What Is an Abandoned Baby Candlestick?

The Abandoned Baby candlestick pattern is a powerful tool in technical analysis, signaling potential trend reversals in financial markets. This pattern is particularly useful for traders seeking to identify lucrative entry and exit points in downtrends.

Key takeaways

- The Abandoned Baby candlestick pattern is a reversal Japanese candlestick pattern.

- It consists of three candles.

- There are two types of Abandoned Baby candlestick patterns.

In this extensive guide, we will delve deep into the Abandoned Baby candlestick pattern, exploring its characteristics, components, trading strategies, and the crucial role it plays in understanding market psychology.

Understanding the Abandoned Baby candlestick pattern

The Abandoned Baby candlestick pattern is a reversal Japanese candlestick pattern that signifies a shift in market sentiment from bearish to bullish or vice versa. It typically appears after a sustained downtrend, and its formation consists of three distinct candles.

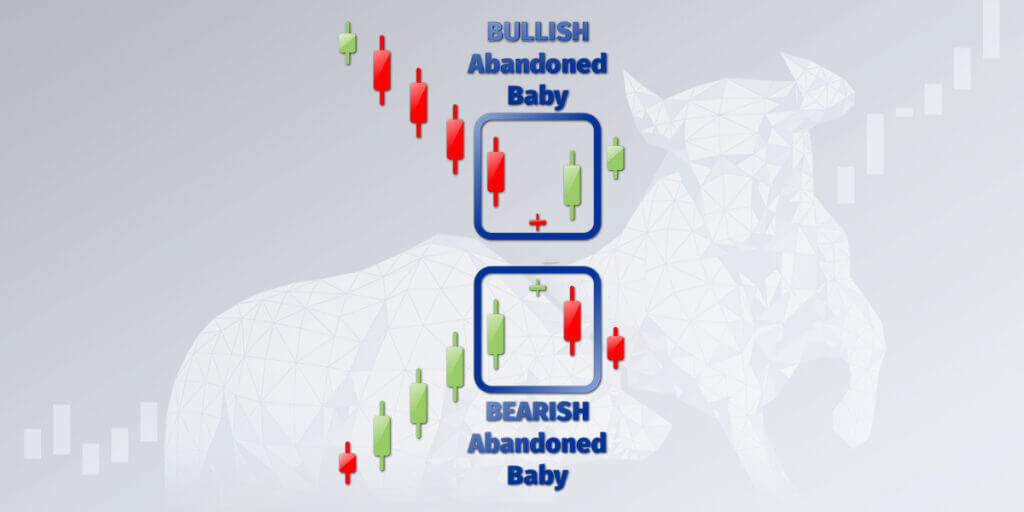

Bullish Abandoned Baby: This variant of the pattern occurs at the end of a downtrend and suggests a potential reversal to an uptrend.

Bearish Abandoned Baby: Conversely, the bearish version of the pattern appears at the end of an uptrend and signals a potential reversal to a downtrend.

Let’s break down the key components of each type of Abandoned Baby candlestick pattern:

Bullish Abandoned Baby candlestick pattern:

First candle: The pattern starts with a large black or red candlestick, representing a strong bearish sentiment in the market.

Second candle (doji): Following the bearish candle, a doji candle appears. A doji has a small body and indicates market indecision, with opening and closing prices nearly identical. Importantly, this doji must gap below the close of the first candle.

Third candle: The pattern concludes with a white or green candle that opens above the doji’s level. This bullish candle reflects a shift in sentiment from bearish to bullish, potentially marking the start of an uptrend.

Bearish Abandoned Baby Candlestick Pattern:

First candle: In this case, the pattern begins with a large white or green candlestick, signifying a strong uptrend.

Second candle (doji): Following the bullish candle, a doji candle appears, but this time it gaps above the close of the first candle. The doji represents indecision and potential trend reversal.

Third candle: The pattern concludes with a black or red candle that opens below the doji’s level. This bearish candle indicates a shift in sentiment from bullish to bearish, potentially initiating a downtrend.

Trading the Abandoned Baby candlestick pattern

Trading strategies involving the Abandoned Baby candlestick pattern require careful consideration of entry and exit points, as well as risk management techniques like stop-loss orders and profit targets. Let’s explore a step-by-step approach to trading this pattern:

Pattern recognition: The first step is identifying a potential Abandoned Baby pattern on your price charts. Ensure that all the criteria for either the bullish or bearish variant are met, including the presence of clear gaps between candles.

