Market News and Charts for August 28, 2020

Hey traders! Below are the latest forex chart updates for Friday’s sessions. Learn from the provided analysis and apply the recommended positions to your next move. Good day and Good Luck!

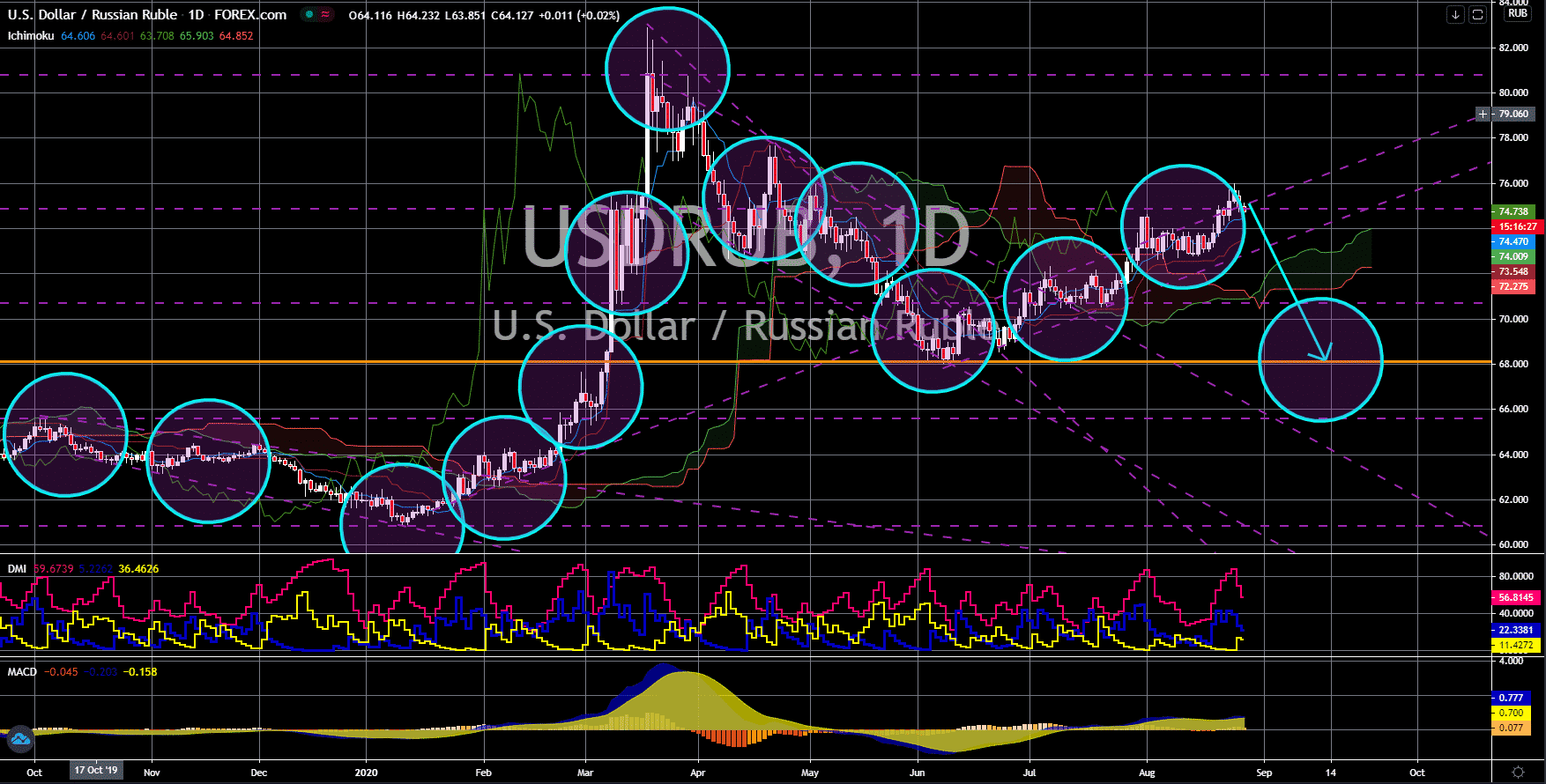

USD/ILS

The pair will continue to move lower in the following days after it broke down from a major support line. The 31.7% contraction in the US economy for Q2 2020 weakens the US position as a mediator between the Jews and the Arabs. This month, Israel and the UAE announced that they will be neutralizing their diplomatic ties. This agreement could be a game changer in the middle east as the Arab League remains committed in boycotting Israeli trades. In the middle of this deal was the United States, who continues to stir global power balance. However, the devastating impact of COVID-19 in the country’s economy might force the US to abandon its ambition in the middle east. Israel’s term sharing politicians, Benjamin Netanyahu and Benny Gantz, are at odds over the country’s annual budget. Disagreement between the two (2) could send the country into another snap election, the fourth of its kind in less than two (2) years.

