Market News and Charts for November 15, 2021

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

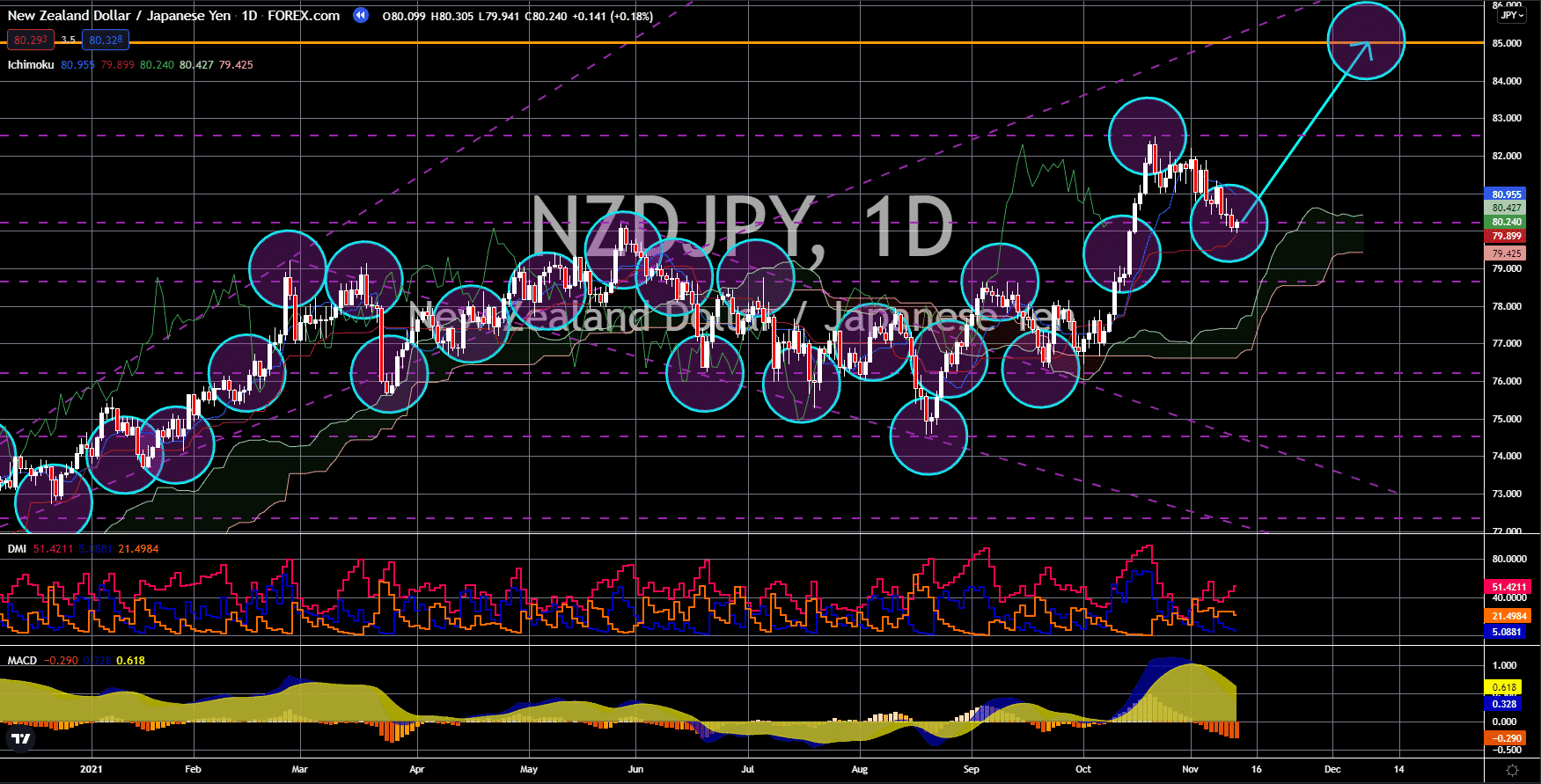

NZD/CAD

Canada’s export-oriented economy wanes from the supply chain status quo around the globe. The country’s Manufacturing Sales is looking to rest at the negative territory at -3.0% month-on-month in September 2021. The sector is continuously receiving the heavy blow of the lukewarm economic growth recorded among its trading partners. In August, the same economic indicator published a 0.5% result, a positive pace, due to the economy’s robust performance brought about by the global reopening of trade. Meanwhile, in an update on Canadian Wholesale sales, analysts are expecting a 1.1% month-on-month growth in September. This is a lot higher than the previous month’s 0.3% record. The measure is one of the most reliable yardsticks of the industry’s health. In an update on the nation’s housing sector, the Housing Starts in October, the result is forecasted to come above 200,000, at around 257,500. The result is higher than September’s bearish settlement of 251,200.

