Market News and Charts for November 29, 2019

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

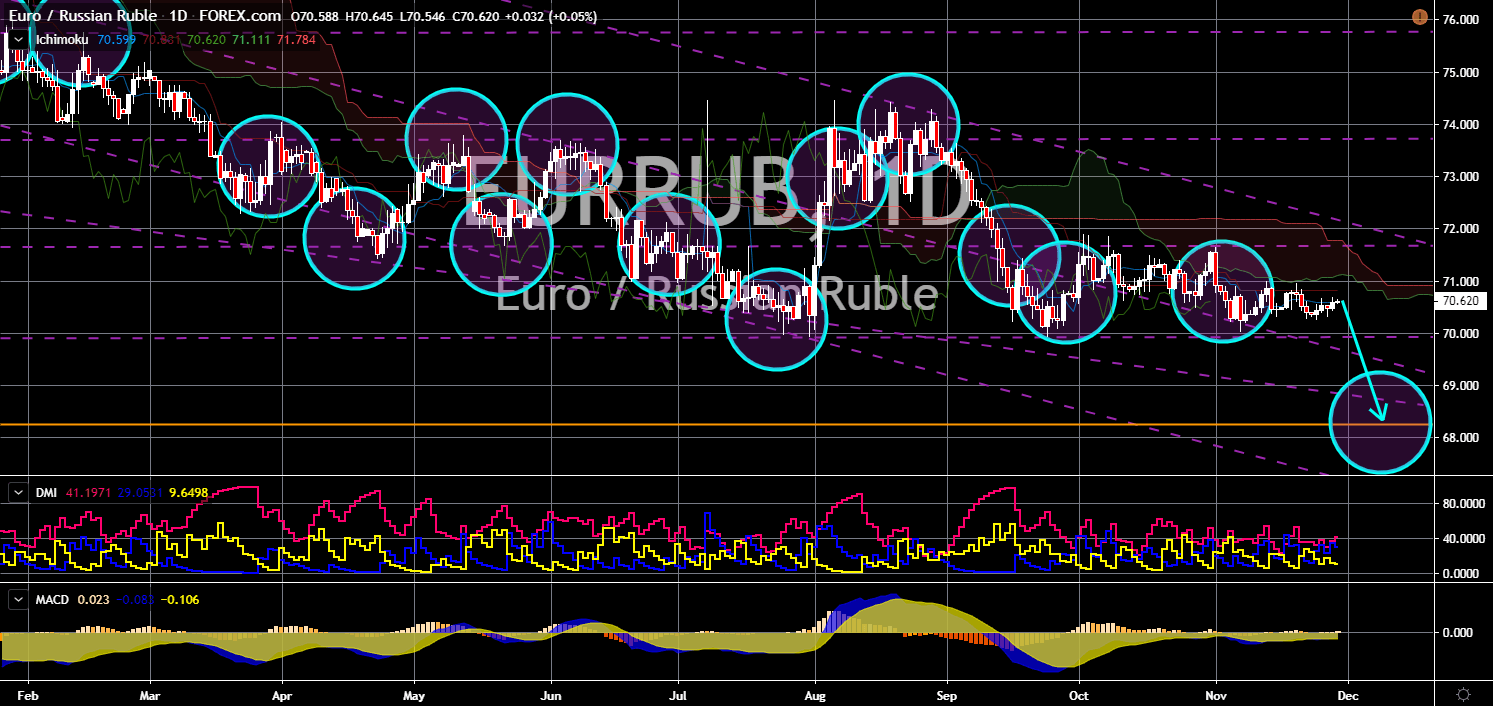

EUR/RUB

The pair is expected to breakdown from a major support line, sending the pair lower. The European Union is divided over Russia’s growing military and economic power. French President Emmanuel Macron, one (1) of the de facto leaders of the European Union, said that the U.S.-led NATO (North Atlantic Treaty Organization) Alliance is brain-dead. This was amid the narrowing relationship between the United States and the Germano-Franco Alliance. Aside from this, France also vetoed the EU enlargement in the Western Balkan, leaving them up for grabs to Russia and China. Russia has seen increasing its influence in the Middle East, Africa and Europe in recent months. Russian President Vladimir Putin recently brokered a deal between archrivals Saudi Arabia and Iran. Russia also hosted the first EU-African Summit last month. And finally, Russia created an economic union known as EAEU (Eurasian Economic Union).

