Gold and Silver: The Price of Gold Above the $1,780 Level

- The price of gold rose above the $1,780 level yesterday after four months.

- During the Asian trading session, the price of silver finds support at the $21.40 level.

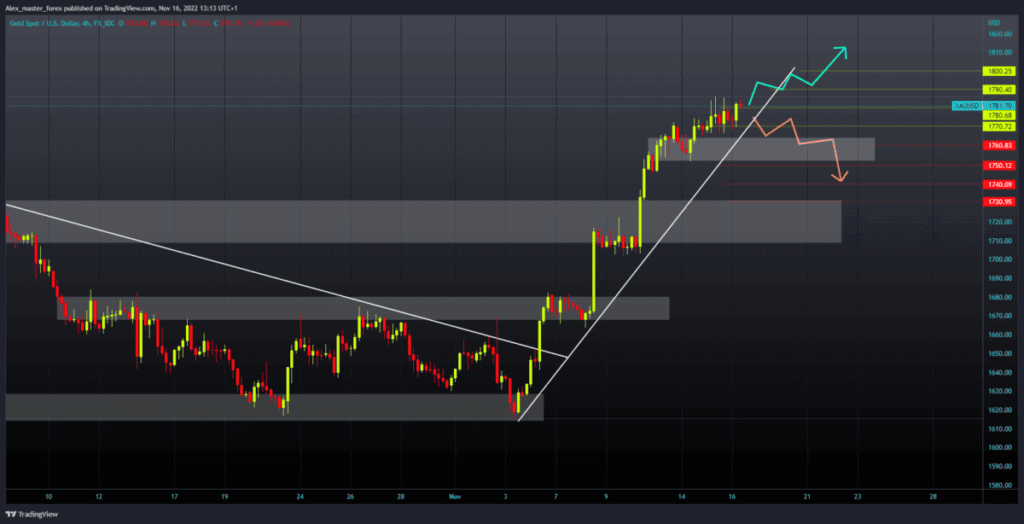

Gold chart analysis

The price of gold rose above the $1,780 level yesterday after four months. In the last couple of days, the price of gold has been rising more slowly compared to the previous week. A weak dollar favors dollar-denominated goods, and gold definitely benefits from that. For a bullish option, we need a continuation of this positive consolidation and a price move to the $1790 level.

Then we need to hold up there in order to try to reach the $1800 level. For a bearish option, we need a negative consolidation and pullback below the $1770 support level. A price drops below this level could shake the current bullish trend, which would lead to a switch to a bearish trend. And the next test for such a scenario would be at the $1750 level. A price drop below could lead to a longer-term pullback in the price of gold. Potential lower targets are $1740 and $1730 levels.

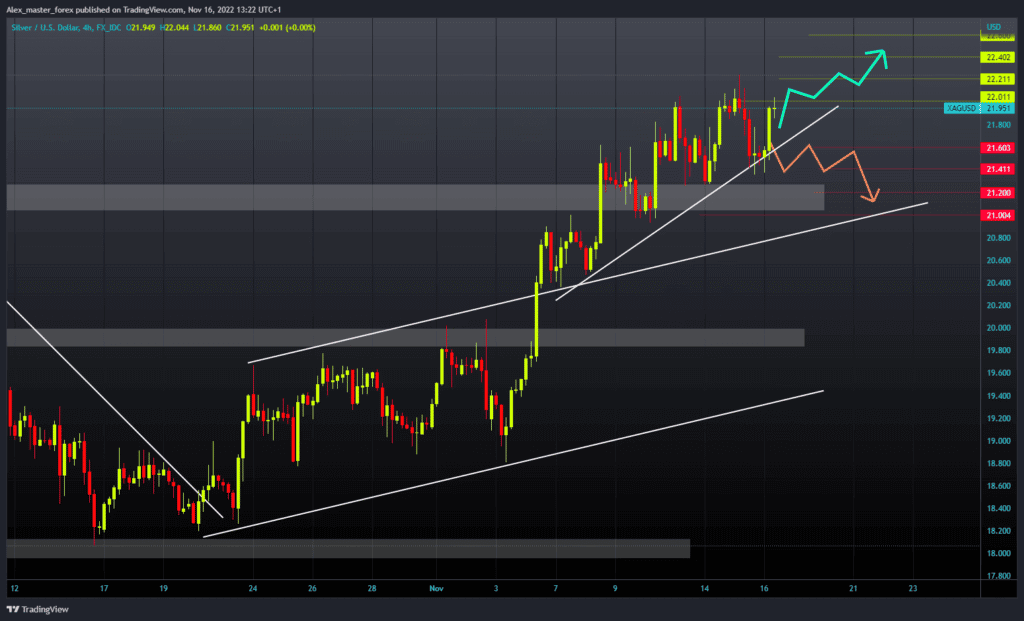

Silver chart analysis

During the Asian trading session, the price of silver finds support at the $21.40 level. After that, we saw a strong bullish impulse that increased the price to $22.00. We are now consolidating around that level and could see a break above if the price manages to hold above there. For a bullish option, we need a move above the $22.20 level.

This would allow us to test the previous high, and we would be able to see a break in silver prices above. Potential higher targets are the $22.40 and $22.60 levels. For a bearish option, a pullback to this morning’s support at the $21.40 level is needed. A fall in the price of silver below this support could lead to a further price pullback. Potential lower targets are the $21.20 and $21.00 levels.