Market News and Charts for November 06, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

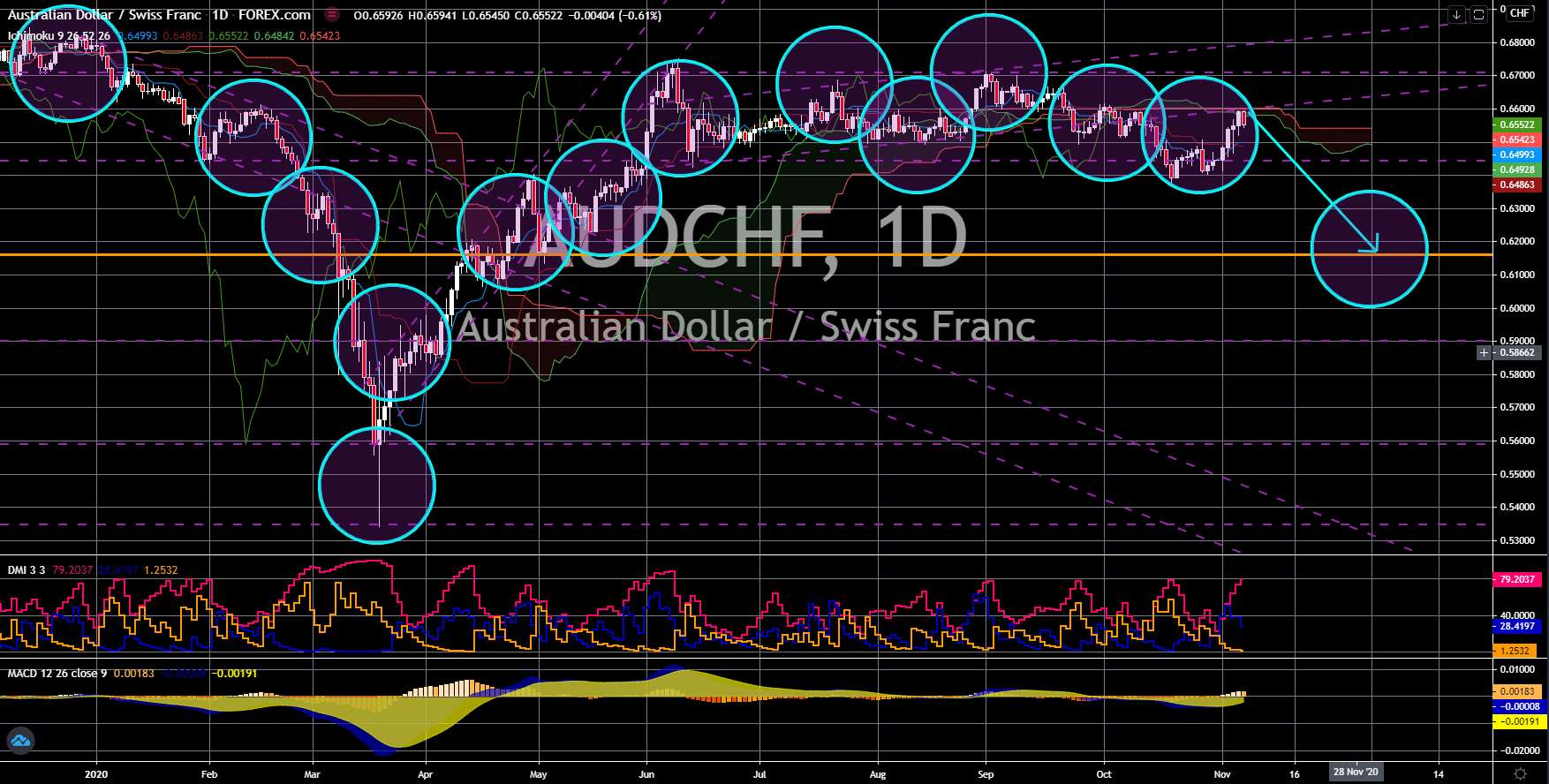

AUD/CHF

The pair failed to break out from an uptrend resistance line, sending the pair lower towards its May 04 low. Despite the better-then-expected imports, exports, and trade balance report, the Australian dollar will still see new lows in coming sessions following the interest rate cut by the RBA. The Reserve Bank of Australia slashed 15 basis points on its short-term benchmark rate to 0.10%. This increases speculations that the Australian economy might need more support to get back on its feet. Meanwhile, the country saw an improvement in its trading sector in Wednesday’s report, November 04. Figures for the imports, exports, and trade balance reports came in at -6.0%, 4.0%, and $5.63 billion, respectively. The high exports support local businesses and support the local currency at the same time. Aside from these, the possibility of a more China-friendly US president could hurt Australia’s trading business with Asia’s giant.

