Market News and Charts for March 31, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

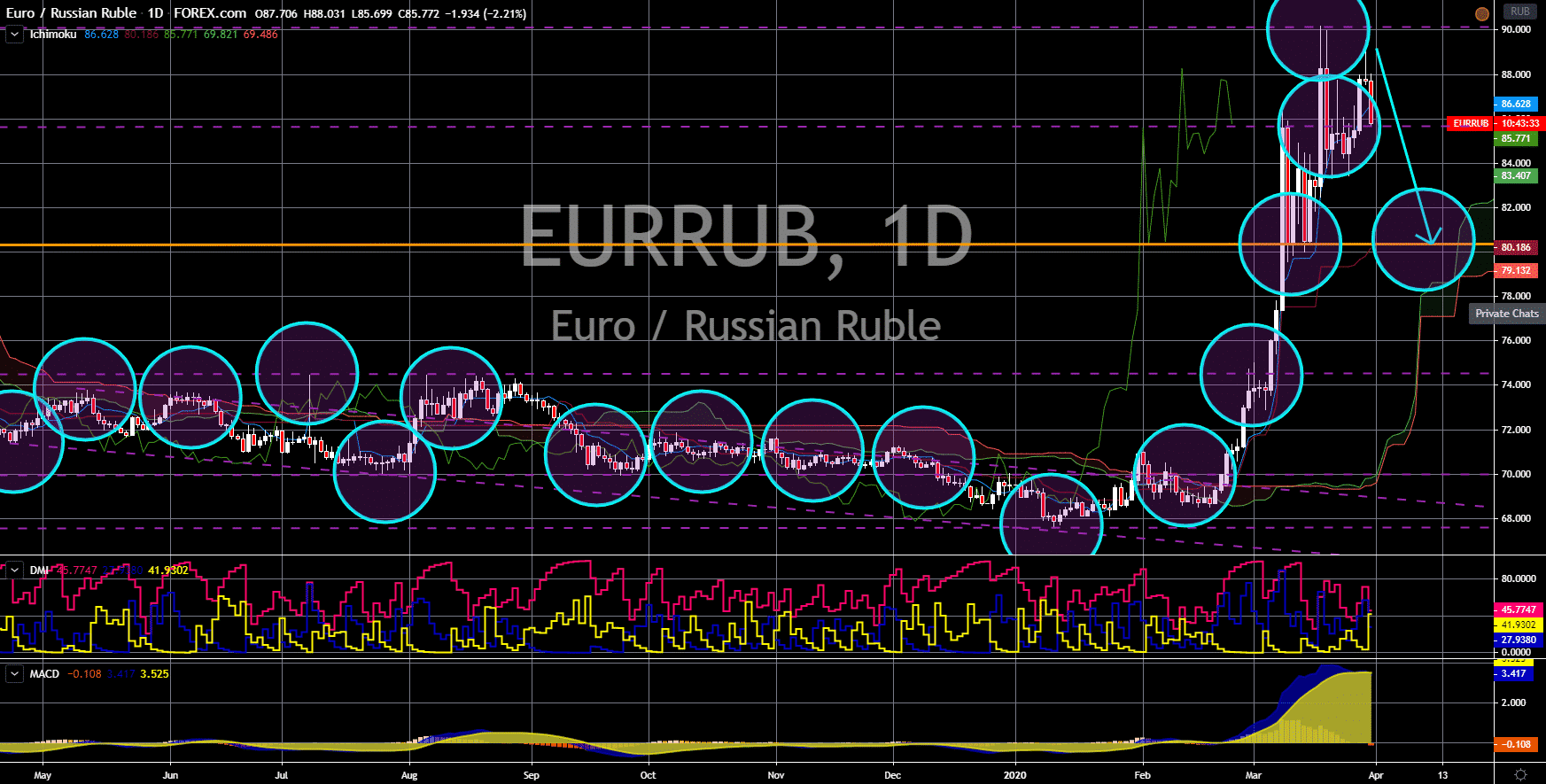

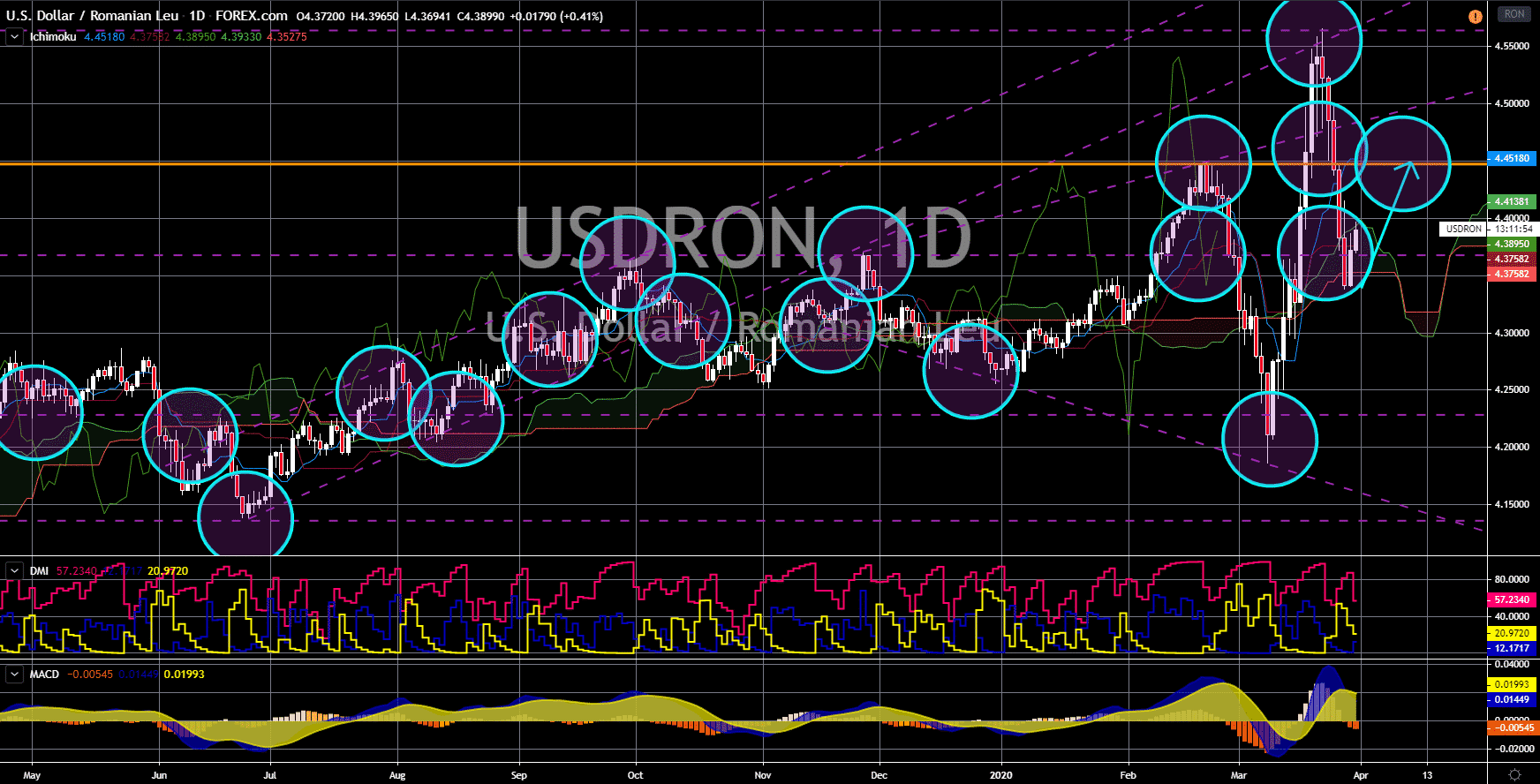

USD/RON

The pair will move higher in the following days towards a key resistance line. Romania reach its peak in 2019 after it recorded a 4.1% growth on its annual GDP. Due to the coronavirus, however, the country is now expected to contract by -6.6% this year. The forecast was lower from the -0.9% slump in GDP growth predicted by analysts 2 weeks ago. This was despite the economic, fiscal, and monetary measures introduced by the Czech government. The outlook on Czechia’s performance will outperform the forecasted figures by analysts on Germany and France. The EU’s economic powerhouses is seen shrinking by at least 4%. This will send these economies into recession and drag other EU member states. The United States, on the other hand, was able to calm investors’ concerns of the economic impact on COVID-19. The US introduces a $2.2 trillion stimulus package to aid the largest economy in the world.

