Market News and Charts for January 28, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

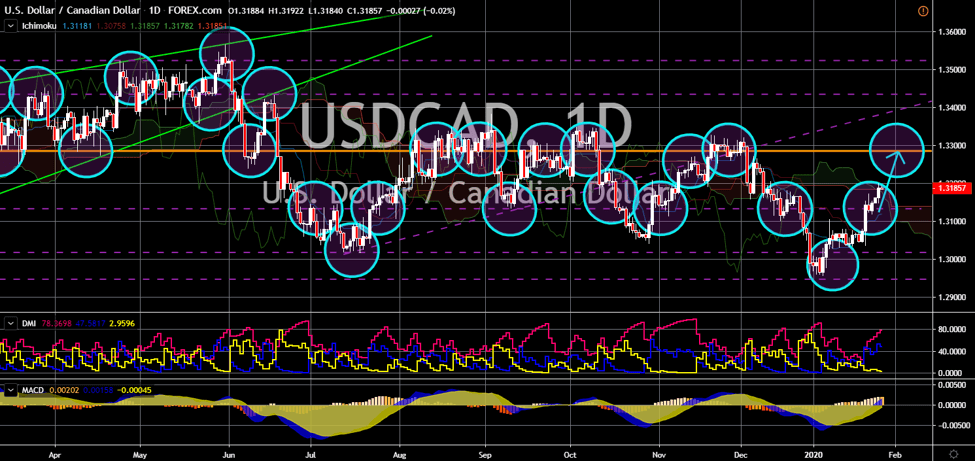

USD/CAD

The pair will continue to move higher in the following days toward its previous low. On December 10, the trilateral economic alliance of the United States, Canada, and Mexico, signed an agreement to replaced NAFTA. NAFTA (North American Free Trade Agreement) will be replace by the USMCA (United States-Mexico-Canada) agreement. On December 19, the US Congress passed the ratified deal to US President Donald Trump. Meanwhile, Mexico and Canada are having a hard time passing the ratified deal to the General Congress of Mexico and the Canadian Parliament. Currently, NAFTA is the largest multilateral agreement in the world. However, the ongoing negotiations to finalize RCEP (Regional Comprehensive Economic Partnership) could replace NAFTA. The RCEP is composed of 10 ASEAN (Association of Southeast Asian Nation) Plus Australia, New Zealand, India, Japan, South Korea, and China.

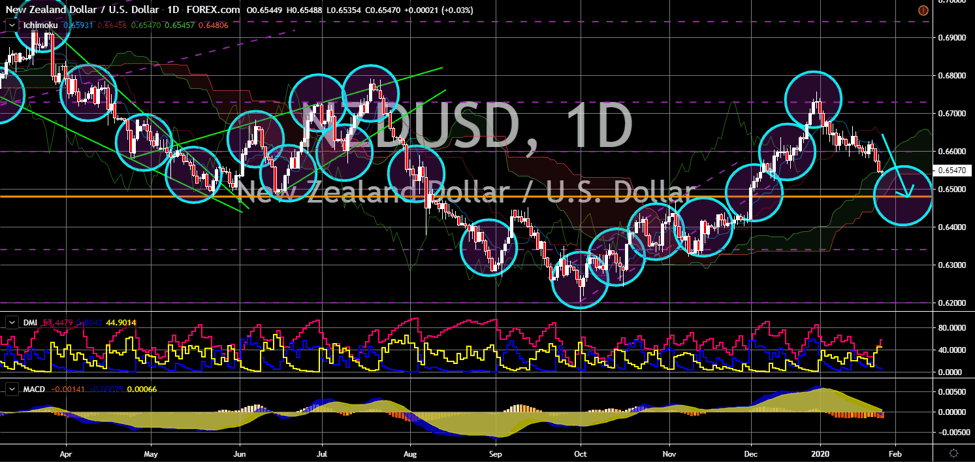

NZD/USD

NZD/USD

The pair will continue its steep decline after it broke down from a key support line. A day before the US is set to impose tariffs to China, the two (2) economic powerhouse signed the phase one trade deal. Under the agreement, Beijing agreed to buy $200 billion worth of US agricultural products. This was to offset the trade deficit between the two (2) countries and to cover the slump in US agricultural sector during the trade war. Though good for the global economy, the phase one trade deal will hurt the New Zealand economy. New Zealand is China’s top agricultural exporter with $17 billion worth of trades last 2018. Kiwi investors are worried about the impact that the additional $200 billion purchase of US goods. In relation to this, New Zealand is ramping up its trading relations with other countries. On December 31, New Zealand and Singapore ratify and upgraded their trading agreement. The deal came into effect the day after the signing.