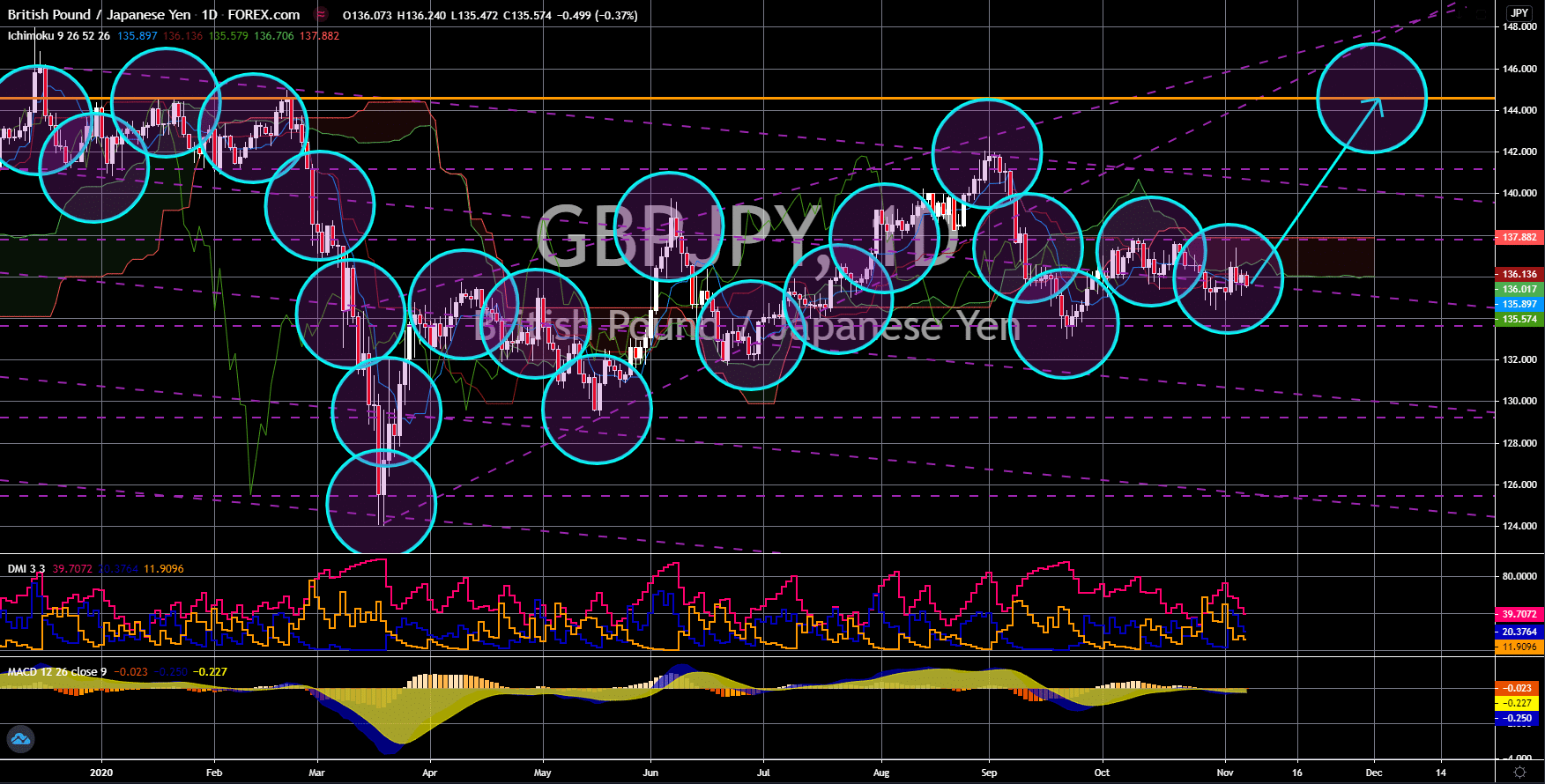

GBP/JPY

The pair will extend its uptrend movement and will retest its February 21 high. Nikkei 225 rose to its highest level since the collapse of Japan’s economic bubble in 1990 amid the better-than-expected corporate earnings of local businesses. The index advanced by 0.91% or 219.95 points to close at 24,325.23. This level broke the previous record held by Nikkei on November 13, 1991. However, the impressive performance of the Japanese yen is taking a toll on the country’s local currency. Another key factor for the weak performance of the Japanese yen was the weak spending per household on an annualized basis. Spending fell by -10.2% in September compared to the same report for the same month a year ago. This figure is also higher than the prior month’s drop of 6.9%. The rising number of COVID-19 cases in Europe could also potentially derail the country’s recovery. The EU-Japan trade agreement created the largest trading zone in the world.