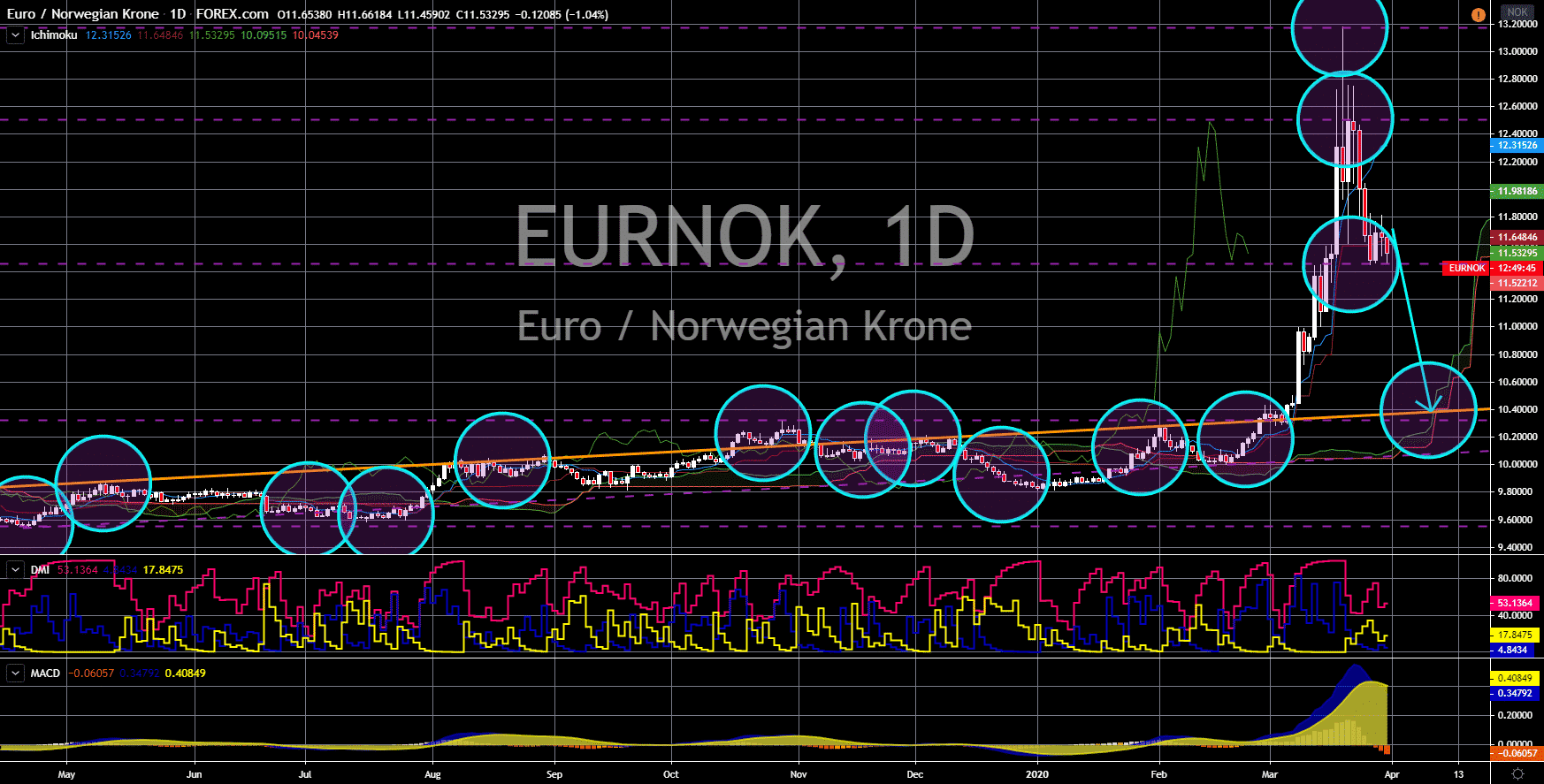

EUR/NOK

The pair will continue its steep decline in the following days, sending the pair lower towards a major support line. With Europe at the heart of the coronavirus, EU member states are expected to contract this year following a disappointing GDP figure for the last quarter of 2019. The two (2) largest economies in the trading bloc – Germany and France – is expected to enter recession this quarter. Analysts gave an optimistic view of -4.4% for the first quarter of 2020. Today, March 21, Germany published reports for its Import and Export Price Index. Both the reports posted negative figures which further led to speculations that real GDP for Q1 might exceed the -4.4% expectations. Unemployment in the country also rose to 1k from the -8k previously recorded. Meanwhile, Norway’s central bank had its lowest currency purchase at -$2 billion. This move will leave the country with more ammunition to counter the economic impact of COVID-19.

