Oil and Natural Gas: August Higher High

- During the Asian trading session, the price of oil recovered from the $88.00 to $90.00 level.

- The price of natural gas formed a new August higher high at the $9.20 level.

- Crude oil throughput at Chinese refineries fell in July to the lowest level since the start of the pandemic in March 2020.

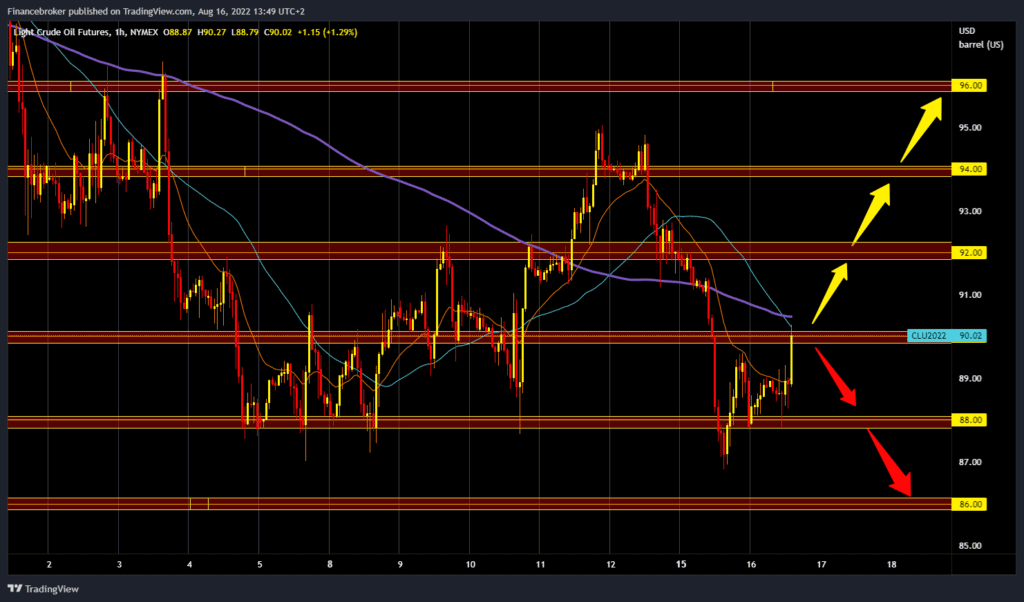

Oil chart analysis

During the Asian trading session, the price of oil recovered from the $88.00 to $90.00 level. Potential resistance at that level is the MA200 moving average. For a bullish option, we need a continuation of positive consolidation and a stay above the $90.00 level. After that, the price of oil could start a new bullish impulse. Potential higher targets are $91.00 and $92.00 levels. We need a negative consolidation and a return below the current support zone for a bearish option. After that, the price could continue its retreat toward the previous support zone. Potential lower targets are $89.00 and $88.00 levels. The price could continue even lower if too much pressure on this support zone continues.

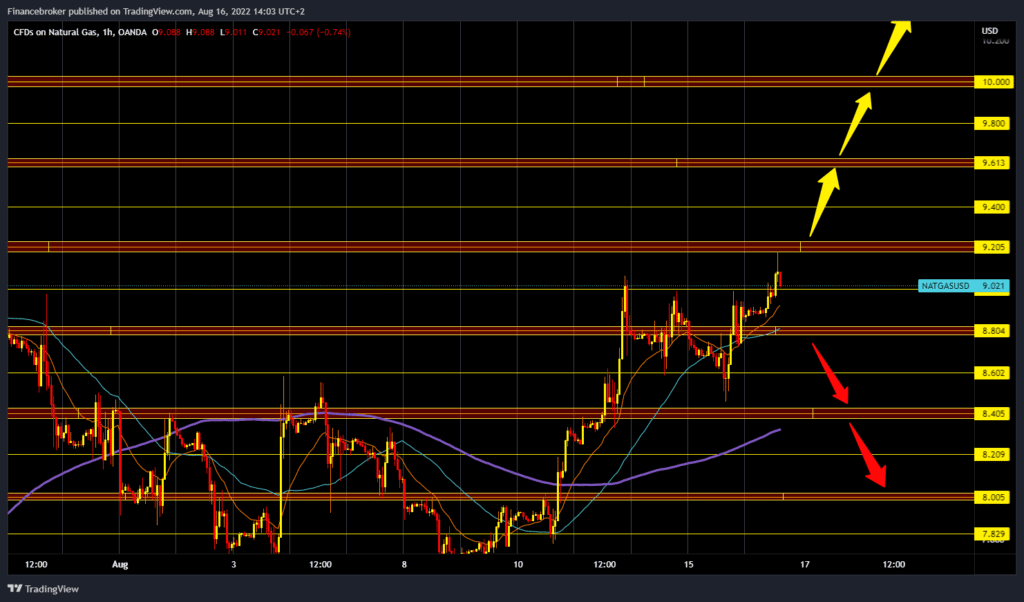

Natural gas chart analysis

The price of natural gas formed a new August higher high at the $9.20 level. During the Asian trading session, the price climbed above $9.00, and for now, we manage to stay above it. The $9.20 level is our current resistance, and we could expect a consolidation above the $9.00 level. If we fail to hold above, the gas price could enter a larger bearish trend. We need a negative consolidation and a price drop to the $8.80 level. After that, we can expect a continuation of the pullback up to $8.60, then $8.40. For a bullish option, we need a positive consolidation and a jump in gas prices above the $9.20 level. After that, we need to hold above to try to continue the bullish trend. Potential lower targets are $9.40 and $9.60 levels.

Market overview

Crude oil throughput at Chinese refineries fell in July to the lowest level since the start of the pandemic in March 2020. Refinery throughput decreased by 8.8% compared to July 2021. Crude oil processing decreased in July due to unplanned shutdowns of state-owned refineries Sinopec and PetroChina. The re-shutdown of major Chinese cities due to new coronavirus cases has also had the effect of reducing demand for black gold. Tonight, The American Petroleum Institute will report (API) on the state of oil reserves on American soil.