Market News and Charts for June 22, 2020

Hey traders! Below are the latest forex chart updates for Monday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

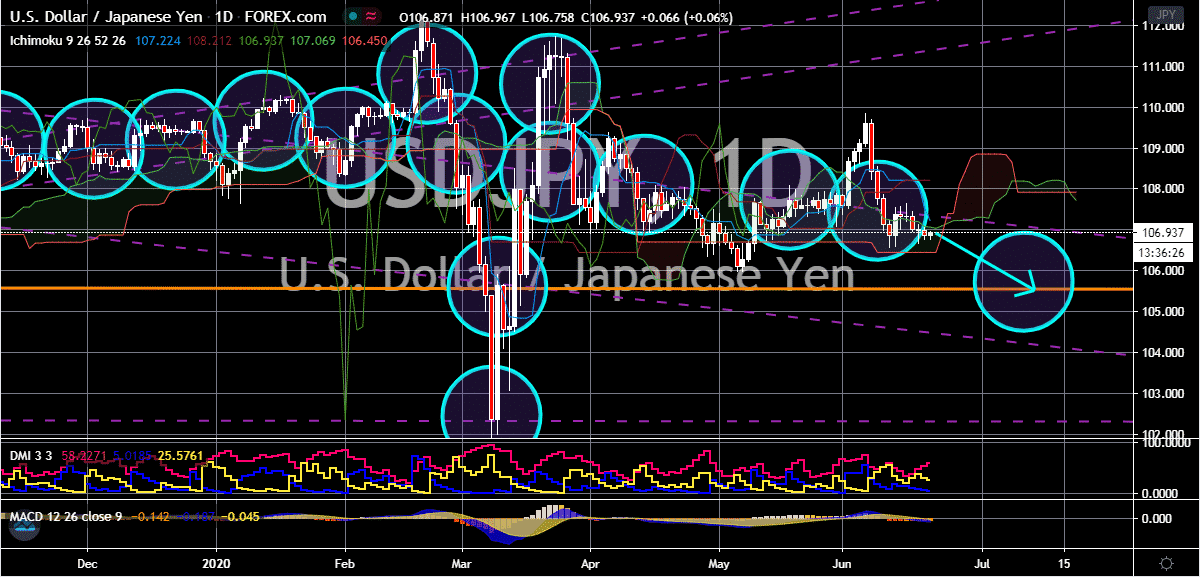

USD/JPY

The US dollar to Japanese yen trading pair should head down to its support level in the trading sessions. The pair is currently seen neutral in the market as both currencies struggle to gain momentum against each other. The pair isn’t expected to have a sharp fall, but rather a steady and gradual slide towards its support level. The Japanese yen is able to hold itself against the US dollar thanks to the relatively low interest rates of most central banks across the globe. In light of the global coronavirus pandemic, countries all across the globe have eased their interest rates to record lows, with some saying that it would most likely remain that low because of the devastating deep economic slump. These low central bank interest rates are helping the Japanese yen in trading sessions. As for the US dollar, it’s seen steady in the market this Monday, and investors are still waiting for further guidance for the beloved safe-haven currency.

