Market News and Charts for October 30, 2019

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

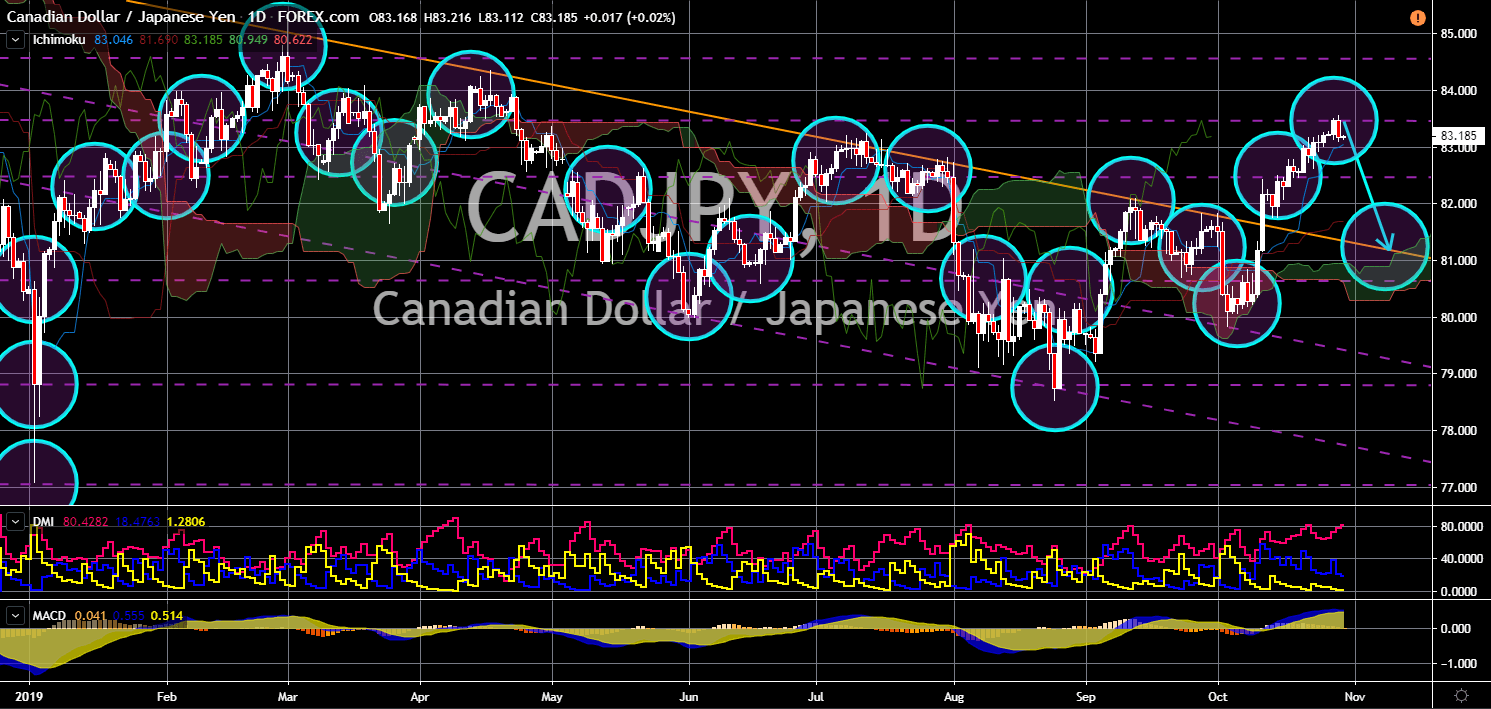

CAD/JPY

The pair failed to breakout from a key resistance line, sending the pair lower towards a major support line. Canada’s rise from the recent issues that dragged the country’s economy can be attributed to Japan. The country’s ratification of the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership) gave member states relief from the ongoing U.S.-China trade war. However, as Japan signed a bilateral trade agreement, Canada was left wondering when the ratified USMCA (United States-Mexico-Canada) will be passed. Since the election of President Trump, he began waging trade wars with enemies and allies, including Canada. The USMCA is expected to renew the U.S.-Canada relationship and thus will benefit both economies. Japan, on the other hand, had also ratified its trading deal with the European Union, which created the largest trading zone in the world.

