Market News and Charts for November 28, 2019

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

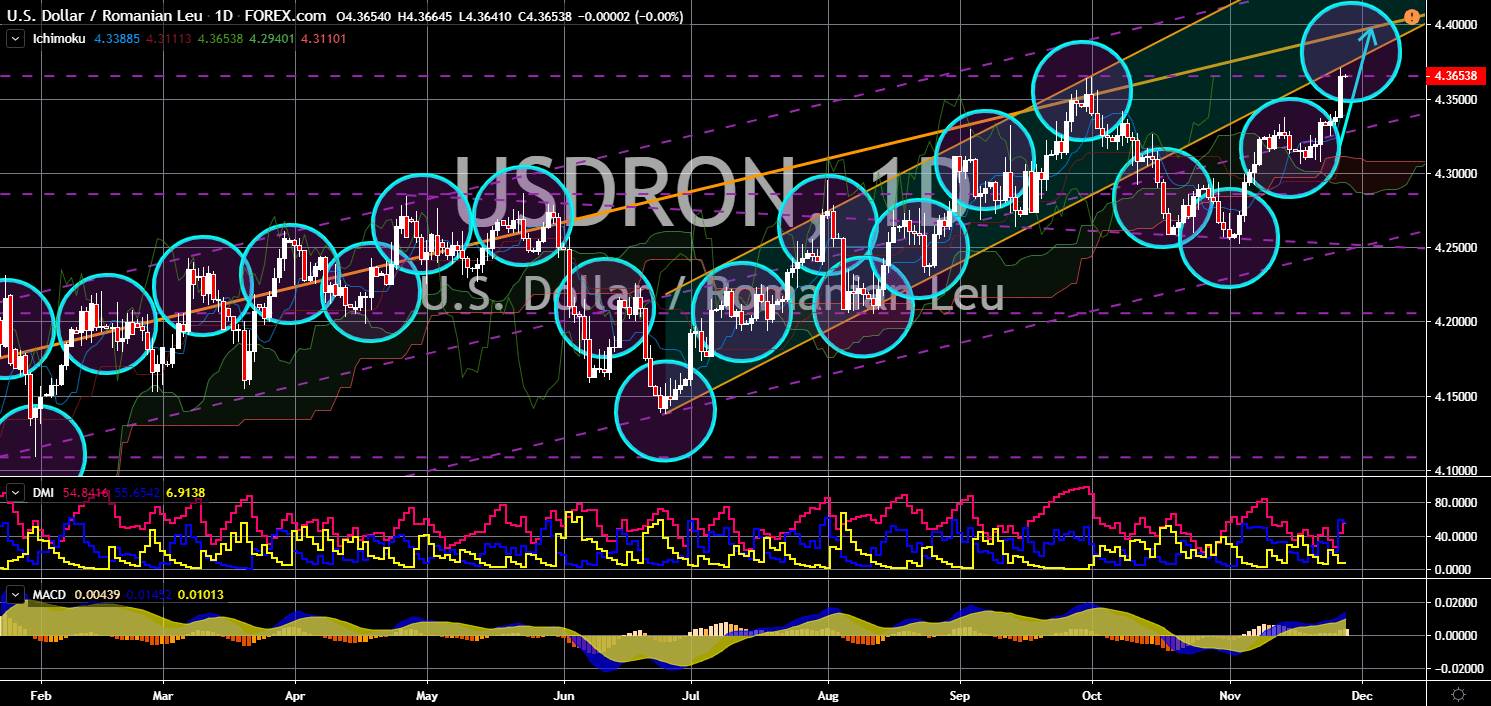

USD/BRL

The pair will continue moving higher in the following days after it broke out from a major resistance line. The U.S. consumption for the quarter is expected to pickup following today’ Thanksgiving Holiday in the country. This will be followed by blockbuster sales for its Black Friday and Cyber Monday events. This is expected to boost the U.S. economy for the fourth and fiscal 2019 reports. On the other hand, the Brazilian economy is under pressure following its exchange rate fluctuations in the previous trading sessions against the U.S. Dollar. The Brazilian real just entered its lowest value against the greenback on Tuesday, November 26, and is expected to continue in the following days. In other news, the U.S. and Brazil is trying to expand their cooperation after the U.S. started to implement the Global Entry Program (GEP). This program allows frequent travelers to have an easier access to the U.S. airports.

