AUD / NZD analysis for April 2, 2021

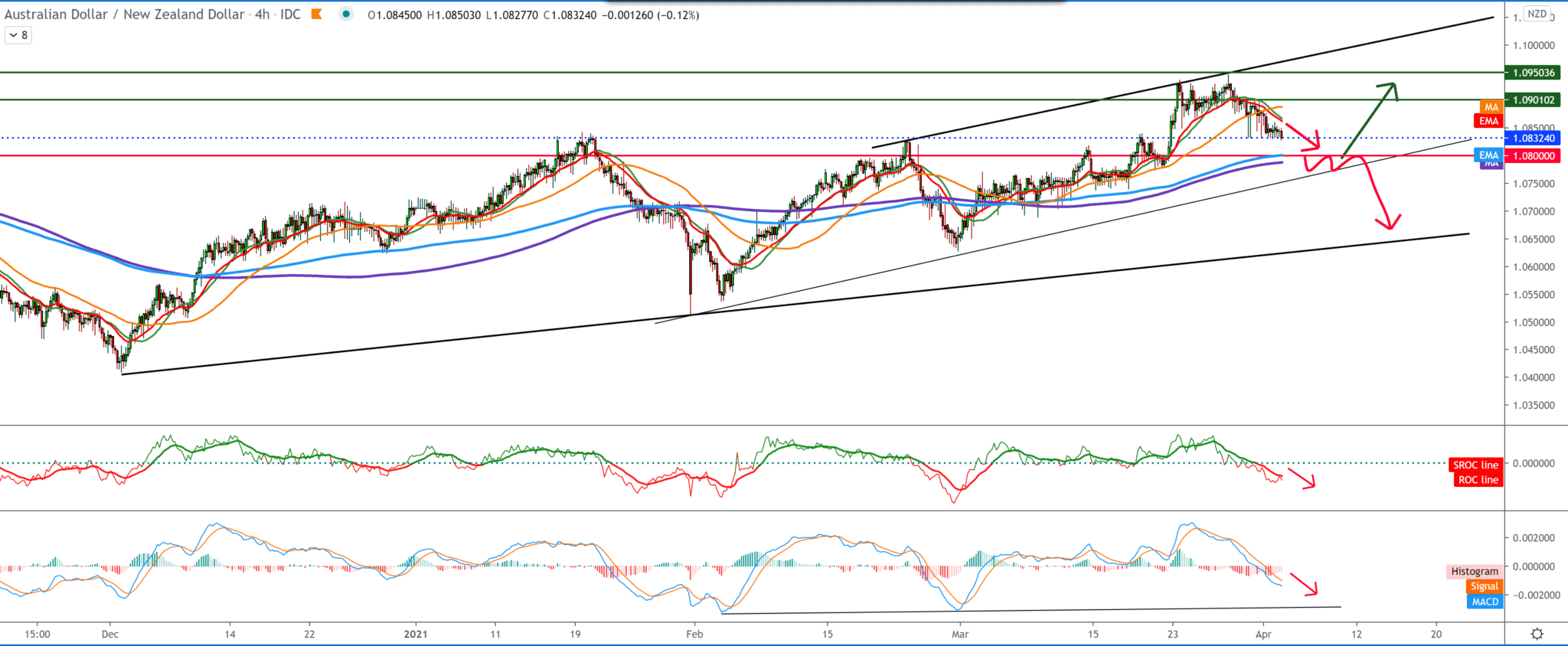

Looking at the chart on the four-hour time frame, we see that the AUD/NZD pair failed to hold around 1.10000 and then make a pullback. The moving averages of the MA20, EMA20, and MA50 are now on the bearish side, directing the AUD/NZD pair towards the MA200 and EMA200 at 1.08000. T we can ask for support for a new bullish momentum and re-target at 1.10000. on the chart, we can draw the lines of resistance and support to make it easier for us in which frame the AUD/NZD pair is moving.

