What is Quote Currency – Forex Explained

Have you ever heard of a Quote currency, but you’ve always wondered what it is all about? In the crypto world, it seems like there are a lot of new currencies that are yet to be discovered and explored.

However, only a few of them get to the spotlight and gather a devoted community.

One of these popular that got our attention is the Quote currency. Better known as the counter currency, it refers to the second currency in both direct and indirect currency pairs. It’s used to settle the base currency value.

In the case of a direct quote, it is considered to be the foreign currency. On the other hand, in an indirect quote, this specific currency represents the domestic currency.

When it comes to listings, it is listed after the base currency in the pair, once currency exchange rates are quoted.

It’s possible for one to determine the amount of the quoted currency needed to sell to purchase one unit of the base or first currency.

Currency pairs and exchange rates

In order to successfully trade currencies in the market, it’s crucial that you have, at least, a basic understanding of the quoted currency.

It’s no surprise that market makers are always eager to trade specific currency pairs in set ways, direct or indirect. That means that learning all there is to know about it is mandatory.

The answer is quite simple for those who want to learn what a currency pair’s exchange rate reflects.

It reflects how much of the counter currency is necessary to be bought/sold in order to buy or sell one unit of the base currency.

For example, as the rate in a currency pair increases, it means that its value will fall, whether the pair is indirect or direct.

Euro and the U.S. dollar – example

Let’s look at another example. Imagine the cross rate between the Euro and U.S. dollar, EUR/USD, or eurusd. It denotes a cross rate between the Euro and U.S. dollar, so we are discussing an indirect quote.

In this example, we have a base and quote currency, where the U.S. dollar is a quote, while Euro is the base currency. The U.S. dollar represents the domestic currency and determines the value of one EUR.

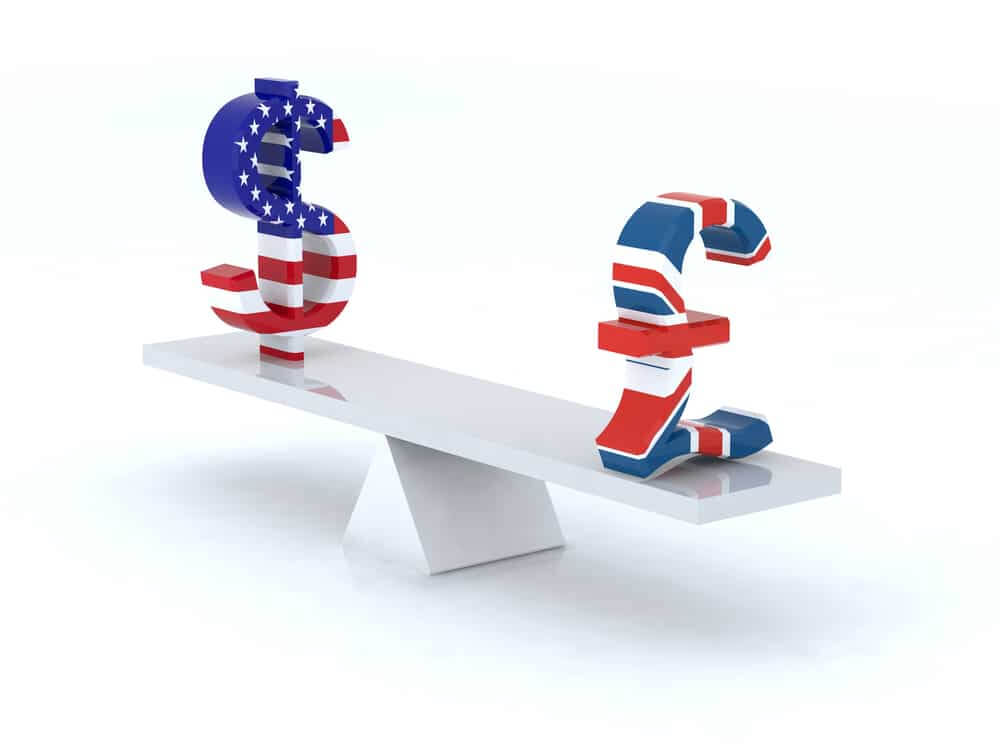

GBP/USD currency pair – example

For instance, if GBP/USD is at 1,5000, then one British pound will be equal in price to $1.5000.