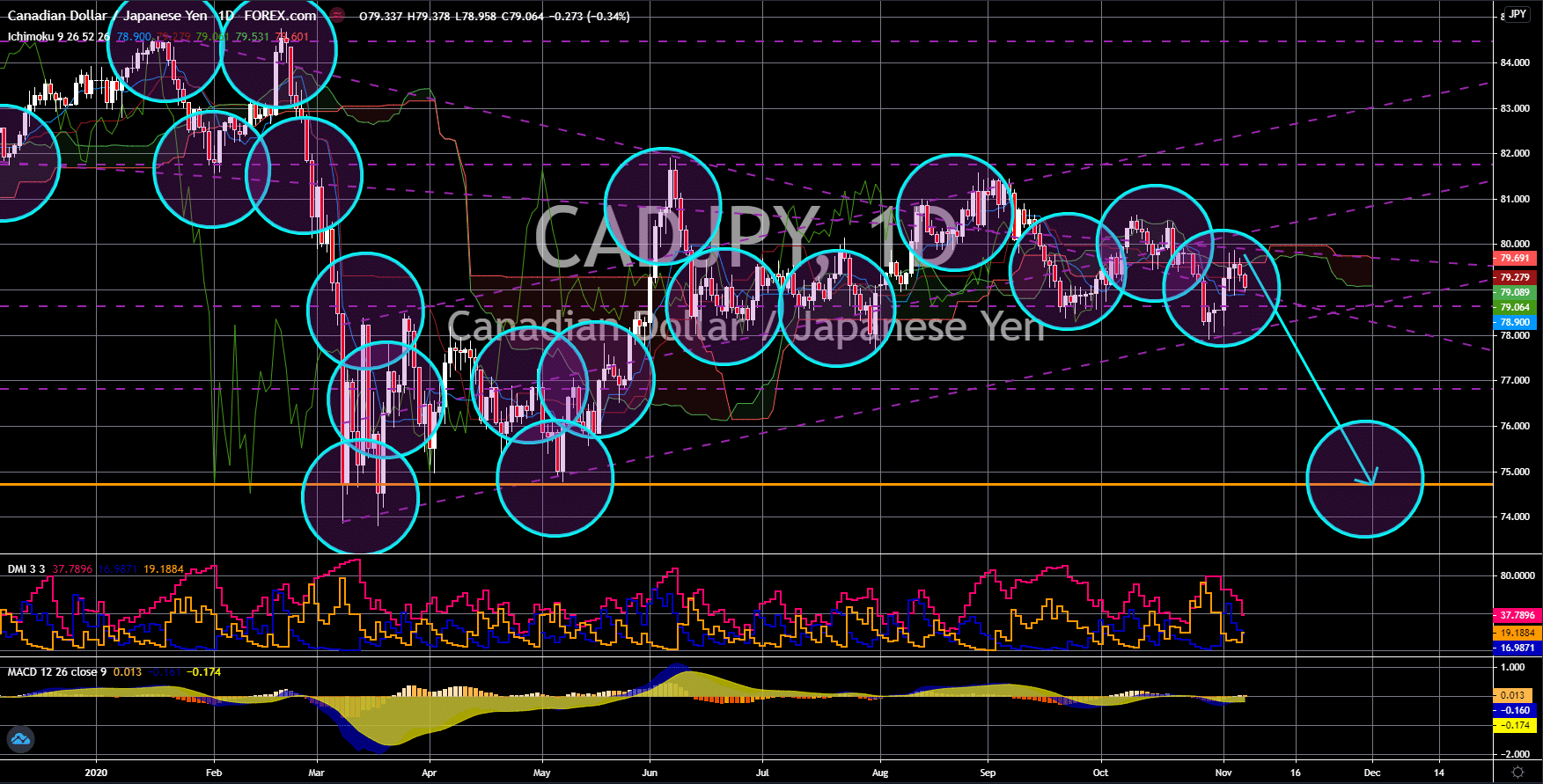

CAD/JPY

The pair will continue to move lower in the following days towards the May 07 low. The weak economic activity and fewer jobs creation is taking a toll on the Canadian dollar. Imports and exports in September beat analysts’ estimates and the previous month’s results. Figures came in at $48.79 billion and $45.54 billion, respectively. Despite this, the country’s trade deficit narrowed to $-3.25 billion which suggests that the country is importing more products than selling domestic products abroad. Meanwhile, there were only 100,000 additional jobs recorded in October, almost a quarter of the 378,000 jobs created last month. This, in turn, could translate into a weaker consumption for the month of September and could send the imports, exports, and trade balance results lower in the upcoming report. The possible change in leadership in the United States could also either help or hurt the Canadian economy.