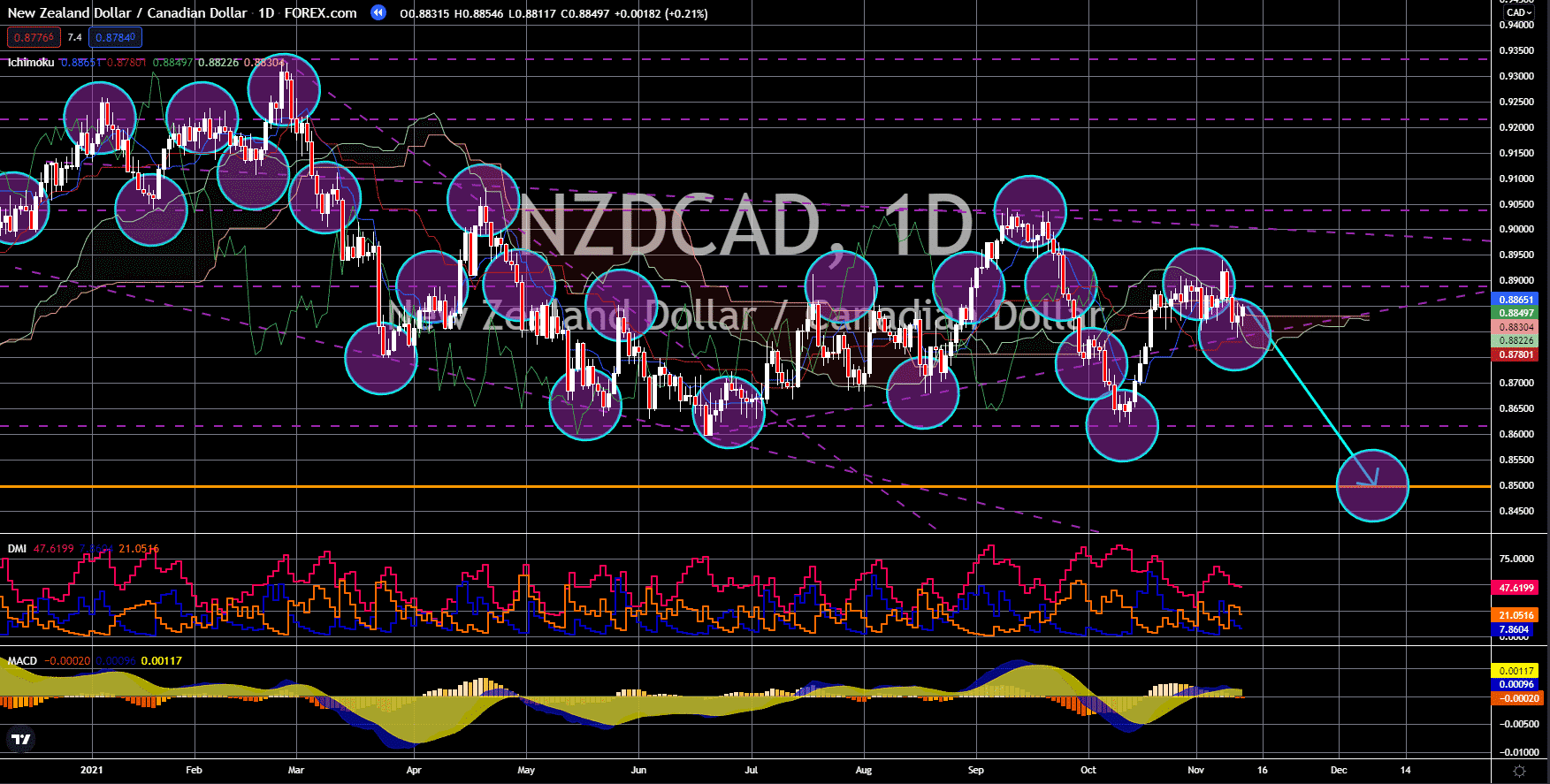

GBP/USD

The United Kingdom’s most important economic metrics showed mixed results on their respective latest deliberations. The country’s gross domestic product (GDP) in the last three months ending in October expanded by another 6.6% year-over-year. On the other hand, this is slightly lower than analysts’ expected 6.8% figure. This is also a sharp downgrade from the second quarter’s robust 23.6% recovery. On the other hand, the MoM basis showed a 0.6% pace while the quarterly result came at 1.3%. The latter yet again disappointed the market’s expectation which was given at 1.5%. In an analysis of Britain’s business sector, the sentiment is bearish. Business investment declined to 0.4%, lower than the forecasted 2.6% quarter-on-quarter hike. Meanwhile, the manufacturing sector is also in the red. The Manufacturing Production report showed a 0.1% MoM growth rate in September, dismaying expectations. Likewise, the year-over-year basis showed a 2.8% increase.