Confirmation: While the Abandoned Baby pattern is a strong signal on its own, it is prudent to seek confirmation from other technical indicators or price action signals before entering a trade. This can provide additional confidence in the potential trend reversal.

Entry point: For bullish Abandoned Baby patterns, consider entering a long position after the formation is confirmed. For bearish Abandoned Baby patterns, consider entering a short position.

Stop-loss order: Implement a stop-loss order to limit potential losses if the trade goes against you. The placement of the stop-loss should be based on your risk tolerance and the specific market conditions.

Profit target: Determine a profit target based on your trading strategy and risk-reward ratio. This target represents the point at which you plan to exit the trade with a profit.

Monitoring the trade: Keep a close eye on the trade as it unfolds. If the price moves in your favor, consider trailing your stop-loss to lock in profits.

Exit strategy: Once the price reaches your profit target or if the trade shows signs of reversing, exit the position. Exiting at the right time is crucial to maximizing gains and minimizing losses.

Market psychology and the Abandoned Baby candlestick pattern

Market psychology plays a significant role in the formation and effectiveness of the Abandoned Baby candlestick pattern. Understanding the underlying emotions and behavior of market participants can provide valuable insights into why this pattern occurs and how traders react to it.

Sentiment shift: The Abandoned Baby pattern captures a sentiment shift in the market. After a prolonged downtrend (for the bullish variant) or uptrend (for the bearish variant), the appearance of the doji signals uncertainty and a potential change in sentiment.

Indecision and reversal: The doji candle in the Abandoned Baby pattern represents indecision among traders. It’s a moment when bears (in a downtrend) or bulls (in an uptrend) are uncertain about the future direction of the market.

Rapid reversal: When the third candle opens in the opposite direction of the preceding trend, it reflects a sudden and often sharp reversal in sentiment. This can be attributed to traders reevaluating their positions and reacting to the change in market dynamics.

Self-fulfilling prophecy: The Abandoned Baby pattern is widely recognized and closely watched by traders. As more market participants identify the pattern, it can become a self-fulfilling prophecy. Traders see it as a strong signal, leading to increased buying (for the bullish variant) or selling (for the bearish variant), further reinforcing the reversal.

Risk management strategies

Risk management strategies are essential for traders and investors to protect their capital and minimize potential losses in the financial markets. Effective risk management helps ensure long-term success and sustainability in trading. Here are some key risk management strategies:

Position sizing: Determine the size of each trade based on your risk tolerance and overall account size. A common rule of thumb is to risk only a small percentage (e.g., 1-2%) of your total trading capital on any single trade. This limits the potential loss on any one trade and ensures you can withstand a series of losses without depleting your account.

Stop-loss orders: Implement stop-loss orders for every trade. A stop-loss is a predetermined price level at which you will exit a trade to limit losses. It acts as a safety net and ensures you don’t let losing trades spiral out of control.

Take-profit orders: Similar to stop-loss orders, take-profit orders are set at predetermined price levels where you will exit a trade to lock in profits. Having a clear profit target helps you avoid the temptation to be overly greedy and hold onto winning trades for too long.

Risk-reward ratio: Assess the potential risk and reward of each trade before entering. Ideally, aim for a risk-reward ratio of at least 1:2, where the potential reward is at least twice the risk. This ensures that your winning trades can offset losses over time.

Diversification: Avoid putting all your capital into a single asset or trading strategy. Diversifying your investments across different assets or markets can spread risk and reduce the impact of a single loss.

Risk tolerance

Understand your risk tolerance and trade within your comfort zone. Don’t take on more risk than you can handle emotionally or financially. Overleveraging or trading with excessive risk can lead to impulsive decisions and substantial losses.

In conclusion, the Abandoned Baby candlestick pattern is a valuable tool in the arsenal of technical analysts and traders. It offers insights into market psychology, capturing shifts in sentiment and potential trend reversals.

When used in conjunction with other technical analysis tools and risk management strategies, the Abandoned Baby pattern can enhance trading decisions and contribute to more successful trading outcomes. However, as with any trading strategy, it’s essential to practice sound risk management and continuously refine your approach to adapt to changing market conditions.