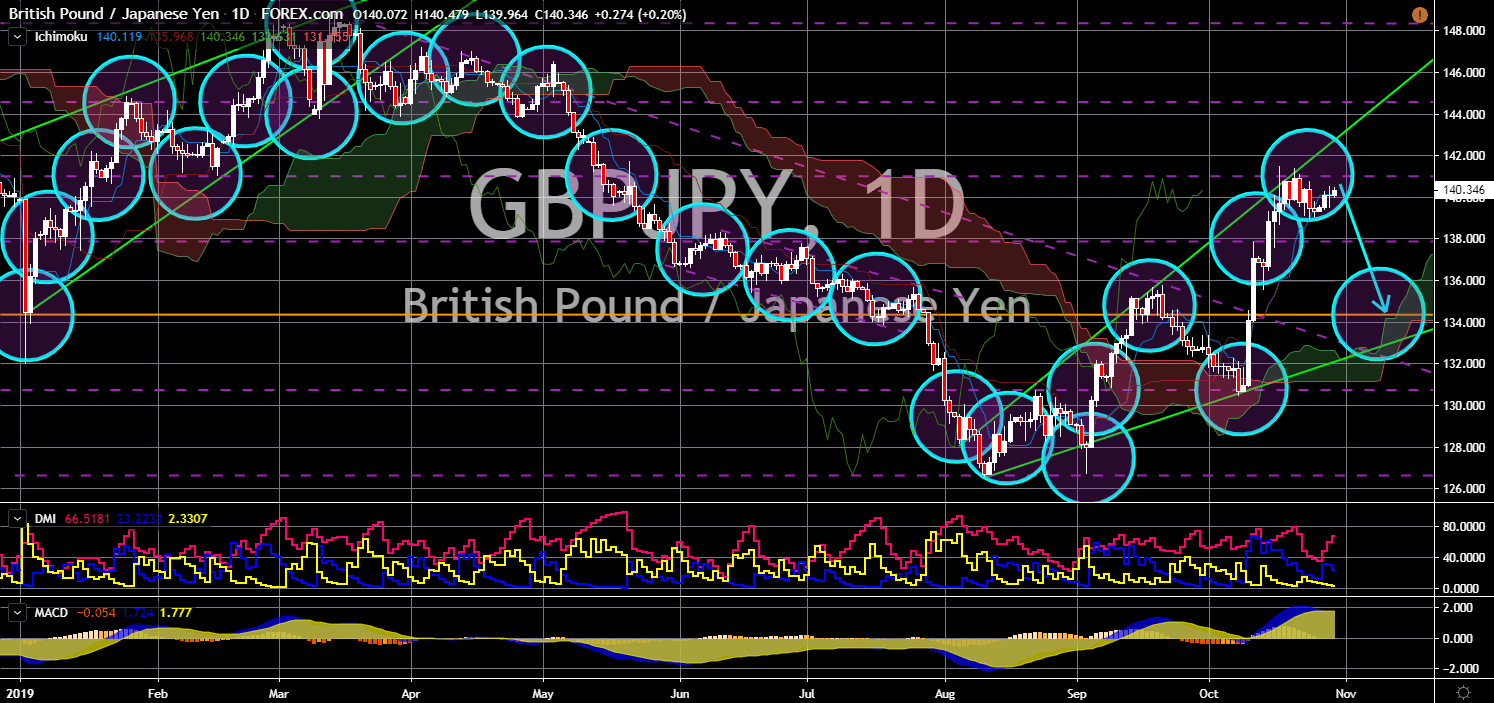

GBP/JPY

GBP/JPY

The pair is showing a series of small candles, indicating a future reversal for the pair. While Japan is moving forward with the recent trade ratifications and trading deals with major economies, the United Kingdom is taking a step back. This was amid the looming withdrawal of the United Kingdom from the European Union. The Brexit is further complicated by the extension until October 31, its third time since its initial withdrawal last March 29. Aside from this, British Prime Minister Boris Johnson won with the UK Parliament approving a general election by December. Japan, on the other hand, is winning its trade war with South Korea after the Bank of Korea cut its benchmark interest rate. BOK Governor Lee Ju-yeol trimmed the country’s interest rate by 25-basis points. Japan has a prime advantage against trading partners as its interest rates sit at the negative territory.

