AERO’s 437% Surge: Decoding Crypto Market Impact

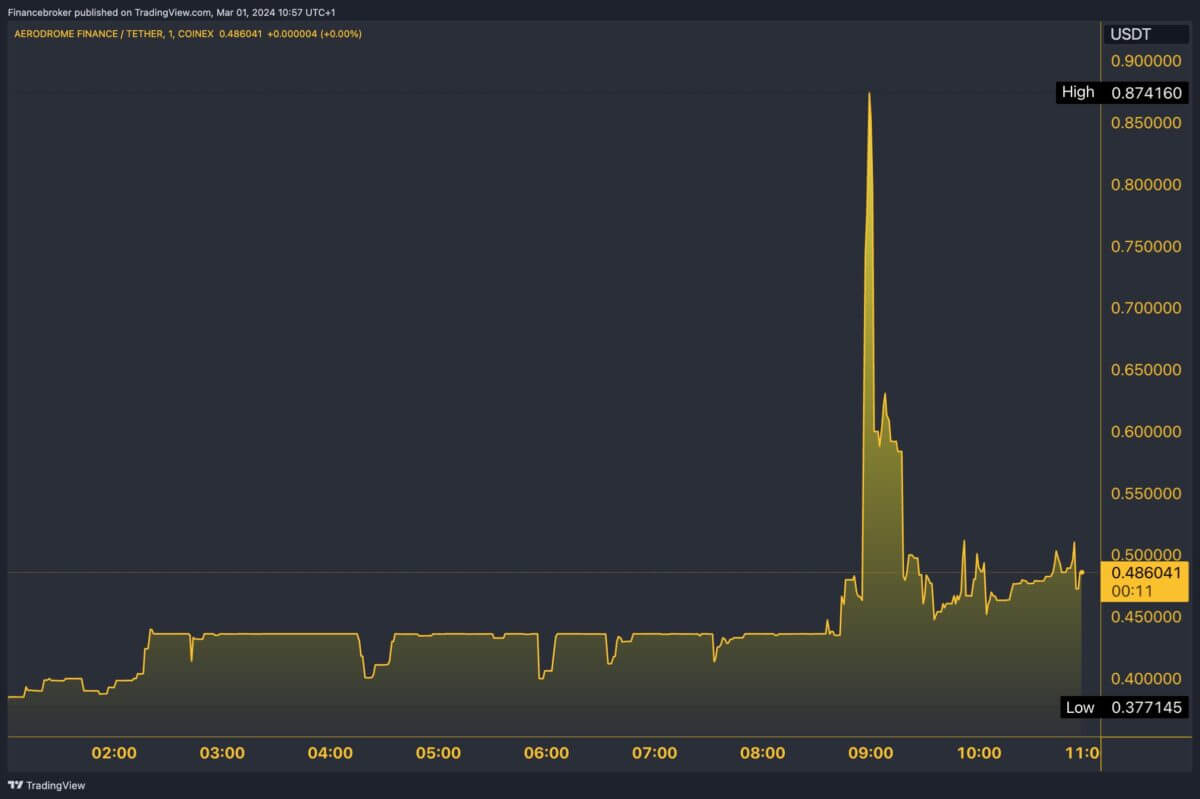

The Aerodrome Finance (AERO) token is currently rallying. Today, the digital currency has hit $0.4724, jumping by a substantial 56.84% in the past 24 hours. Overall, it has gained a staggering 437.08% over the last seven days. This surge has elevated its market capitalization to $75,578,232, highlighting its growing appeal in the cryptocurrency ecosystem.

Crypto Market Hits $2.4 Trillion: AERO Leads

The global cryptocurrency market capitalization has surged to $2.4 trillion, indicating the sector’s robust expansion and investor enthusiasm. Despite AERO’s trading volume witnessing a 16.60% dip, its market performance starkly contrasts with the average global market growth of 17.80%. This positions AERO as a standout performer, especially within the Base Ecosystem of cryptocurrencies.

The Token’s Journey: From $0.00001861 to $0.4777

The journey of the Aerodrome Finance token from its all-time low of $0.00001861 to the recent peak of $0.4777 demonstrates dramatic growth and resilience. Such an astronomical rise from its inception points to the volatile yet potentially rewarding nature of cryptocurrency investments. Furthermore, the platform’s ability to navigate through recent challenges, such as the DNS attack, showcases its security measures and operational resilience. These are vital factors for sustaining investor trust.

Aerodrome Finance’s Future: Navigating Volatility

The recent price surge in AERO can be attributed to several factors, including investor behaviour, market sentiment, and the underlying value propositions of the Aerodrome Finance platform. The decrease in trading volume juxtaposed with the price increase could signify a consolidation phase or a buildup to a more significant market movement, often observed in cryptocurrencies undergoing rapid valuation changes.

Predicting the future trajectory of AERO requires careful consideration of current momentum, market conditions, and technological advancements within the platform. The token has the potential for further growth. However, the volatile nature of the market demands cautious optimism, as external factors like regulatory changes or market sentiment shifts could impact future valuations.

AERO vs. Giants: Risk-Reward Analysis

While BTC, ETH, and SOL have established robust market presences, AERO’s recent surge points to its growing niche. Despite the significant difference in market capitalization, AERO’s exceptional 437.08% weekly increase contrasts sharply with the more stable, incremental gains typically seen in established cryptocurrencies like Bitcoin.

Today, as Bitcoin maintains a steady trajectory, AERO’s dramatic rise suggests it offers a unique, albeit higher, risk-reward opportunity for investors exploring beyond traditional market leaders.

The Project’s Strategy: Regulatory Compliance

Understanding and navigating the evolving regulatory landscape is essential for AERO to maintain its upward trajectory and market relevance. This involves several strategic considerations:

- Proactive Compliance: By staying ahead of regulatory changes and ensuring compliance, AERO can mitigate risks associated with legal non-compliance. Proactive measures, such as engaging with regulatory bodies, can facilitate smoother operations and foster positive relations with authorities.

- Adaptive Business Models: As regulations evolve, so too must AERO’s business strategies. Adapting to legal requirements without compromising the platform’s core functionalities will be key to sustaining growth and user engagement. This could include revising transaction protocols, enhancing security measures, or modifying governance structures in response to legal mandates.

- Community and Stakeholder Engagement: Building a strong community around this token can provide resilience against regulatory headwinds. Engaging with stakeholders can also help in shaping a favorable regulatory environment and in crafting informed, community-backed responses to legal challenges.

- Global Perspective with Local Action: Given the international nature of cryptocurrencies, adopting a global perspective while implementing localized strategies can also be effective.

AERO’s Outlook: Beyond Current Trends

The remarkable ascent of Aerodrome Finance (AERO) reflects broader market dynamics and investor sentiment within the cryptocurrency space. Its resilience in the face of challenges and rapid price increases underscores the potential of emerging DeFi platforms. However, as with any investment, particularly in the volatile crypto market, due diligence and cautious analysis are paramount. Investors should stay informed about regulatory developments, market trends, and the technological evolution of platforms like AERO to make informed decisions. The future of AERO, while promising, hinges on its ability to adapt, innovate, and navigate the intricate landscape of global cryptocurrency regulations and market forces.