Market News and Charts for September 30, 2020

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

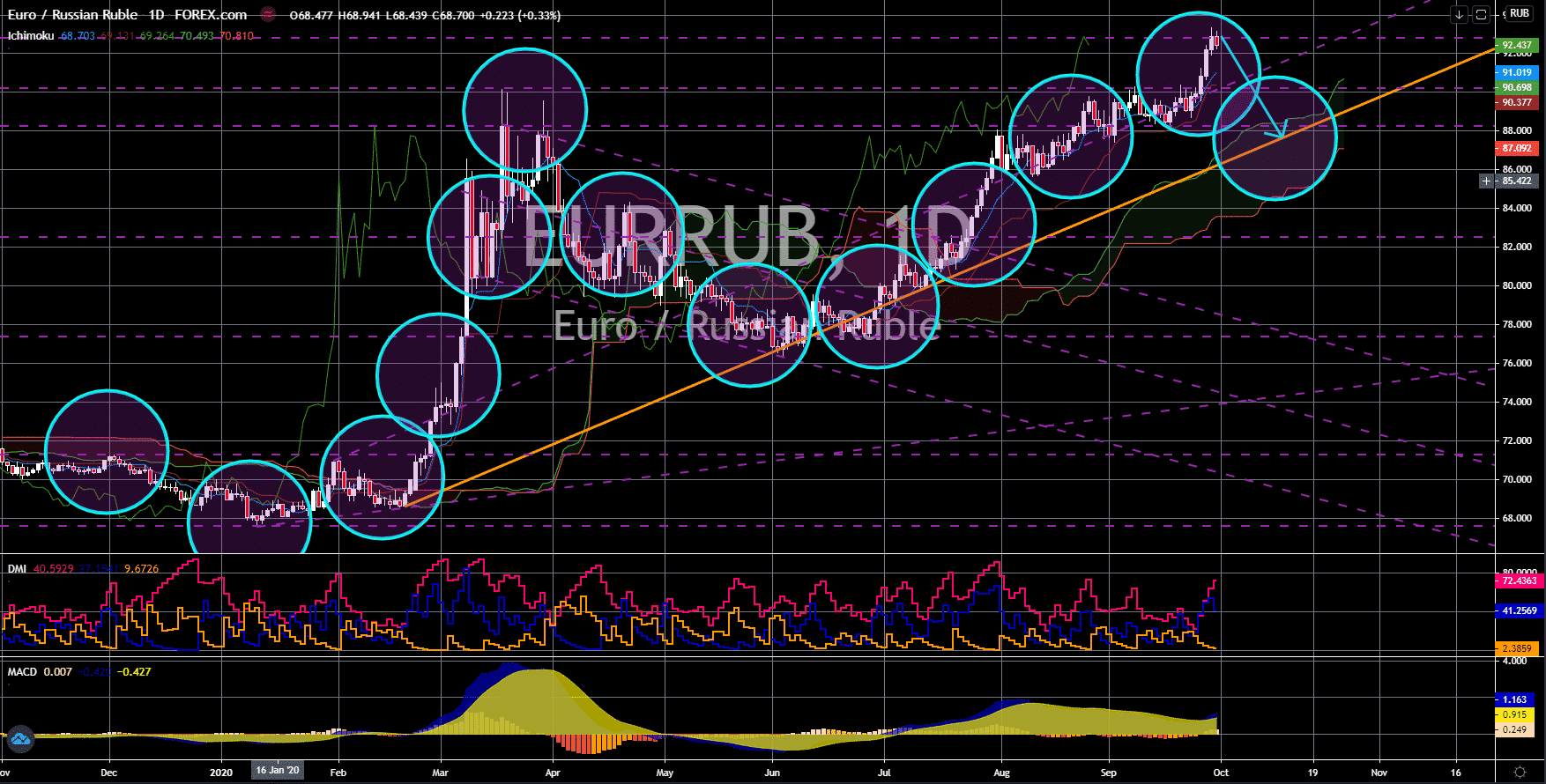

EUR/RUB

The pair will fail to break out from its January 2016 resistance line, sending the pair lower towards an uptrend support line. Germany is expected to post a 6.4% unemployment rate for the fourth consecutive month today, September 30. In addition to this, analysts are expecting a negative change in unemployment for the current month at -8K. This suggests that the EU’s largest economy is struggling to return to its normal economic health despite containing the virus. For investors, the recent figures mean that Germany’s economy is not recovering. On the other hand, Russia recorded it’s highest one-day increase of COVID-19 cases in more than three (3) months with 8,135 new cases. Despite this, the country was seen expanding its trading deals with other countries including Belarus, South Korea, and Japan. Currently, it accounts for almost half of Belarus’ foreign direct investments (FDI) and its trade deal with South Korea is nearing $25 billion.

