Per Stirpes Meaning – What Does Per Stirpes Mean in a Will?

Per stirpes is a term used in inheritance law. Let’s see how per stirpes distribution works and what other methods in estate planning to distribute assets exist.

Per Stirpes Meaning

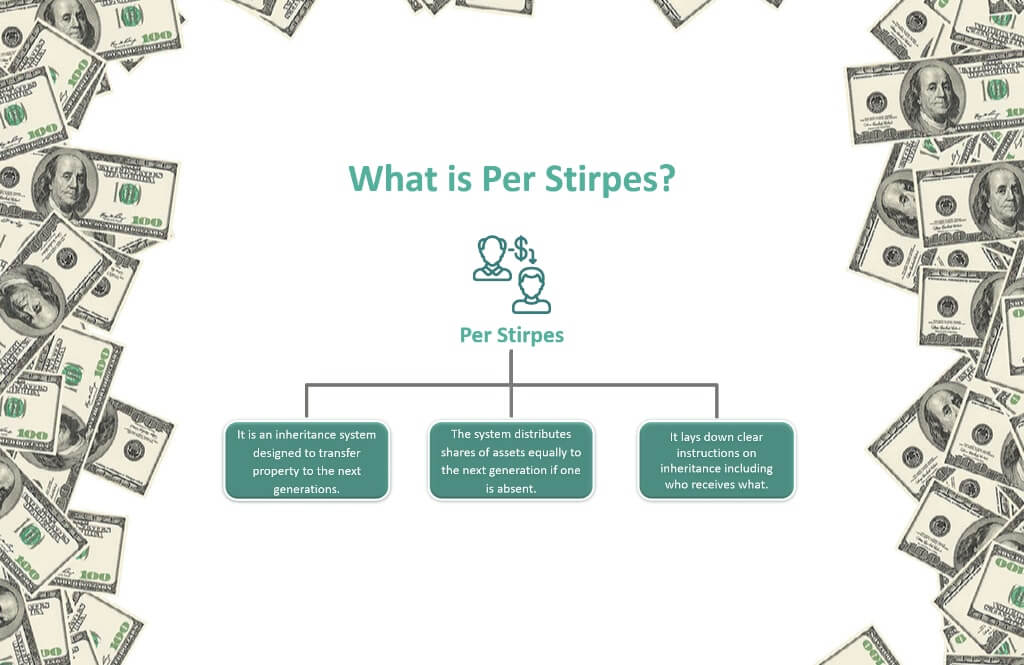

“Per stirpes” meaning is a legal term originating from Latin. It occurs in estate planning and inheritance laws. It determines how assets are distributed among heirs when a beneficiary passes away before the testator.

The term “per stirpes” translates to “by roots” or “by branch” and is a way to distribute assets among a deceased beneficiary’s descendants.

The easiest way to think of a per stirpes designation is this: if a Beneficiary dies before you do, their share of your estate will automatically and evenly go to their child or children.

Example of per stirpes

Let’s say a testator has three children, A, B, and C. Child B predeceases the testator, leaving behind two children (B1 and B2). With per stirpes distribution, if child B is no longer alive, their share would be divided equally between B1 and B2, while children A and C would receive their original shares.

How does per stirpes distribution work?

- Primary Beneficiary: The testator designates primary beneficiaries in their will or trust. These beneficiaries are typically their immediate family members, such as children.

- Predeceased Beneficiary: If one of the primary beneficiaries predeceases the testator, meaning they die before the testator, the assets that would have been inherited by that beneficiary are distributed among their own descendants.

- Distribution among Descendants: The assets are divided equally among the deceased beneficiary’s own children (if any). If a deceased beneficiary has no living children, the assets may be divided among their grandchildren or further descendants, depending on the applicable laws or specific instructions in the will or trust.

Per stirpes distribution ensures that each branch or line of descendants receives an equal share of the assets, even if the original beneficiary is no longer alive. It maintains a fair distribution of assets within a family lineage.

It’s important to note that per stirpes distribution may vary depending on the jurisdiction and the specific provisions outlined in the will or trust. Consulting with an estate planning attorney can provide more accurate and detailed guidance on the application of per stirpes in a particular legal context.

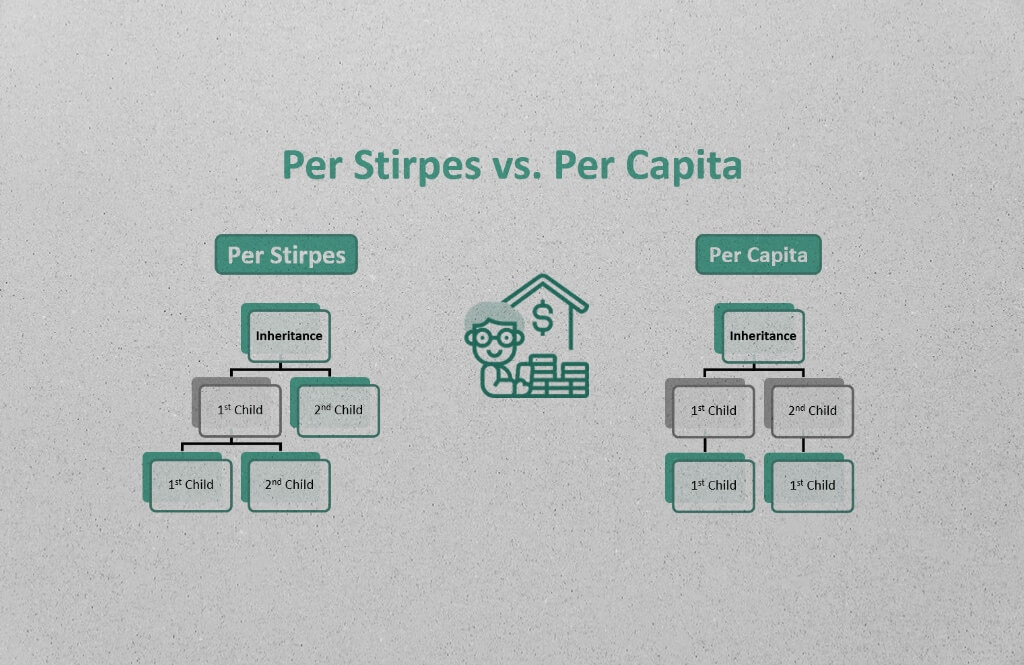

Per stirpes vs per capita

Per stirpes and per capita are two different methods used in estate planning to distribute assets among beneficiaries when some beneficiaries predecease the testator (the person who made the will or established the trust). These methods determine how assets are divided among surviving family members.

Per capita means “by head” or “by person.” Under per capita distribution, each individual beneficiary receives an equal share of the assets, regardless of their familial relationship to the predeceased beneficiary. The assets are divided among the living beneficiaries at the same generational level.

Let’s consider the same scenario as above. Child B predeceases the testator, leaving behind two children (B1 and B2). With per capita distribution, the assets would be divided equally among the surviving beneficiaries: child A, child C, B1, and B2. Each would receive an equal share, regardless of their generational connection.

The choice between per stirpes and per capita distribution depends on the testator’s intentions and the specific family circumstances. It’s important to consult with an estate planning attorney to understand the implications of each method and to ensure the estate plan aligns with the testator’s wishes. The applicable laws in the jurisdiction can also impact the default method of distribution if the testator hasn’t specified their preference in the will or trust.