Pending Orders in Forex – Forex Explained

What are your thoughts on pending orders in forex? Are you familiar with pending orders?

People who aren’t familiar with the forex market may find it hard to understand the concept of pending orders.

The way pending orders are utilized or why they are utilized at all isn’t that obvious compared to the standard trading orders (market orders). Thanks to pending orders, it is easier to automate the trading process.

Interestingly, there are four basic types of pending orders. We need to note that two of them are derived types. Both of them are quite popular. Moreover, there are two complex types. It is noteworthy that complex types aren’t very popular.

Let’s learn more about the types of pending orders.

Limit and stop orders

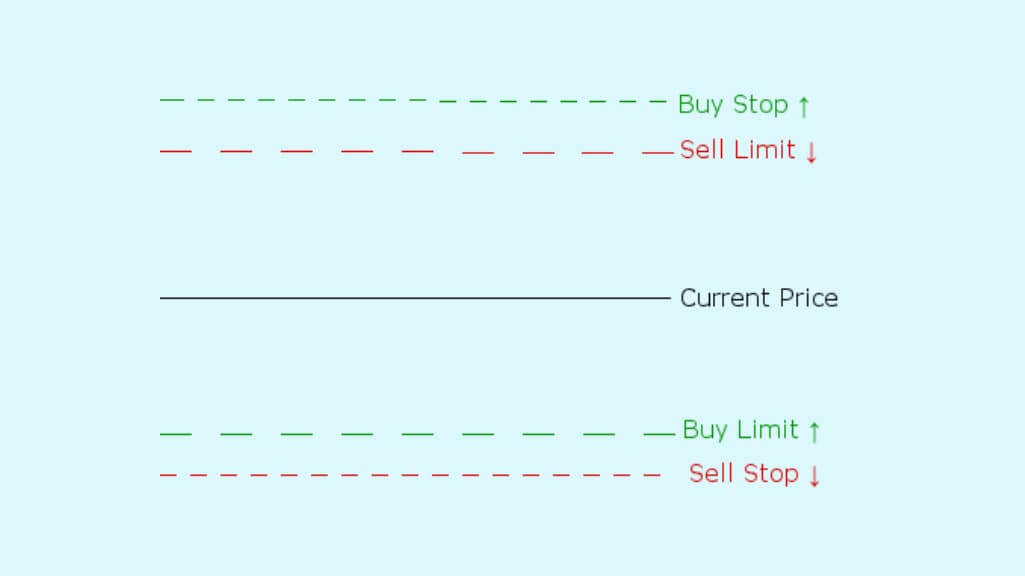

Buy Limit is utilized if you would like to buy a currency pair (open a long position) at a level that is below the current price.

What about the Sell Limit?

It should be used when you plan to sell a currency pair (open a short position) at a level that is higher compared to the current price.

Let’s focus on a Buy Stop. Interestingly, it is a pending order to buy a currency pair (open a long position) at a level that is higher than the current price.

We shouldn’t forget about Sell Stop. It is used to sell a currency pair (open a short position) at a level that is below the existing price.

What do you need to know about Stop-Loss and Take-Profit?

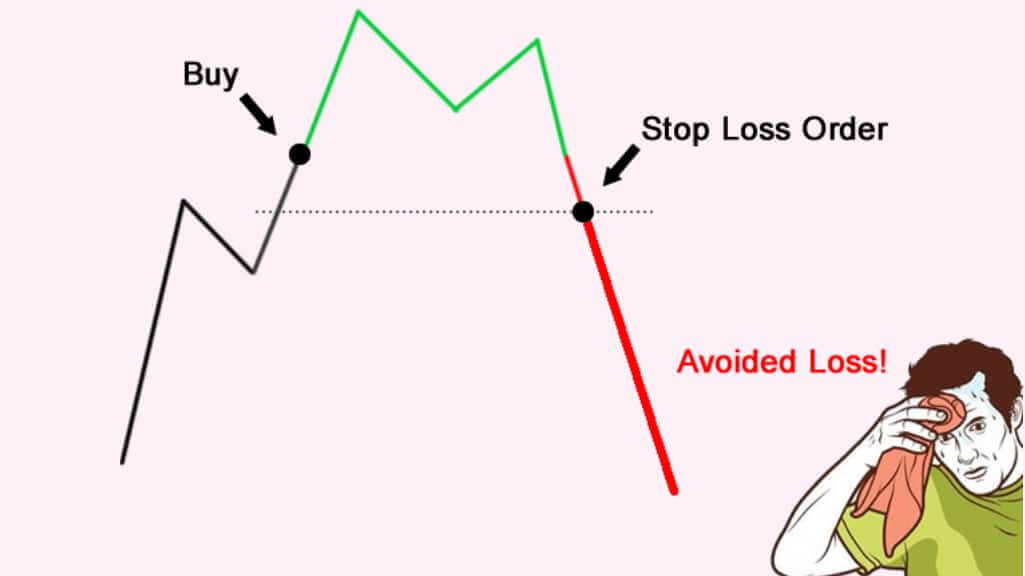

Let’s start with Stop-Loss. It is used in order to prevent an excess loss on a position.

Did you know that Stop-Loss is automatically triggered whenever the price hits an assigned level?

It is desirable to remember that stop-loss can only be set to the level above the current price for short positions. What about long positions?

