Market News and Charts for October 09, 2019

Hey traders! Below are the latest forex chart updates for Wednesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

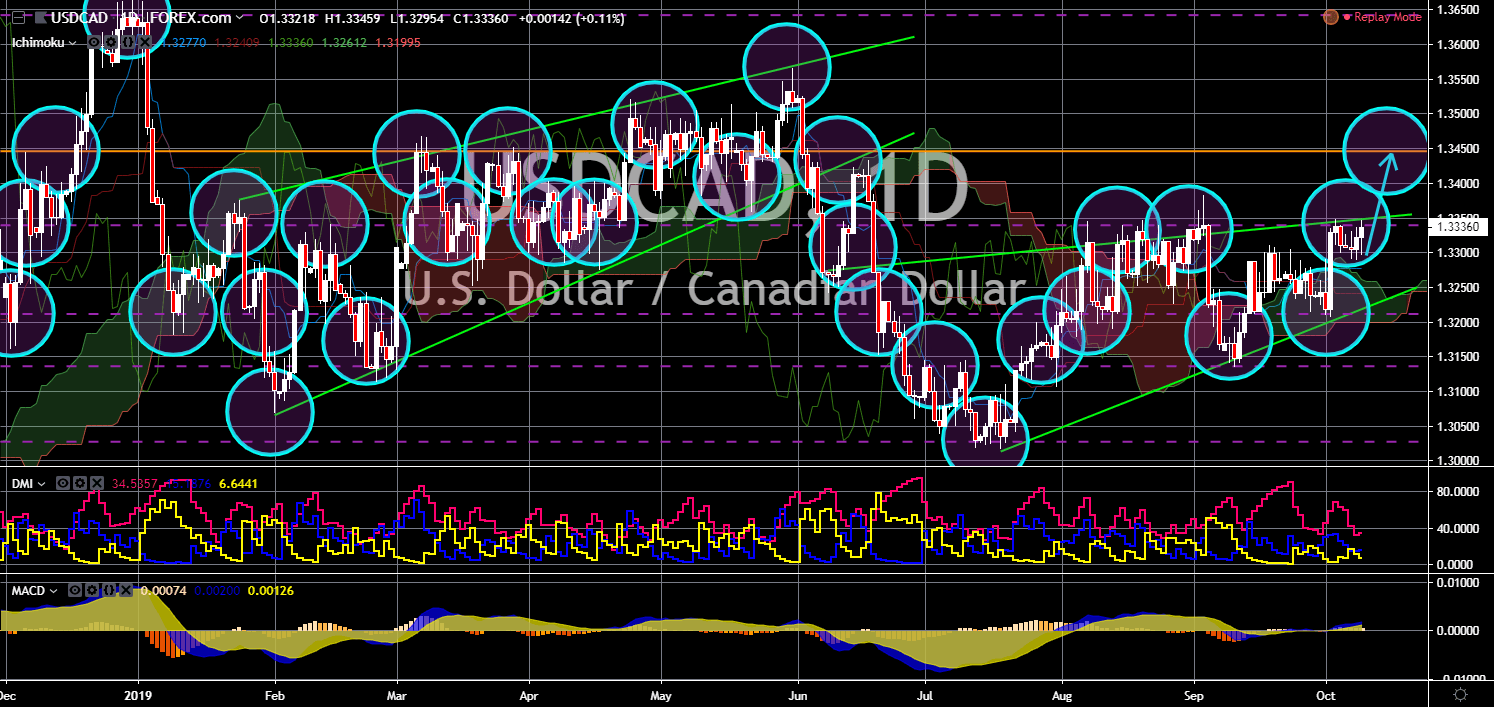

USD/CAD

The pair is expected to break out from a “Rising Wedge” pattern resistance line. Only thirteen (13) days remain before Canadians is set to vote for their new prime minister. The incumbent PM, Justin Trudeau, is seeking a reelection bid for the second term. His rival for premiership is the Conservative Leader, Andrew Sheer. Sheer is a dual citizen, holding a U.S. and Canadian passport. This is expected to benefit the United States once he wins as Prime Minister. The U.S. is seeking for approval of the ratified NAFTA (North Atlantic Treaty Organization). This was President Trump’s promise during the 2016 presidential election. And this is seen as one of the major catalysts if he seeks to run for another term. Justin Trudeau is facing several scandals including his meddling of the SNC-Lavalin case. Trudeau and his team were accused of pressuring then justice minister to drop charges against the company.

