8 Key Elements of a Financial Analysis

If you want to measure your business’s potential for its long-term growth, one of the best indicators is its financial health. Business owners who have knowledge of their financial standing generally have companies with more profits, revenues, and success. As a first step to improve your company’s financial literacy, you must conduct its financial analysis. Specifically, a thorough financial analysis consists of 8 key elements, each having its own set of ratios and data points.

1. Revenue

A business’s revenue is its basic cash source. That is to say that the quality, quantity, and revenue timing can determine the success of a business in the longer run.

- Revenue Growth = (Revenue this Period – Revenue Last Period)/Revenue Last Period

During revenue growth calculation, do not consider one-time revenue as it can alter your analysis.

- Revenue per Employee = Total Revenue/Average number of Employees

This calculation helps you determine your business productivity. The higher the value, the more productive your business is

- Revenue Concentration = Revenue from Client / Total Revenue.

For a customer that contributes more to your revenue, you can face a sudden financial downfall if they cease to buy from you. Hence, no single customer should contribute more than ten percent of your total revenue.

- Revenue per Employee = Revenue / Total Number of Employees

This measures productivity by determining the optimal employees required to run your organization and how much revenue each employee generates.

2. Profit

For your business to run smoothly for a long time, you have to produce optimal profit consistently.

- Gross Profit Margin = (Revenue – Cost of Goods Sold)/Revenue.

A higher GPM means that your business is capable to sustain and pay for expenses even in times of less revenue.

- Operating Profit Margin = (Revenue – Cost of Goods Sold – Operating Expenses) / Revenue

Where interest and tax are not included in operating expenses. OPM measures your business’s ability to

- Net Profit Margin = (Revenue – Cost of Goods Sold – Operating Expenses – All other expenses)/Revenue

Your NPM is the remaining amount that is used for reinvesting into your business and paying dividends to stockholders.

3. Operational Efficiency

Your business’s operational efficiency determines your resource utilization efficiency. Specifically, lesser Operational Efficiency results in weak growth and small profits.

- Accounts Receivables Turnover = Net Credit Sales / Average Accounts Receivable.

ART determines how you are managing the credit given to customers. High ART means that your business is efficiently managing the credit whereas lower ART means you need to improve your credit collection from customers.

- Inventory Turnover = Cost of Goods Sold / Average Inventory.

This analysis determines your efficiency in handling inventory. The higher the better, as a lower number indicates that either you are not able to sell at an optimal level or you are producing more than the demand.

4. Capital Efficiency and Solvency

These are elements of interest for investors and lenders.

- Return on Equity = Net Income / Shareholder’s Equity

RoE measures the returns that investors are getting from you.

- Debt to Equity = Debt/Equity

This generally shows your leverage to operate, which should not exceed more than what is realistic for your business.

5. Liquidity

Analyzing equity helps you determine how much ability your business has to generate cash for covering its expenses. In fact, if liquidity is poor, even higher profits or revenue growth cannot compensate for it.

- Current Ratio = Current Assets / Current Liabilities

Your business’s current ratio determines its ability to pay short-term liabilities from its current assets and cash. A ratio of less than 1 means that you don’t have enough current assets to do this, whereas a ratio of above 2 is a good indication.

- Interest Coverage = Earnings before Interest and Taxes / Interest Expense

This measures a business’s ability to pay interest expense from generated cash. A ratio value of less than 1.5 can be a cause of concern for lenders.

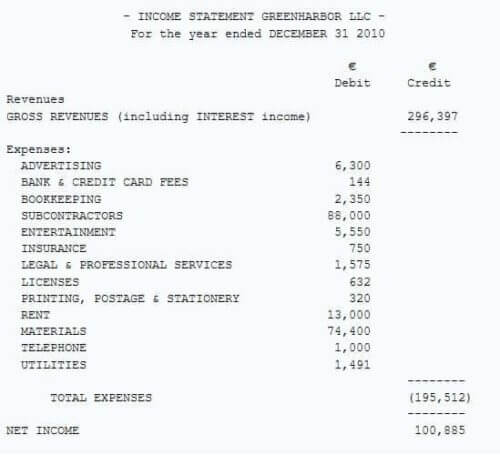

6. Income Statement

An income statement is a company’s financial performance over a time period and indicates a business’s profitability. Particularly, it is a good predictor of its future performance and assesses its capability to generate cash flow in the future. It is also referred to as a Profit and Loss statement, Statement of Earning, or Statement of Operations.

The top of an income statement shows the revenue earned in a given time period and all operating expenses and Cost of Goods Sold whereas, the net income is deduced after accounting for all revenues and expenses.

7. Balance Sheet

A balance sheet shows a company’s assets, liabilities, and owner’s equity at a specific time. It must show that the amount of your assets is equal to your liabilities and equity combined.

Assets = Liabilities + Equity

A balance sheet helps to measure how quickly your inventory is sold and how efficiently you generate revenue. You can deduce the following calculations from a balance sheet.

- Net Working Capital = Current Assets – Current Liabilities

Is the aggregate of your current assets and current liabilities.

- Account Receivable Days = Net Value of Credit Sales / Average Accounts Receivable

Determines how efficiently you use your assets.

- Total Asset Turnover = Sales / Average Total Assets

Calculates your business’s ability to make sales against its assets.

8. Cash Flow Statement

Your cash flow statement shows the total cash that your business generated during a given time period. Specifically, it indicates current liquidity, solvency, and ability of a business to change cash flow in the future.

- Cash from Operations: It indicates all cash flows related to your business operations. These include sales, production, delivery of products, and customer payments along with inventory costs, shipping, advertising, and purchase of materials.

- Cash from Investment: It refers to cash intended to generate over a long period of time by investing money into something.

- Cash from Financing: It refers to cash generated by borrowing, raising business money, or repaying.

These sections of the cash flow statement show the sources of cash and how it is being used. For many investors, cash flow statement is an important indicator of performance for a business. For measuring your cash flow quality and creating an analysis, the following ratios can be calculated.

- Operating Cash Flow to Net Sales = Operating Cash Flow / Net Sales

Determines how much cash is generated against net sales

- Free Cash Flow = Cash from Operations – Capital Expenditure for Current Operations

Free cash flows helps you measure how efficiently your business generates cash.

How will Financial Analysis Help You?

All in all, this was a general overview of what goes into conducting a financial analysis. As a final step of the analysis, you need to create a benchmark to compare your performance against. This should be done for each key element as well as overall financial position of your business.

Firstly, determine your current financial condition with that of your past to see if your performance has improved or worsened. Ideally, the performance of past three years is enough, but if you have access to older data, you can use that too. You can also spot trends by looking at your present and past financial conditions. For instance, if your liquidity has consistently decreased, you can make changes accordingly.

Secondly, compare your analysis with your direct competitors to give you an actual measure of your position in the market. For instance, an annual revenue growth of 10 percent may seem good to you, but if your competitor’s growth is 30 percent, it indicates that you have a weaker performance as compared to your direct competitors.

Finally, consider your contractors. Investors, lenders and key customers often ask for benchmarks of your financial performance. Maintaining your data points and financial ratios in predetermined limits allow third parties to safeguard their interests.

-

Support

-

Platform

-

Spread

-

Trading Instrument