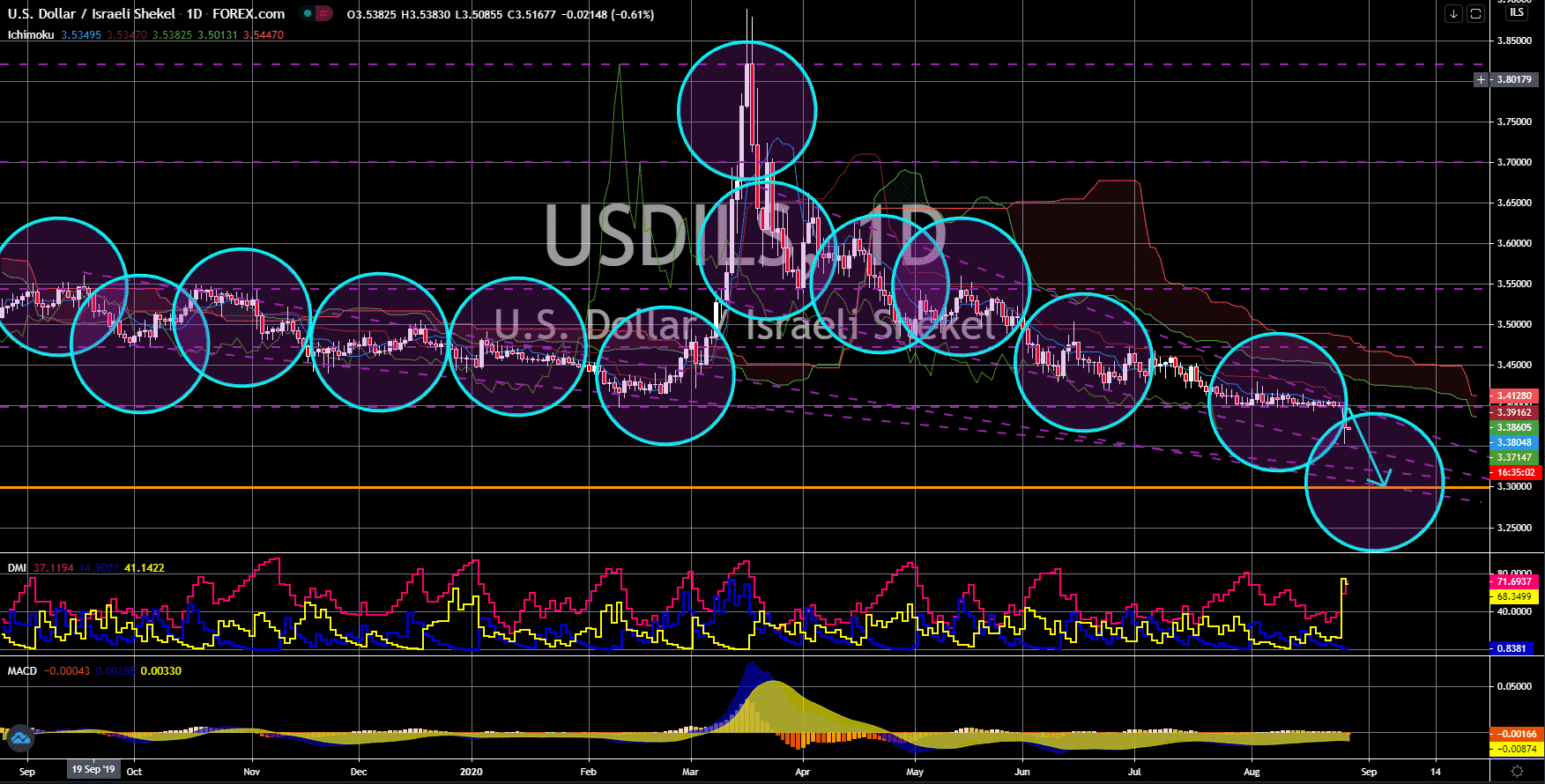

USD/SEK

The pair will fail to break out from a downtrend channel resistance line, sending the pair lower in the following days. Sweden will be publishing its second quarter GDP report today, August 28. Expectations for the April to June report is an economic decline of 8.6%. The country’s herd immunity program was meant to prevent its economy from collapsing. However, recent reports suggest that the country suffered the same fate with its neighbors. However, the Swedish koruna will thrive against the US dollar as the largest economy in the world suffered a worse economic contraction. Furthermore, Sweden’s report from yesterday gave hope among investors that Sweden is on the path of recovery. Consumer and manufacturing confidence posted 84.4 and 97.7 results for the month of July compared to prior numbers of 83.3 and 95.7 points, respectively. Its retail sales also grew 1.9% last month, higher than 1.0% expectations and 1.3% prior result.