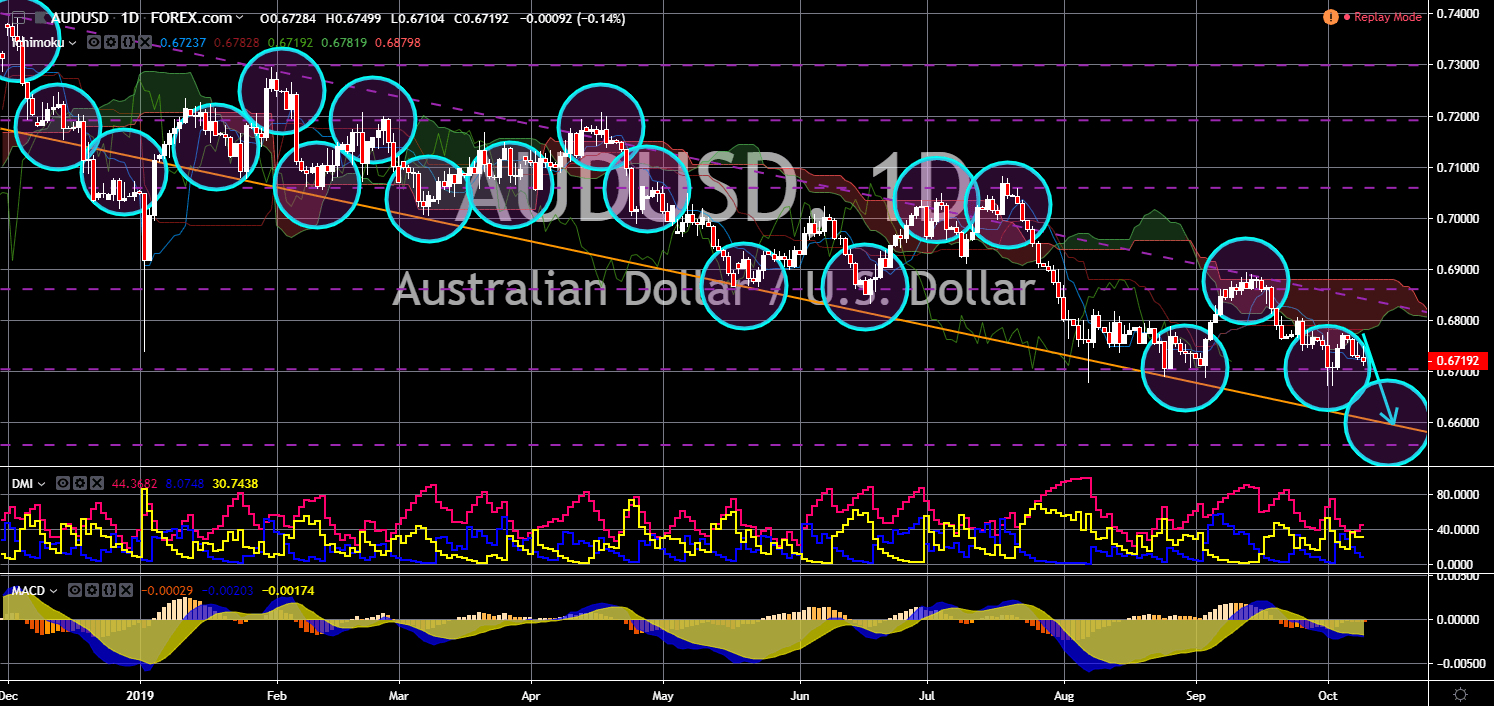

AUD/USD

AUD/USD

The pair is seen to break down from a major support line, sending the pair towards the downtrend support line. Analysts have a growing concern over Australia’s bending to U.S. pressure. Australia was the only remaining member of the Five Eyes Intelligence Alliance that is still at ban with Huawei. U.S. President Donald Trump warned its allies regarding the possibility that the telecom giant is spying for the Chinese government. Aside from this, Australia joined the U.S.-led coalition in the Strait of Hormuz. This was amid Iran’s seizure of western oil tankers on the choke point, affecting the global oil supply. Now, Australia supported President Trump’s decision to Syria. However, in less than 24 hours after the withdrawal, Australian Prime Minister Scott Morrison is already worried. He said that Turkey’s advancement in Northern Syria could lead to the resurgence of the terrorist group Islamic State.

