Bitcoin and Ethereum losing ground with increasing bearish pressure

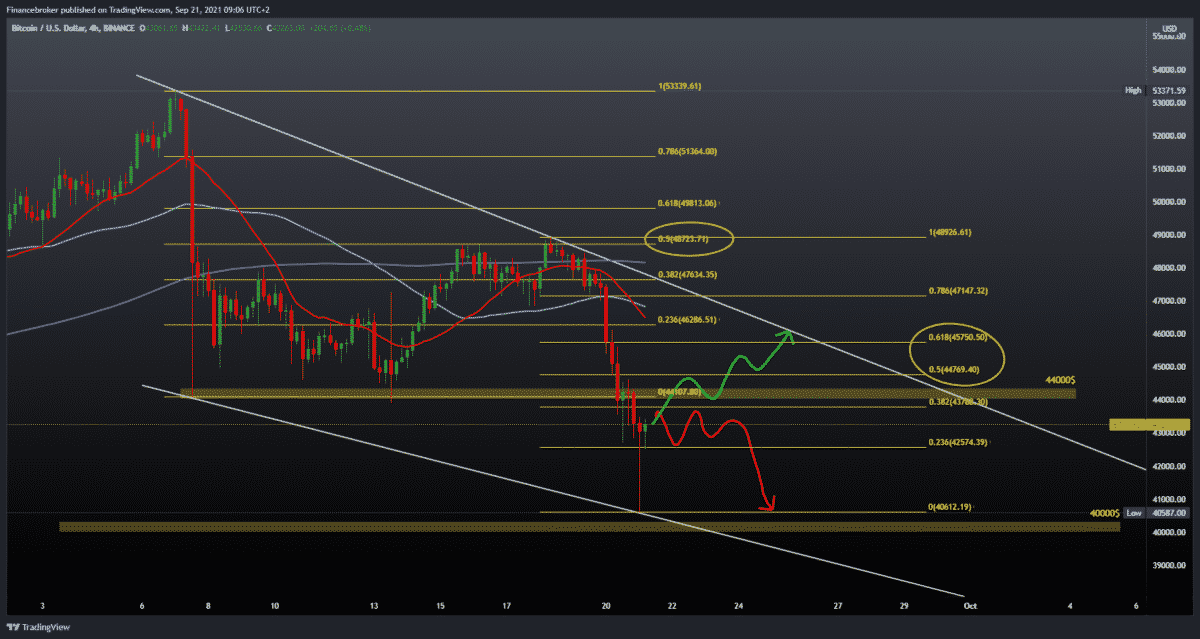

Looking at the four-hour time frame chart, we see that the Bitcoin price this morning tested the zone around $ 40,000, dropping to $ 40,587. After that, the price drops to the current $ 43,100. Bearish pressure continued from yesterday when the price at the beginning of the day was $ 48,000. We need a positive consolidation and break above 38.2% Fibonacci levels 43788% for the bullish scenario. The main target on this time frame is the zone 50.0-61.8% Fibonacci levels in the range of $ 44770-45750. Up above that zone, the next resistance awaits us in the form of a declining trend line, and a break above this resistance line returns us to the bullish trend. To continue the bearish trend, we need to pull the price further and retest the previous low to $ 40587.

