AUD/USD analysis for April 2, 2021

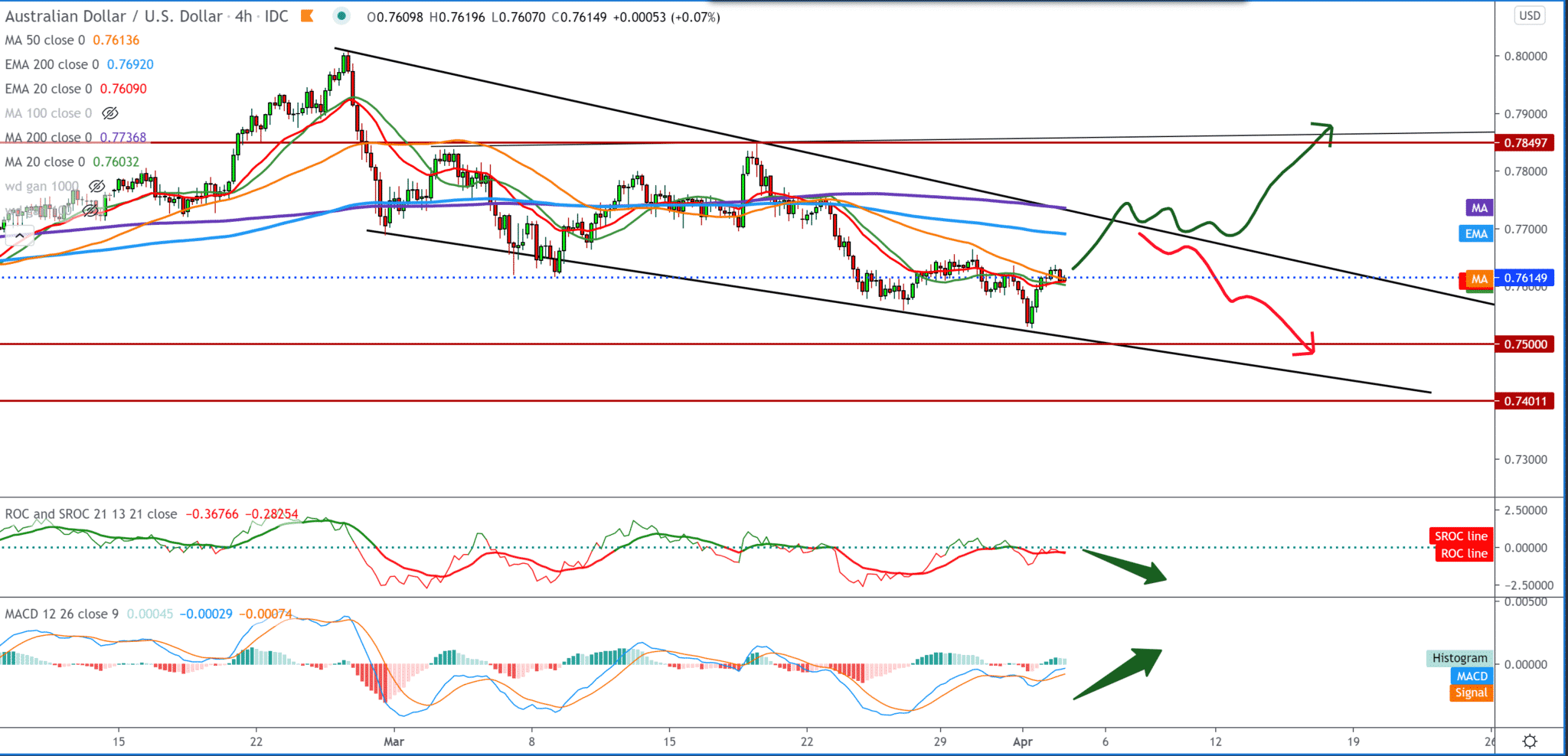

Following the chart in the four-hour time frame, we see that the AUD/USD pair currently finds support in the moving averages MA20, EMA20, and MA50. If the AUD holds up, we can expect it to climb to 0.77000 between the EMA200 and MA200 and the upper resistance line. The break above that line leads us to the previous high at 0.78500, expecting the next resistance.

Otherwise, if we see rejection, we go back down to test the psychological level again at 0.75000. If we look at the MACD indicator, we see that ar has crossed above zero and that the blue line has crossed over the signal line. It also gives us a signal that a bullish trend is possible to continue.

