Market News and Charts for December 27, 2019

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

USD/CAD

The pair will break down from a major support line, which will send the pair further lower in the coming sessions. Analysts and investors were optimistic that the ratified NAFTA (North American Free Trade Agreement), also known as USMCA (United States-Mexico-Canada), will be implemented next year. This was following comments from Speaker Nancy Pelosi that changes on the initial deal were almost done. Following the comeback of Democrats during the Midterm election, they were able to halt progress to US President Donald Trump’s key policies, including the funds for his proposed border wall between the United States and Mexico. The USMCA is expected to help the US agricultural sector to grow after they have been hit by the US-China trade war. However, many were still skeptical that the changes on the initial proposal will turn political and will offset any benefit the agreement has with the US economy.

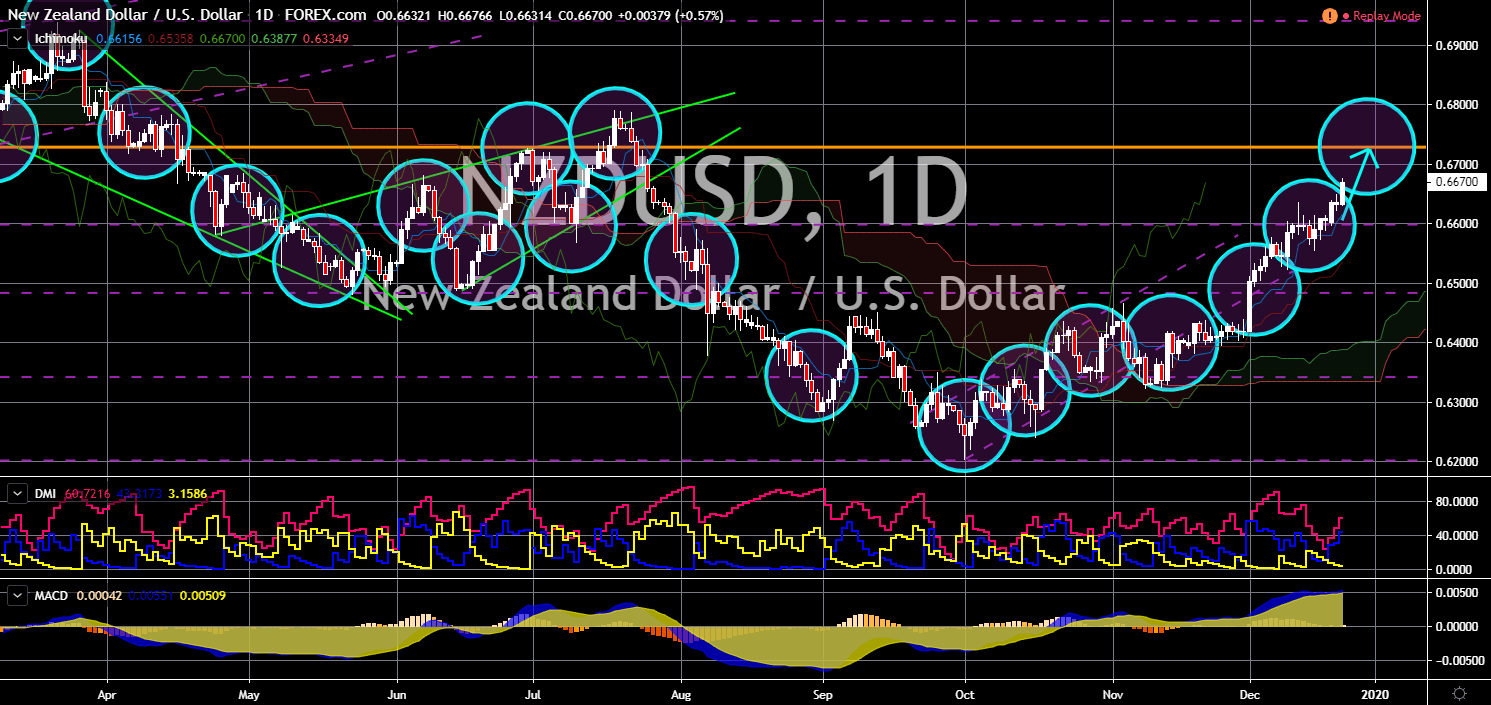

NZD/USD

NZD/USD

The pair is expected to continue its rally in the following days to reach its 7-month high. 2019 has been one (1) of the best years for New Zealand as the country transitions from a world power dependent to having its independent foreign policy. During the height of Huawei issue, New Zealand Prime Minister Jacinda Ardern reiterated that the country’s decision whether to ban or not to ban Huawei is irrespective of the US nor the UK’s pressure. New Zealand also abstained from taking sides in Venezuela between the Maduro government and self-proclaimed interim president, Juan Guiado. Moreover, Ardern was praised in the Muslim community following her handling of the Christchurch attack. The country was also part of the ratified pacific-rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership) and the regional trading pact, the RCEP (Regional Comprehensive Economic Partnership), both pact without the United States.

