Market News and Charts for November 22, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

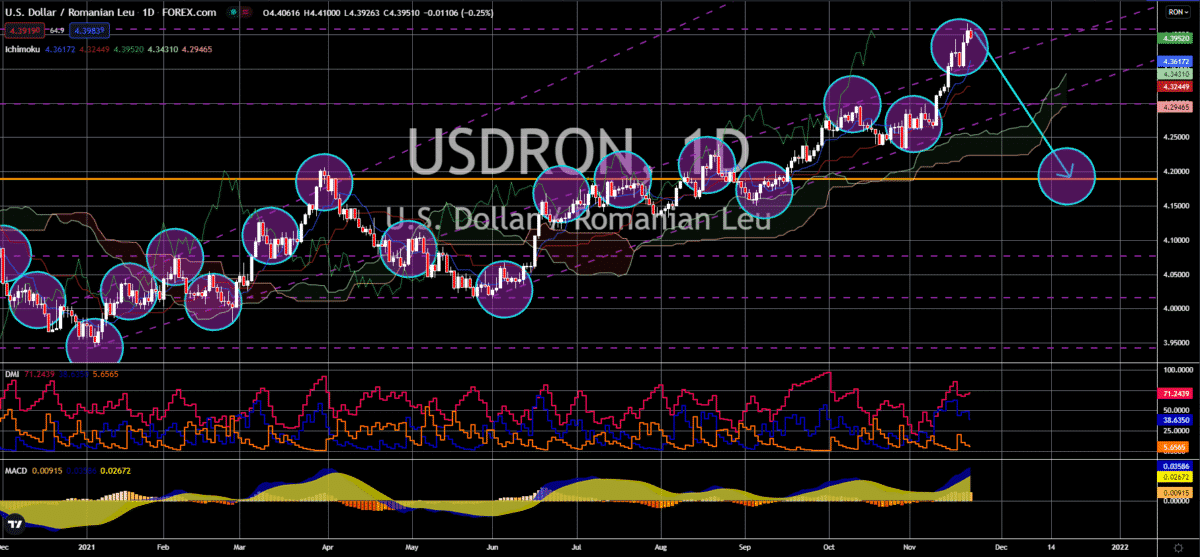

EUR/BRL

Eurozone’s Consumer Confidence Index might fail to move on again from the negative side. The November result of the economic indicator will be released on Monday, November 22. Analysts expect a -5.5% result for the month, reaching another level of low from October number of -4.8%. Citizens are finding it hard to restore confidence in the bloc’s economic activities given the sudden deviations that restrict a steady growth. In a statement on Friday, European Central Bank President Lagarde adamantly reiterated that there will be no rate hike happening by next year. This is despite the surging consumer prices, recording a 4.1% pace in October. The region’s inflation has now sat beyond the ECB’s original target rate of 2.0%. Adding to the downward pressure is the worsening Covid scenario seen in some European Union countries. Its largest economy, Germany, is on the brink of a new lockdown. Meanwhile, Austria imposed its fourth restriction on November 22.

