05 May chart overview for Bitcoin and Ethereum

- Today, the price of bitcoin in consolidation is around 39,600 dollars during the entire Asian session.

- Ethereum continues its bullish journey that began earlier this week. On May 1, the price was $ 2,715, and now it has climbed to $ 2,928.

- Bitcoin options expire in the next 48 hours

- The IMF is concerned about the adoption of bitcoin in the Central African Republic

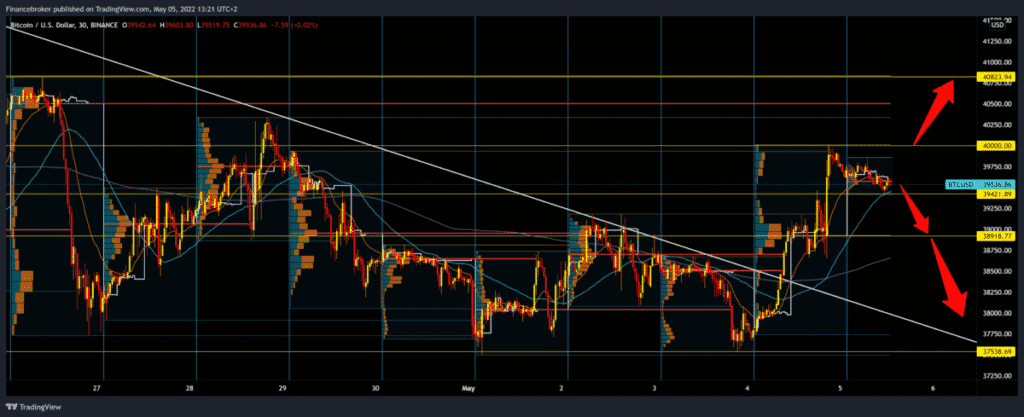

Bitcoin chart analysis

Today, the price of bitcoin in consolidation is around 39,600 dollars during the entire Asian session. We can say that this is a bullish correction after the price jumped to $ 40,000 yesterday. If this correction continues, we have strong support at the $ 39,000 level. The day is very slow, and we have no events that could have a stronger impact on the price. We need a negative consolidation and a break below the $ 39,420 level for the bearish option. Our next potential support is $ 38,600 first, and only if it doesn’t last do we go further down to $ 38,000, the larger support zone. We are looking for a maximum drop and support in the zone of around 37,500 dollars. We need a break above the $ 40,000 resistance for the bullish option. After that, we can hope that the price will continue to recover with the appropriate consolidation. The first next upper resistance is at $ 40,350, then the $ 40,825 level, lower high April.

Chart:

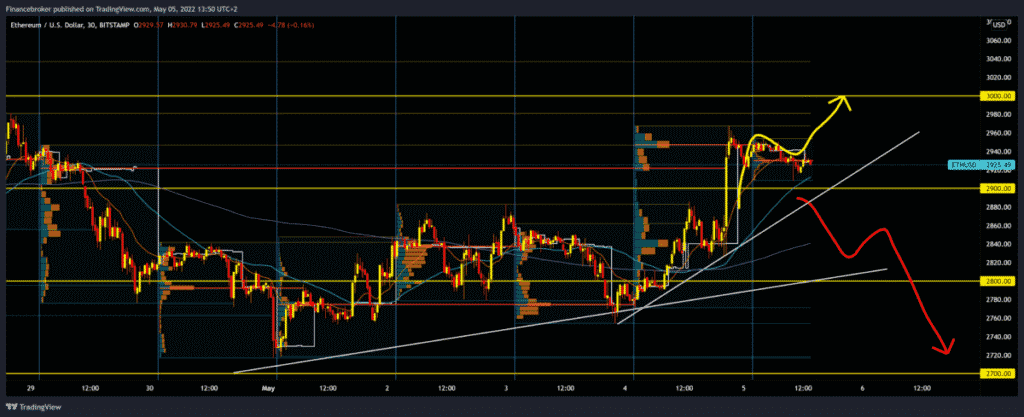

Ethereum chart analysis

Ethereum continues its bullish journey that began earlier this week. On May 1, the price was $ 2,715, and now it has climbed to $ 2,928. Last night Ethereum formed its high this week at $ 2967. Since then, we have been in a correction, and this morning we found support at $ 2,908. If this consolidation continued for too long, the bearish pressure would increase, which would lower us below the $ 2,900 level and break below the trend line. Below, the next potential support is at 2840 from the MA200 moving average. The next one is at the $ 2,800 price point, where we would test the May trend line of support. For the bullish option, we need a break above $ 2967. After that, we can expect Ethereum to jeopardise the $ 3,000 level. Break prices above would boost bullish optimism in continuing price recovery.

Chart:

Market overview

Bitcoin options expire in the next 48 hours

The main reason for the current action of bitcoin prices is investors’ concern due to the declining macroeconomic situation. Professional investors are more worried about the effect of tightening the economic policy of the US Federal Reserve.

Billionaire hedge fund manager Paul Tudor recently argued that as monetary authorities raise interest rates due to declining financial conditions, the current environment is not favourable for investors.

The expiration of the option on May 6 in Bitcoin is positioned at 735 million dollars. However, this figure is expected to decline as the currency trades below the $ 40,000 range.

A call-to-put ratio of 1.22 reveals an open interest of $ 405 million calls (purchase) versus the $ 330 million puts (sale) option.

So, if the price of bitcoin does not improve and stays below $ 39,000 even on May 6, then the bears will get $ 100 million of these options for sale that are available to them.

Therefore, bitcoin bears should be kept below $ 39,000 tomorrow, May 6, to secure a profit of $ 145 million. Meanwhile, the bulls can take control and avoid losses by pushing the price above $ 40,000 and easily make a profit of about $ 100 million.

The IMF is concerned about the adoption of bitcoin in the Central African Republic

The International Monetary Fund (IMF) has expressed concern over the adoption of bitcoin in the Central African Republic as a legal tender, saying it poses many challenges for the country and the region.

The National Assembly of the Central African Republic passed a resolution on accepting bitcoin as a legal tender last month, which surprised many observers, becoming the first country in Africa and the second in the world to recognize bitcoin as a currency.

Like other countries and companies that are more involved in cryptocurrency, the Central African Republic believes that the adoption of bitcoin will help its struggling economy.

This could be the beginning of a new wave of countries that accept bitcoin as a legal tender. Developing countries, in particular, can benefit from asset classes, as they can help digitize economies and encourage innovation, especially in countries with large non-banking populations that rely heavily on remittances.

While bitcoin has helped increase tourism revenues in El Salvador, volatility risks make it unpredictable. And this is what the IMF is most about worried.