $ 1,800.

Market overview

The U.S. Federal Reserve is beginning to shrink its $ 9 trillion balance sheet that has grown in recent years in a move called quantitative tightening (QT).

Analysts at the crypto exchange and financial investment firms have conflicting opinions on whether KT, starting Wednesday, will put an end to a decade of unprecedented growth in crypto markets.

Under CE conditions, more money is created and distributed as the Fed adds bonds and other treasury instruments to its balance sheet.

The Fed plans to decrease its balance sheet by $ 47.5 billion a month over the next three months. It plans to cut $ 95 billion in September this year, and the goal is to reduce its balance sheet by $ 7.6 trillion by the end of 2023.