Market News and Charts for September 11, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

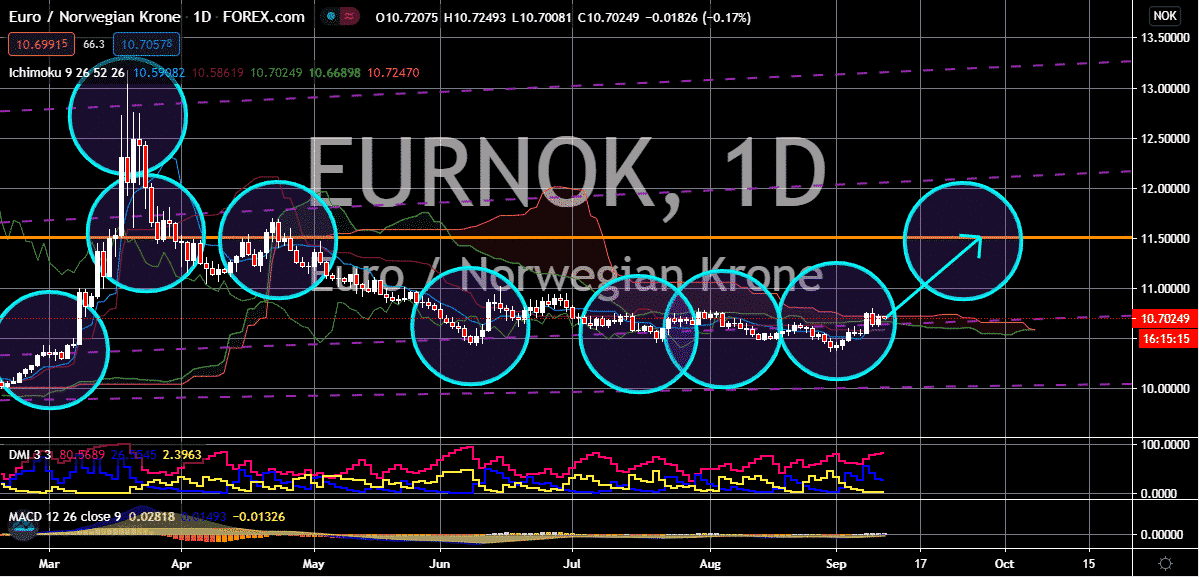

EUR/NOK

The fall in crude prices has pushed the Norwegian krone on the defensive against the euro. Bullish investors of the pair are now looking to recover their losses from the previous weeks and push the pair’s prices towards their resistance level by the latter part of the month. The surprise build-up in crude oil inventories has caused the crude market to turn bearish, affecting commodity-linked currencies like the Norwegian krone. The poor economic activities recorded by Norway also hinders the cause of bearish investors, preventing them to stand firm against the euro. According to official reports, the economic recovery of the country from the impact of the coronavirus pandemic is slower than expected. This should be a great opportunity for bulls to seize as the euro gets ready to test the European Central Bank’s threshold. Yesterday, the euro received support when the ECB failed to offer any significant reasons to break the common currency’s rise.