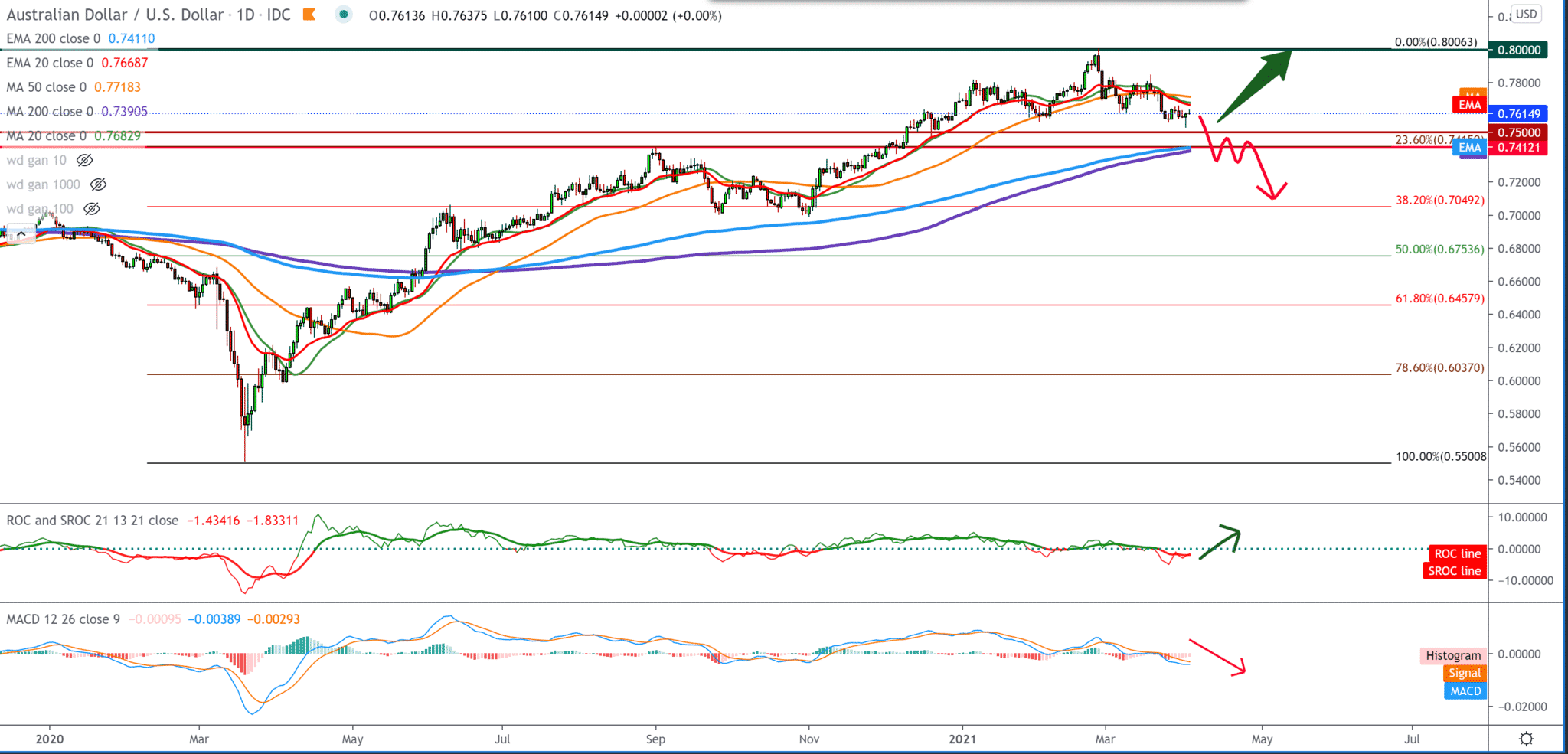

On the daily time frame, we see that the AUD/USD pair encounters support slightly above 0.75000 but that the upper side is still under pressure from moving averages MA20, EMA20 that have dropped below MA50. When we set the Fibonacci retracement level, we see that it is very likely that the AUD/USD pair will drop to 23.6% Fibonacci level where the support of MA200 and EMA200 is waiting for us. For the bullish scenario, we need a break above the moving averages again to look at 0.8000, otherwise, for a stronger bearish scenario, we need a break below MA and 23.6% Fibonacci levels, and then we look towards 0.7000.