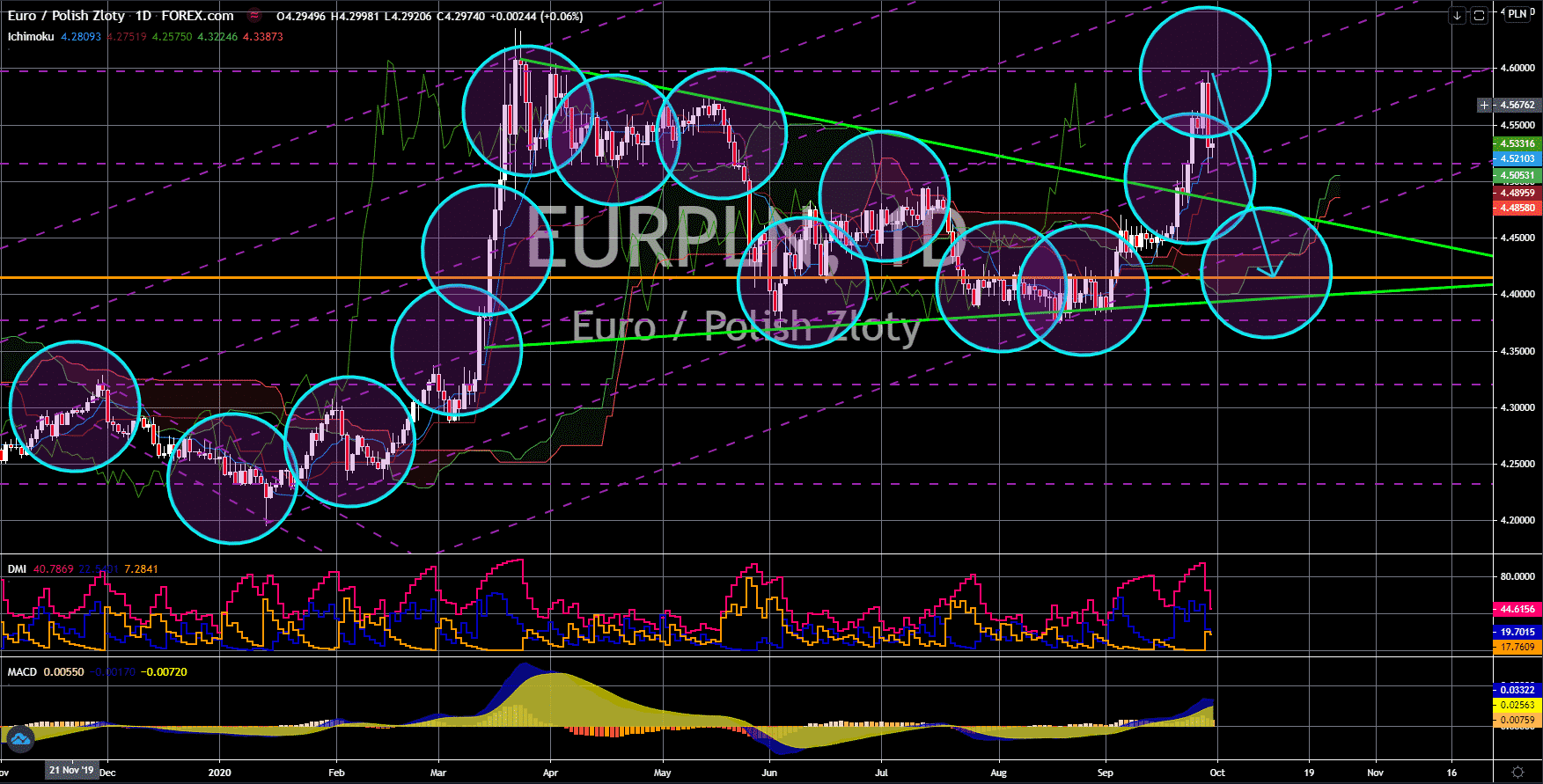

EUR/PLN

The pair failed to break out from a major resistance line, sending the pair lower towards a major support line. Germany’s retail sales MoM report recorded its second highest monthly growth since July 2011. However, this optimism quickly turned into pessimism as the country’s year-over-year result for the report recorded a 3.1% improvement. This represents the second consecutive decline for the report, which contradicts the MoM report for the month of August. While western Europe’s economy remains uncertain with its future, the eastern Europe led by Poland is on the rise. A recent report showed the country shrinking by less than 3.0% this year. Analysts also see a strong rebound for the economy in 2021. A major catalyst for this was the country’s strict tax collection. Moreover, the recently passed 2021 budget for Poland includes a budget deficit of up to 4.6% to help businesses and individuals to cope up with the economic impact of COVID-19.