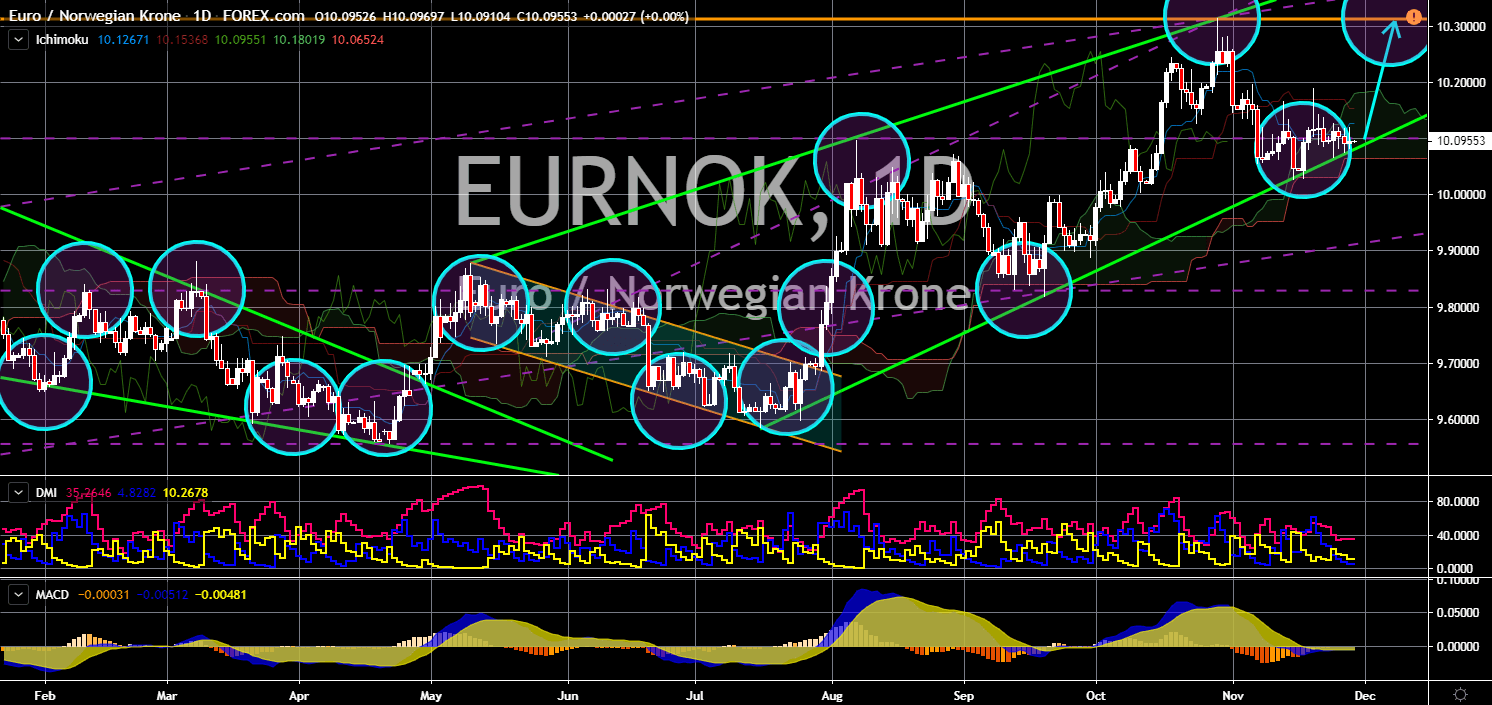

USD/RON

USD/RON

The pair is expected to breakout from a major resistance line, sending the pair higher toward its all-time high. Romanian President Klaus Iohannis was able to secure his position on the recent presidential election in the country. Political analysts viewed this as s positive sign for the United States, which recently installed THAAD (Terminal High Altitude Area Defense). The U.S.-led NATO (North Atlantic Treaty Organization) Alliance defended this move as purely a defense mechanism. The installation comes amid the increasing military and political influence of Russia in Crimea, a Ukrainian territory. Ukraine is applying both to become a member of the European Union and NATO. Romania, on the other hand, was trying to play fire with the United States and China. The country is being courted by Huawei technology to host its regional hub. The move could potentially open the European Union to Chinese investments.