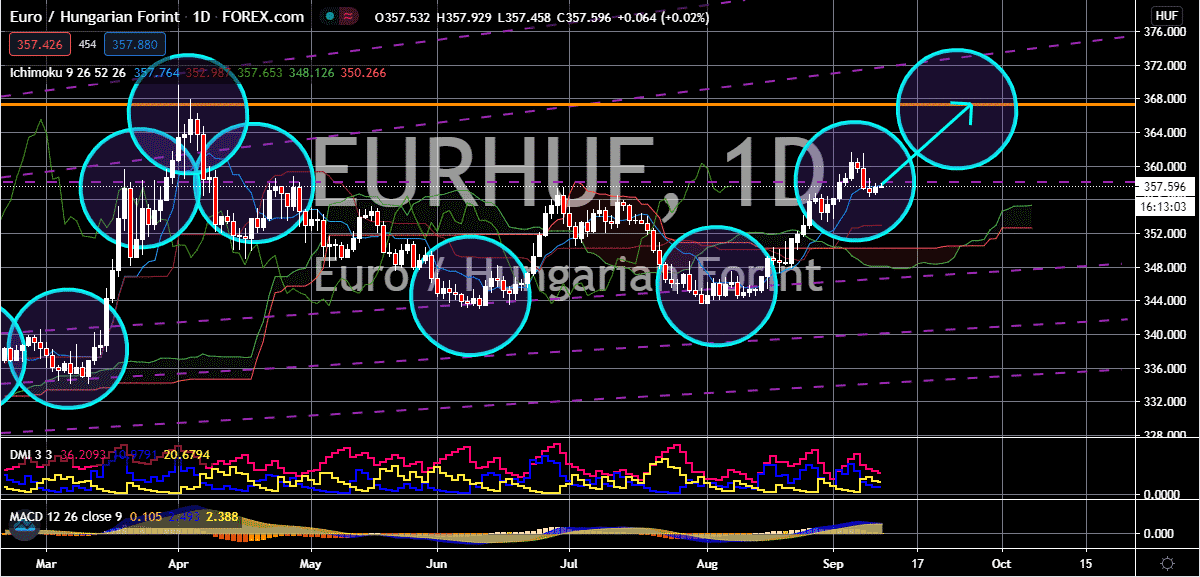

EUR/HUF

The Hungarian forint manages to force the exchange rate to steady today. However, it is believed that the tides will turn in favor of the bloc’s euro, allowing it to appreciate against the Hungarian forint. The trading pair should reach its resistance by the latter part of the month. Moreover, it was just recently reported that Jobbik deputy leader Daniel Z Karpat called on the Hungarian government over its passive response and stance over the concerns for the weakening Hungarian forint. According to the deputy leader, the nation is helping international export producers at the cause of their people and the currency. Karpat suggested that the government should increase the prices of its imported products to put pressure on consumers and argued that a smartphone could be up by more than 100 euros. The weak forint allows bulls to thrive and considering that there are no major policy changes from the ECB’s meeting, the euro should continue to appreciate.