Stop-loss can only be set to the level below the existing price in the case of long positions. It is important to note that it is a Buy Stop for your Sell trades and a Sell Stop for your Buy trades. The vast majority of all forex brokers feature trading platforms that provide an opportunity to set stop-loss as a simple parameter of a position or an order.

Now, we can focus on Take-Profit. It is utilized in order to close a position with a satisfactory amount of profit. As in the case of a Stop-Loss, Take-Profit is triggered automatically at a certain level.

As a reminder, Take-Profit can only be set to the level below the current price for the short positions. Importantly, Take-Profit can only be set to a level above the existing price when it comes to long positions. Notably, Take-Profit is a Buy Limit for your Sell trades and a Sell Limit when it comes to your Buy trades. Hopefully, the vast majority of trading platforms allow setting a take-profit as a simple parameter of a position.

Stop limit orders

Buy Stop Limit is an interesting type of order. Why? It combines the features of Buy Stop as well as Buy Limit types of orders.

This type of order is used in order to place an order to buy a currency pair at a level that is above the existing market price; however, only in the case if the price is at or below the limit determined by the forex trader. Importantly, a Buy Stop Order is triggered when the price hits the stop determined by the trader.

Thanks to the Buy Stop Limit, you have the chance to control your buy orders better. While Buy Stop may end up in buying at a higher price than you were expecting due to a market gap, delayed execution by your forex broker, or other reasons, Buy Stop Limit makes sure that you will not pay more than you are ready to spend.

However, there is always a risk that the Buy Stop Limit order will never be fulfilled if the price surpasses your limit and continues its journey to the top.

We shouldn’t forget about the Sell Stop Limit. It shares many similarities with Buy Stop Limit. However, it combines the features of Sell Stop as well as Sell Limit types of orders.

Sell Stop Limit is utilized in order to sell a currency pair at a level that is below the existing market price; however, only if the price is at or above the limit determined by the forex trader.

Interestingly, if the price drops to the level where the forex trader has placed the stop, then the order will become a Sell Limit order to sell the pair at or above the limit determined by the forex trader.

Pending orders in Forex

Now, you know what to answer if someone asks you about pending orders in forex. It is important to learn as much as possible about pending orders in forex. However, we shouldn’t forget about other important aspects.

Do you know how to select the best forex trading strategy?

People who aren’t familiar with forex trading strategies may find it difficult to select one. Let’s start from the beginning. Without exaggeration, we must understand the best methods of selecting a forex trading strategy.

You need to pay attention to three main elements when it comes to forex trading strategies.

Time frame! It is crucial to select a time frame. Remember, there is a noticeable difference

between trading on a 15-min chart and a weekly chart.

For example, if you would like to become a scalper, then it is better to focus on the lower time frames.

On the contrary, swing traders are likely to utilize a 4-hour chart, and a daily chart, in order to generate profitable trading opportunities. To make a long story short, you need to ask yourself one question: how long do I want to stay in a trade?

It is worth noting that varying time periods correspond to various forex trading strategies.

When selecting your forex trading strategy, you should ask yourself: how frequently do I want to open positions? For instance, if you plan to open a higher number of positions, then it is better to select a forex trading strategy called scalping.

You should also pay attention to position size. Locating the proper trade size is of the utmost importance.

You should be really careful when it comes to your financial stability. So, it is better to set a risk

limit at each trade. For example, forex traders tend to set a 1% limit on their trades. Hence, you won’t risk more than 1% on your account on a single trade.

Successful forex strategies

Let’s discuss successful forex strategies. One such strategy is scalping.

Interestingly, forex scalping is a popular strategy among traders. The strategy mentioned above

is focused on smaller market movements.

Notably, scalping involves opening a large number of trades in an attempt to bring small profits per each.

Consequently, traders who use the above-mentioned strategy work to generate larger profits by generating a large number of smaller gains.

The strategy mentioned earlier has gained popularity due to its liquidity and volatility. We need to note that investors are searching for markets where the price action is moving regularly in order to capitalize on fluctuations in small increments.

There is no ideal forex trading strategy. So, scalping also has its disadvantages. For instance, you can’t afford to stay in the trader for a long period of time. Besides, the strategy mentioned earlier requires a lot of time and attention. However, not all traders have time to constantly analyze charts in order to locate new trading opportunities.

Day trading

Another successful forex trading strategy is day trading. It refers to the process of trading currencies in one trading day. The strategy mentioned above is mostly used in forex. Nevertheless, it is possible to use it in other markets as well.

The idea behind the strategy mentioned earlier is to open and close all trades within a single day.

As opposed to scalpers, who plan to stay in markets for a couple of minutes, day traders usually stay active over the day, monitoring and managing opened trades.

In most cases, day traders use 30-minute and 1-hour time frames in order to generate trading ideas.

The vast majority of day traders tend to base their trading strategies on the news. Interest rates and elections, among other factors, have a noticeable influence on the market.

It takes time and effort to become a successful trader. Nevertheless, it is possible to overcome all challenges. Yes, the forex market is the largest financial market. Moreover, you should understand all risk factors.

It would help if you learned as much as possible about the largest financial market in the world.

For example, it makes sense to read articles and books about various forex trading strategies. It is desirable to understand the difference between them. Moreover, don’t hesitate to ask for help. Feel free to contact your friend or colleague with the knowledge and experience to help you.

It also makes sense to learn from famous forex traders. As you can see, the forex market is one of the most amazing markets in the world. People from all over the world are interested in the forex market. Feel free to join the ranks of forex traders.