Market News and Charts for June 23, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

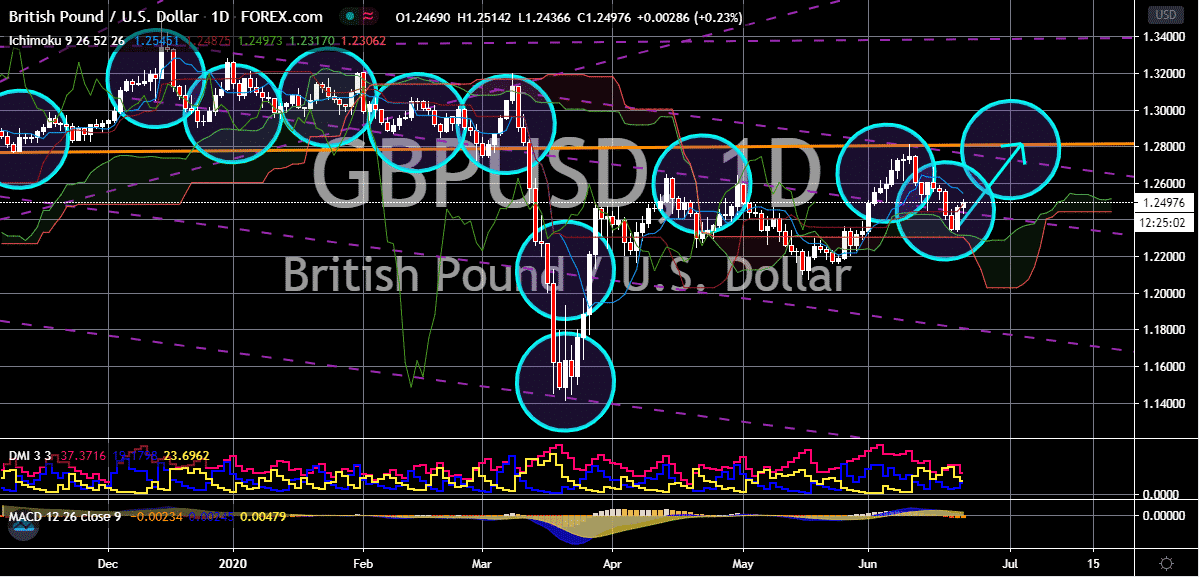

GBP/USD

The US dollar struggles to gain a grip on the GBPUSD trading pair. The pair is currently seen flirting with a critical support level in sessions. However, prices aren’t expected to go below that level and instead, would climb to their resistance around the 1.28000-mark. The pair should reach that level by the first few days of July as the US dollar weakens from the recent clarification regarding the trade war. Just recently, White House trade adviser Peter Navarro stated that the trade negotiations between the two economic giants are “over”. This immediately blew out of proportion and was interpreted differently by some experts. However, President Donald Trump chimed in suggesting that Navarro was talking about the first phase of the US-China trade deal that was sealed earlier this year. This debunked the concerns that the White House is jumping off-board from the controversial and highly awaited trade negotiations.

