Market News and Charts for November 19, 2020

Hey traders! Below are the latest forex chart updates for Thursday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

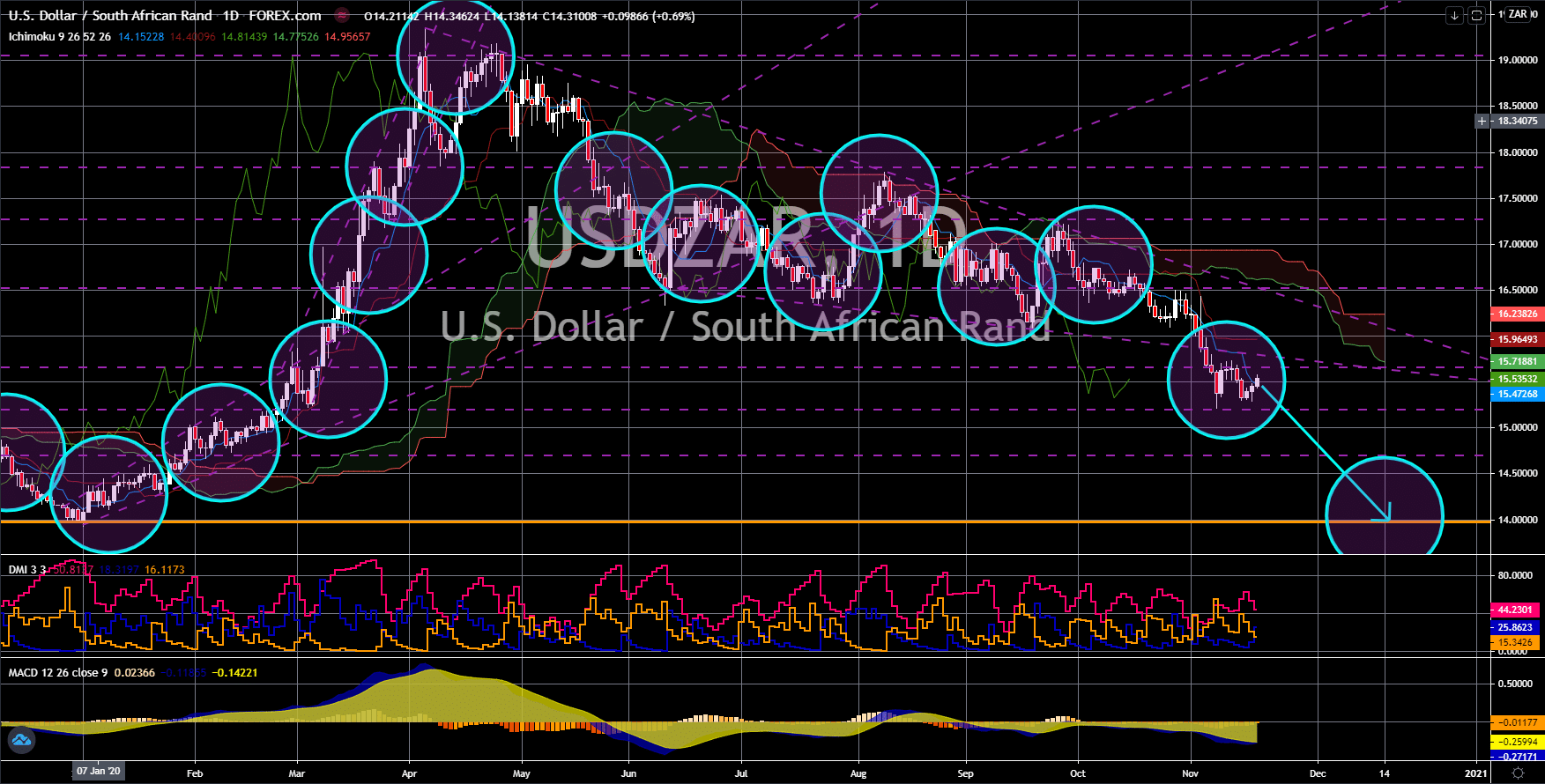

USD/PLN

The pair will break down from a major support line, sending the pair lower towards its May 2018 low. Poland and Hungary have sent the EU Commission scrambling to find ways to pass the 2021-2027 EU Budget. The $2.13 trillion was aimed to help EU members to recover from the devastating economic impact of the pandemic. However, the eastern countries were not pleased with the new policy that will tie the fund to a country’s compliance with the EU rule of law. This means that the commission can lessen Poland’s budget if it found the country violating the law. Poland’s decision to veto will have a negative economic impact on the Eurozone and the single currency. As most EU countries use the euro currency, Poland’s veto will affect their economies. However, this will be the reverse for EU countries that kept their national currencies. In other news, the Polish Development Fund said that Poland can go back to its pre-corona level by the end of 2021.