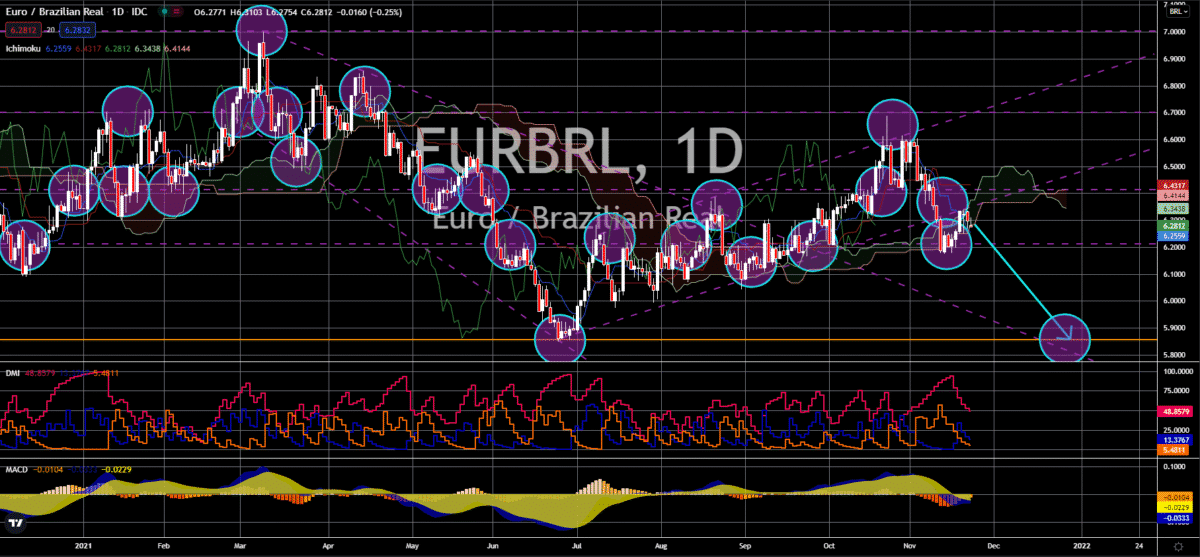

GBP/BRL

The United Kingdom’s retail sector performance showed green results all across the board but still remained under pressure. The country’s October Retail Sales recorded a -1.3% year-over-year pace which is better than analysts’ expected -2.0% decline. On the other hand, this result is higher than the previous month’s -0.6% level, showing that the country’s retail sector is still far from attaining a full recovery. On a monthly measure, the result came at 0.8%, moving past the average consensus of 0.5% level. This is also higher than September’s negative 0.2% notch. Business owners in the retailing niche suffer from the rising costs of raw materials. As of the latest deliberation, the United Kingdom’s Consumer Price Index sits at 4.2%, higher than expert’s projection. Similarly, the result represents a decade-old high, igniting some worries on the future trajectory of Britain’s benchmark inflation. The Bank of England (BOE) kept its interest rates unchanged in its latest policy meeting.

