Market News and Charts for February 04, 2020

Hey traders! Below are the latest forex chart updates for Tuesday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

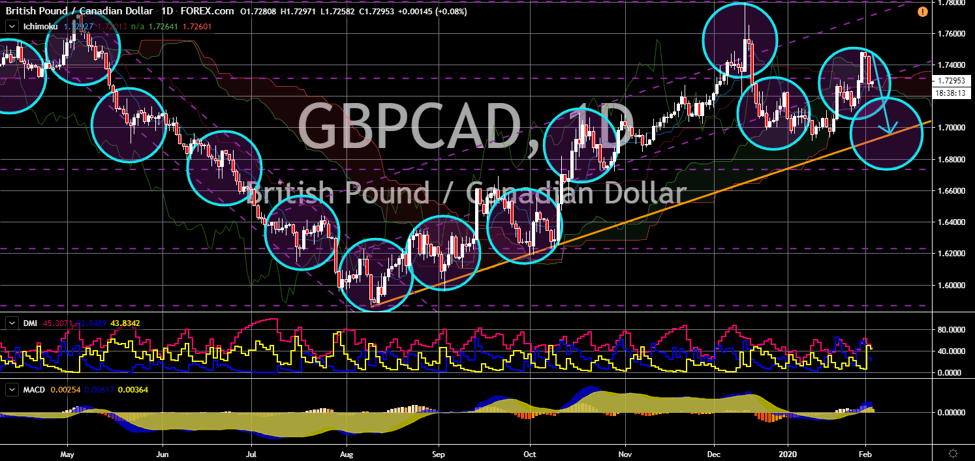

GBP/AUD

The pair will bounce back from a major support line, sending the pair higher towards its previous high. An independent and stronger United Kingdom appears following the comments made by UK Prime Minister Boris Johnson. He said that Britain will not follow EU rules on future trading deals. The two (2) parties are currently in negotiations following the withdrawal of the United Kingdom from the European Union on January 31. As the UK negotiates deals with the EU, it is also increasing ties with non-EU countries. The country’s trade minister already assured New Zealand that it will be its priority in post-Brexit trade agreements. The UK is also looking towards Australia for a free trade agreement (FTA). However, the government of Australian PM Scott Morrison seems wary of its former colonial master. Despite his unwillingness to expand the current trading pact between the two (2) countries, analysts see Australia taking the hit more than the UK.

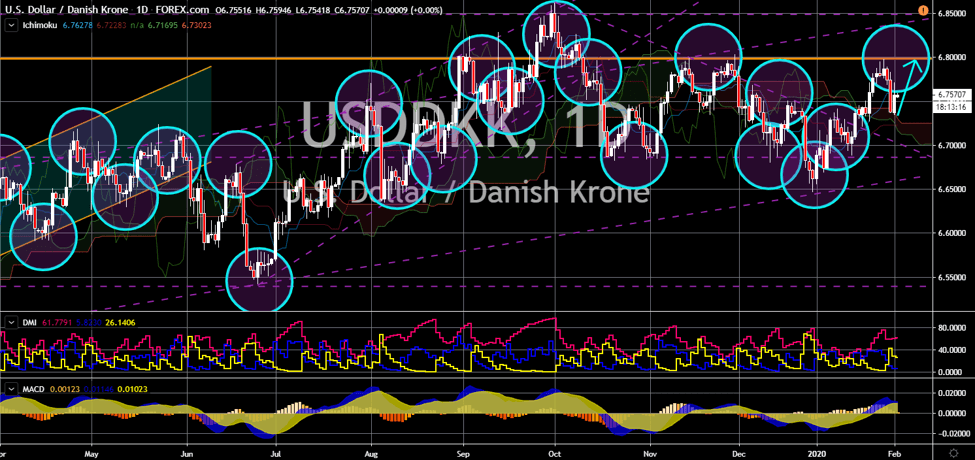

GBP/CAD

GBP/CAD

The pair will move lower in the following days and head towards the uptrend channel support line. Canada has another card on hand after Prince William and Meghan Markle departed from the United Kingdom for Canada. As the Royal Family embattles with heirs to succeed Queen Elizabeth, Canada is reaping the benefits of the rift. The couple announced in early January that they are cutting their professional ties with the Royal Family to live as private citizens in Canada. In other news, Canada’s possible trading deal with the United Kingdom increases amid the widening EU-Canada relationship. The two (2) parties haven’t ratified the Comprehensive Economic and Trade Agreement (CETA). This was amid accusations between the two (2) countries that the other party was not able to fulfill the agreements made. UK’s temporary tariff rates are also more lucrative compared with the EU with the CETA.