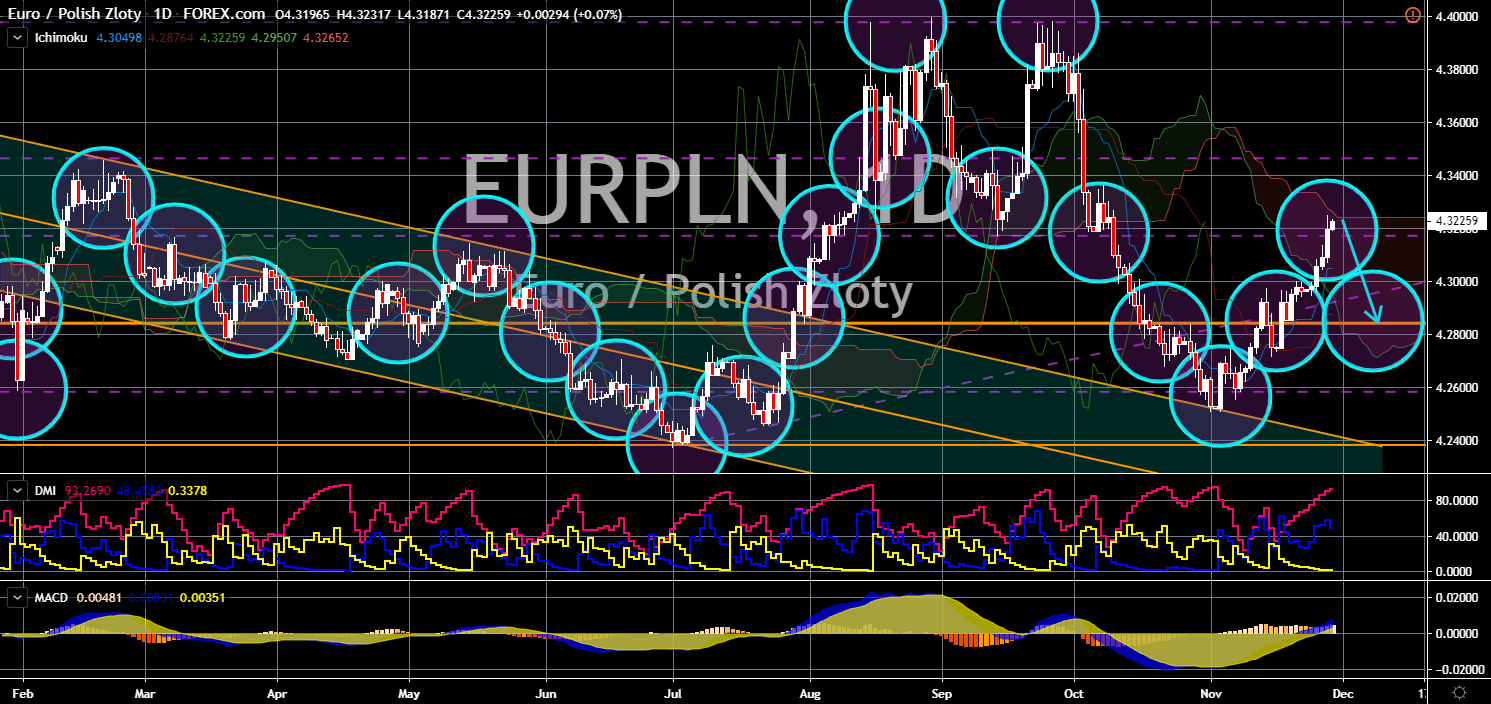

EUR/PLN

EUR/PLN

The pair will reverse back in the following days towards a key support line. The European Union and its member states are due to publish several reports today. German unemployment data is expected to continue its upward movement. The country’s retail sales also showed a disappointing negative figure, further putting pressure on the single currency. The same is expected for Italy’s Consumer Price Index (CPI). France consumer spending also slowed down for the month of November, which affected its gross domestic product (GDP) after it showed a similar growth from the previous month at 0.3%. With the western Europe experiencing a slowdown, the East is on the rise. Poland is among the fastest growing economy in the European Union along with other Visegrad group members. This is expected to shift the power balance inside the European Union in the years to come.