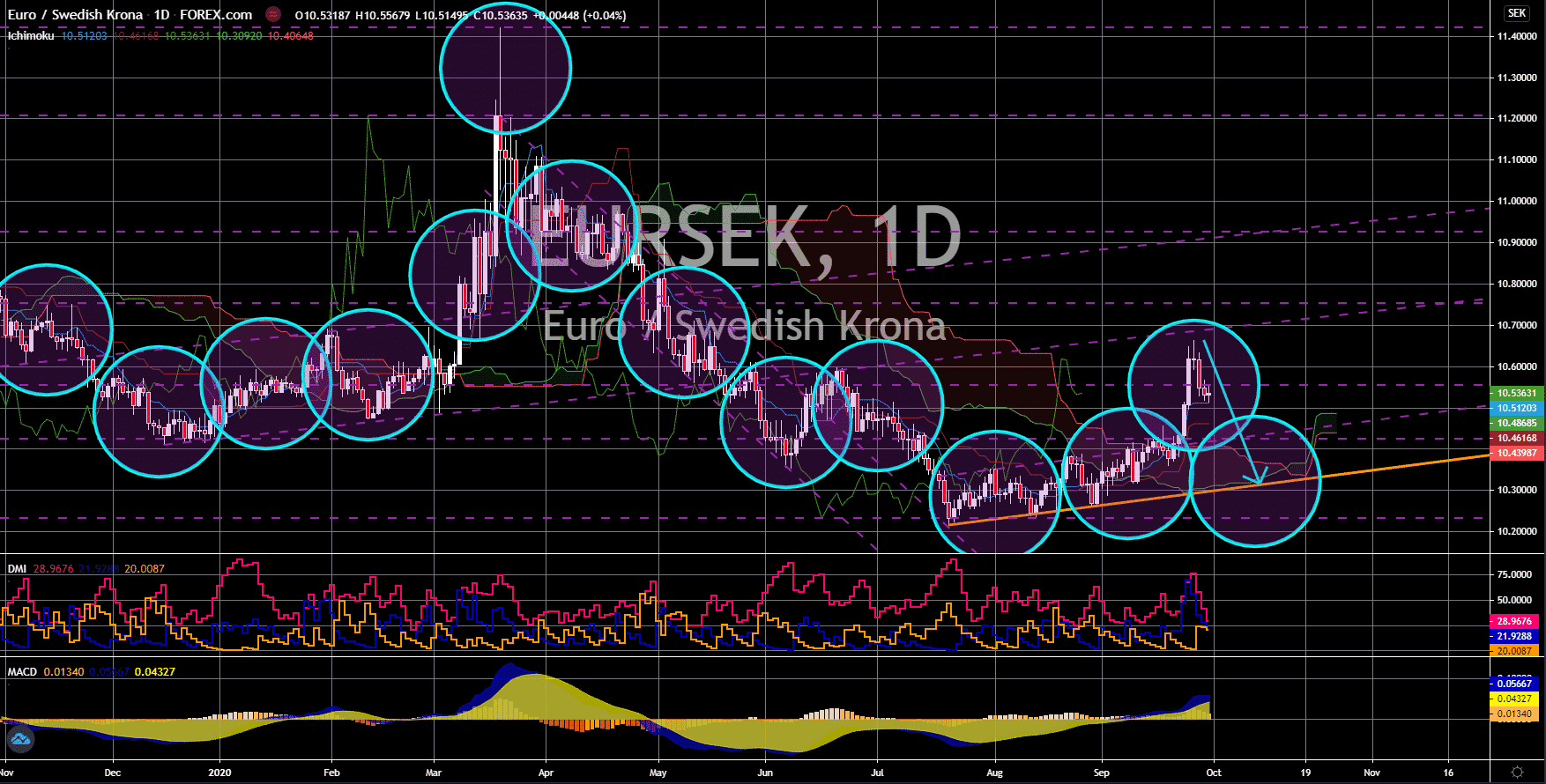

EUR/SEK

The pair will reverse back towards a strong support line after it failed to break out from an uptrend resistance line. Admission of international students in Sweden was up by 13.0% despite the ongoing coronavirus pandemic. The 2018-2019 batch has contributed around $122 million in the Swedish economy. The government said the increase in the number of admitted international students for 2020-2021 could further increase this figure. This, in turn, will help the Swedish economy to recover faster from the pandemic. Meanwhile, recent figures from Germany showed continuous concerns by investors over the near-term recovery of the EU’s largest economy. Unemployment was still high and employment change for September was negative 8K. Also, retail sales YoY confirmed a downtrend pattern in the report. This suggests that Germany is yet to fully recover from the economic effect of the coronavirus pandemic.

