Is Forex Trading Haram – Get All The Essential Information

Who would have thought that trading would be a matter of religious faith? Is Forex trading haram or halal? Is the stock market haram?

In the case of Muslim traders, it is necessary to respect the principles of Islam in the context of trading. It’s where the concept of Islam trading comes in.

Let us introduce you to the concept of halal trading and how to do Islamic trading. You will also have an overview of the best Islam trading brokers. Finally, if you are a beginner, you will find a detailed tutorial to get you started.

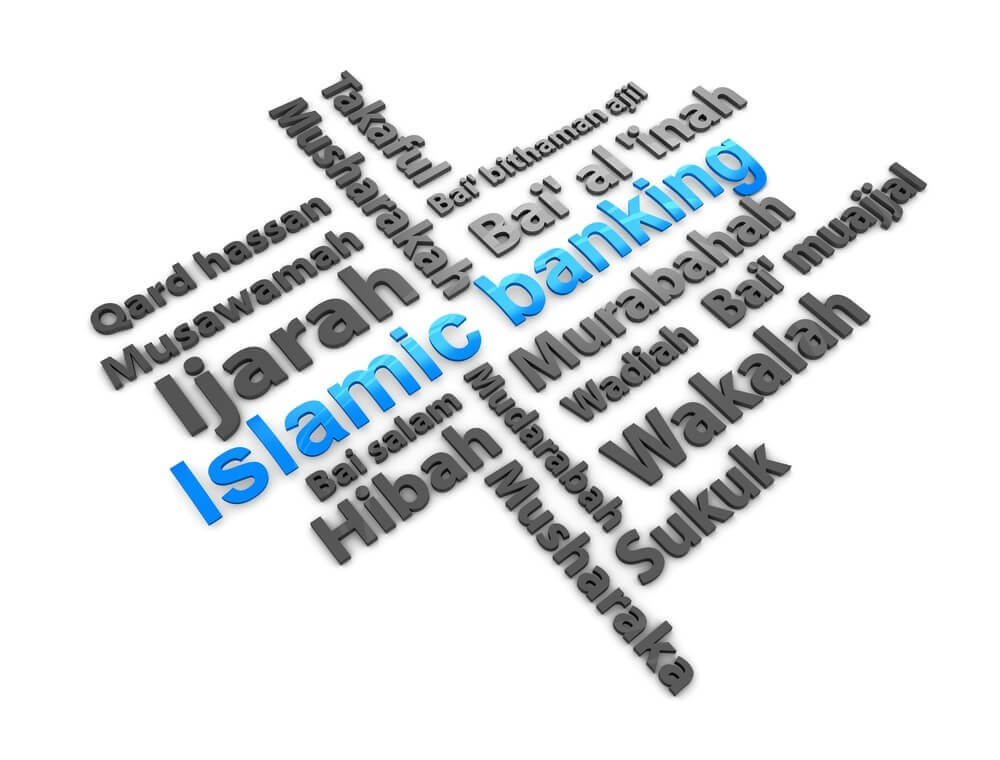

For a long time, banking and investing were banned in countries where the laws of Islam occurred. Interest income prevented Muslims from using banking services. But gradually, however, Islamic finance came into being.

Is Forex trading haram?

If you are wondering if Forex trading is halal, it all depends on the conditions provided by an accredited broker. The same goes for the dilemma of whether the stock market is haram or halal?

It must be immediately outlined that not all brokers can be trustworthy. An unlicensed broker is not ultimately compatible with what is considered “Islamic trading.”

Organizations that issue quality licenses include Financial conduct authority (FCA), Cyprus securities and exchange commission (CySEC), US Securities and exchange commission (SEC), Australian Securities and investments commission (ASIC), and others. Usually, information on regulators features at the top or bottom of the broker’s website.

Generally, currency exchange could be both haram and halal, depending on the intent of the retail investor.

So let’s see what ethically Islamic online forex trading and banking investing, and the best kind of account to open.

There is haram trading and halal trading.

When it comes to trading Forex and Islamic laws, you need to be vigilant since it depends on the type of trading and brokerage service. Not every broker complies with Islamic rules of trading nor offers the proper account. Forex trading is halal if you opt for the broker that fits your religious code.

Is Forex trading haram – Trading Halal Meaning

First and foremost, you need to know financial activities prohibited by Islam laws.