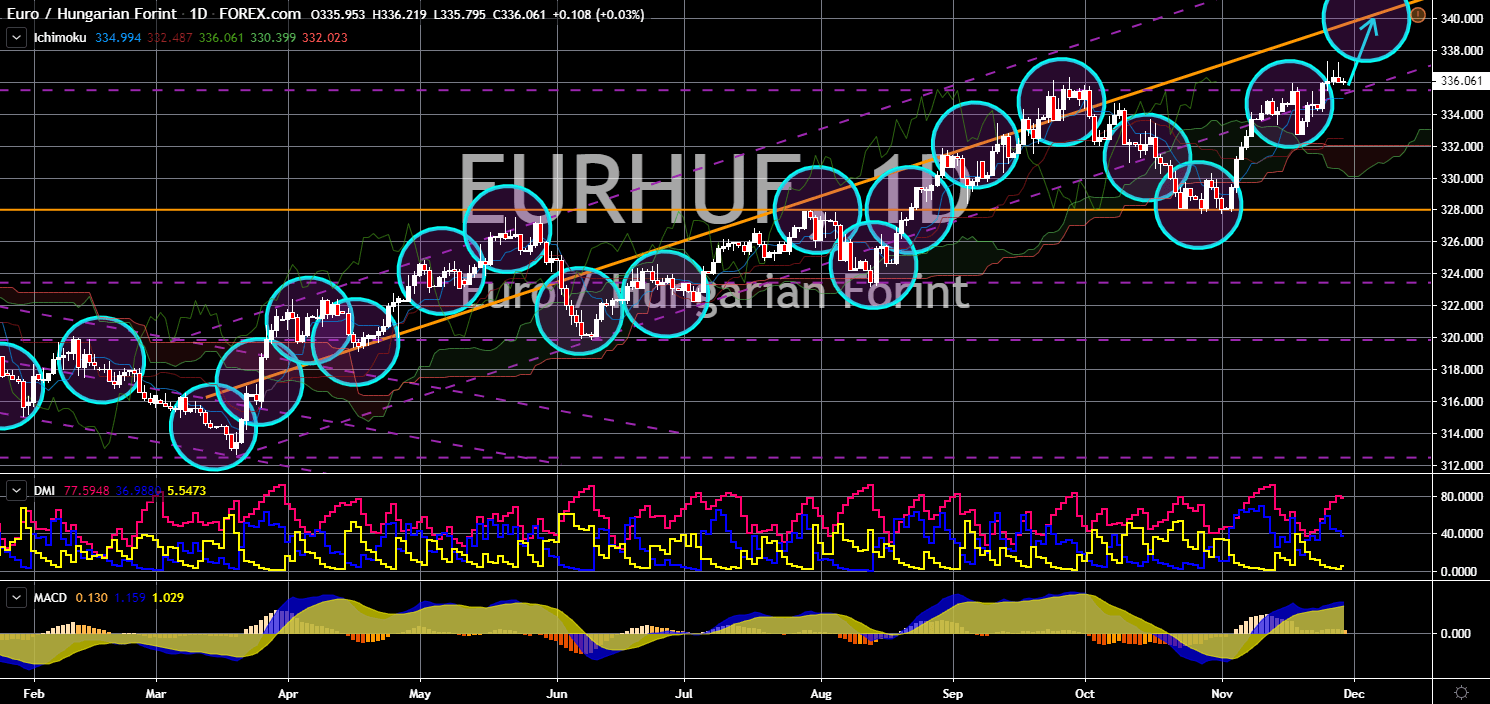

EUR/NOK

The pair is expected to bounce back from a major support line, sending the pair higher. The European Union and its member states just released several reports that will support the single currency’s strength. The Eurozone Money Supply increased this month by 5.6%, faster than the 5.5% from the previous month and from the 5.5% that analysts were expecting. Aside from this, Italy’s Producer Price Index (PPI) stabilized this month at -0.1%. Spain’s Consumer Price index report month-over-month (MoM) and year-over-year (YoY) were both positive. However, among EU-member states who published their reports, it is Germany that is still struggling. The largest economy in Europe just dodged a possible recession this month. However, this will not spare the country from another possibility of recession. In other news, Eurojust, the European Union’s Judicial Cooperation Unit extend its arrest to a non-EU country, Norway.