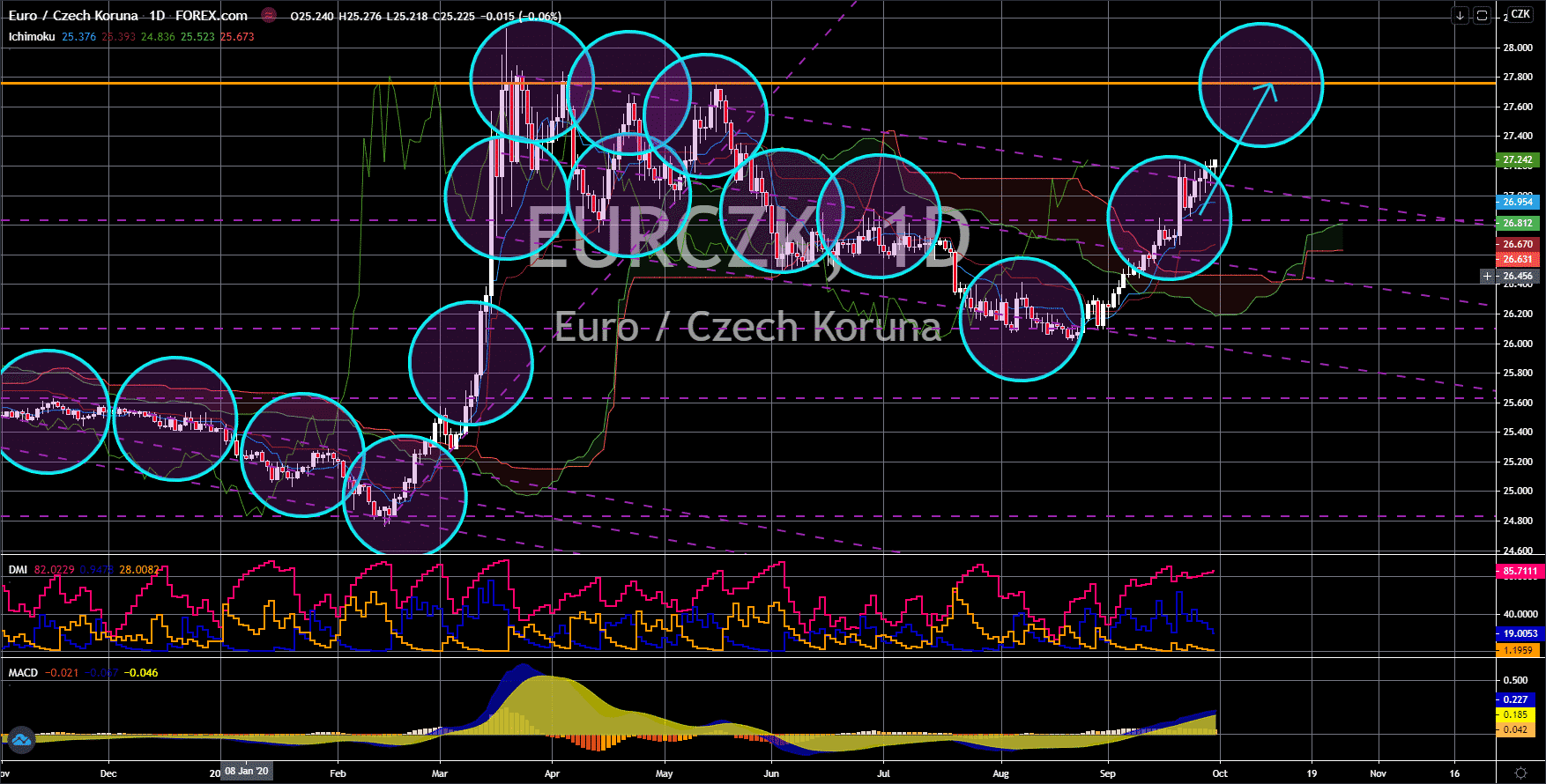

EUR/CZK

The pair broke out from a downtrend resistance line, sending the pair higher towards its March-May high. The European Union faces many challenges ahead including the slowdown in Germany and France, COVID-19, and Brexit. Recently, the EU and the UK resumed talks regarding Britain’s looming withdrawal from the largest trading bloc. Politicians are now trying to make concessions to make Brexit smooth ahead of the January 01, 2021 deadline. Aside from these, a new problem is brewing from the east and the south. The coronavirus pandemic is expected to cause a spike in migration as people from the Middle East and Africa were forced to find a better future. However, all of these investors’ concerns were overshadowed by the recent announcement in Czech Republic. Apparently, a new state of emergency is looming as the country faces the threat of a second wave of COVID-19. This could further delay the recovery in Czechia.