- Payment and receipt in any form of interest. In basic trading, this is a swap-free account, charged when a position is open overnight. In the Islam trading account, this swap is intentionally removed.

- With the regular account, it is possible to exchange with a delay in the context of trading operations. However, some brokerage companies specifically remove this feature for Islam investing.

- In some cases forex is considered gambling. However, always bear in mind that trading is a professional activity. It requires analyzing the trends in the market, assessing companies and entire countries. Thus, it cannot be gambling, which is strictly prohibited by sharia.

- Lack of risk and benefit-sharing. In Forex trading, the risks and rewards are always at the same level. If an asset goes up, you get the income. If that asset declines in value, you suffer the loss.

Thus, a special Islamic forex account, Islamic forex trading, and Islamic stock account allow investing in the Islamic halal market.

Definition of Islamic trading account in Forex

The Islamic account allows forex traders to avoid the prohibitions of Islam and, at the same time to trade in the halal stock and foreign currency exchange. The Islamic account was developed specifically for those who wish to trade in the financial markets but are not able to use other accounts due to their religious values.

The stock market in an Islamic framework is broadly similar to traditional trading. Islamic trading involves opening buy and sell positions on Forex, CFDs (contract for difference) indices, commodity CFDs, equity CFDs, bond CFDs, and ETFs (exchange-traded funds).

Thanks to this, traders with Islamic accounts can achieve the same goals as traders with standard accounts.

A simple guide for Islamic traders

In Islamic trading, there are specific principles and guidelines that differ from conventional trading practices, primarily due to religious considerations. Here’s an explanation of two relevant keywords in the context of Islamic trading:

1. Borrow Money

In Islamic trading, borrowing money or taking a loan often involves adhering to the principles of Shariah, Islamic law. Traditional interest-based loans, known as usury or “riba,” are strictly prohibited in Islam.

Islamic finance promotes partnerships that distribute risk and profit between lenders and borrowers, like Mudarabah or Musharakah contracts. The borrowed money should not have interest, and the borrowing terms must follow Islamic ethics.

2. Short Selling

Short selling is a trading strategy where a trader sells an asset that they do not currently own with the expectation that its price will fall in the future.

In Islamic trading, short selling can be problematic because it may involve selling something you do not possess, which can be seen as a form of speculative gambling, known as “Maisir,” and is generally discouraged in Islamic finance.

However, some scholars have proposed alternative structures for Islamic short selling that comply with Shariah principles, such as parallel contracts that involve immediate possession and deferred payment.

Is the stock market haram in Islam- Investing in Stock Exchange

After we answered ” is forex trading haram” let’s tackle other investment types. To invest in the Islam stock market, you must choose an Islam broker. Islamic trading as opposed to other known trading methods in the market.

It is a bit complex since it is clearly based on Shariah law, a code that governs the administrative and legal principles of Muslims, permissible according to Islamic law.

Few brokers adapt their system to Islam trading, to what is permissible in Islam. So the first thing to do is to do your research to find a broker who offers Islam trading. A suitable broker will allow you to meet these criteria:

- Do not yield interest

- Speculation must be done without delay and overnight interests

- The trader should not bet on high-risk trades

- There must be sharing of benefits and risks.

Is entering the world of forex trading a worthwhile endeavor?

Besides asking yourself: “Is Forex trading haram or halal” you should also ask yourself “Is it worth entering in?” Data indicates that a significant majority of hopeful forex traders meet with disappointment, with some experiencing substantial financial losses.

The use of leverage presents a dual scenario, offering the potential for substantial gains while also exposing traders to significant losses. Additionally, the presence of counterparty risks, platform malfunctions, and unexpected bouts of market volatility further complicate the journey for individuals considering forex trading.

In Conclusion – Is Forex trading haram

In general, the answer is NO if you, as a Muslim, do it with suitable brokers.

Muslims cannot take high risks, which is why a good grasp of analytical tools that minimize risk is more than necessary.

Without high risks, some would say that it is a kind of margin trading where the probability of making maximum money is low, and the probability of losing all of your money is also high. But for enthusiasts, this is a way of trading with respect for their religion.

With Islam trading, the trader does not seek to be rich at all costs. It should be enough just to seek to make profits that will allow him to live well.

And although profits for Islamic traders are rarer than for others, some brokers have seen fit to adapt their systems to them to achieve a certain profit level.

-

Support

-

Platform

-

Spread

-

Trading Instrument