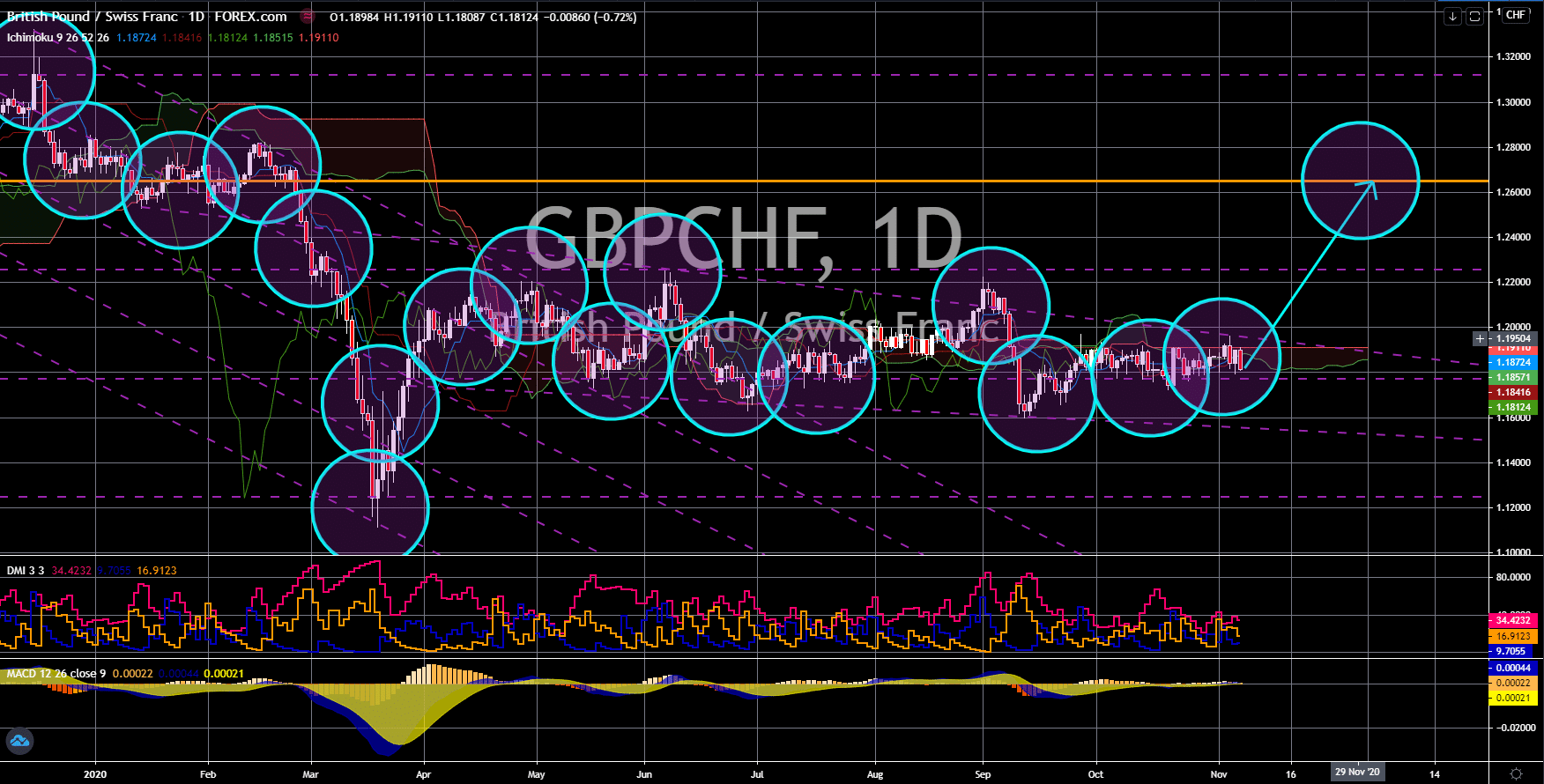

GBP/CHF

The pair will bounce back from its current support line, sending the pair higher towards a major resistance line. The United Kingdom’s Composite and Services PMI remains intact with 52.1 points and 51.4 points, respectively. Despite these figures failing to beat their previous records and analysts’ estimates, they are still above the 50-points benchmark. Meanwhile, Germany, France, and Italy posted better-than-expected results but were below the 50-points mark. On the other hand, Switzerland’s economy is bound to suffer from the rising number of coronavirus infections in the country. On Wednesday, November 03, Switzerland posted its highest daily infection cases at 21,842. Currently, the country has the highest infection rate in Europe with 174 infections per 10,000 individuals. The United Kingdom has also a rising number of COVID-19 patients. However, the upbeat outlook in its economy will help the pound thrive against the Swiss franc.