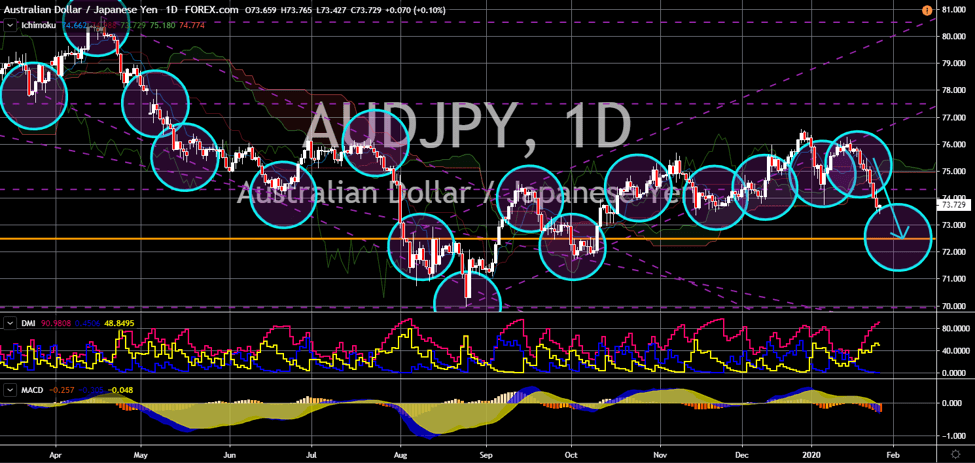

AUD/JPY

The pair will continue moving lower after it broke down from an uptrend channel support line. China’s Coronavirus has revived global economic fears. Australia and Japan are currently leading the Asia Pacific region and their economies will suffer the most from the outbreak. In Japan, tourism companies are facing 20,000 cancellations of package tours. An economic expert further warned that this virus could impact the Japanese economy more than the SARS virus in 2003. With SARS, Japan’s economic expansion was 0.2% lower. However, the Coronavirus could potentially shave 0.45% economic expansion. Meanwhile, Australia takes the collateral damage from the slump in Chinese stocks in recent days. Currently, the Australian share market already lost $36 billion in value as the Wuhan virus continue to scare investors. Tourism industry in Australia and Japan will suffer from the coronavirus panic.

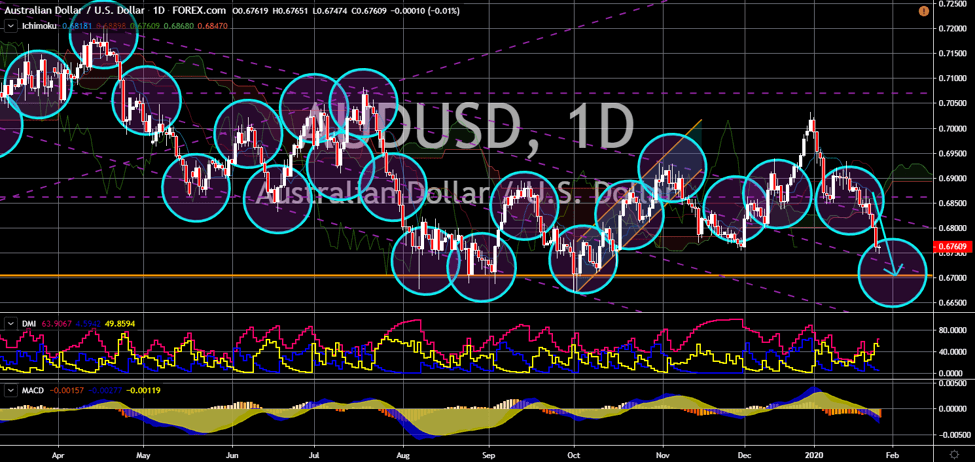

AUD/USD

The pair will continue to trade lower and head towards a major support line. The US has all the aces against China. On December 14, the US and China signed the phase one trade deal. Analysts said the signing could possibly end the year-long trade war between the two (2) largest economies in the world. Now that China’s economy is under pressure from the coronavirus, the US could further flex its economic might. On the contrary, the Australian economy is taking the hit from the slump in the Chinese economy. The Australian Securities Exchange already lost $36 billion due to panic selling on Chinese stock. Further damages are in hindsight as the number of infected people continues to increase. In other news, China’s finance ministry and National Health Commission already allocated $12.8 billion to curb the spread of the coronavirus as death toll rises to 82. Confirmed cases in China, on the other hand, already reached 2,744.