LOFI ICO is currently trending. What about Arealeum?

The Lofi network is an innovative project that has recently caused much market uproar. Like Arealeum, it’s currently high-ranked. The company plans to start the next stage of its initial coin offering. LOFI is the platform’s native utility token, which is very popular among investors. They snatched the LOFI tokens when the team launched the ICO on August 26, 2022. At that time, this BEP-coin was trading for 0.005 USD per LOFI. However, the company allotted only 19% of the total supply (10,000,000,000 tokens) on that occasion. Since then, the users have been waiting for the second stage of LOFI ICO.

The team members built this platform on the Ethereum blockchain. While the latter has many advantages, the Lofi protocol has different aspirations and values. It brings innovative ideas and believes that its project might change the Defi world. For instance, most platforms are limited to one blockchain currently. That means if you build your product on Ethereum, you mightn’t be able to move it on Solana or some other chain. While there are enough similarities to make trade or exchange possible in some cases, more often, that’s not the case.

The Lofi team contemplated this problem and decided to offer an alternative solution. After all, users shouldn’t be confined to one chain when they can benefit from several ones. Thus, the company is working to build an innovative platform that will be compatible with various environments. The team named this new project Chain Bridge technology. It will be able to configure the network according to its value, opening new possibilities.

How will the LOFI Chain Bridge work?

The company used Ethereum’s ERC-20 protocol to launch Chain Bridge. However, the team pointed out that while this blockchain is great for building DApps, it lacks programmability. Besides, ETH has quite high transaction fees, which is another drawback.

The Lofi project aims to improve the inflexible transaction environment that currently makes the exchange so tiresome for most traders. The company also developed a new kind of blockchain that runs in parallel with ETH. The latter allows users to enjoy a better Smart Contract function. In addition, this chain is compatible with the Ethereum Virtual Machine (also called EVM).

Moreover, the team stated that Lofi isn’t a typical off-chain scaling or layer 2 solution. It will be an independent blockchain. Lofi’s other advantage is that it can work offline. This chain will boast advanced tools. It will be compatible with dApps of the Ethereum ecosystem, as well. Besides, the team designed Lofi in such a way that it will work with other apps such as MetaMask. Overall, this project offers great features. Hence the investors’ interest in it.

Arealeum’s ICO is also trending. Why’s that?

Arealeum is a new blockchain ecosystem. It runs self-reinforcing investment cycles, and the process continues endlessly. The company incorporated an innovative Cycle-Engined Technology to create its platform. According to the team, the latter’s system is based on specific algorithmic rules. The team predefined these rules in a set of contracts that are publicly available. Arealeum wants to offer absolute transparency to its investors and customers. Thus, all information about the project is available for users to see.

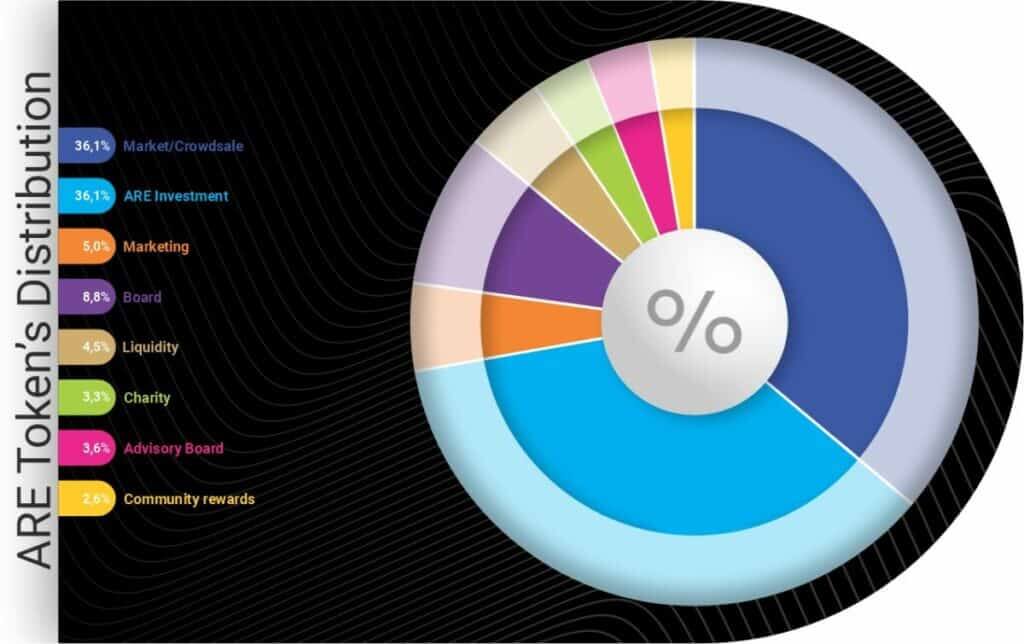

Furthermore, the company created the platform’s utility token – ARE. The team based it on the Ethereum platform, using the ERC20 standard. Arealeum is currently trending on various ICO listing platforms. Its pre-sale will start on April 16, 2023, and end on July 15, 2023. Token holders will have many benefits. For example, they can vote about the future development of the Arealeum ecosystem.

The total supply of Arealeum tokens is 3,050,000,000, but only some percentage will be available for ICO purchase at this stage. The platform will accept ETH, BTC, USD, and EUR in exchange for its native coins. Arealeum has a unique approach and an experienced team. It will enable customers to buy and sell various tokens. On the other hand, these tokens often represent shares in promising startups. Thus, when customers purchase the tokens, they become investors in high-potential projects.

That is an easy way to generate additional income, especially if you have enough funds to buy a substantial share. However, there’s no need to sink all your money into one project. Diversification is always a good strategy. In such a way, you are relatively insured from risks attached to every investment.