Ethereum chart analysis

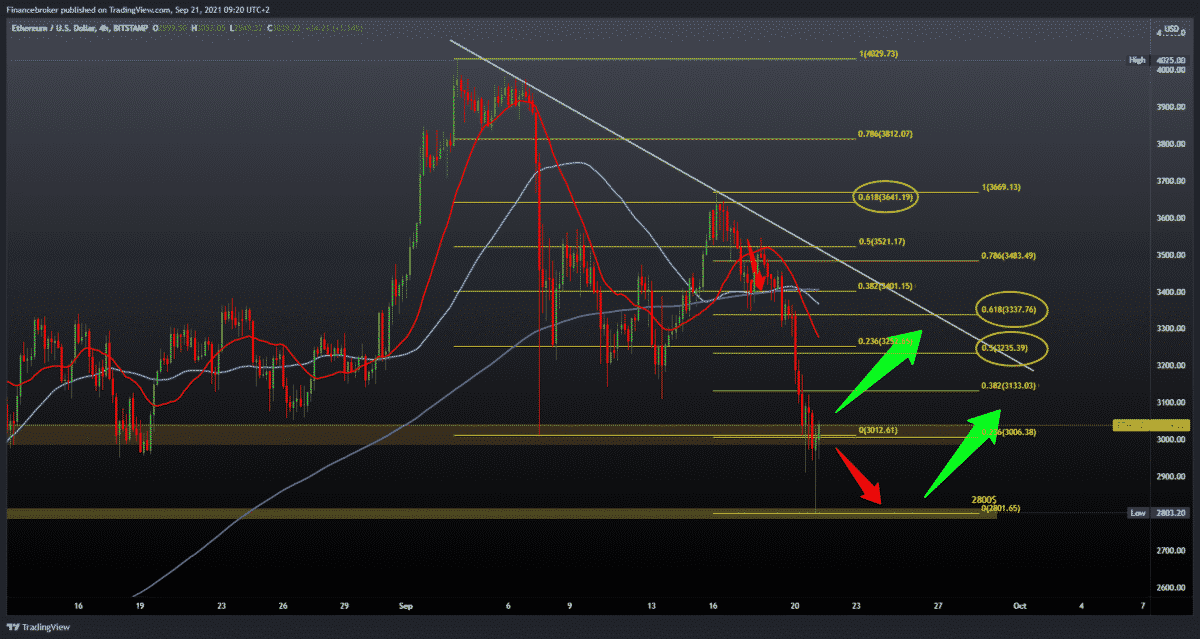

Looking at the chart on the four-hour time frame, we see that the Ethereum price this morning made a new low at $ 2803. After that, we have a price withdrawal to the current $ 3050, and we can expect a further withdrawal in the zone 50.0-61.8% Fibonacci level 3225-3337 $. Above, we need to pay attention to the falling trend line and the zone of moving averages because this can again be an obstacle for us to continue the bullish trend.

Market overview

El Salvador news

Thousands gathered in the capital, El Salvador, for the first major protest against President Najib Bukele when protesters said he had taken on much power, weakening the independence of the judiciary, adding that he could seek re-election.

Some protesters protested against the decision of the Bukele government to make the cryptocurrency bitcoin the legal currency in El Salvador, which became the first country in the world to do so, the AP reported.

Bitcoin news

The bitcoin market is experiencing instability again. The price of bitcoin has dropped significantly in the last 24 hours. Bitcoin is currently trading at $ 42,732 and has lost 9.5 percent of its value. Bitcoin and the larger crypto market had a successful week, and the leading cryptocurrency fluctuated between $ 42,000 and $ 48,000.

At the same time, the index of fear and greed dropped to 27, which indicates that investors are worried.

Approximately $ 1 billion in BTC was liquidated on Monday morning, and more than 1 BTC left the exchange at the same time. Bitcoin recorded net outflows of $ 62 million in August, the fourth consecutive month of net outflows for Bitcoin-based products. This trend changed in the first week of September (starting on August 30), with Bitcoin products recording an inflow of $ 59 million, the largest amount of weekly inflows since the May decline.

Others news

The Boston Bloc Association (BBA) has joined a working group of block-focused firms to publish functional tools that will come in handy as a guide to Massachusetts lawmakers in their efforts to create a favorable regulatory environment for the Commonwealth.

As part of a handbook and recommendations to Massachusetts legislators, the BBA, working with Media Shower and the Digital Commerce Chamber, proposes several legislative principles, proposals, and concepts that will create an enabling environment for blockchain innovation to thrive. In addition, the team proposes five specific legislative recommendations, such as the establishment of a State Working Group on Blockchains, the creation of legal or regulatory sandboxes, and the standardization of tax liabilities.

Cryptocurrency regulation in the United States takes many forms. While Wyoming, New York, and Texas are at the forefront of advocating for valid cryptocurrency regulations, other states are beginning to make remarkable progress. The embrace of Blockchain and its sub-technologies, including Bitcoin, Non-Fungible Tokens (NFT), and Decentralized Finance (DeFi), are now becoming part of American evolution as many seek to find the future of money and finance in general.

Ejecting regulations is the right path, a noise that many in the digital currency ecosystem have been repeating for years. Federal agencies, with the Securities and Exchange Commission and the Commodity Futures Trading Commission (CFTC), also define the rules governing the digital currency ecosystem. Stacking led to the loss of developers and crypto investors. The impact of this lack of clarity in regulation has been particularly driven by the ripple at the turning point in the legal battle with the SEC over the status of XRP as a security.

Recognizing the potential stalemate in introducing progressive legislation from the top, state regulators are now taking the laws into their own hands. Crypto could be the largest winner, in the long run, if state legislators consider the content of the proposal supported by the BBA.

-

Support

-

Platform

-

Spread

-

Trading Instrument