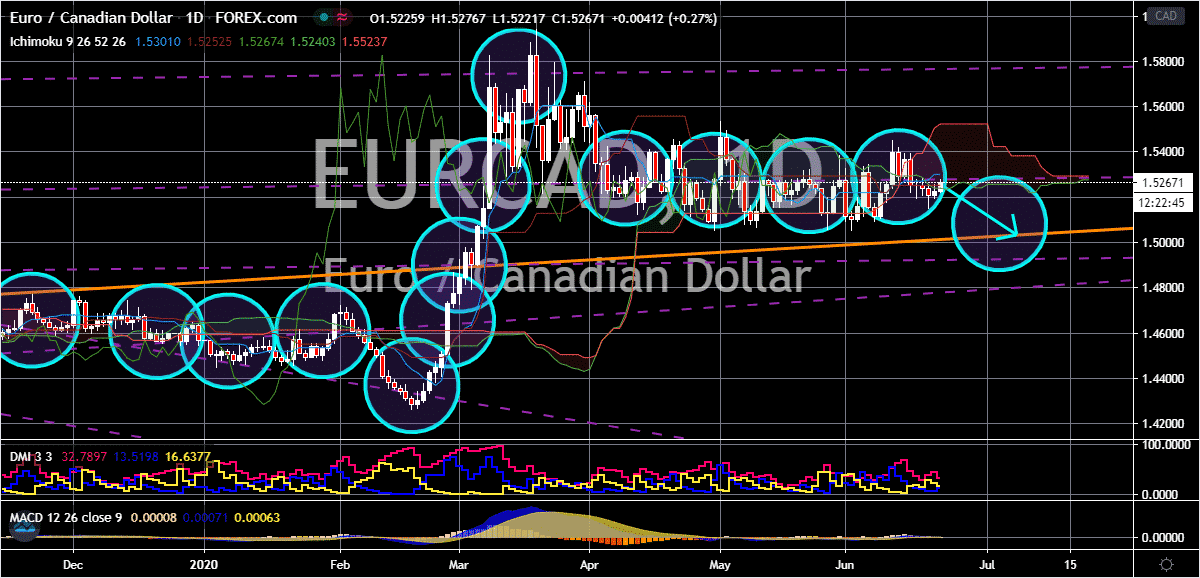

EUR/CAD

The bloc’s single currency struggles to gain altitude against the commodity-linked currency, Canadian dollar. The euro to Canadian dollar trading pair is now projected to gradually go down to its support levels in the coming days as the loonie gains support from the resiliency displayed by the crude market. In fact, the support is coming in just in the nick of time as bearish traders take advantage of the escalating concerns for the euro and the bloc’s biggest economy, Germany. The powerhouse economy of the bloc is seeing renewed lockdown restrictions in some cities because of the new confirmed cases there. This raises concerns about the status of the economy and if it could still hold up against the immense pressure. However, it appears that the euro is also supported by the significant slowdown in the downturn of the eurozone this June. As other economies in the region ease their lockdown restrictions, the toll on the bloc’s health has also eased.