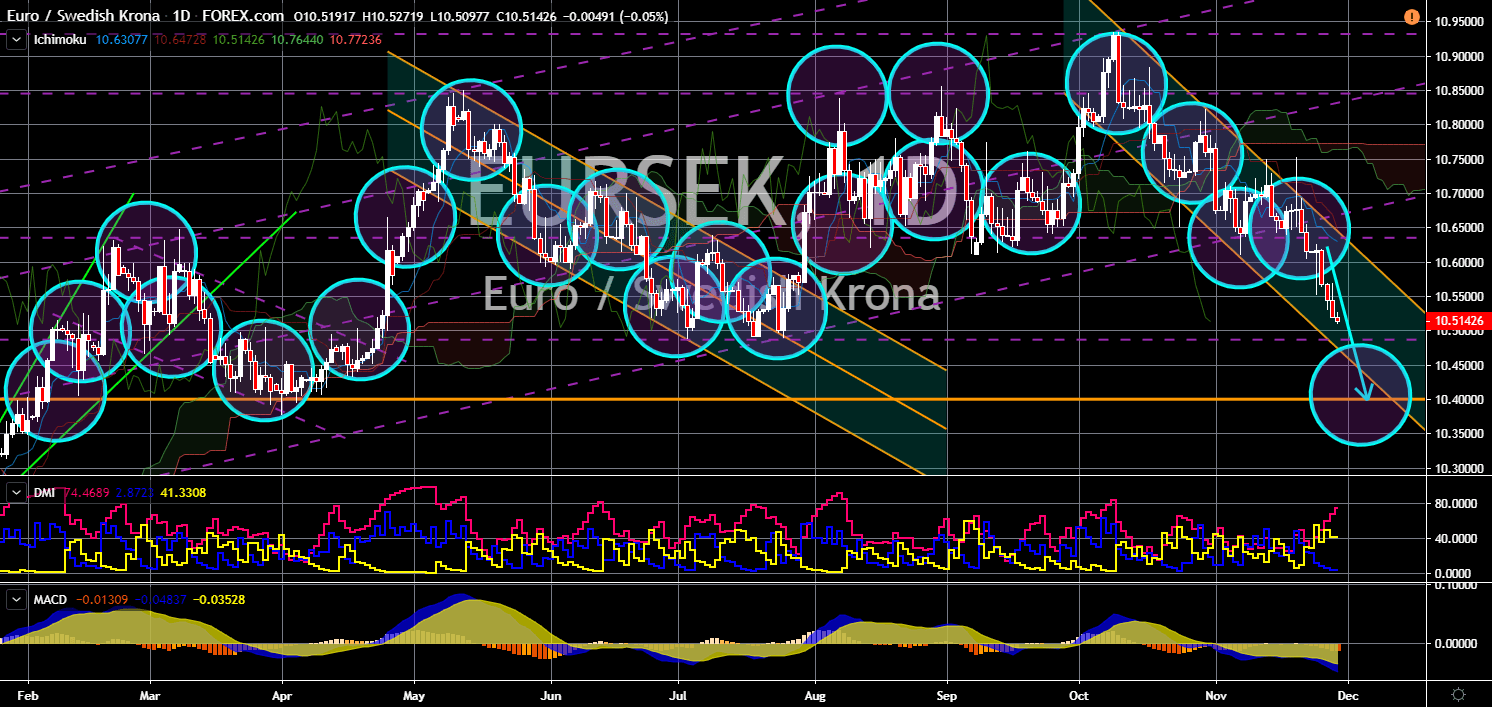

EUR/SEK

The pair is expected to continue its steep decline in the following days. Sweden is Denmark six (6) months ago. As Denmark approves Russia’s Gazprom Nord Stream pipeline 2, the Swedish court rejected it. Some EU-member states expressed their concern with the increasing dependency of Germany to Russia’s liquified natural gas (LNG). Aside from this, the Germano-Franco leadership is changing its tune with the U.S.-led NATO (North Atlantic Treaty Organization) Alliance. France is deepening its ties with Russia, while Germany is lobbying China. In other news, the Swedish government just backed North Macedonia’s accession in the European Union despite the objection from French President Emmanuel Macron. This move is expected to further divide the European Union. The V4 nations were given major positions under the leadership of European Commission President Ursula von der Leyen.

