What is IMPP stock (Imperial Petroleum Inc)?

In this article, we will be exploring the IMPP stock. Investors interested in this company’s stock will have to trade it on the NASDAQ stock exchange. This stock represents Imperial Petroleum Inc. This is a company with its base in Athens, Greece, focusing on shipping oil internationally.

The founders established the company on May 14, 2021, meaning it has not been around long and is still finding its feet. It ships multiple liquid crude-derived petroleum products, as well as edible oils. The positive aspect of developing an oil product shipping operation is evident. Most importantly, investing in shipping allows for a business to profit quickly. This is unlike establishing an oil-producing and drilling company. That would require several years of finding potential oil sources and investing in creating their mining bases. Similarly, for oil refinement, acquiring all the necessary expertise and hardware to create a refinement plant may take some time. By focusing on shipping, the company has made significant headway in a short amount of time. All they need is to establish a base of operations, find clients, and acquire the vehicles necessary for transport.

To ship their products overseas, they use a large fleet of their own. This fleet includes a large number of tankers, some of which could carry up to 46,000, and some up to 160,000 metric tonnes. It offers its services to refineries, oil producers, and commodity traders.

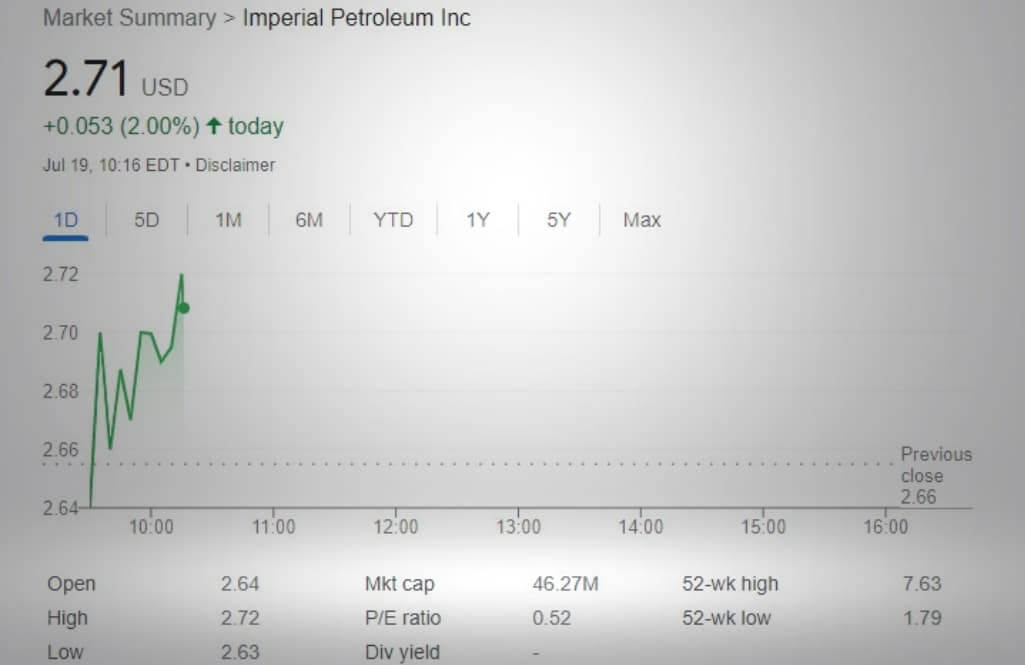

IMPP stock performance

In the short term, the performance of the stock has been mixed recently. Thus the indications of investor confidence are unclear. The indications on the future IMPP stock forecast are unclear as well, as the profitability of the company is uncertain. Now may be a good time to investigate the stock at this pivotal moment for the company.

So now to further expand on the stock’s performance. The IMPP stock price stands at $2.90, a far cry from its 52-week high of $8.85 earlier, so it has evidently been struggling recently. So why is the IMPP stock dropping?

The reason for this stark drop is initially due to the company issuing additional stock. This had diluted the stock value. However, the development to keep in mind here is that the company issued these new stocks for a reason. The company had needed to raise money to make new acquisitions, and the issuance of further stocks was helpful in accomplishing this. However, the shareholder dilution and the new acquisitions were over a year ago. It appears that the profits from the company have unfortunately not yet met expectations. As a result, the IMPP stock price has kept dropping.

It has, in a short while, dropped from its latest high of $3.85 on the 22nd of June, after which it has been a sell candidate. That amounts to an almost 25% drop in less than a month.

Some optimism

Despite all this negative news, in the last two weeks, there have been more fluctuations. This has led some stock analysts to predict that the future may actually look positive for the IMPP stock. Analysts predict that the stock is currently in a lull and should be in a wide and strong upturn over the coming months. In fact, they predict a rise of over 17% over the following 3 months. By the end of this 3 month period, analysts believe it could hold at a value between $3.13 and $5.40. This is where the IMPP stock price target should aim. Furthermore, the earlier acquisitions may prove to have been a good long-term investment for the company, thus potentially promising greater profitability in the months to come.

Initially, on 7 July, there was some optimism on the stock, as analysts recommended to buy. If it reaches a new high point soon, there are predictions of further rises. There will likely be some resistance at $3.01 and $3.55, and breaking above these points would produce further positive projections.

Significant recent issues

There are caveats for this 3-month period as well, however. If the value of the stock breaks below $2.67 soon, this may indicate that the upturn will be slower. In the less optimistic scenario, it could also indicate that this upturn analysts predict may no longer be happening.

There is considerable risk with trading the stock currently, however, as it has been relatively low liquidity as of late. This is likely due to the low volume of trade in the stock at periods. Low liquidity makes it difficult for investors to ensure they can sell their stock, thus increasing the risk. There is usually much volatility during the day, meaning rather erratic price changes in short periods of time.

Earlier predictions for this Monday set prices to open at $2.97 and to close at $0.293 lower or higher than the last closing price. Due to the volatile nature of the stock, paying attention to the closing and opening prices on each day is more important than its price at any one moment. The actual performance does not bode well, however. It already had opened lower than the expectations were, at $2.94, and had closed at $2.72.

In conclusion, despite positive predictions for the oncoming months, very recent developments have not been so positive. Combine this with the generally risky nature of the stock, and the future does not look bright. It seems likely that the stock will not flourish for the following days and weeks. Therefore our recommendation would be to avoid the IMPP stock for the time being. Further developments in the future could change the outlook.