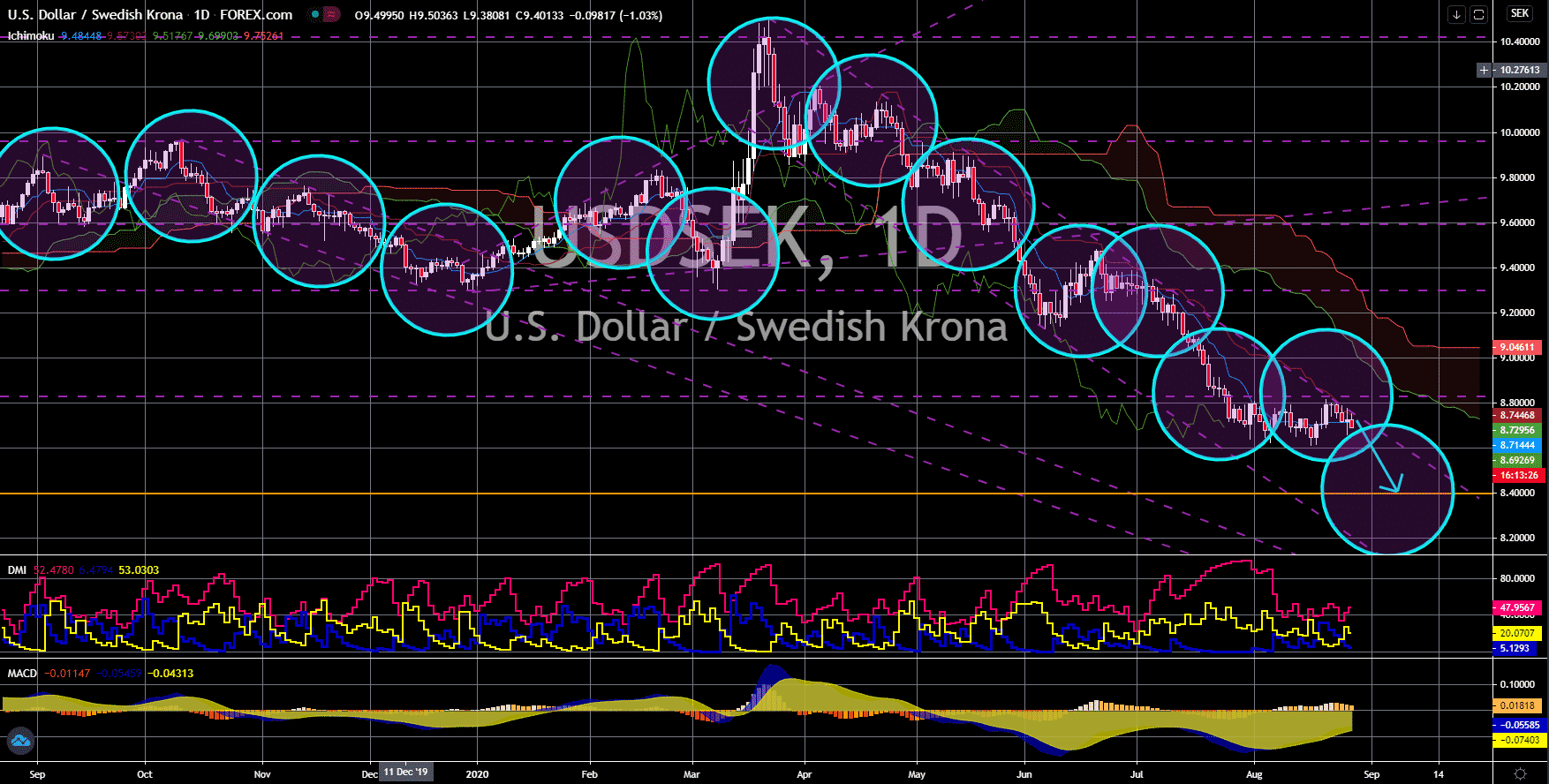

USD/ZAR

The pair is expected to break down from a major support line, sending the pair lower towards another major support line. The recovery in China is helping the yuan-infused economy of South Africa to thrive. On its recent reports, SA said its CPI grew by 1.3%, Core CPI at 0.7%, and PPI with 1.2%. These figures were higher compared to their previous results and from analysts’ expectations. Investors are betting on these small recoveries against the massive drop in the US GDP for the second quarter of 2020. Aside from the GDP, personal income and personal spending’s results are set to be published this week. Expectations for these reports by analysts were bearish at -0.2% and 5.6%, respectively. The expected contraction in the personal income supported the recent initial jobless claims in America. The number of persons applying for unemployment benefits added 1,006K this week, just lower by 100K from last week.

