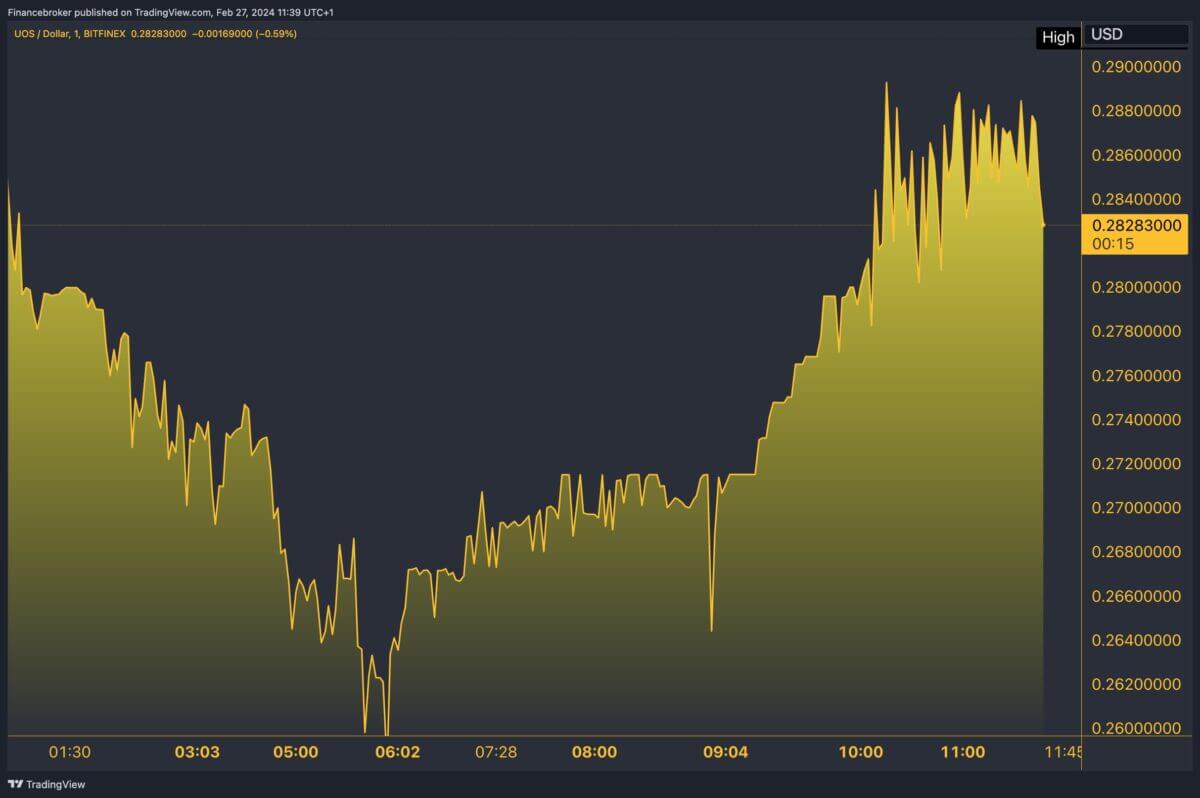

Ultra (UOS) has experienced significant fluctuations in the dynamic world of cryptocurrency. Today, the price of UOS is $0.2847, with a 24-hour trading volume of $3,805,633.66. However, over the last 24 hours, the token’s price has declined by 14.25%. Despite this short-term downturn, the 7-day price movement tells a different story, showcasing a remarkable increase of 56.21%.

UOS Hits $104.6M Cap, Circulates 370M Coins

The circulating supply of UOS is currently 370 million, leading to a market capitalization of $104,602,954. Upon examining additional metrics, the current UOS price adjusts slightly to $0.279, showing an increase of 19.3% against Bitcoin and 26.5% against Ethereum. Throughout the day, prices ranged from $0.2662 to $0.3456, reflecting the volatile nature of the market.

The fully diluted valuation is at $284,176,320, with a total and max supply capped at 1 billion UOS. Over the past week, the price has fluctuated from $0.1703 to $0.3424. Despite recent gains, it’s essential to note that UOS is still far from its all-time high of $2.49 on November 25, 2021, and has risen significantly from its all-time low of $0.02137 on September 2, 2019.

The most active trading pair for UOS has been on Uniswap V3 (Ethereum), specifically the UOS/USDC pair, with a volume of $306,559 in the last 24 hours. The global 24-hour trading volume is closely mirrored at $3,804,115, positioning UOS at market rank #428.

Broader Crypto Market: BTC Surges to $56,740, Ether Up 4.7%

The cryptocurrency market has observed significant movements, with Bitcoin’s price surging over 10% to $56,740. This was its highest since November 2021, and Ether’s price increased by 4.7% to $3,234. Analysts have linked this surge in Bitcoin and Ether to various factors, including a new high in Bitcoin spot ETF trading volume, which reached $2.4 billion on February 26, and enhanced investor confidence.

Recent developments include Reddit disclosing its cryptocurrency holdings, which include Bitcoin, Ether, and Polygon’s Matic. Former President Donald Trump has also shown a change in sentiment towards cryptocurrencies. Additionally, Circle’s decision to end support for USD Coin (USDC) on the Tron network and the Federal Reserve’s analysis of stablecoin market dynamics are noteworthy.

Spot Bitcoin ETF Inflows Watched Amid Concerns

The market is closely monitoring the inflows of the spot bitcoin exchange-traded fund (ETF) amid concerns due to issues at the BitForex exchange, including a $57 million outflow and halted withdrawals.

Today’s price changes and market data for Ultra (UOS) underscore the volatile nature of the cryptocurrency market. Despite short-term declines, the significant weekly growth indicates a positive trend for UOS. However, investors should remain vigilant and consider broader market trends, such as Bitcoin’s and Ether’s performance and global economic factors, before making investment decisions. The recent developments and expected market movements suggest a cautious but optimistic outlook for the cryptocurrency market.