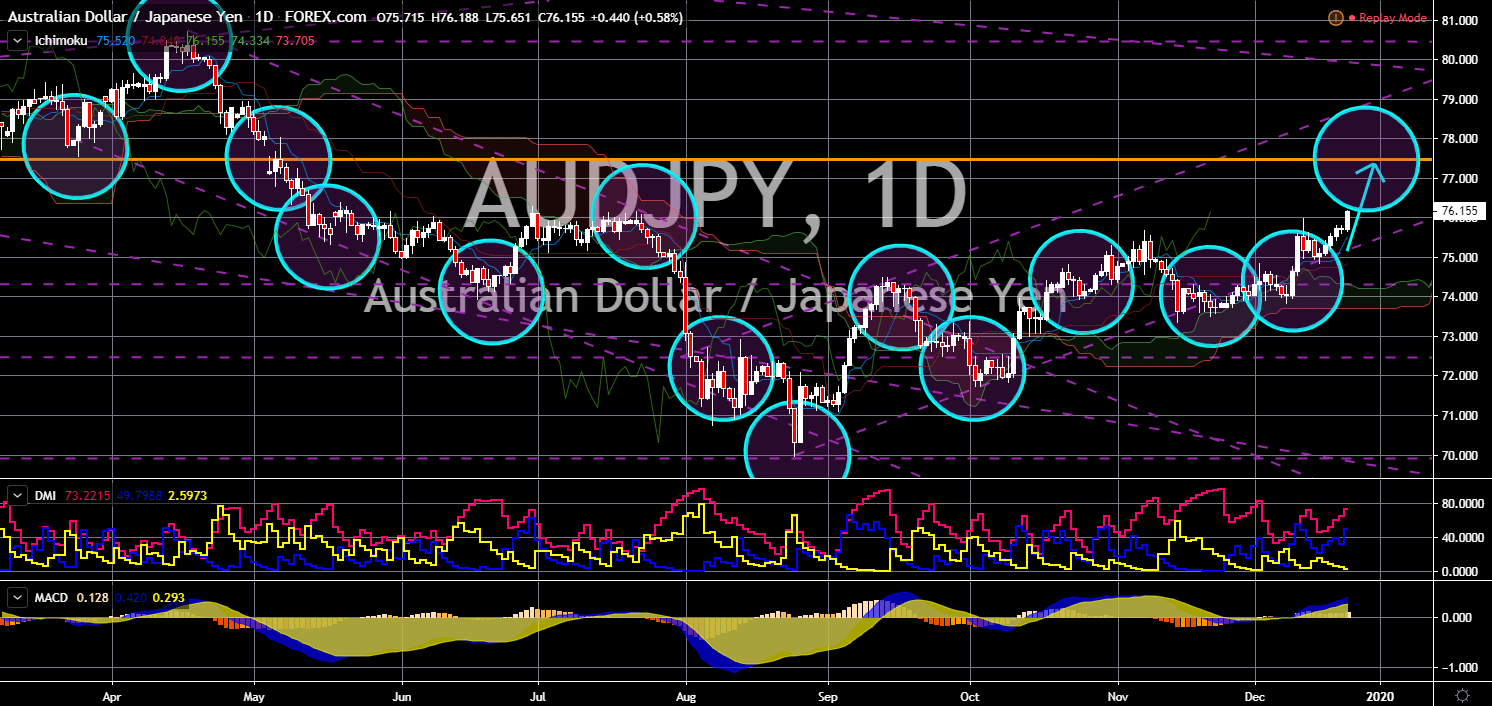

AUD/JPY

The pair will continue to move higher in coming sessions and reach its 8-month high. The Japanese yen is losing its appeal with investors and traders. This was amid the clarity on the Brexit deadline and the signing of the phase one of US-China trade war. The win of British PM Boris Johnson signaled the withdrawal of the UK from the EU on January 31, three (3) years after the 2016 Brexit referendum. Johnson’s Conservative Party won 42.4% of the seats, giving him the majority control over the parliament. On the other hand, the US and China is ending their year-long trade war with their recently signed phase one trade deal. Analysts and investors were optimistic that the deal might end the global economic uncertainty. In addition to the faltering yen was the possibility that the Bank of Japan (BOJ) might cut its interest rate by 2020 and to once again introduced a Quantitative Easing (QE) to stir the Japanese economy.