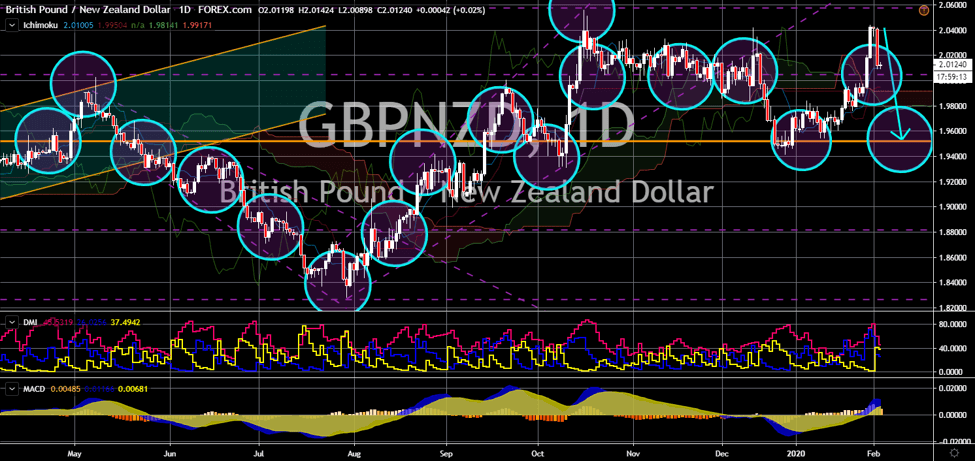

USD/DKK

The pair will continue its upward movement in the following days towards a major support line. The increasing tension between Denmark and China is favorable to the United States. In the previous months, the US-Denmark relations hit rock bottom after Margrethe Vestager, former EU Commissioner for Competition and now Vice President of the European Commission for a Europe Fit for the Digital Age, led the digital taxation. Under the digital tax law, foreign companies with revenue more than $1 billion will need to pay taxes to the EU. This was aside from the tax imposed by each member states. Vestager also led Apple and Google’s tax charge. However, the outbreak of the novel coronavirus has replaced the tension between the US and Denmark. A Danish newspaper created an image depicting the Chinese flag with a picture of viruses to which China demands an apology. However, PM Mette Frederiksen cited Denmark’s freedom of speech.

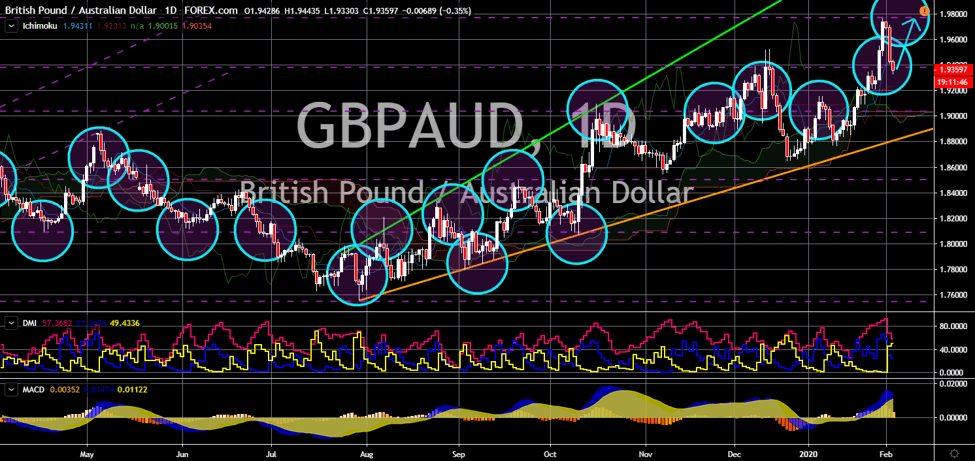

GBP/NZD

The pair will reverse back in the following days after a series of rally. New Zealand ministers for trade and foreign relations are now making moves to secure economic and political deals with the United Kingdom. This was after Britain officially withdraws from the European Union on January 31. On the previous meetings between the UK and NZ ministers, the UK assured Wellington that it will be its priority for post-Brexit trade agreements. On contrary to its neighboring country, Australia, New Zealand maintains strong relations with the European Union. Today, New Zealand is due to publish its unemployment report for the month of December. Analysts are anticipating a positive result following the signing of the US-China phase one trade deal last December 14. Unemployment in the country currently sits at 4.2%, which is one of the lowest in the world. The trend also shows the unemployment rate in the country further dropping.