Market News and Charts for June 19, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

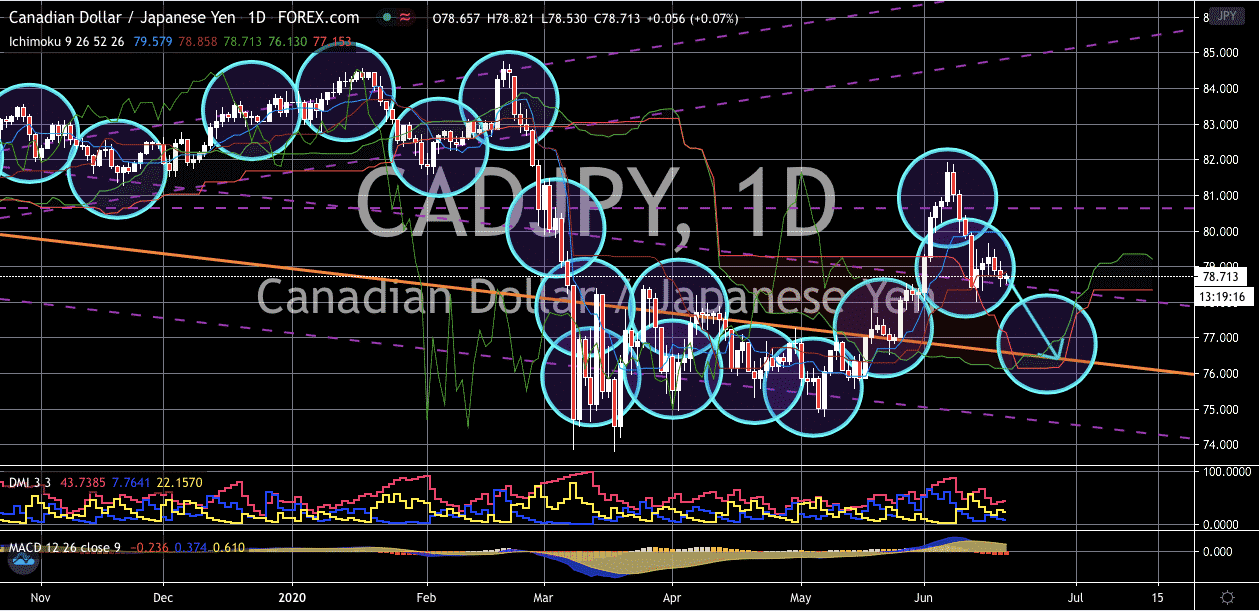

AUD/CHF

The Swiss franc slightly slows down in today’s trading following the recent news about the Swiss National Bank’s monetary policy decision for June. The trading pair is lingering around a critical support level and the last time that prices tried to go down, bears were rejected. Now, it appears that the Australian dollar is back on the defensive. The pair is on track to gradually inch its way downward towards its support level. If bearish investors manage to break past its nearest support, it’s expected that it will continue down and hit the support level just above 0.62000. The pair avoided a major jolt after the Swiss National Bank announced its decision to hold on to its current interest rates. Switzerland’s current interest rates still sits at -0.75% as expected by the market. And as for the Australian dollar, the efforts of the authorities to keep its retail sales figures afloat is helping the antipodean currency give a tough time to the safe-haven asset.

