06 May chart overview for Bitcoin and Ethereum

- After the price of Bitcoin rose to the $ 40,000 level yesterday, a sharp drop to the $ 35,677 level soon followed.

- The price of Ethereum is currently at its May low of $ 2,660. As of yesterday afternoon, we have a powerful pullback price with a $ 2975 level.

- Crypto markets lost $ 150 billion as Bitcoin crashed to its lowest point since Russia’s invasion.

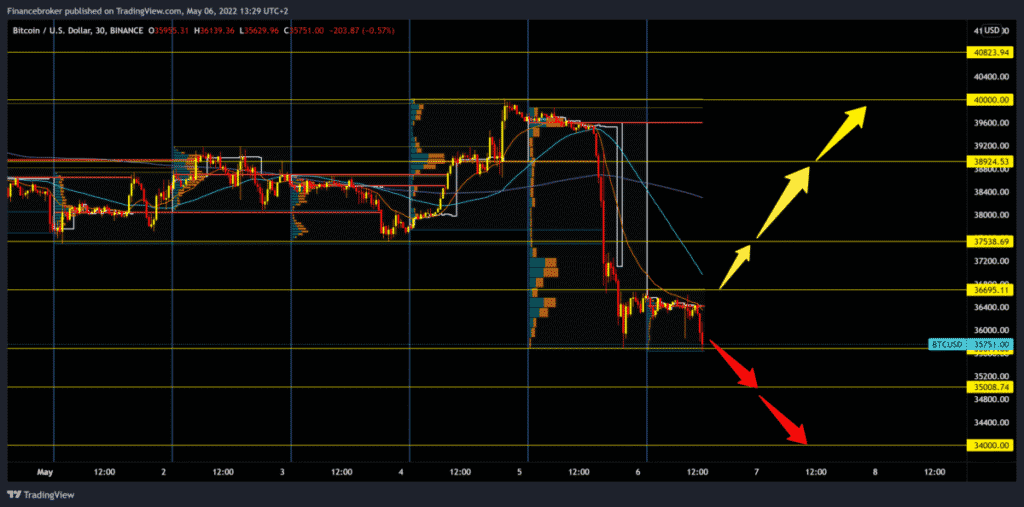

Bitcoin chart analysis

After the price of Bitcoin rose to the $ 40,000 level yesterday, a sharp drop to the $ 35,677 level soon followed. There seemed to be too much pressure on the price to do something more, but she didn’t have the strength to do it. A slight recovery was seen up to the $ 36,700 level, but again we have bearish pressure that has lowered the price once again to the 35820 level, testing the previous lower low. If the support zone does not last, then we can expect a price drop of up to $ 35,000. We need new positive consolidation and growth above the $ 36,700 level for the bullish option. after that, we can expect further recovery towards previous higher levels. first a $ 37540 level, then a $ 39,600 and a $ 40,000 psychological level.

Chart:

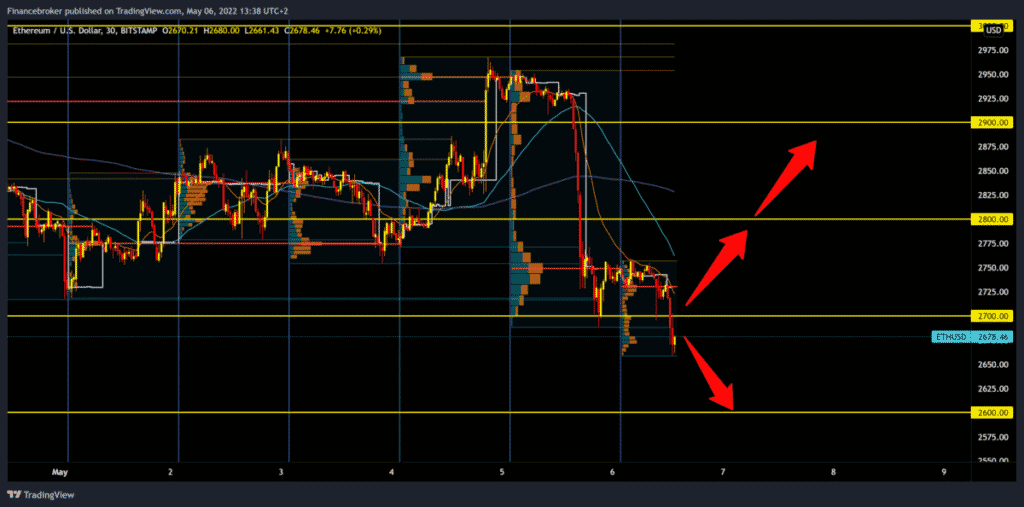

Ethereum chart analysis

The price of Ethereum is currently at its May low of $ 2,660. As of yesterday afternoon, we have a powerful pullback price with a $ 2975 level. ETH has lost almost 10% of its value in the previous 24 hours. We are looking for potential support at the price of $ 2,600, and if it does not last, then we expect the price to continue to fall to $ 2,500 and maybe even lower. If by any chance Ethereum finds support here, we need a new positive consolidation and a return above the $ 2,750 level. Our following bullish targets are $ 2800, respectively, then $ 2900 and $ 2975 previous high and high resistance.

Chart:

Market overview

Crypto markets lost $ 150 billion as Bitcoin crashed to its lowest point since Russia’s invasion. Just a few days ago, the Bitcoin began to recover from the last price drop below $ 38,000. The Bulls pushed assets to the north following the FOMC Meeting, in which the Fed said it would raise interest rates by 0,50% instead of 0,75%, and the BTC trampled on $ 40,000.

However, this step was short-lived because bitcoin was stopped there and remained slightly below that level the next day.

The situation changed vigorously in the next few hours, as reported yesterday. Bitcoin began to fall sharply and fell by about $ 4,000. In addition to causing millions in liquidations, the cryptocurrency has fallen to its lowest level since Russia invaded Ukraine, below $ 36,000.

BNB, Ripple, Terra, Dogecoin, Shiba Inu and Tron have lost between 5-6% in the last 24 hours. An even bigger drop in prices is evident in Solana (-11%), Cardano (-9%), Polkadot (-10%), Avalanche (-13%) and NEAR Protocol (-15%).

In an even worse situation are STEPN (-26%), Zilliqa (-20%), ApeCoin (-17%), Waves (-17%), Moonbeam (-17%), Axie Infinity (-16%), Coffee (-15%), and Phantom (-15%) all lost double digits.

The market capitalization of all cryptocurrencies fell by $ 150 billion and dropped far below $ 1.7 trillion.