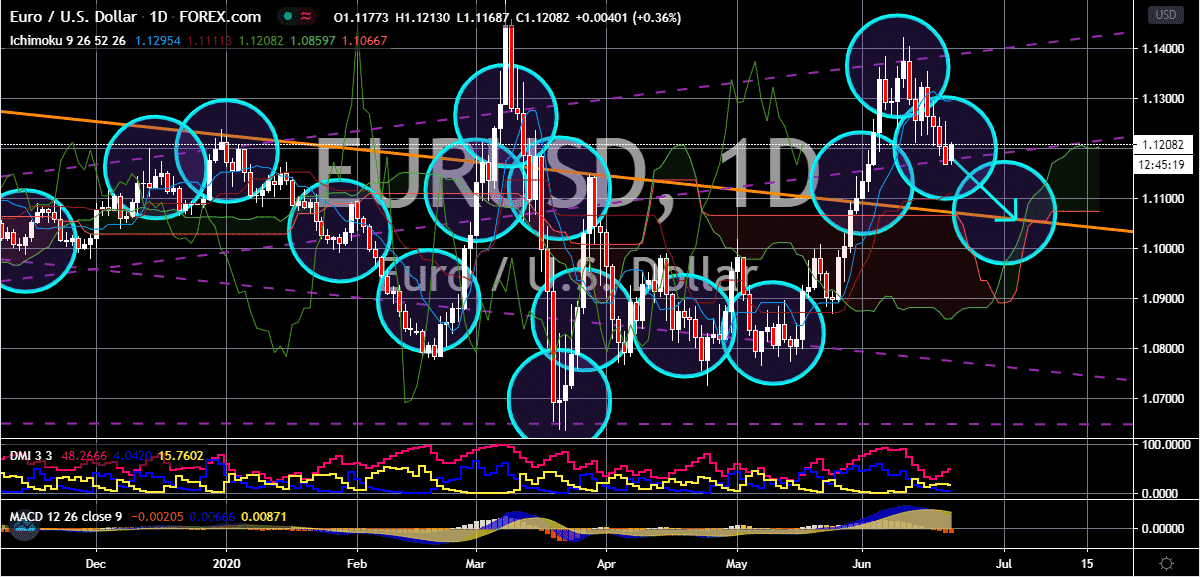

EUR/USD

The euro to US dollar saw a sharp correction last week. The trading pair took a drastic turn towards its support level. In fact, the pair is seen trading in positive territories this Monday as the pair struggles to break past that support. However, the pair’s price should head downwards and hit its lower declining support level. The safe-haven appeal of the US dollar is bound to drag the EURUSD pair lower and lower as bears take advantage of the heightening concerns about the global pandemic. Recent reports that the globe is now facing the second wave of infections have boosted the security asset, helping it to dominate the global currency trade. Aside from that, the euro is pressured by the news that the number of cases in Germany, the bloc’s largest economy. It was recently reported that Germany placed hundreds of people in quarantine after some residents tested positive for the deadly and highly contagious coronavirus.