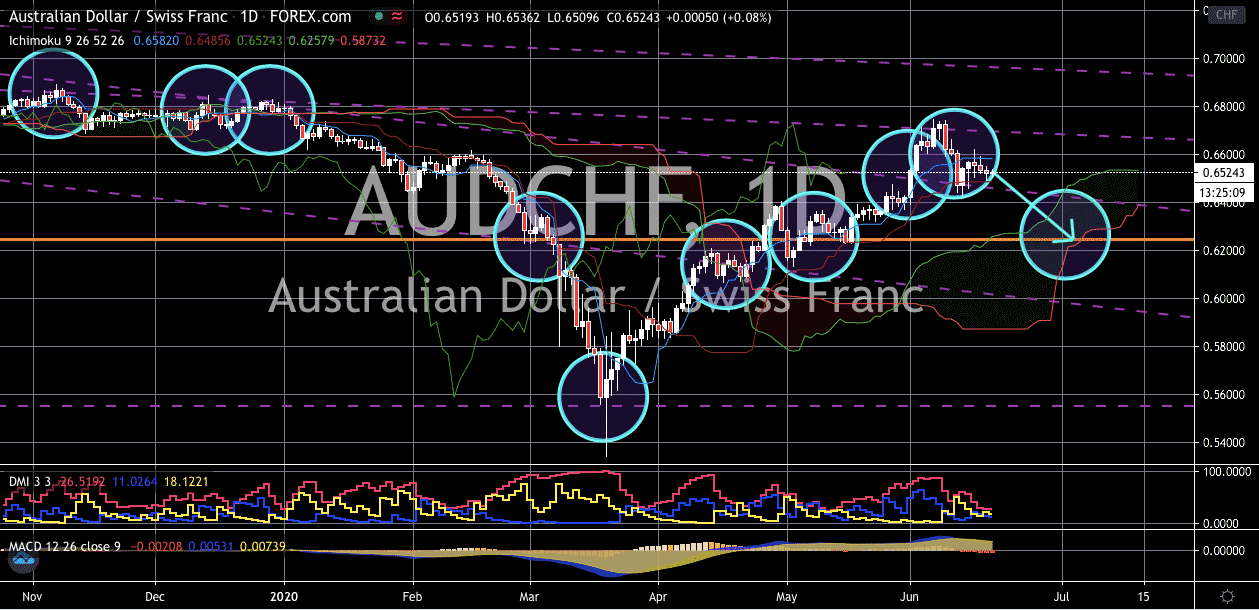

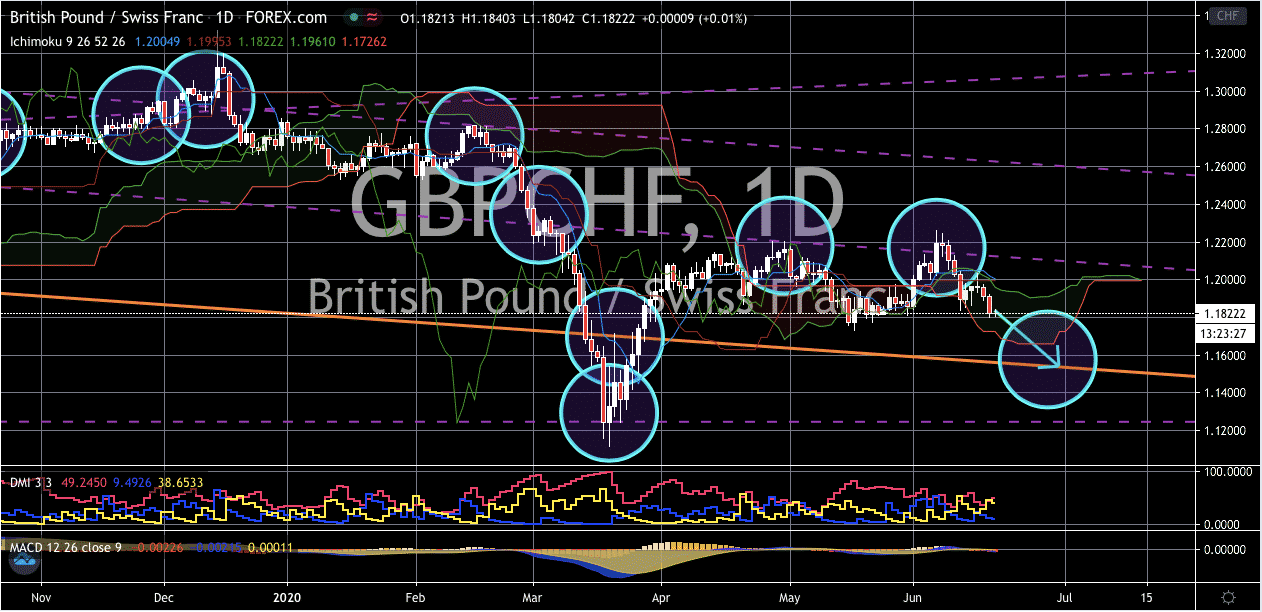

GBP/CHF

Bears are gaining momentum and are forcing the British pound to Swiss franc exchange rate lower. Although as of writing, it appears that prices are steady. This is because of the decision of the Swiss National Bank to keep its relatively low interest rates. Looking at it, Switzerland currently has the lowest interest rates in the world, sitting at negative -0.75%. However, the interest rate decision of the Swiss National Bank won’t be the downfall of the Swiss franc. Over the past few months, the central bank has been ramping up its efforts to prevent the franc from appreciating. Unfortunately for them, the pandemic just made their work even harder as the demand for safe-haven assets like the franc blows up. The concerns about a second wave of coronavirus infections is helping bearish investors of the pair. Still, the Swiss National Bank said that it is ready to step in again to prevent the Swiss franc from rallying if it deems it necessary.

