| General Information |

|

|---|---|

| Broker Name: | SpreadEX |

| Broker Type: | Crypto |

| Country: | UK |

| Operating since year: | 1999 |

| Regulation: | FCA |

| Address: | Freepost RRRS-GTBG-HGZB, SpreadEX Ltd., Churchill House 26-30, Upper Marlborough Road, St Albans, Hertfordshire, AL1 3UU |

| Broker status: | Active |

| Customer Service | |

| Phone: | +44 1727 895 000 |

| Email: | [email protected] |

| Languages: | English |

| Availability: | Mon - Sun 8 AM - 5:30 PM |

| Trading | |

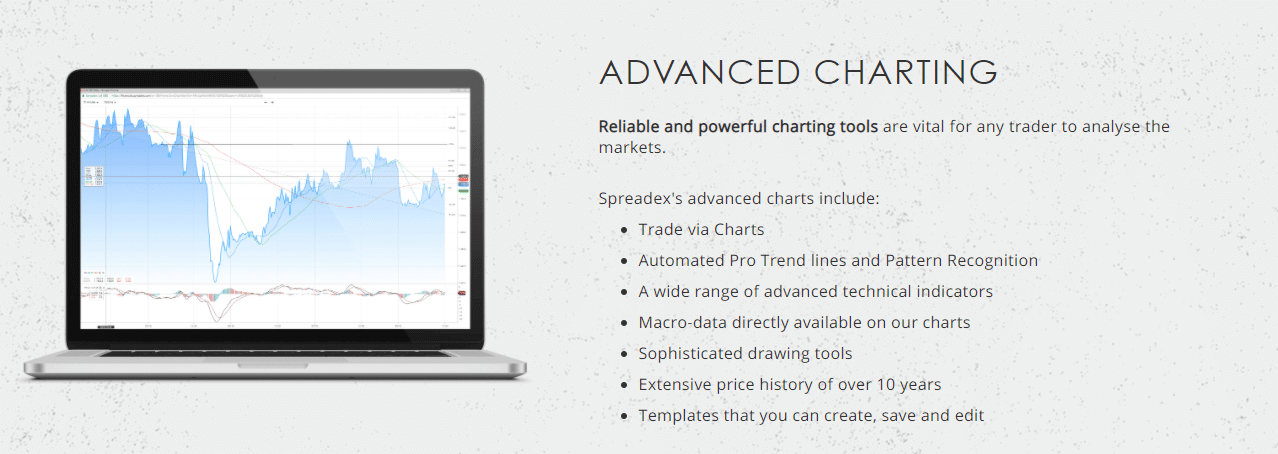

| The Trading platforms: | Proprietary |

| Trading platform Time zone: | - |

| Demo account: | - |

| Mobile trading: | Yes |

| Web-based trading: | Yes |

| Bonuses: | - |

| Other trading instruments: | Commodities, Indices, Stocks |

| Account | |

| Minimum deposit ($): | $0.01 |

| Maximal leverage: | 1:200 |

| Spread: | Fixed |

| Scalping allowed: | Yes |

-

Support

-

Platform

-

Spread

-

Trading Instrument

Comments Rating

( reviews)

One of the best!

This broker is one of the best I have tried! Very satisfied, i give my 5 stars to SpreadEX !

Did you find this review helpful? Yes No

Good

I am a total perfectionist and I set for nothing less. I don’t give our good reviews easily, however, in this case would say this broker deserves a 10 out of 10!

Did you find this review helpful? Yes (1) No

The best crypto provider!

the broker provides the best spreads and crypto services by far. The very fist time I got to trade cryptocurrencies (my fav things to trade in the world) I was shook to the core.

High quality platform and fantastic services – the best trading experience in my trading life.

Did you find this review helpful? Yes No