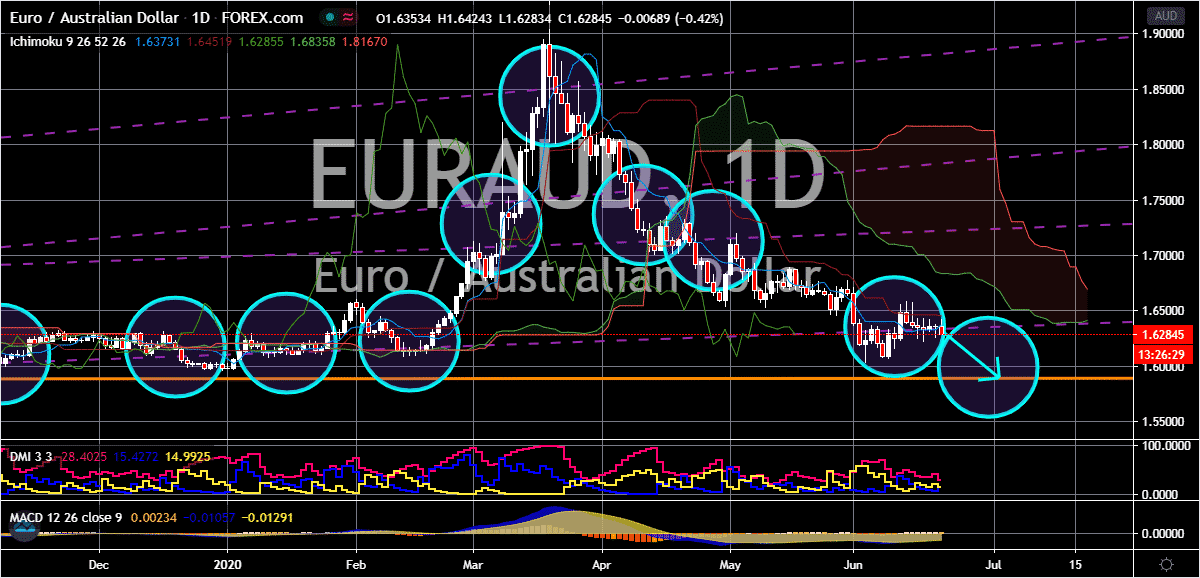

EUR/AUD

Prices remain awfully neutral in the past couple of sessions and this Monday. Both the euro and the Australian dollar are struggling to gain momentum on each other. Despite that, the trading pair should eventually go gradually down to its support level as Australia eases its lockdown restrictions in some cities. With that being said, the Antipodean country is also facing the second wave of infections in its largest cities. The government is already warning another spike in unemployment should this scenario gets worse. Once the pair’s price reaches the support, bullish investors could take advantage and force the pair to ricochet off the area. Just recently, the Reserve Bank of Australia said that the rising Australian dollar isn’t a problem yet for the authorities. RBA Governor Philip Lowe said that the continuous appreciation of the Aussie should hinder the recovery of the economy, citing better health and economic outlooks compared to other nations.

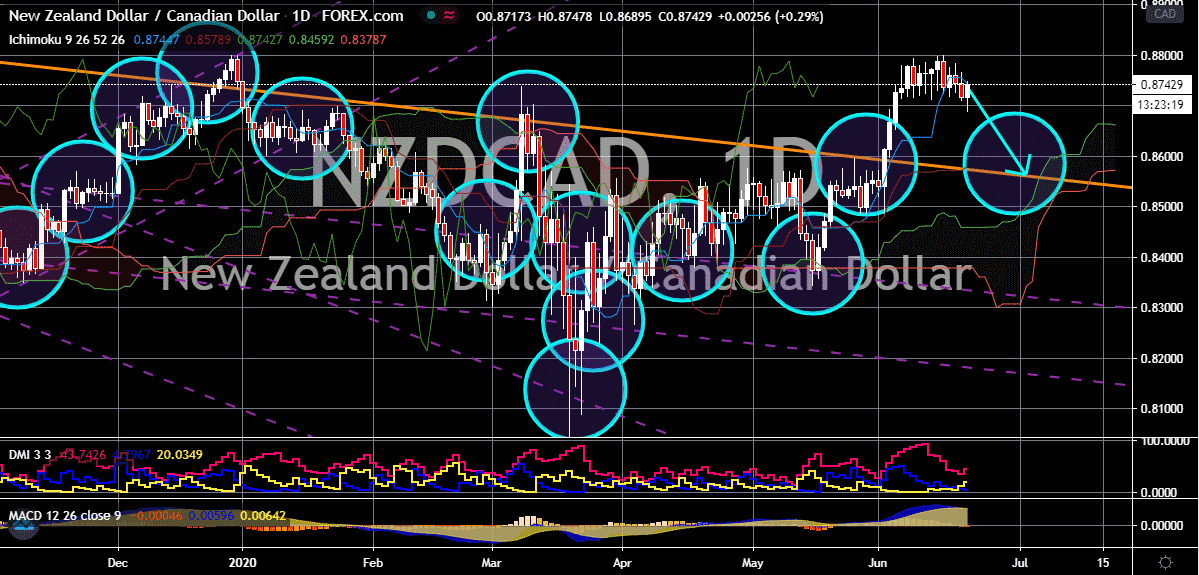

NZD/CAD

The New Zealand dollar to Canadian dollar exchange rate takes a U-turn and is now expected to head lower towards its support level. The attention turns towards the Reserve Bank of New Zealand as its widely projected to leave its official interest rates at record lows of 0.25% this week in its upcoming monetary policy meeting. The dovish stance of the central bank is weakening the New Zealand dollar against the Canadian dollar. In fact, the loonie is still benefiting from the broader steadiness of the US dollar. Should the Canadian dollar take advantage of the kiwi’s weakness the pair would dramatically erase some of its major gains from earlier this month. Unfortunately for the kiwi, it can’t rely on its neighbor, the Australian dollar, as it also faces challenges of its own. Moreover, despite the Reserve Bank of New Zealand dollar expressing its willingness to have negative rates if necessary, it’s not expected to take its rates to negative levels this time.