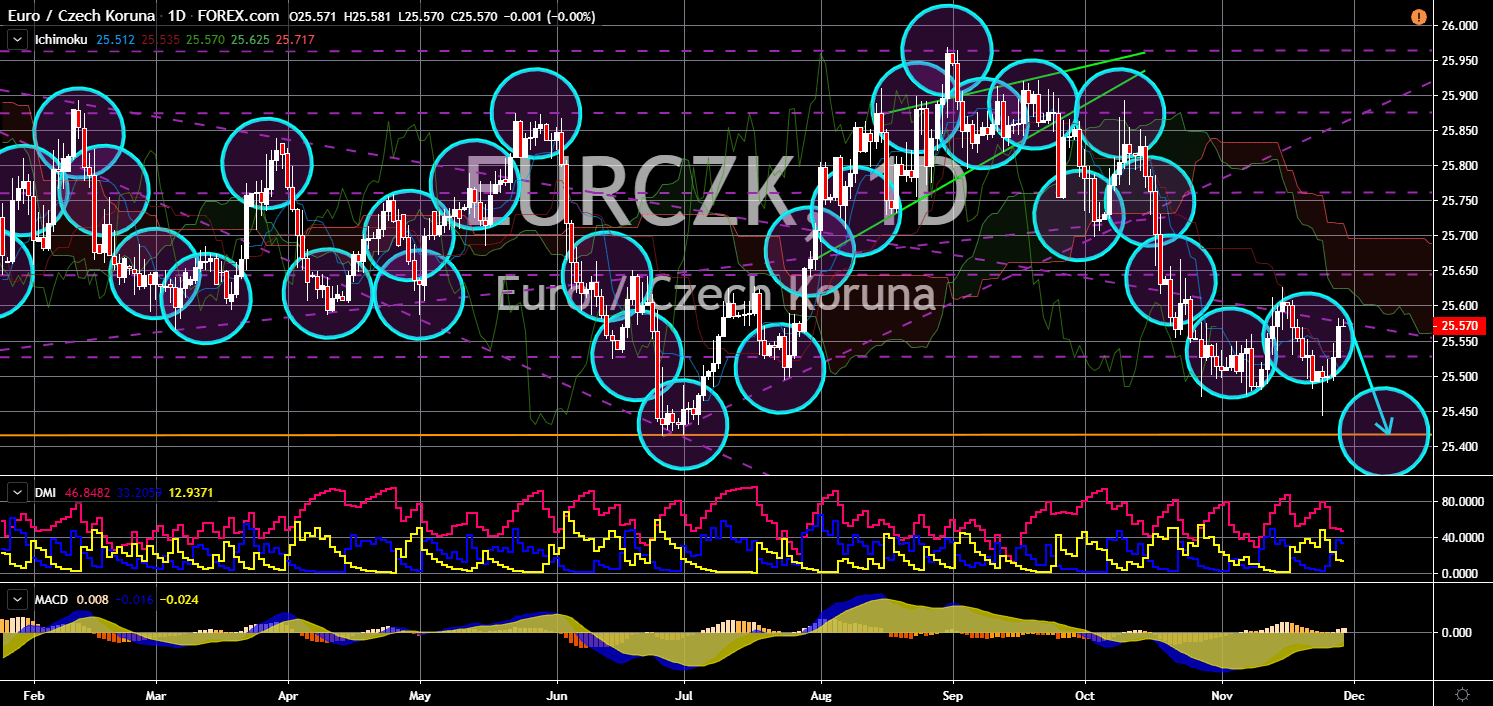

EUR/CZK

The pair will fail to breakout from a major downtrend resistance line. Many political analysts viewed the visit of European Commission President Ursula von der Leyen with the V4 nations as a success towards the integration of the divided European Union. However, some analysts were still worried that the European Union might have compromised more than its should to these countries. Von der Leyen got the approval from the European Parliament with her commissioners on November 27. The major positions were given to the eastern and nationalist group inside the European Union, the Visegrad group. This was despite the EU accusing Poland, Hungary, and Czech Republic of breaking the bloc’s law after it refused to take refugees in 2015. The approval of the commissioner also comes a month after Czech Prime Minister Andrej Babis was accused by the European Council of gaining personal interest from the EU subsidies.