Battle World Token (BWO) Plummeted Today. Will It Rebound?

In the last 24 hours, the Battle World token (BWO) experienced a significant price decline, dropping by 29.07%. It’s currently trading at $0.03985. However, this downturn comes after a notable 25.38% increase in price over the past week. Such fluctuations highlight the dynamic and unpredictable nature of the cryptocurrency markets.

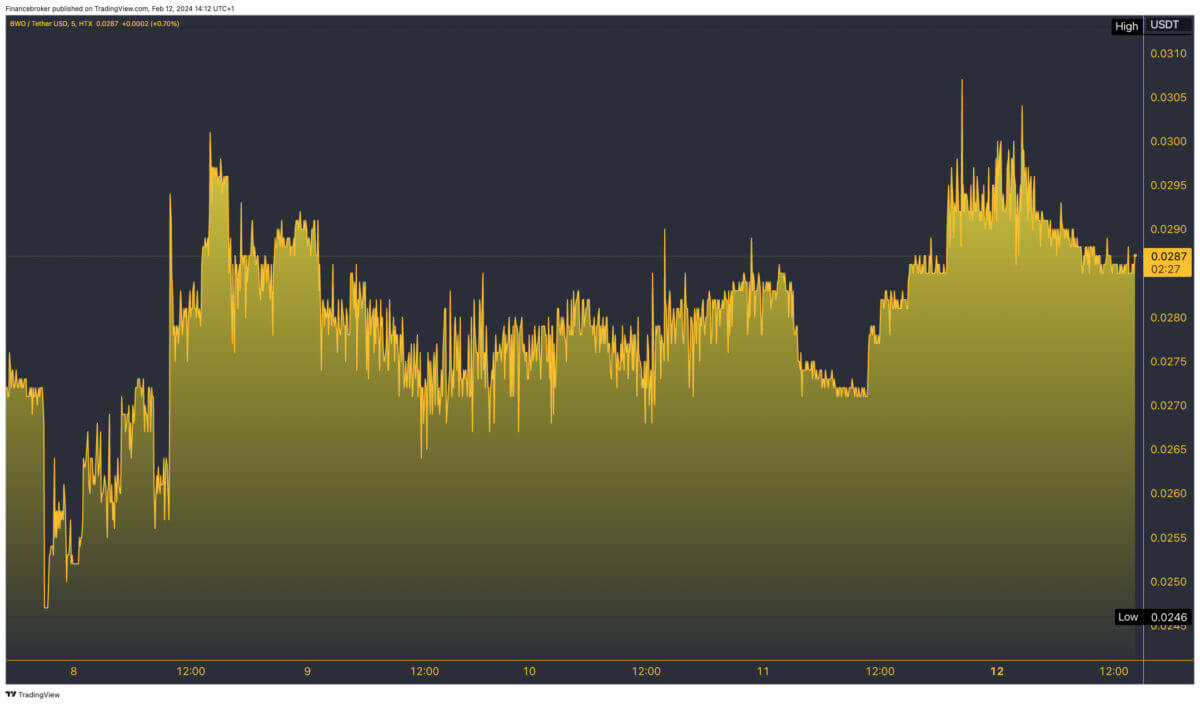

Recent Price Movements of BWO

Battle World’s price saw a wide range in the past 24 hours, moving between $0.03618 and $0.05686. Despite the recent dip, BWO’s market capitalization stands at $24,185,021, ranking it #879 among cryptocurrencies.

Moreover, the circulating supply of BWO is approximately 588.98 million tokens out of a total and max supply of 1 billion tokens. The 24-hour trading volume of $878,628 suggests a healthy level of activity despite the price decline. This activity level indicates that investors are actively engaging with the token. They either adjust their holdings in response to the market or attempt to capitalize on the volatility.

BWO’s Performance in Context

When considering BWO’s performance, it’s essential to look at its recent highs and lows. The token reached an all-time high of $0.9814 about a year ago but has decreased by 95.83% from that peak. Conversely, it reached an all-time low five days ago at $0.02498, showing a swift recovery of 63.96% from its current price. These figures demonstrate the token’s potential for rapid changes in value, offering both risk and opportunity for traders and investors.

The token is most actively trading on centralized exchanges like Coinone, with the BWO/KRW pair showing significant volume. This liquidity is crucial for investors looking to enter or exit positions in BWO. Moreover, the recent performance of BWO, outperforming the global cryptocurrency market and its peers within the Polygon Ecosystem, suggests a bullish sentiment among its investors despite the broader market’s challenges.

Broader Market Trends and Economic Indicators

Broader economic indicators and events often influence the cryptocurrency market’s movements. Upcoming reports on core CPI, retail sales, and PPI in the United States could impact investor sentiment across financial markets, including cryptocurrencies. As crypto markets hover around a total capitalization of $1.9 trillion, traders will closely watch the indicators of inflation and consumer spending for their potential impact on investment strategies.

While BWO has faced a significant downturn, its recovery over the past week and the active trading volume signal a resilient interest among its investors. As with any investment, particularly in the volatile crypto market, individuals should conduct thorough research and consider their risk tolerance before making decisions. The upcoming week’s economic events and their impacts on the broader financial markets will be critical for investors to monitor, offering insights that could influence the cryptocurrency market’s direction.