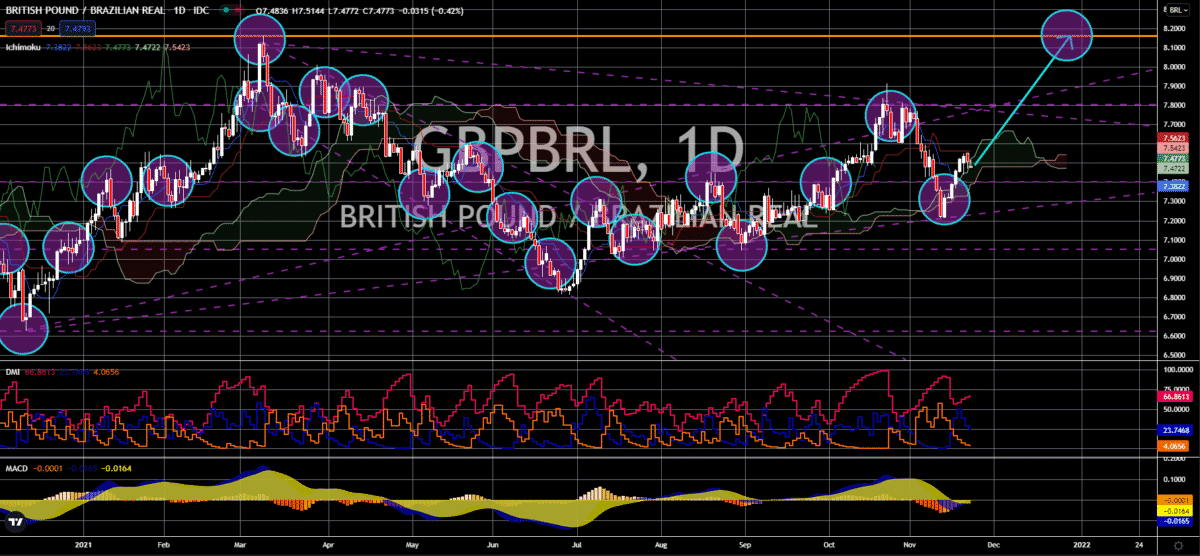

USD/BRL

Brazil’s Federal Revenue will be up for viewing on the first regular trading day of the week. In the October report, the administration updated 149.02 billion in collection from the country’s business sector. The indicator has followed a steady uptrend, beating analysts’ projection month after month since the start of the year. However, the good news is not enough to buoy the overall health of its struggling economy. Last week, Brazil’s government revised gross domestic product expectations downward for this year. Brazil’s Ministry of Economy is looking at a 5.1% expansion for 2021. It is lower than the 5.3% growth rate given previously. The same lukewarm sentiment might linger through the next year. For 2022, economists see South America’s largest economy expanding 2.1% which is significantly lower than the 2.5% given during the initial estimate. Brazil has been hardly hit by the ongoing global energy price surge and the spillover effects of the supply chain crunch.

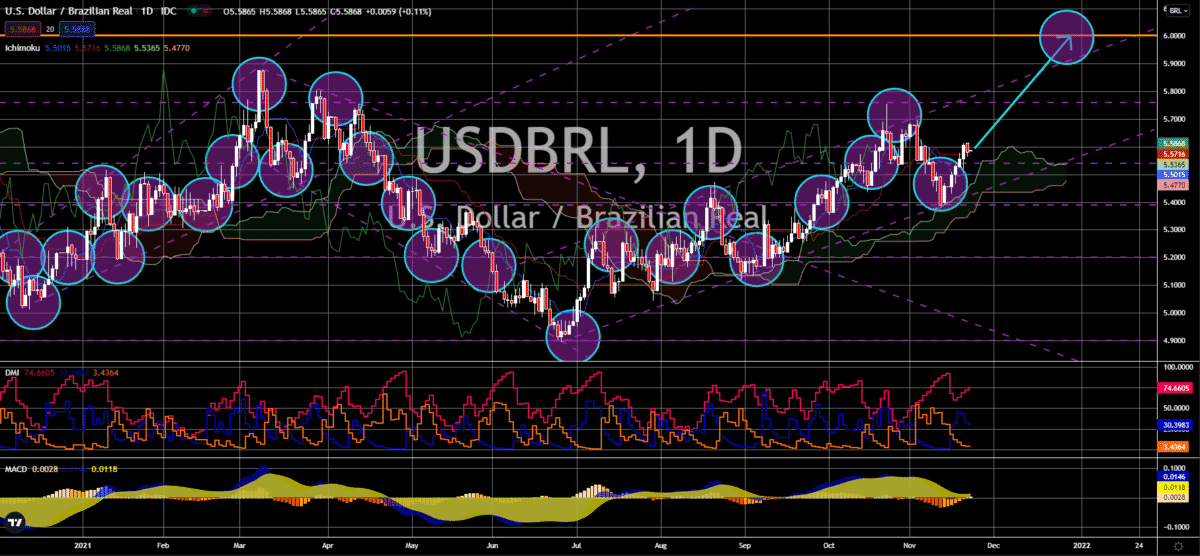

USD/RON

The United States is welcoming a week of holiday, which is also anticipated to stage momentum towards December’s healthy consumer spending. On November 22, the country will update on its Existing Home Sales for October which is expected to come at around 6.20 million units. This is lower than September’s 6.29 million sales, thus making analysts slightly contemplative about the overall health of the housing market. In a brief context, September’s pace holds the highest record since the start of fiscal 2021. However, in October, the rising costs of houses might have dismayed and motivated buyers to think twice about making a purchase. Prices are steadily growing and are still far off from reaching a cooler state given the influx of demand. In a look at the past US record, May reported 5.78 million units sold followed by June’s slightly higher 5.87 million sales. Adding on, July updated 6.00 million sales while August’s data came slightly lower at 5.88 million units.