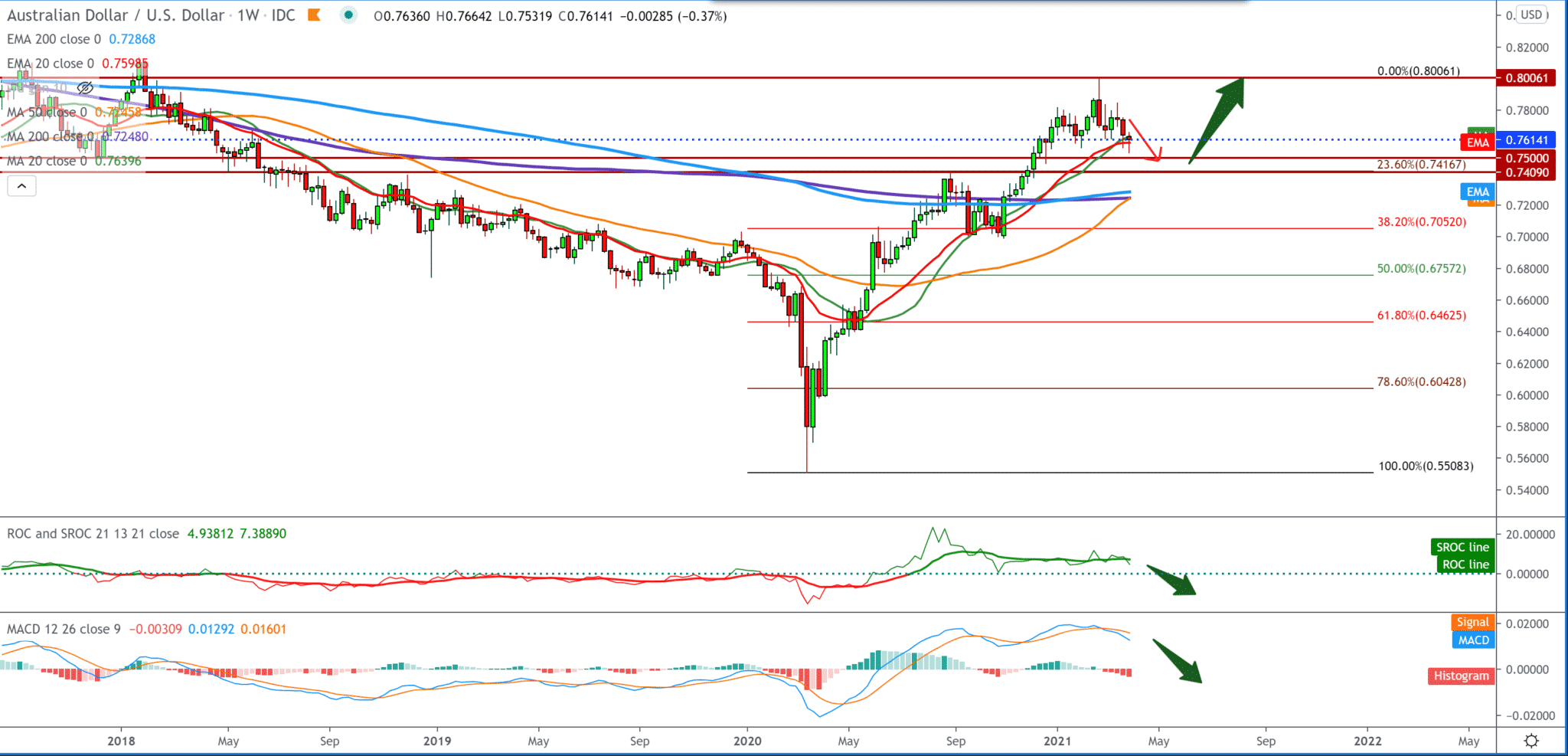

At the weekly time frame, the AUD/USD pair tests moving averages of MA20 and EMA20 with a higher probability of going down even before looking for better support on the chart. And we can find it on the Fibonacci 23.6% level, where the support of MA200 and EMA200 is waiting for us. Looking at the MACD indicator, it is as if the bearish scenario is beginning, and we will see a deeper pull on the chart below 0.75000, maybe up to 0.72000.

-

Support

-

Platform

-

Spread

-

Trading Instrument