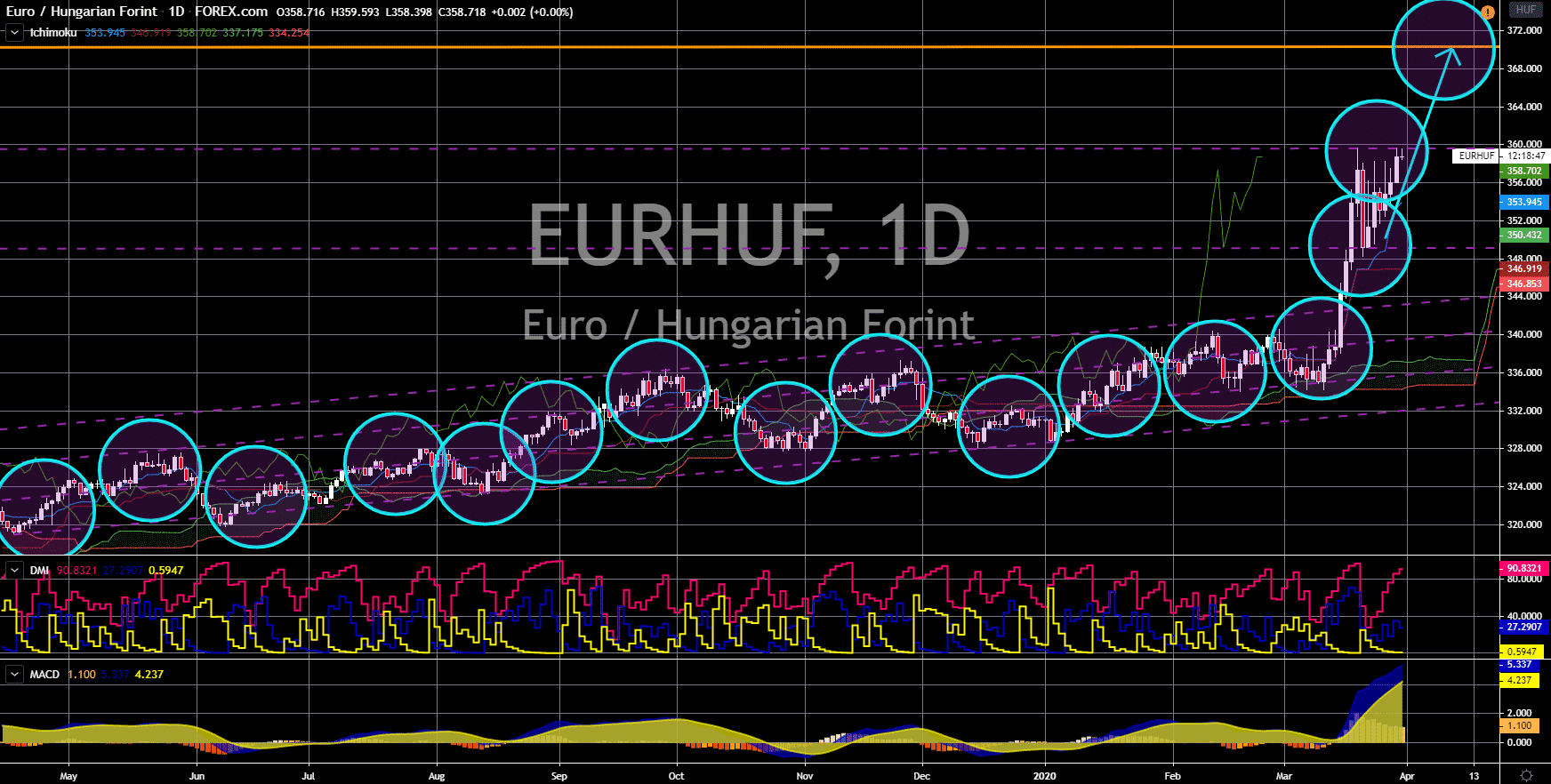

EUR/HUF

The pair will breakout from its current high, sending the pair higher towards its nearest resistance line. Hungary is in an economic and political turmoil brought by the deadly coronavirus. An economic think tank warned that Hungarian GDP might slow down by 2-3% in the first quarter of 2020 before eventually sliding by another 20% in Q2. This was after the COVID-19 forced companies in the manufacturing and service sector to partially and/or temporarily close. Hungarian Prime Minister Viktor Orban tried to calm the market by promising to restart the country’s economy on the first or second week of April. In addition to this, Orban was able to sway the parliament to shut itself off and grant him power to rule by decree. He was also able to suspend the parliamentary election if the governing body chooses to trigger an election campaign this year. However, analysts are worried that this might lead to an abuse of power.

EUR/RUB

The pair will reverse back towards a key support line after it failed to break out from a major resistance line. Russia is on track to protect its economy from global turmoil created by the coronavirus. This was after Prime Minister Mikhail Mishustin launched a $4 billion fund initiate to aid airline and tourism companies. In addition to this, President Vladimir Putin said the country will come out “stronger” after its oil price war with Saudi Arabia left Russia’s economy vulnerable. Despite the economic uncertainties surrounding the country, the possibility of Europe, particularly the European Union, entering a recession will weigh down on the single currency. Analysts anticipate Germany and France to enter economic recession in the first quarter of 2020. This was after the disappointing figures released for Q4 2019. Analysts were also not convinced by the decision of the ECB President Christine Lagarde to left the bloc’s interest rate unchanged.