In case the base currency, which is the British pound, increases in value, or if the quote currency, which is the U.S. dollar, drops, the necessary amount of dollars to buy one British pound will increase.

On the other hand, in case the base currency drops in value or the quote currency increases, the opposite effect will happen.

The cross rate between USD and CAD – example

When it comes to the cross rate between the U.S. dollar and the Canadian dollar, we can tell that it’s denoted as USD/CAD and that it represents the direct quote.

For those who are still unaware of its meaning, we can say that CAD is the quote, while USD is the base currency.

The Canadian dollar is used as a reference to settle the value of one U.S. dollar. From a U.S. perspective, the CAD represents the foreign currency.

What factors affect currency pairs?

In order to understand the quote currency better, it’s essential to get to know what factors affect currency pairs.

Some of these factors include economic activity as well as monetary and fiscal policy achieved by interest rates and central banks.

We are aware of the fact that the U.S. dollar and the Euro represent significant currencies. These currencies are more likely to be the base currency than the quote currency in a currency pair. It’s a widespread situation, especially in the exotic currency trades.

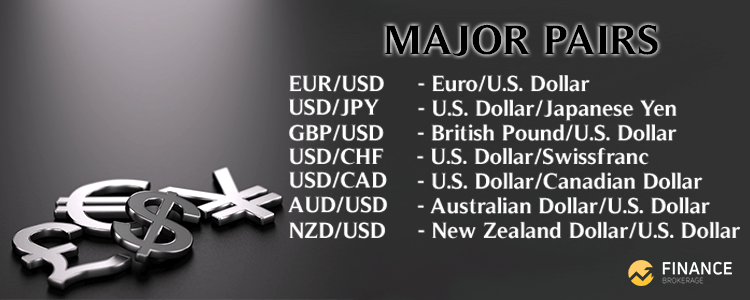

The most popular currency pairs traded in 2021

- EUR/USD

- GBP/USD

- EUR/GBP

- USD/CHF

- USD/JPY

As we can see from the example above, the first one in these pairings represents the base currency, while the second is the quote currency.

Interesting facts about the Forex market

The Forex market, also known as the foreign exchange market, is a fascinating financial arena with unique characteristics and immense scale. Here are some interesting facts about the Forex market:

Largest financial market: The Forex market is the largest and most liquid financial market in the world. It dwarfs other markets in size, even the stock market.

24-hour market: Unlike stock markets, which have specific hours, the Forex market operates 24 hours a day, five days a week.

This is because it’s not tied to any physical location and transactions are conducted over-the-counter (OTC), through a network of banks, rather than on a centralized exchange.

Influence of news and events: The Forex market is highly sensitive to geopolitical events, economic indicators, and major news.

Leverage: Forex trading often involves leverage, which means traders can control large positions with a relatively small amount of capital. While this can amplify profits, it also increases the risk of significant losses.

Decentralized market: The Forex market is decentralized, meaning there is no central exchange or regulator. It is a global network of banks, brokers, and traders.

Participants: The market participants range from large financial institutions and multinational corporations to individual retail traders.

The interbank market accounts for a significant portion of the total turnover.

Speculation and hedging: While some use the Forex market to hedge against international currency and interest rate risk, others speculate on currency movements to make profits.

The Forex market’s sheer size, accessibility, and the potential for profit and loss make it a highly dynamic and interesting financial market.

The Bottom Line

So, what did we learn from this article that you need to remember? As a severe and devoted trader who is eager to create a successful and long-term trading career, what are the essentials that you need to keep in mind? Here are the key takeaways:

- In the Forex market, currency unit prices are quotes as currency pairs.

- The quote, or the counter currency, represents the second currency in both direct and indirect pairs.

- It is used to value the base currency.

- The base currency, known as the transaction currency, is the first currency in a pair.

- The exchange rate of one particular currency pair reflects how much of the quote currency is necessary in order to buy or sell one unit of the base currency.

- If the rate in a currency increases, the value of the quote currency decreases.

- It is the foreign currency in the direct quote.

- In the indirect quote, the quote currency represents the domestic currency.

- In case one person wants to buy a currency pair, he will sell the counter currency.

- If the trader shortens a currency pair, he’ll buy the counter currency.

-

Support

-

Platform

-

Spread

-

Trading Instrument