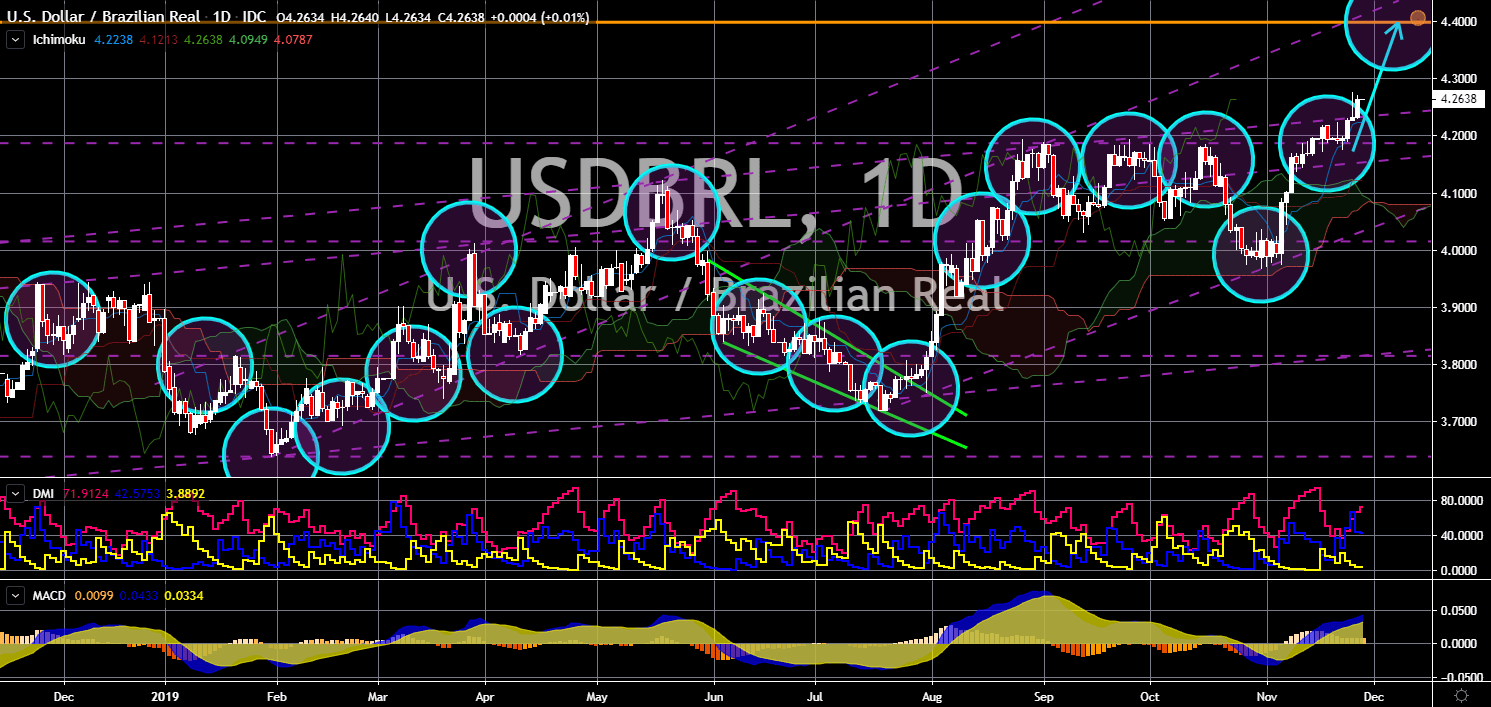

EUR/HUF

The pair will bounce back from an uptrend channel support line towards the channel’s middle resistance line. Earlier this month, Hungarian Prime Minister Viktor Orban called for the European Union to have a fair EU budget. Just days after this comment, Hungary accepted $1.65 billion fine for mismanaging the EU funds. This was seen by analysts as a slap for Hungary who for months has been trying to defy the European Union. Despite this misallocation of funds, Hungary was trying to spend the money wisely on education. The government spent 4.9% of its GDP on education this 2019 to $2.11 billion, which is higher than the EU average. Analysts see Hungary calming down in the past few months following the visit of Ursula von der Leyen, European Commission president. Hungary was given the portfolio for EU enlargement by Von der Leyen as part of the western leaders’ reconciliation with the eastern Europe.