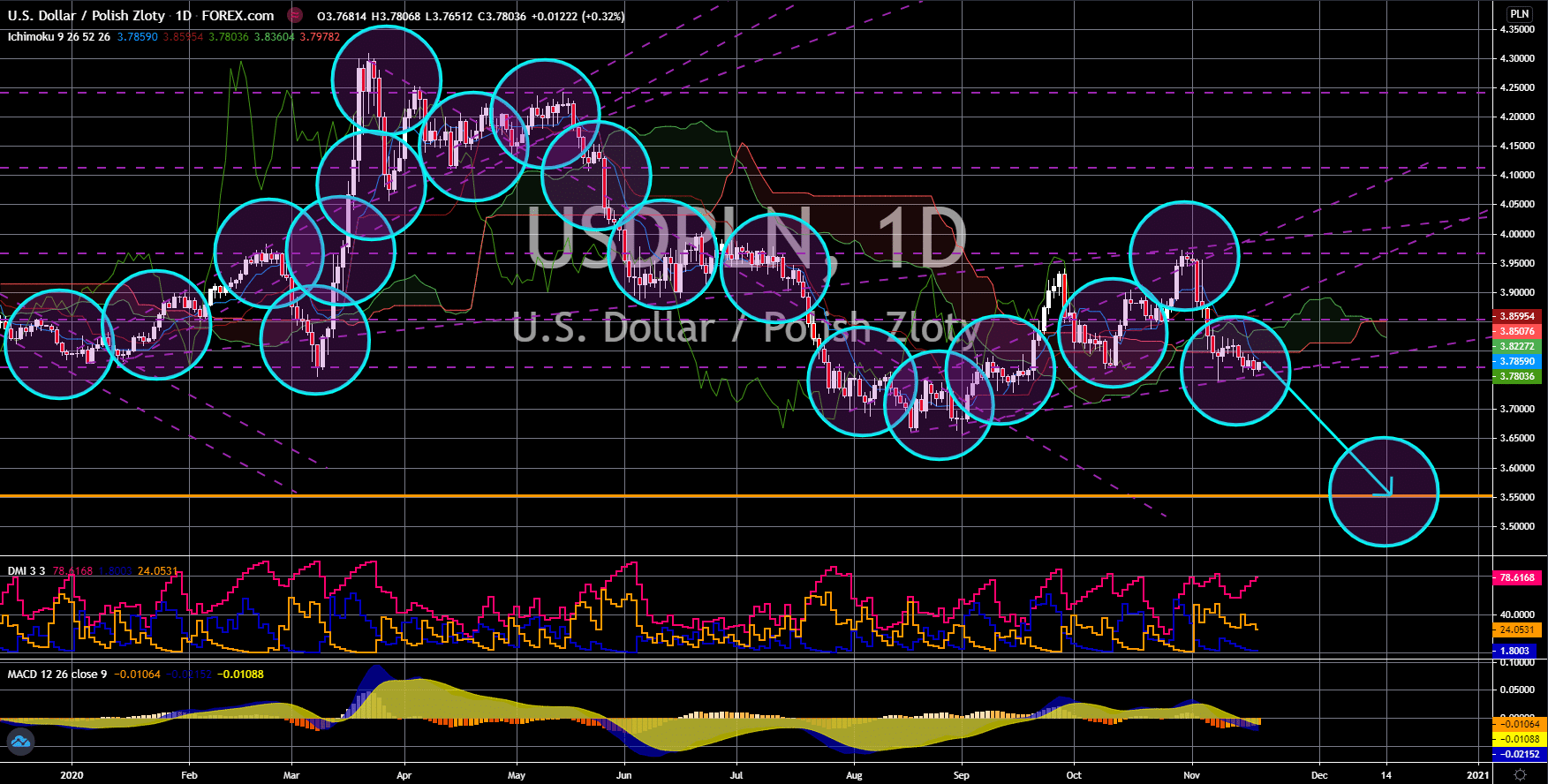

USD/ILS

The pair is currently trading at its lowest level and is expected to further go lower in the following days. The recent GDP report from Israel relieved investors that the country can bounce back from the pandemic. In Q2, the country’s economy contracted by 29.8%. This was followed by an expansion of 37.9% in the third quarter, which reflects the status of Israel’s economy after the first lockdown was lifted. This easily beats analysts’ expectations of 24.0%. The Q3 figure was the highest recorded quarterly jump since 1995. The recent surge in the country’s economy was fueled by a 44.6% increase in exports, a 43.1% surge in the business output, and a jump of 42.0% in private consumption. Also, foreign direct investments (FDI) increased by 7.3%. Meanwhile, the import was the only sector which saw a negative figure on the most recent reports. Figure came in at -6.0%. However, this will only justify a surge in shekels in the coming weeks.

