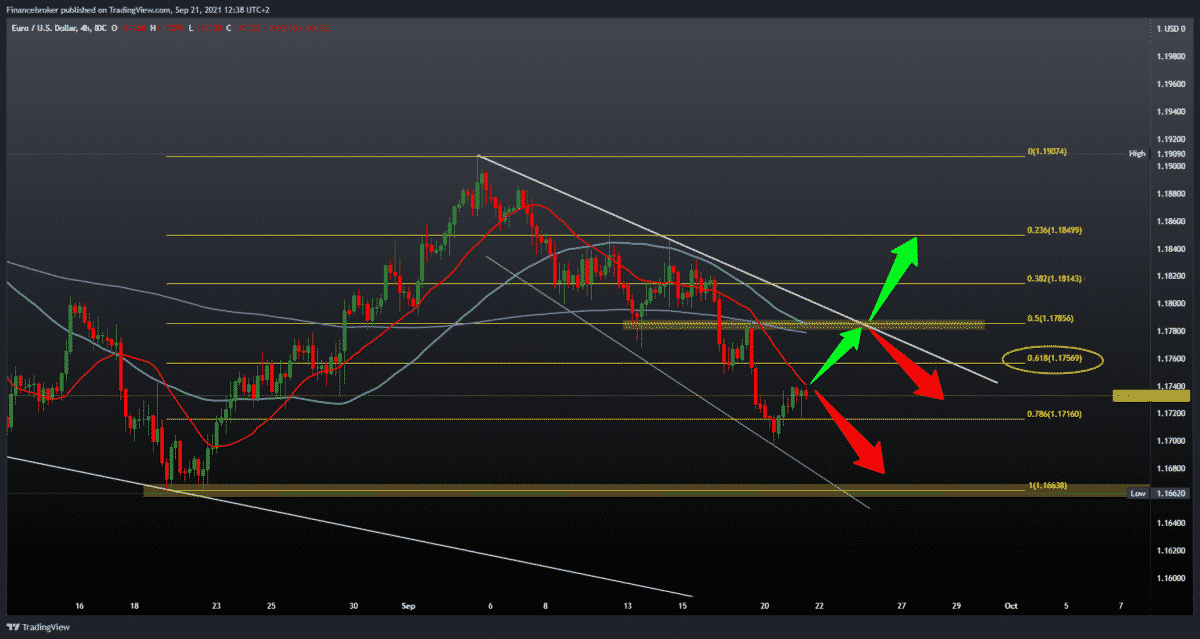

EURUSD and GBPUSD still trying to reduce losses

Looking at the chart on the four-hour time frame, we see that the EURUSD pair found support at 1.17000 and climbed to the MA20 moving average at the current 1.17330. For further continuation, we need a break above this resistance and 61.8% Fibonacci level at 1.17570; after that, higher resistance awaits us in the zone at 50.0% Fibonacci level at 1.17860. The above additional resistance is created by the upper trend line, MA50 and MA200 moving averages, redirecting the pair to the bearish scenario. Then again, we will test the previous low at 1.17000.