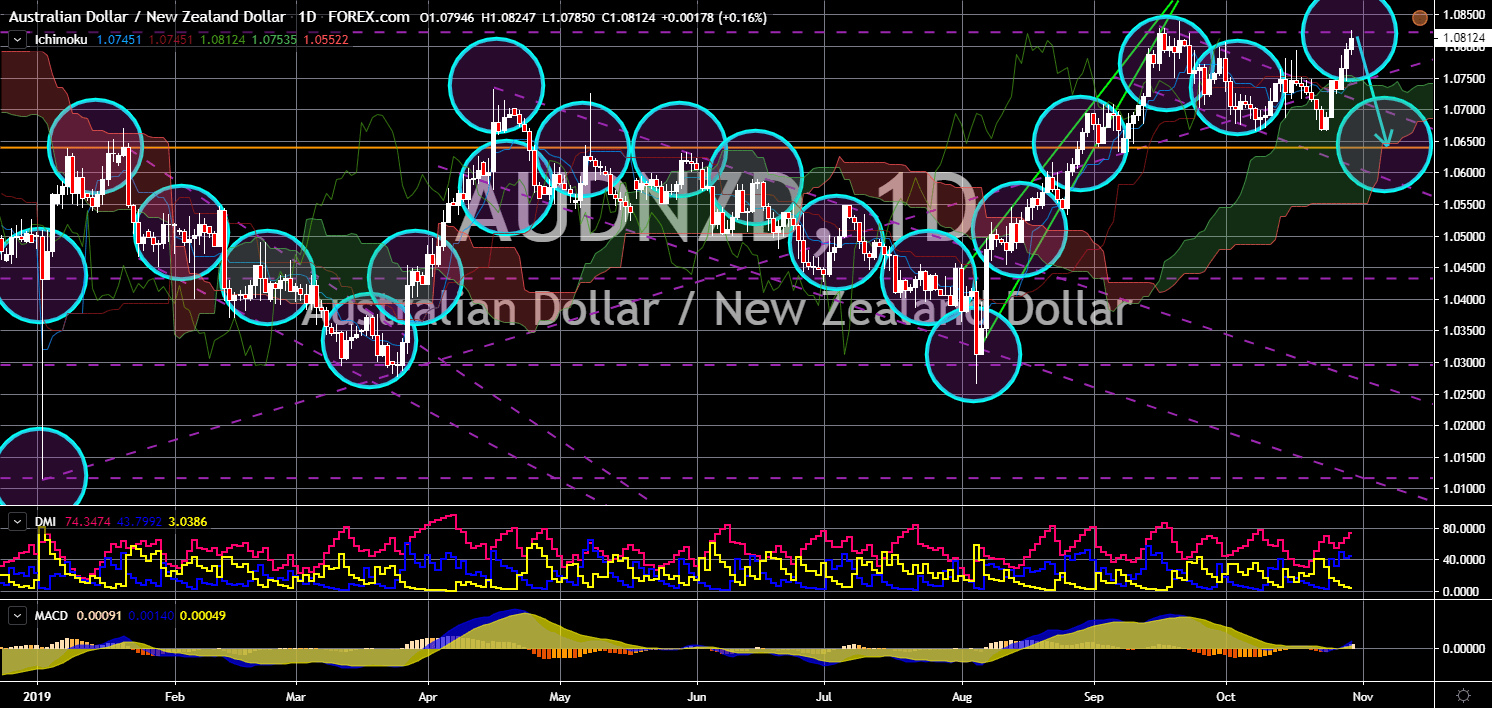

AUD/NZD

The pair is expected to fail to breakout from a major resistance line, sending the pair lower towards a major support line. The Australian Dollar is expected to retreat following several controversies surrounding its prime minister, Scott Morrison, and the Australia-New Zealand history. Morrison was engulfed with a constitutional eligibility crisis following the announcement by New Zealand Department of Internal Affairs that he was entitled to be a New Zealand citizen at the time of his birth. Hi maternal grandfather was born in New Zealand but was not a citizen. The section 44 of the Australian constitution prohibits dual citizens from running for parliament. In other news, Norfolk Island, an Australian territory and a tiny landmass with 1,800 people, said that they wanted to be in a free association with New Zealand. 36% voted to be part of New Zealand, while only 25% wanted to be associated with Australia.

