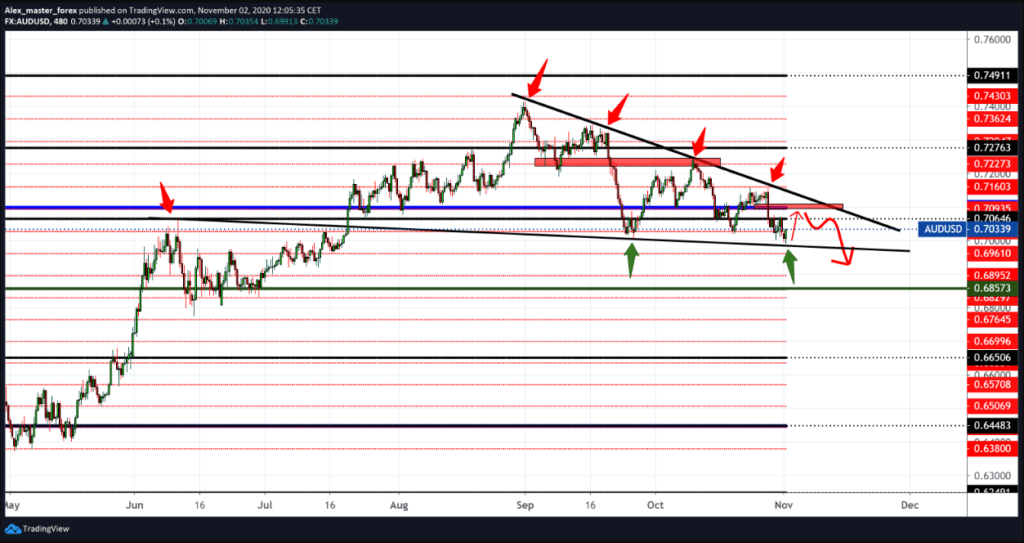

The AUD/USD pair on November 2, 2020

AUD/USD pullback to resistance before the interest rate cut. Due to the increase in the number of newly infected with Coronavirus in Europe and the record number in America, the Australian dollar gained enough to make a pullback to the trend line’s resistance before shortening the interest rate that the Reserve Bank of Australia estimates.

For now, the trend line has proven to be a good resistance. After more than three months of lockdown in Victoria, the area has not reported any new cases for the last few days in a row. Authorities remain extremely cautious with a reopening scheduled.

The RBA will announce its decision next Tuesday, and investors are already doing so. The central bank will announce its decision next Tuesday, and investors are already setting prices at a reduced rate at a record low of 0.1%.

Despite optimistic Chinese manufacturing PMIs, the Australian dollar sought China’s intention to gain any significant advantage instead of being pressured by escalating tensions with its key trading partner. China banned Australian timber imports from Queensland over the weekend.

Additional reports say Chinese importers are preparing for another round of restrictions on Australian trade goods, including bans on copper ore, copper concentrate, and sugar, which expected to be introduced this week.

Further strengthened the case of additional concessions by the RBA. The US presidential election is the most important event of this week, will be held on Tuesday, and we can expect the first results in early Wednesday.

We can expect more concrete results of the elections in America by the end of the week. Both Trump and Biden’s staff will likely declare victory because, according to opinion polls, there is a close battle for the presidency.

This week is full of economic news and reports and political news regarding the American elections, and as the most significant burden on the global economy, Coronavirus, which is rapidly spreading in Europe and America.

-

Support

-

Platform

-

Spread

-

Trading Instrument