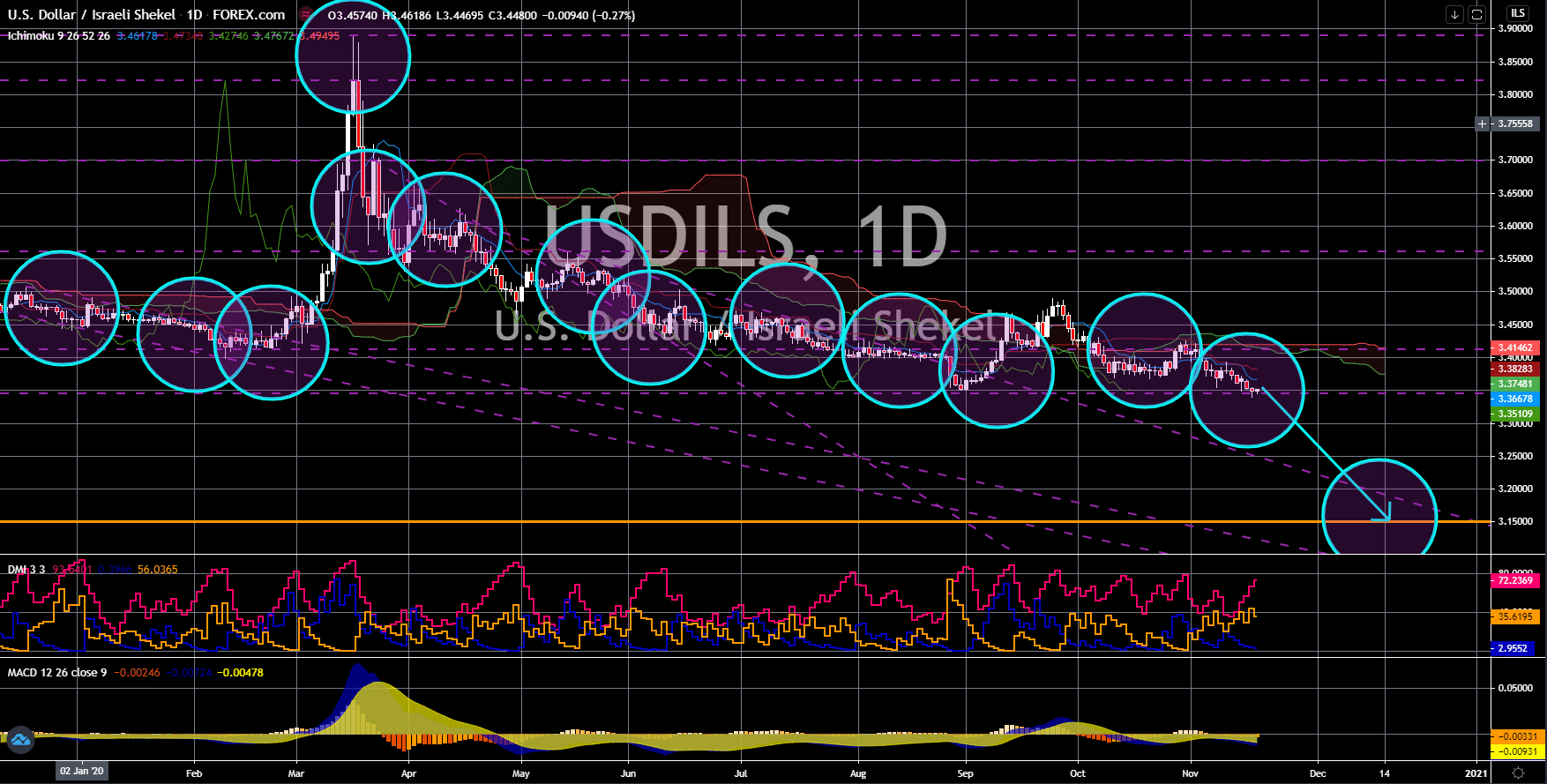

USD/SEK

The pair will break down from a major support line, sending the pair lower towards the 8.00000 price zone. Sweden had the lowest unemployment rate for the past five (5) months. This was after the country posted a 7.8% rate which was comparatively lower compared to September’s 8.3% result. Meanwhile, analysts forecasted a small change in the US initial jobless claims report. Expectations for this week’s report was 707,000 while the prior result was 709,000. The reason for the dull expectations was the resurgence of COVID-19 globally which could cause another wave of unemployment. The US still leads the list of countries with the highest number of coronavirus cases at 11.6 million, or 20% of the global cases. Europe will also see a surge in the number of its cases. However, the second wave is more catastrophic for the US economy with China lurking on its back and waiting to surpass its economy.