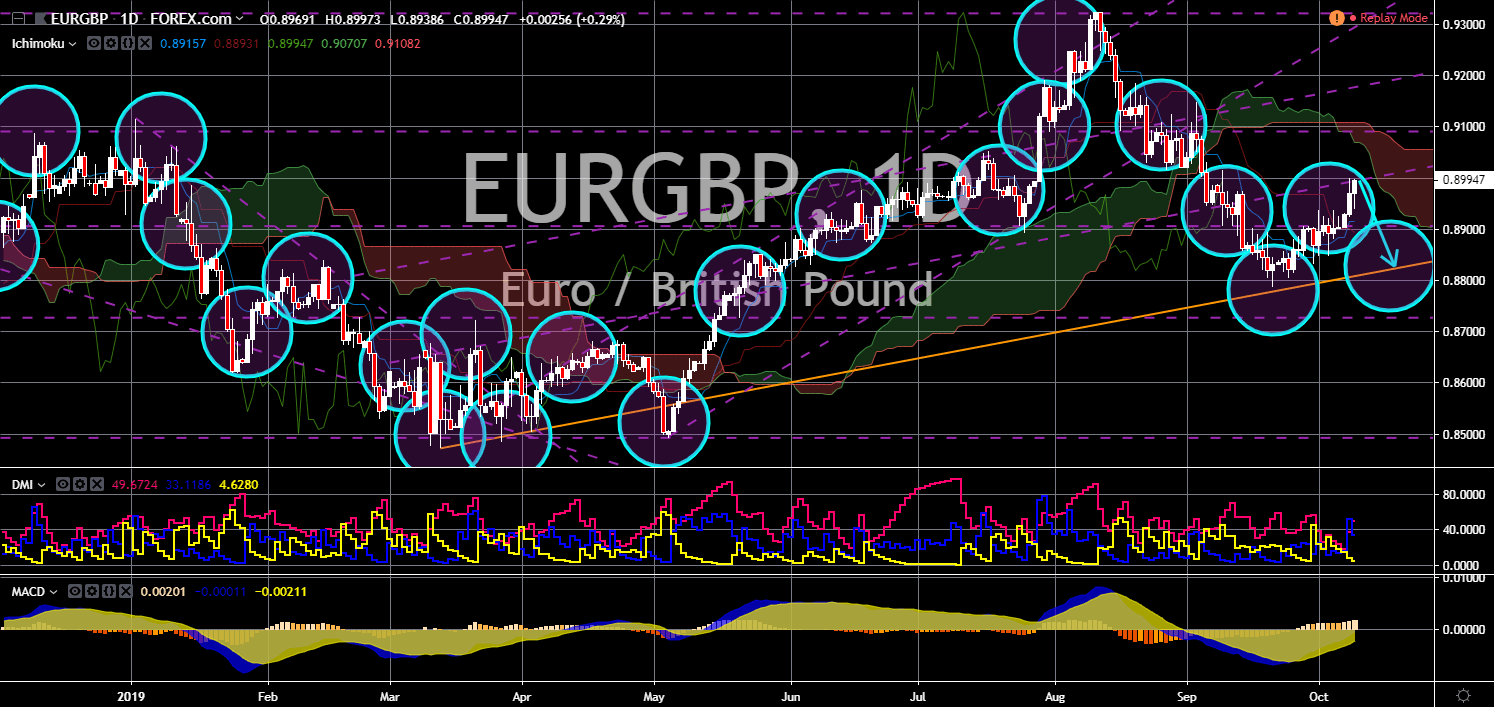

EUR/GBP

The pair will fail to break out from an uptrend channel’s middle resistance line, sending the pair lower toward its support line. Johnson summoned an emergency meeting with the EU leaders on October 19, just 24 hours away from the EU Summit. This will be the last pushed between the United Kingdom and the European Union to agree on a deal. Britain is set to leave the largest trading bloc until October 31 and a no-deal Brexit is in hindsight. Brussels is expected to offer a Brexit extension to prevent the UK from crashing from the EU without a deal. However, the British PM warned that he will not fight in an election just to argue on a no-deal Brexit. This suggest that PM Johnson will likely drag the UK out of the EU, with or without a deal. EU leaders, on the other hand, suggest that Britain should make more concessions. The Irish border is also expected to be discussed during the meeting between Johnson and the EU leaders.