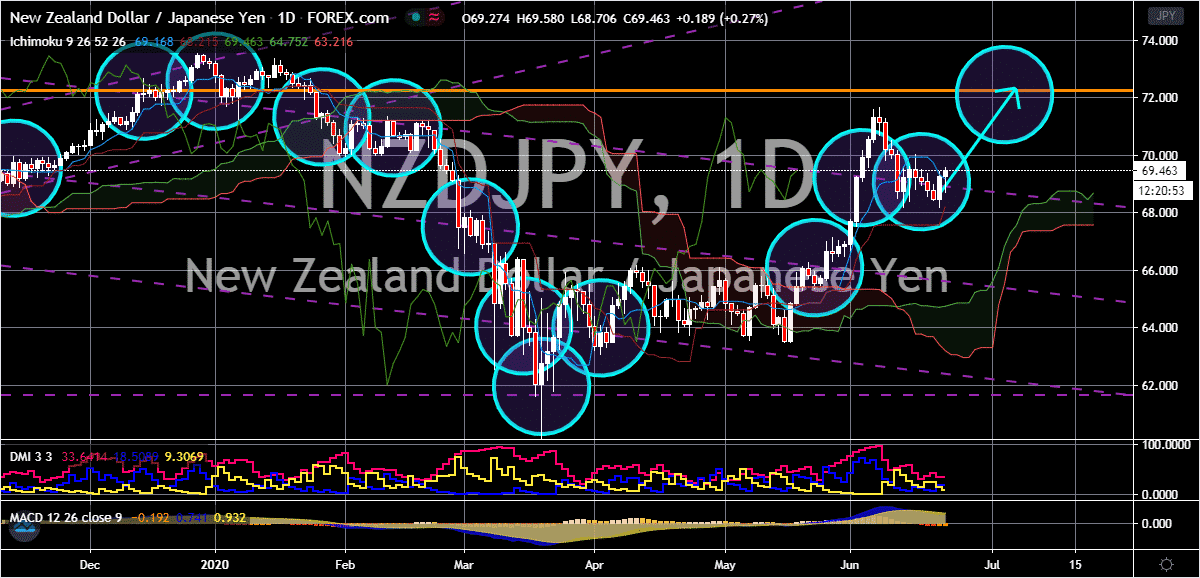

NZD/JPY

The New Zealand dollar slightly flinches against the Japanese yen earlier this Tuesday thanks to trade war-related news. The antipodean currency, along with the Australian dollar, moved due to the misinterpretation of Peter Navarro’s comment about the trade war. Fortunately for bullish investors, the pair is able to get back to its feet and continue gaining against the Japanese yen in the trading sessions. As of writing, the pair is seen flirting with a critical support level, and it is seen that the Japanese yen is having a hard time pulling prices lower. This suggests that the safe-haven appeal of the Japanese yen is not enough to overpower the New Zealand dollar. Later today, the Reserve Bank of New Zealand is due to give its monetary policy decision. And the pair is seen advancing ahead of the announcement. Investors are expecting that the kiwi central bank will leave its official interest rates unmoved at 0.25%, its lowest level yet.

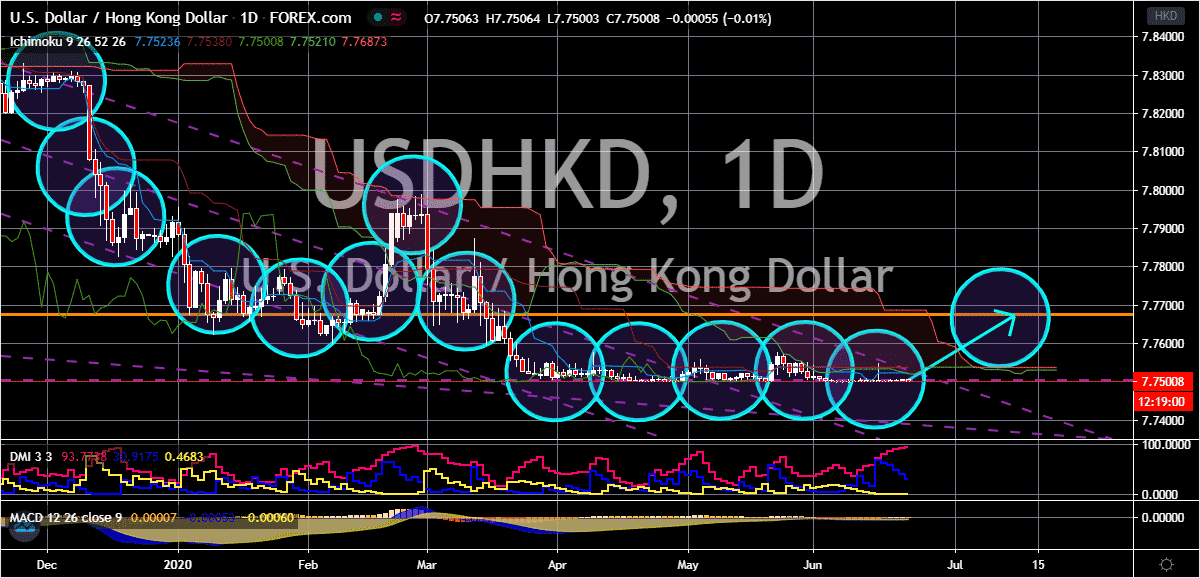

USD/HKD

The Hong Kong dollar keeps the beloved US dollar grounded in the trading sessions. the safe-haven currency is no match for the pegged Hong Kong dollar and remains vulnerable against it despite the eventual fluctuation in demand for safe-haven assets. However, bullish investors are hoping to make a dent on the confidence of bearish investors and eventually help the pair get back up on positive territories. The greenback is expected to steadily push the Hong Kong dollar towards the pair’s resistance by the first half of July. Despite that, the firm statement of the Eddie Yue, Chief Executive of the Hong Kong Monetary Authority, makes it difficult for bullish investors to hope on the USDHKD trading pair. Yue insisted that the pegged currency is the pillar of the country’s monetary and financial system. Assing that any shifts in the global policies or fluctuations in the market won’t change the pegged currency, painting grimmer hopes for bulls.