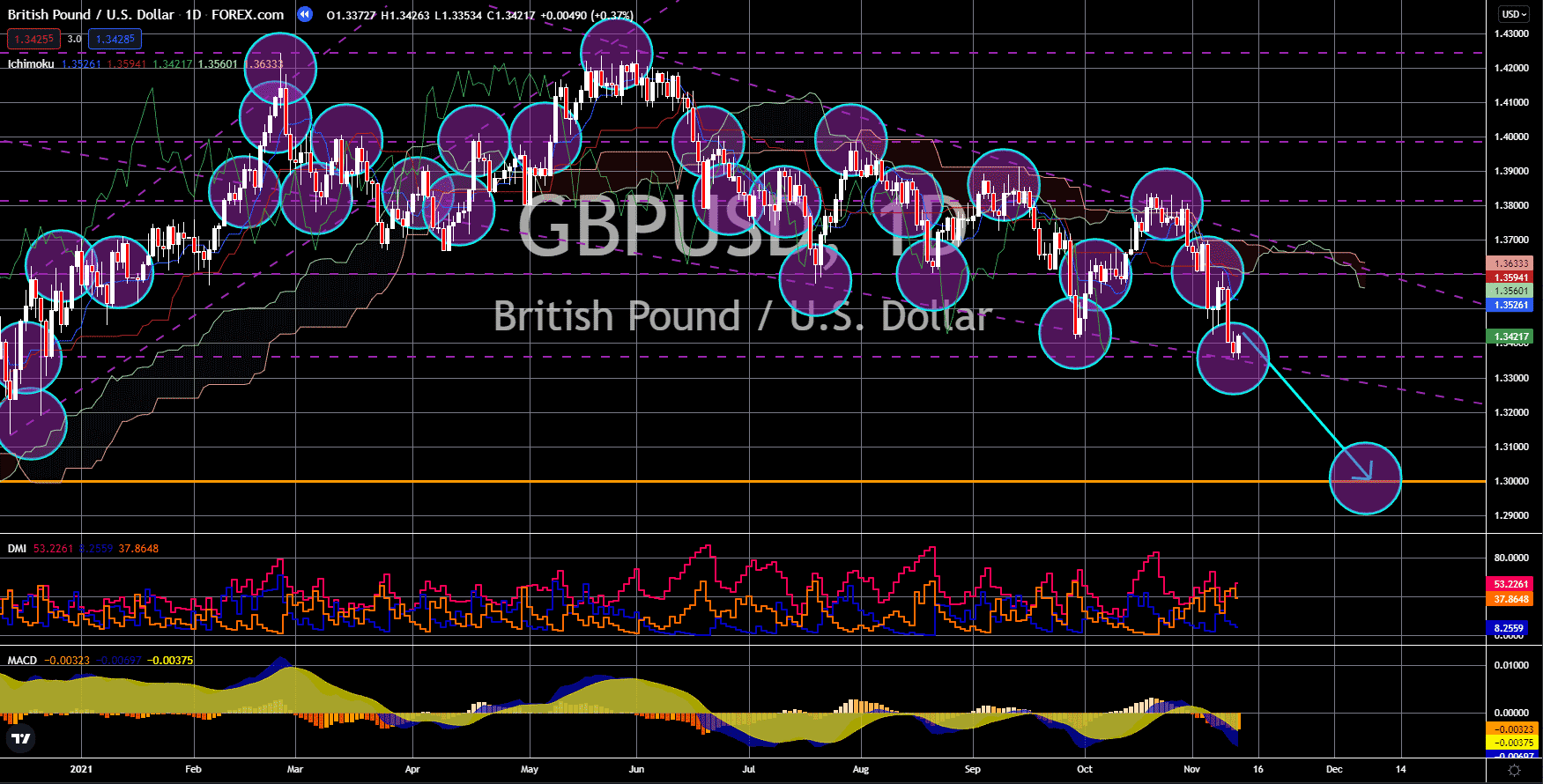

EUR/CAD

The Eurozone’s employment results for the third quarter fiscal 2021 will be released on November 15, the first day of the week. Overall employment rested at 1.58 million in Q2 but is forecasted to stall in the three months to October. This is because of the supply chain problems that weigh on firms’ capacity to hire more manpower during the period. Meanwhile, the bloc will also update on its gross domestic product data for Q3 during the same day. Third quarter GDP is expected to note a 2.2% quarter-on-quarter expansion. This is in line with the previous quarter’s result. The yearly basis is also forecasted to come positively at a positive 3.7% pace, which is also the same with Q2 results. Economists from the Eurozone recently upgraded their expectations on the economy’s full-year result. Experts are predicting a 5.0% growth for this year, as member states recover from the coronavirus pandemic. However, bumpy roads ahead should be expected due to trade disruptions.