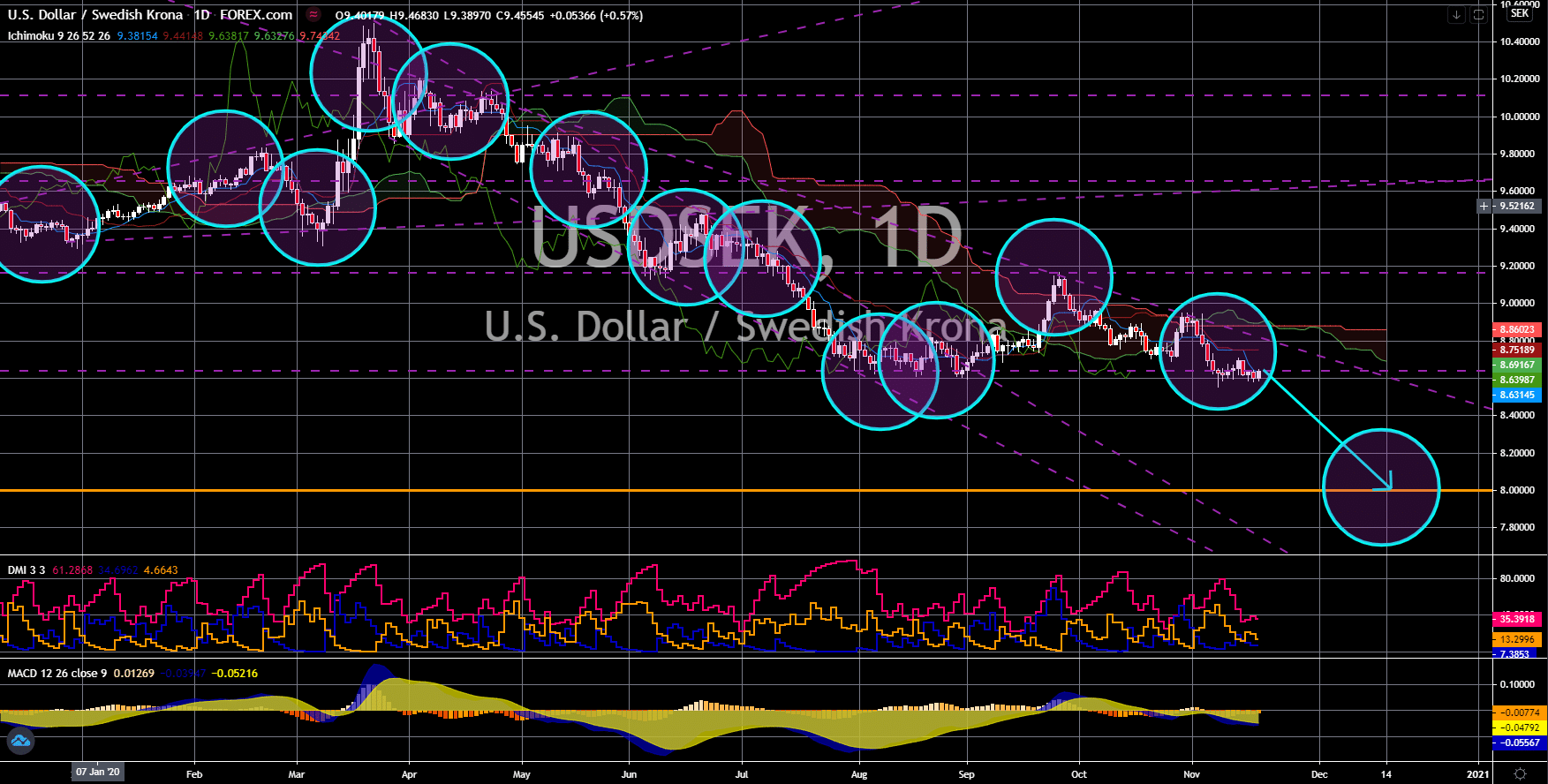

USD/ZAR

The pair will continue to move lower in the following days towards its year-to-date low. This week will be a disappointing one for the greenback investors. Most results from the US are either stagnant or below analysts’ expectations. The number of building permits in the country for the month of October was the same from the result it had back in September. The figure was 1.545 million. Meanwhile, October is not the best month for the trading business. Import went down by -0.1% from 0.2%. The same thing is true for exports which saw its recent report increased by 0.2%, which is lower compared to the prior record of 0.6%. On the other hand, retail sales failed to beat both analysts’ expectations and previous results of 0.5% and 1.6%, respectively, after posting a 0.3% figure. While the western world crumbles, China is expected to grow this 2020 despite the pandemic. South Africa’s exposure to the Asian powerhouse will send the rand higher.