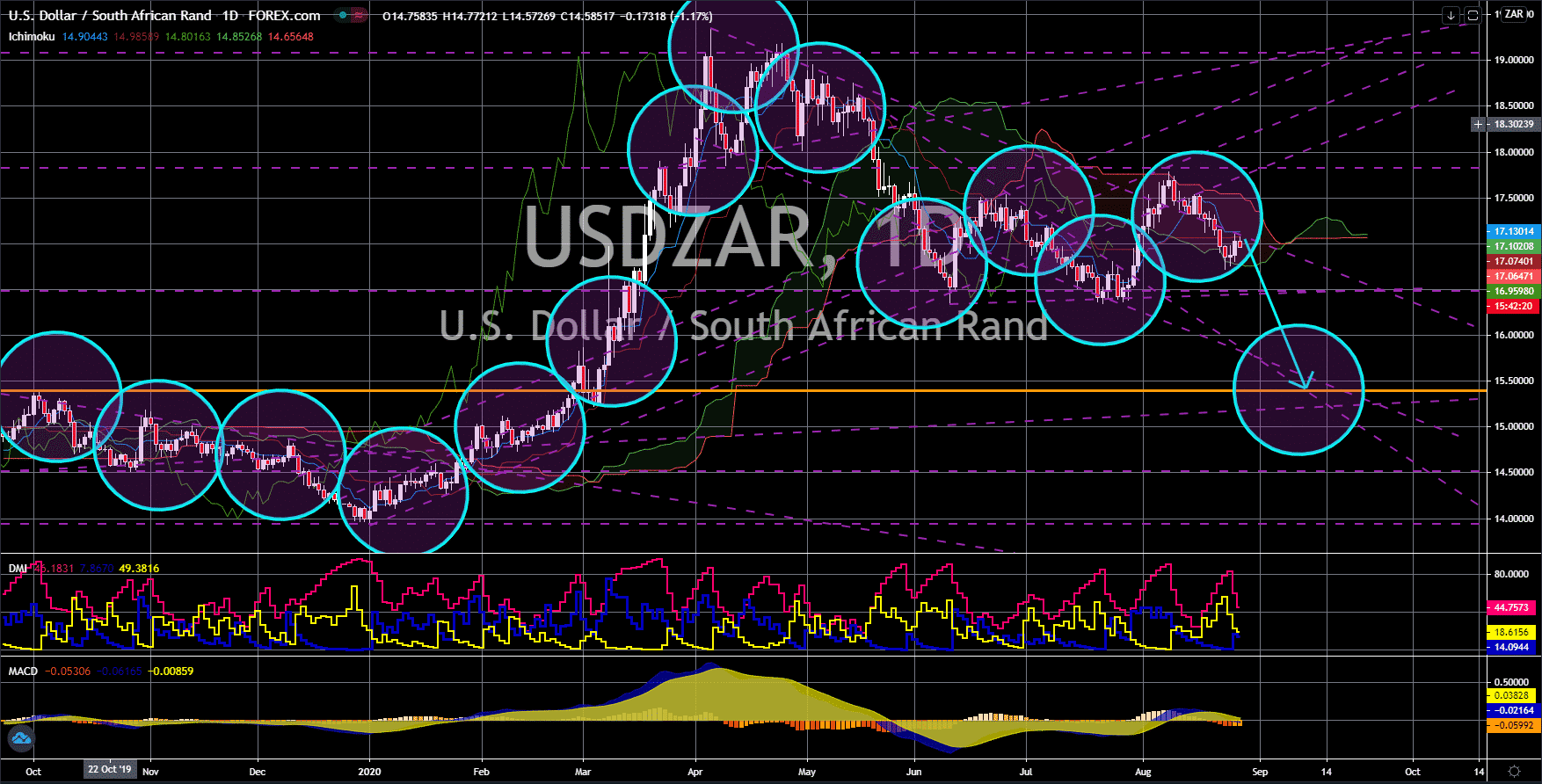

USD/RUB

The pair will fail to break out from an uptrend resistance line, sending the pair lower towards a major support line. The success of Russia with coronavirus will help the ruble get back on its feet against the greenback. Yesterday, President Vladimir Putin said that COVID-19 impact on the country’s economy has peaked. He added that he is expecting an economic recovery by next year. In addition to this, Russia claimed it created the world’s first COVID-19 vaccine known as Sputnik V. Meanwhile, companies in the US are still on their phase 3 trial before their vaccines will be available for commercialization. Investors are worried that the US’ competitiveness is already lagging, which could affect its economic performance in the coming months. In its yesterday’s report, the US said its economy plunged by 31.7%. Its unemployment rate figure is not also looking good. Analysts said the same scenario will continue until a vaccine is introduced to the market.