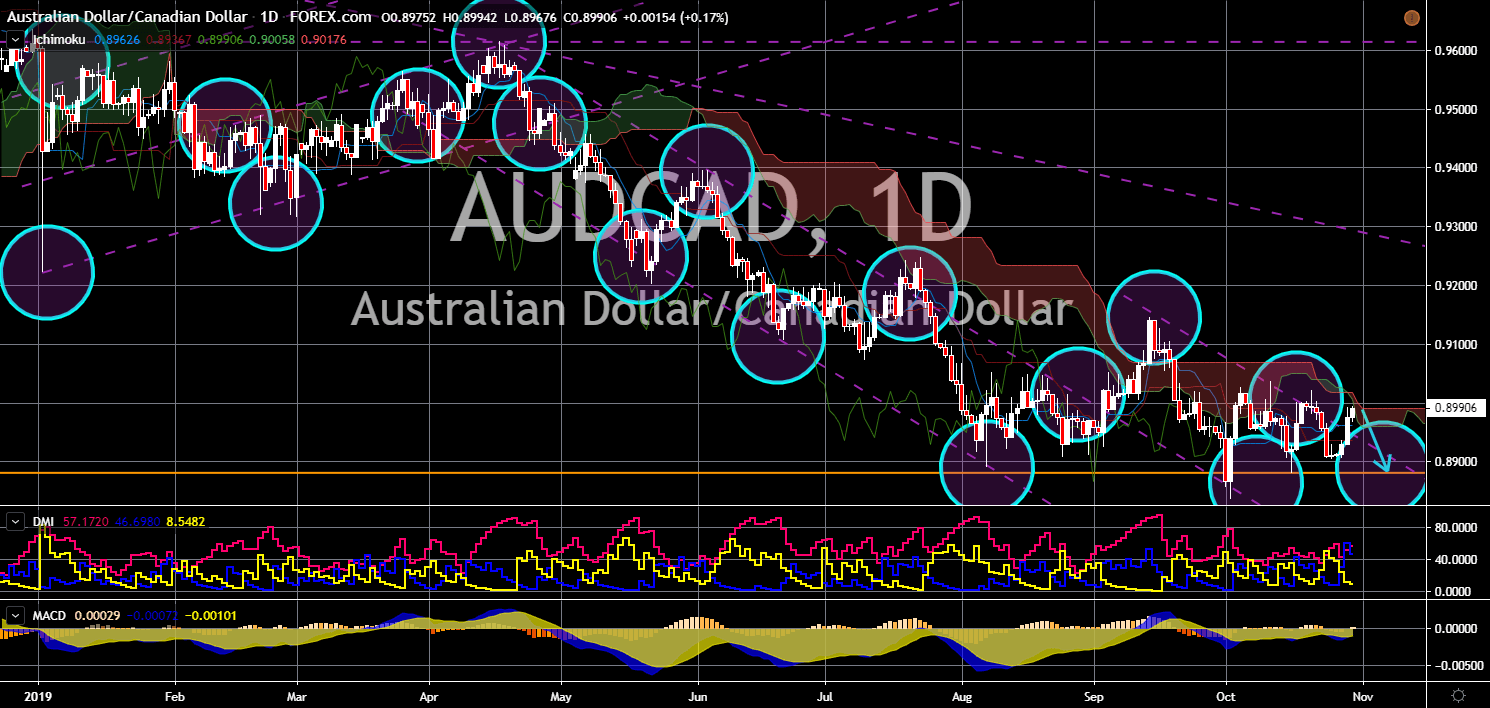

AUD/CAD

The pair is expected to continue its downward movement toward its previous low. Canadian Prime Minister Justin Trudeau won his second term while Australian Prime Minister Scott Morrison’s eligibility as a PM was being questioned. Despite winning the election, however, Trudeau can only form a minority government after his Liberal party lost the election. This will be problematic for him as he has less support from the parliament. But one thing that Canada is better with Australia is Immigration. Canada supports multiculturalism on both houses. Australia, on the other hand, was increasingly susceptible to racial discrimination. This set the country apart from New Zealand with the handling of different cultures. This makes Australia unpopular with the Arab nations, while Canada and New Zealand are being welcomed. Canada has more leverage than Australia in signing trade agreements with the UK and the EU.

-

Support

-

Platform

-

Spread

-

Trading Instrument