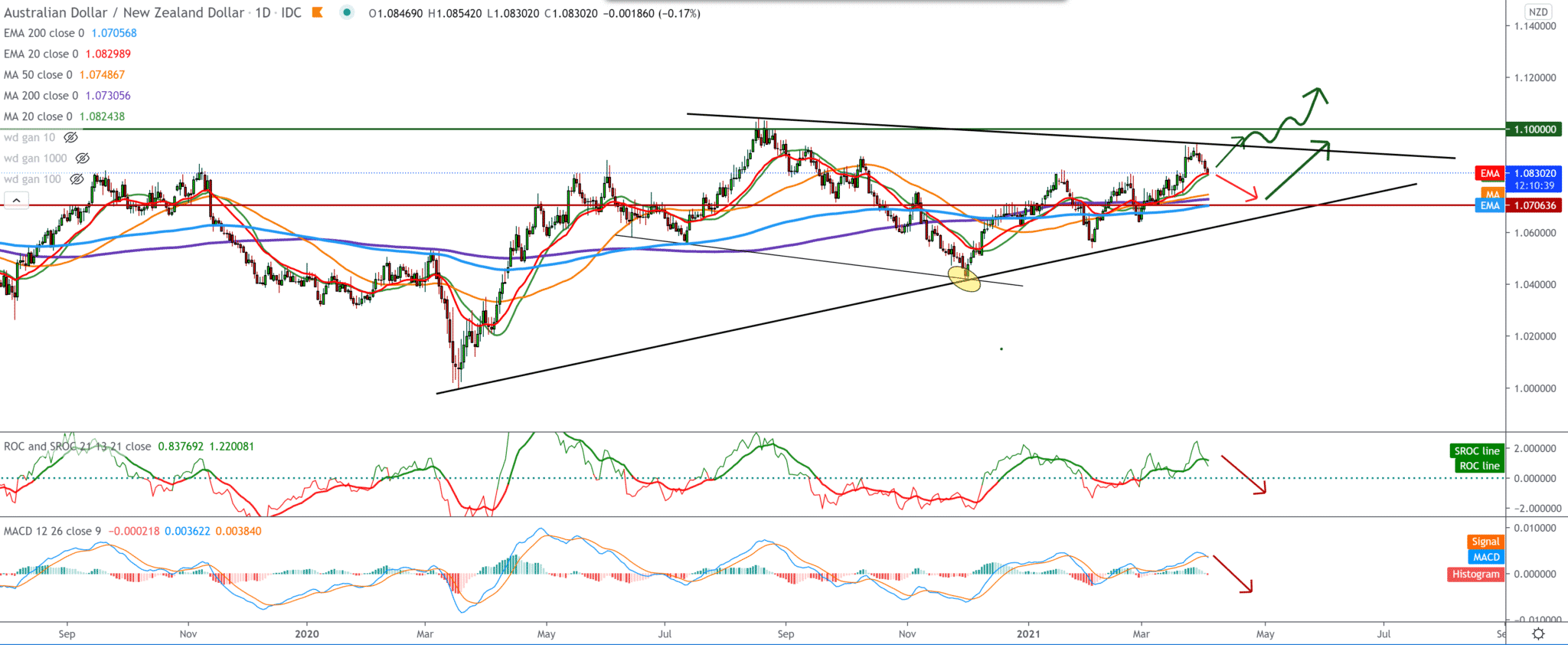

On the daily time frame, we see a halfway to moving averages MA20 and EMA20, where we can expect some resistance. The break below leads us to the zone around 1.07000 and moving averages MA200 and EMA200. We can still notice that when we set the upper and lower trend line, the AUD/NZD pair is directed to the corner of the triangle, and the room for maneuver is getting smaller, which means that we will soon see a bigger shift on the chart. Bearish is currently in effect until we see better support and a change in the chart’s image.

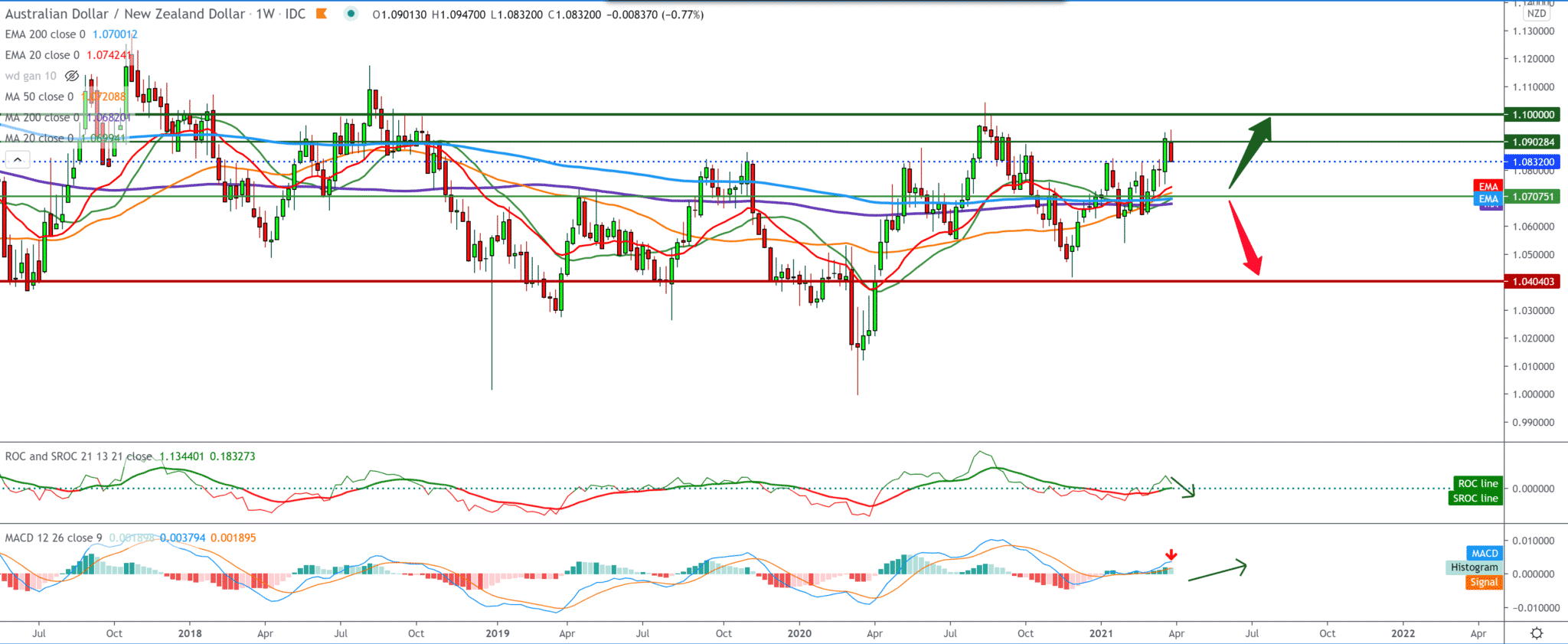

On the weekly time frame, we can notice that the AUD/NZD pair is still moving sideways in a certain range. Even moving averages are so clustered around the middle of this consolidation and sideways movement that they do not give any clearer picture of the trend’s potential direction. Based on this latest candlestick, we can conclude that next week we will see the bearish trend’s continuation at least up to 1.07000 support around moving averages.

Today is a holiday in Australia and New Zealand, so we have no economic news from that market.

-

Support

-

Platform

-

Spread

-

Trading Instrument