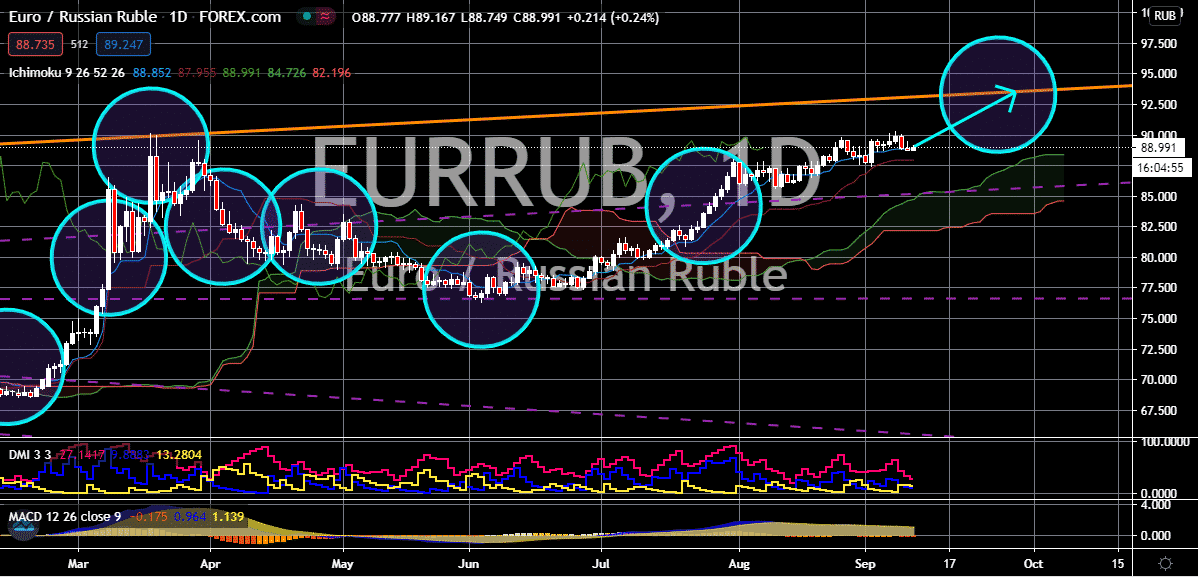

EUR/RUB

The concerns over sanctions against Russia are causing the ruble to continue buckling against the eurozone’s single currency. The euro to Russian ruble exchange rate is projected to climb up towards its resistance level as the euro gradually steps on its gas pedal. Just recently, it was reported that Russian Deputy Prime Minister Yuri Borisov vowed that the country would help the Syrian government survive the crippling sanctions of the United States. The Russian official said this during his visit to Syria after Russia launched its military intervention in the country. Aside from that, other nations are also imposing detrimental sanctions against Moscow, including Germany. Earlier this week, Berlin’s foreign prime minister, Heiko Mass has held out the probabilities of imposing heavy sanctions on Russia if the Kremlim fails to provide crucial information about the controversial poisoning of the country’s opposition leader Alexey Navalny.

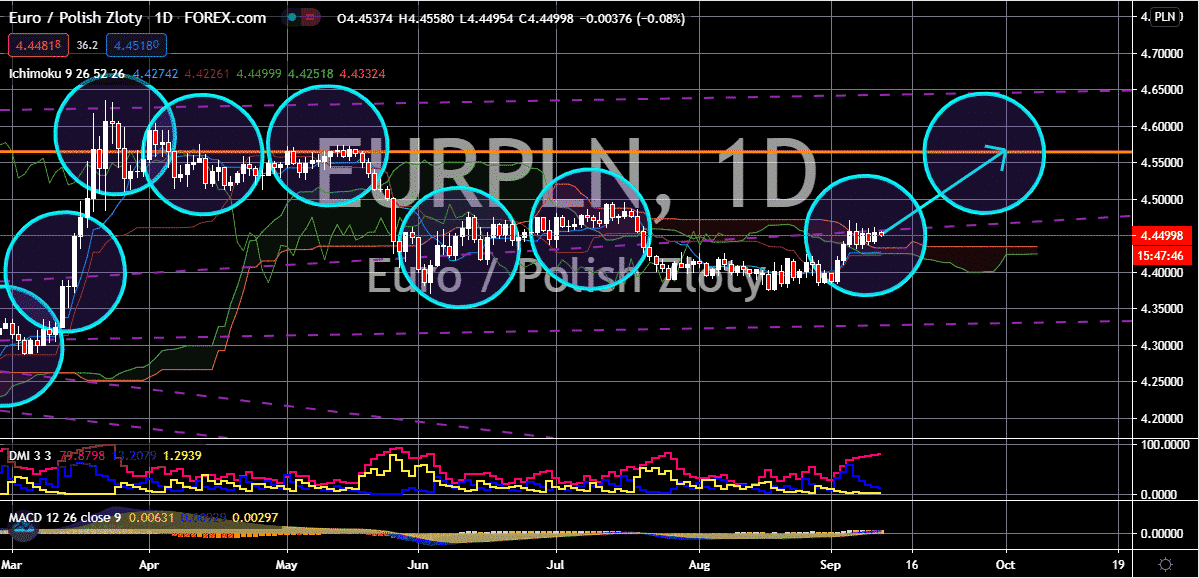

EUR/PLN

The Polish zloty remains firm against the euro, but bulls are looking to force the pair’s prices towards their resistance level by the end of the month. Looking at the chart, it appears that the past few days have been a constant push and pull between bulls and bears, luckily for the euro, the tide should turn towards its favor soon. Just recently, Poland’s prime minister Mateusz Morawiecki said that the country’s currency still has room to strengthen as the Polish economy recovers from the unfortunate damages of the pandemic. However, right now, that would be a problem considering that the euro is also strengthening after the meeting of the European Central Bank yesterday. on Thursday, European Central Bank president, Christine Lagarde, said that the eurozone’s domestic demand has been seeing significant recovery signs, fueling the confidence of bullish investors. Lagarde also downplayed the appreciation of the euro.

Unethical brokers

Unethical trading brokers. Do not trade with them.

Did you find this review helpful? Yes No

Total scam

They are a total scam with no customer support.

Did you find this review helpful? Yes No