BTC and Eth Falling Channel – Price Prediction

- This morning, the bitcoin price fell below $ 30,000, forming its new May low at $ 29781.

- The price of Ethereum this morning formed a new May low by falling to $ 2,200.

- A record $ 5.6 billion in bitcoin was transferred to centralized exchanges as traders left the market in panic.

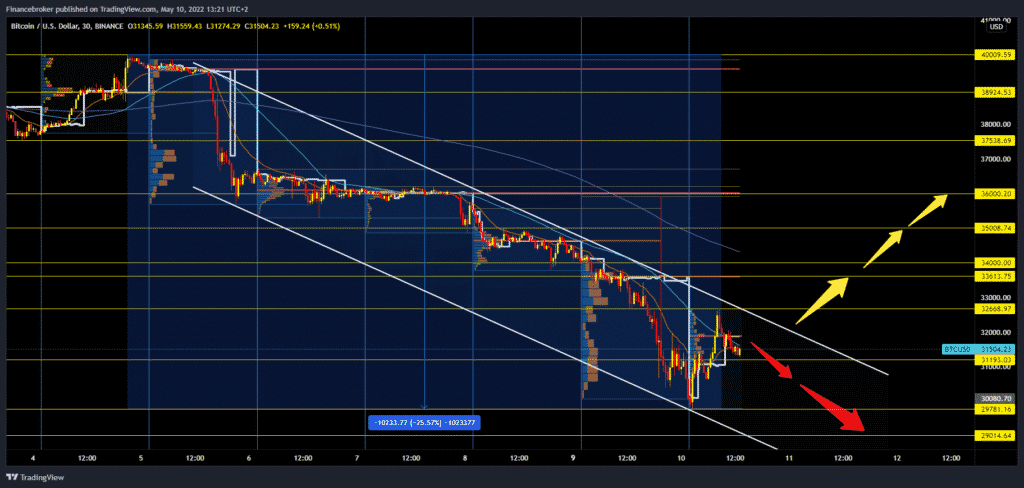

Bitcoin chart analysis

This morning, the bitcoin price fell below $ 30,000, forming its new May low at $ 29781. It consolidated quickly and retreated again above $ 30,000 and climbed to the $ 32,670 level. It was all short of breath as we saw a new pullback and a drop in price to $ 31,360. Bitcoin is still in a falling channel, and as long as it moves inside it, we remain in a bearish trend. For the bullish option, we need to form a new higher low on the chart zone above $ 31,000. After that, the price needs to be broken above the upper line of the canal and the $ 33,000 level. Our first target is yesterday’s $ 33,600-34,000 zone. A break above would increase bullish optimism for the continuation of the potential price correction. Our next targets are a $ 35,000 psychological level, followed by last week’s $ 36,000 consolidation.

Chart:

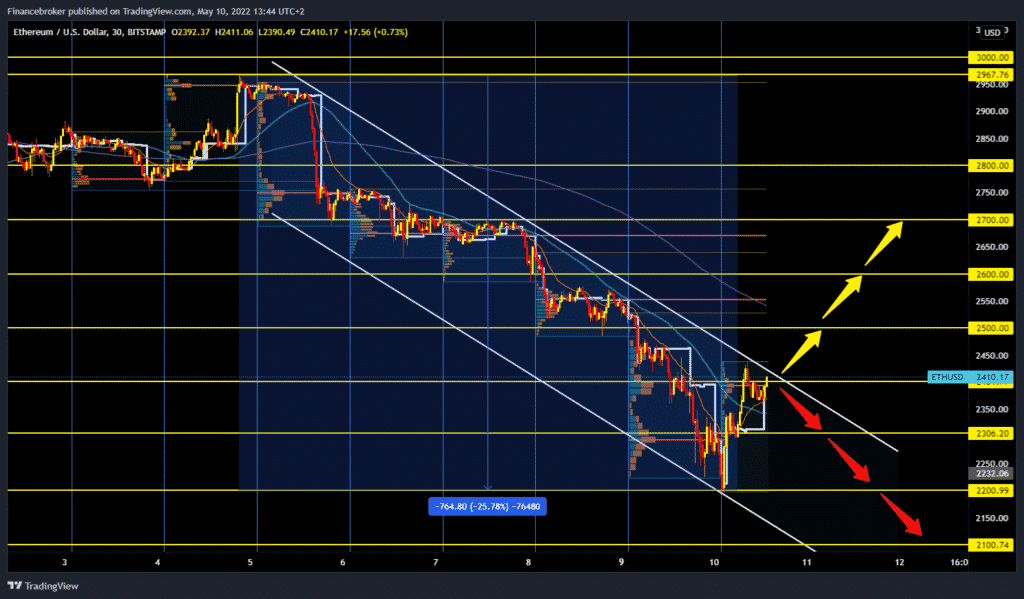

Ethereum chart analysis

The price of Ethereum this morning formed a new May low by falling to $ 2,200. After that, we have a quick withdrawal of up to $ 2450. Ethereum failed to break through the falling channel, but it is very close to doing so. To continue the bullish trend, we need a jump in the price to the $ 2,500 level, at which we expect the next consolidation. The above targets are $ 2550, then the $ 26750-2700 zone. We need continued bearish consolidation and withdrawal below the $ 2,300 price and new testing of the minimum at the $ 2,200 price for the bearish option. Our lower support targets are $ 2,100, then $ 2,000 psychological level.

Market overview

A record $ 5.6 billion in bitcoin was transferred to centralized exchanges as traders left the market in panic.

Cryptocurrency traders achieved the largest inflows of a cryptocurrency exchange in 2022. The crypto market currently fell to the levels of July 2021.

As the provider’s data on the chain suggests, traders transferred $ 5.6 billion in Bitcoin to centralized cryptocurrency exchanges from Glassnode’s watch list. Total market inflows will be significantly higher.

The increased pace of inflows shows the reluctance of retailers and investors to hold digital assets because they want to make a profit or small loss and leave the marketspace. Active sales create a surplus of supply in the market, which leads to a discount and a potential reversal of the trend.

Bitcoin has already experienced a huge jump directly from $ 29,000 to $ 32,000 within a few hours. That shows plenty of resistance above $ 30,000 to $ 40,000 as the correction in the market happened in a few days, which is a speculative sign.