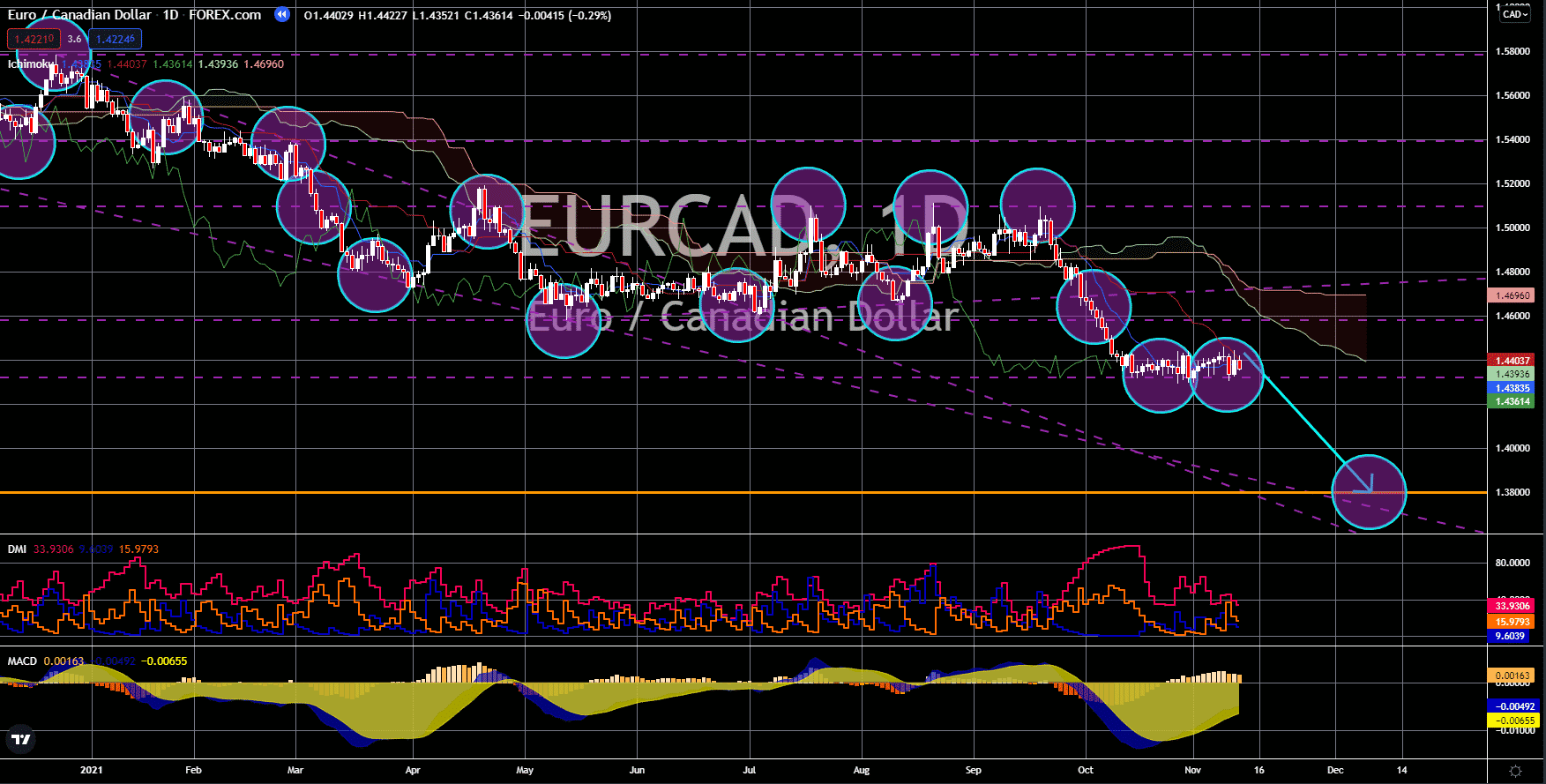

NZD/JPY

Japan’s economic health gets red marks all across the board during the third quarter. The country’s gross domestic product in Q3 declined -0.8% quarter on quarter. This is a bigger quarterly fall than expected which is -0.2%. Similarly, this is above the previous three-month period’s -0.3% decline. On a yearly basis, the important economic indicator also rested in the red after coming at -0.3%. This is a significant upgrade from the average analysts consensus, which is a -0.6% year over year decline. Experts highlighted that this is Japan’s first ever quarterly decline since the start of fiscal 2021. This means that the world’s third-largest economy might be experiencing stagnation amid the ongoing administrative instability on top of the pandemic. For the record, Prime Minister Suga stepped down in September, just months after Shinzo Abe’s resignation. Aside from the political shakeup, Japan has also been affected by the growing problems with the supply chain bottlenecks.