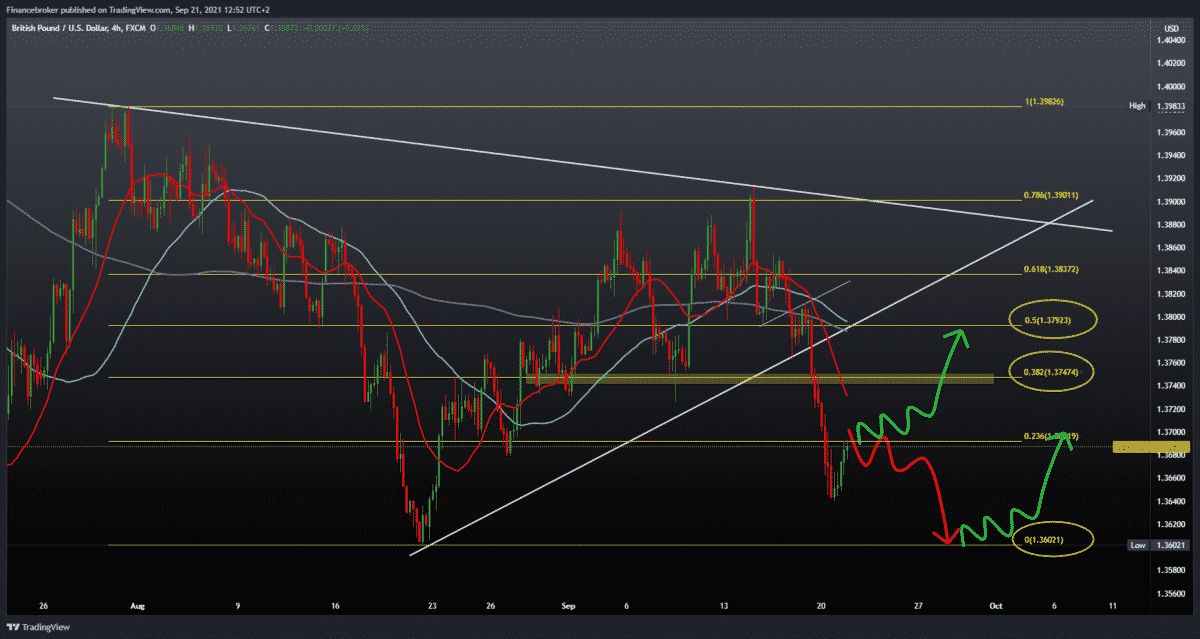

GBPUSD chart analysis

Looking at the chart on the four-hour time frame, we see that the GBPUSD pair dropped to 1.36400 yesterday, and after that, we have the current pullback to the current 1.36816. We are now testing the 23.6% Fibonacci level at 1.37000, and to continue on the bullish side, we need a break above, and only after that is there a chance that we will climb to the next 38.2% Fibonacci level at 1.37500. What we can still notice is that the concentration of moving averages in the zone is around 50.0% Fibonacci level at 1.37920.

Market overview

The UK budget recorded its second-highest record in August, according to data from the National Statistics Office on Tuesday.

Excluding public sector banks, net public sector borrowing amounted to GBP 20.5 billion in August 2021. It was the second-largest borrowing in August since the start of monthly records in 1993. However, this was GBP 5.5 billion less than in August 2020.

Central government revenue rose by GBP 5.3 billion in August, while central government expenditure fell by GBP 1 billion compared to last year.

From April to August, borrowing reached GBP 93.8 billion, the second-largest financial borrowing from August to August since the beginning of monthly records in 1993.

With the intention of the Chancellor signaling in her budget on October 27 that the fiscal stimulus seen since the beginning of the pandemic is now firmly at an end.

According to a survey released by the Confederation of British Industry on Tuesday, production records in the UK set the highest record in September.

The order book balance rose to 22 percent in September from 18 percent in August, the Industrial Trends Survey revealed. This was the strongest increase in orders since April 1977.

At the same time, the balance of the book of export orders improved to -2 percent, the most since March 2019, from -16 percent in August.

However, production growth slowed for the second month in a row in three months in September. The balance fell to +16 percent from +22 in August. The 25 percent balance expects production growth to accelerate over the next three months.

“Today’s research highlights how, amid various supply challenges, companies are beginning to struggle to meet high demand,” said the CBI’s deputy chief economist. Although nearly half of the surveyed manufacturers reported order books above average, production growth slowed down sharply.

Switzerland’s exports fell in August after rising in the previous month, data from the Federal Customs Administration showed on Tuesday.

Exports fell by a real 0.4 percent on a monthly basis in August, after rising 1.1 percent in July.

Imports grew 0.2 percent per month in August, after an increase of 1.0 percent in the previous month.

-

Support

-

Platform

-

Spread

-

Trading Instrument