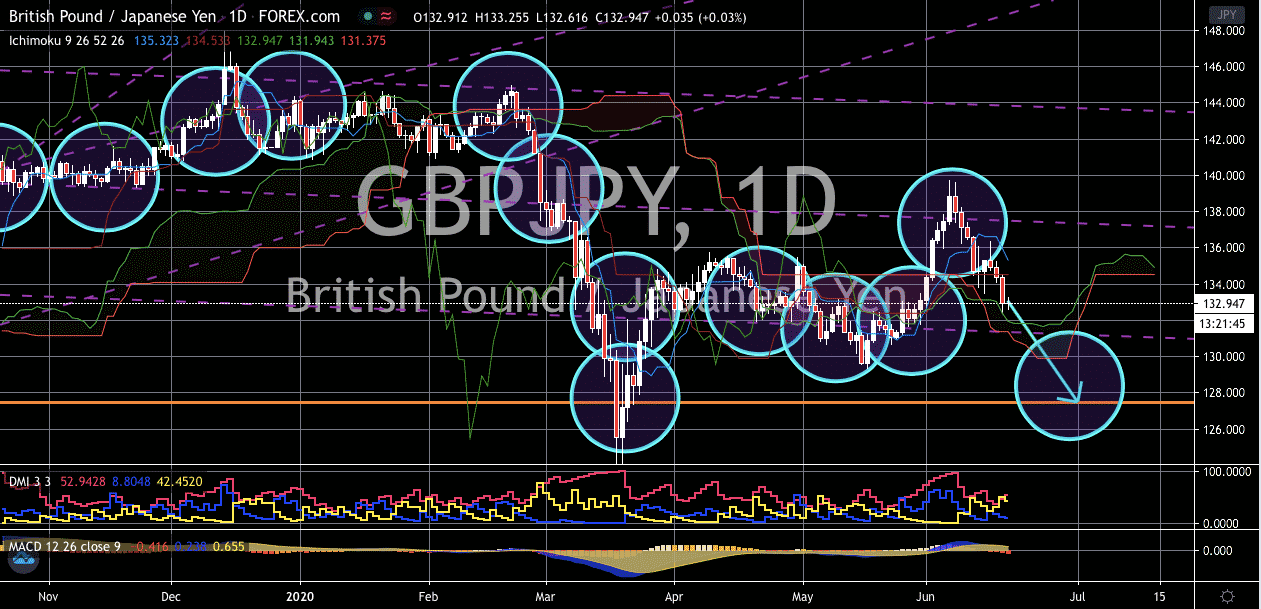

GBP/JPY

The British pound tries to force the trading pair to steady this Friday. Starting late last month until early June, the British pound floored its gas pedals in attempts to recover its losses against the Japanese yen. However, the sterling’s fuel quickly ran out and now the pair is heading back down to its support level. In fact, prices are forecasted to break its initial support and head to lower, just below the 128.000-mark. The pair should reach its support level by the end of the month thanks to the safe-haven appeal of the Japanese yen. The recent news from the Bank of England caused the British pound to fall sharply yesterday. It was reported that the Bank of England suggested to further expand its already massive quantitative easing program. This even after adding 100 billion pounds to its quantitative easing earlier yesterday. The news heavily weighed on the sterling yesterday. Fortunately, the news does not appear to be affecting it anymore today.

CAD/JPY

The exchange rate is seen flirting with a crucial support level in trading sessions. Bearish investors are looking to force prices even lower past it and reach its second support level before the month ends. The Japanese yen lost its grip on late May, allowing bullish investors to rally in the previous sessions. However, the momentum quickly shifted, along with the dynamics in the global market. Once the risk appetite died, safe-haven currencies like the Japanese yen came out once again to dominate the market. Investors are extremely concerned by the fact that the number of coronavirus cases are still rapidly increasing. Although it’s debated by experts as to whether the globe is already at its second wave of infections. Aside from the lost of risk appetite, another factor that’s weighing on the loonie is the poor performance of its economy. It was reported that the bank of Canada believes that the economy is facing a long and rough recuperation period.