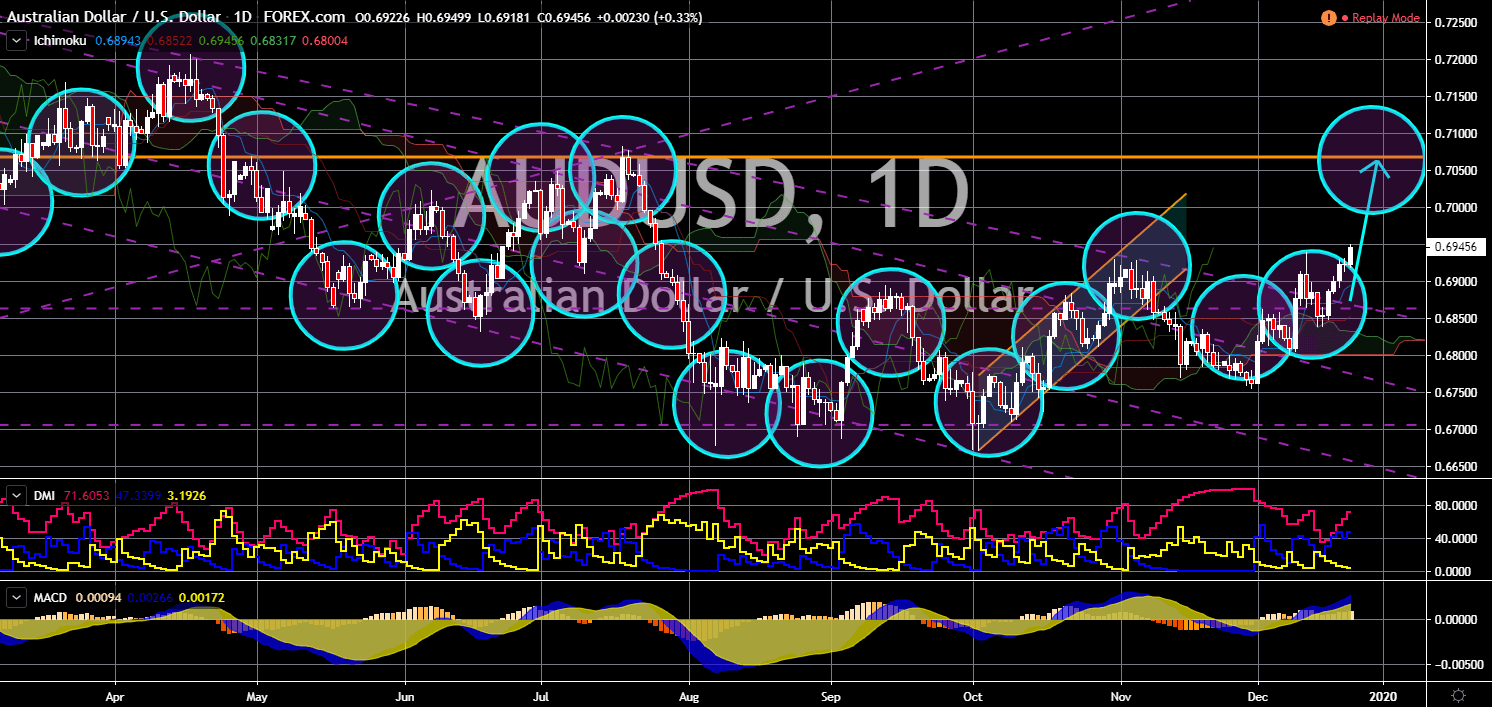

AUD/USD

The pair is expected to continue moving higher in the following days after it broke out from a downtrend resistance line. The Australian economy was dragged by the escalating US-China trade war. This was coupled by the uncertainty in politics, which paved the way for the Australian economy to flirt with recession. However, as the United States and China signed their phase one trade deal, the Australian economy is expected to recover. In addition to the better global economic condition was the possibility that the ASEAN (Association of Southeast Asian Nation) Plus Six (Australia, New Zealand, India, Japan, South Korea, and China) will build the largest trading bloc in the world was putting optimism on the Australian dollar. Australia also led the ratification of the pacific-rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), together with Japan. The win of PM Boris Johnson is also expected to push the AUD higher.