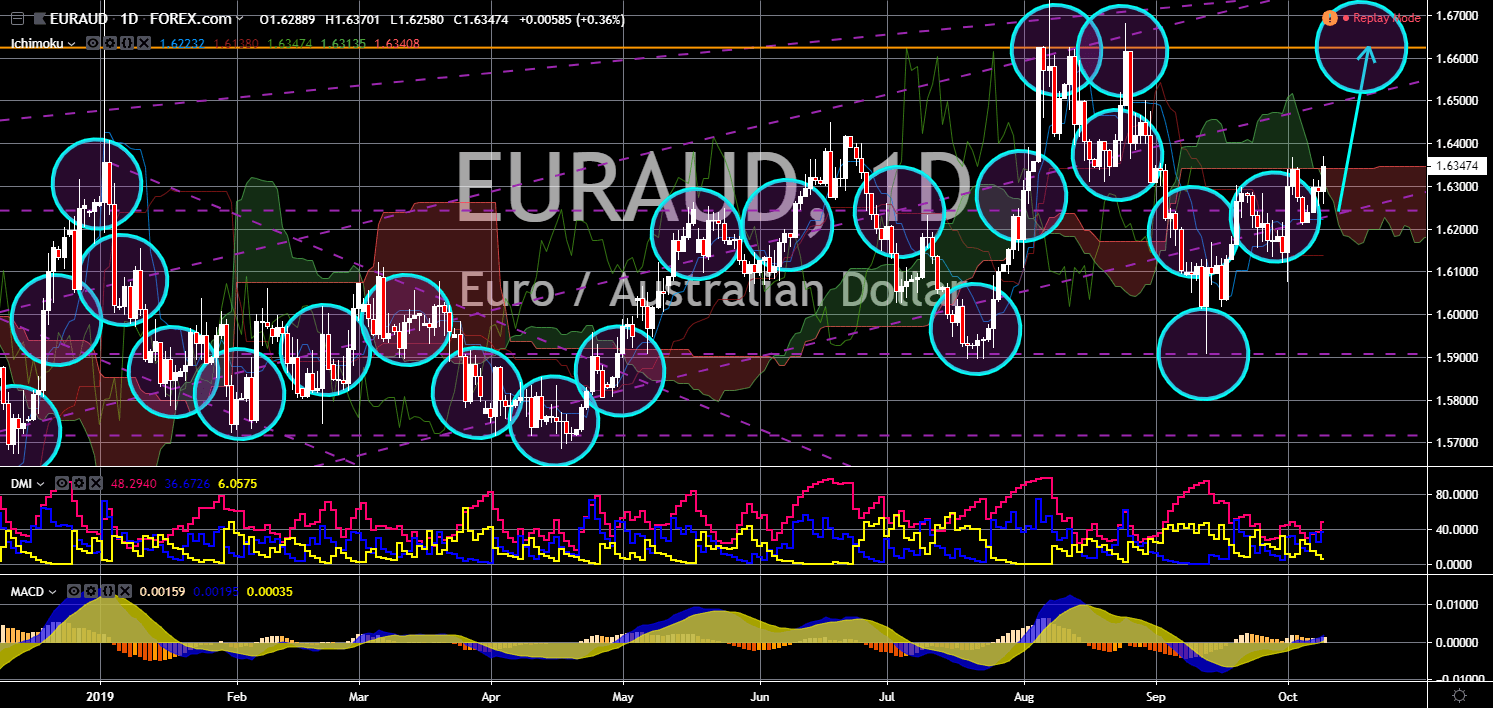

EUR/AUD

The pair is expected to bounce back from a “Pitchfork” support line, sending the pair higher toward its previous high. Australia’s relationship with the European Union is under pressure following a more U.S. stance that the country is showing. Australia supported the United States on its international policies, including the ban of Huawei 5G technology. Australia also supported the U.S.-led coalition on the Strait of Hormuz. Now, the U.S. demands the country to support its trade war with China and the European Union. Australia is at odds with the EU following the bloc’s decision to ban some Australian exports. This move was made following Australia’s signing of the post-Brexit trade agreement with the United Kingdom. The United States is also looking to sign a bilateral trade agreement with Britain once it officially withdraws from the bloc.