Gold and Silver: New lower low

- At the beginning of today’s trading day, the price of gold dropped to the $ 1808 level.

- During the day, the price of silver ranged from $ 21.00 to $ 21.37.

- Yields on ten-year U.S. Treasury bonds have climbed above 3.4% for some time, their highest level in more than 11 years.

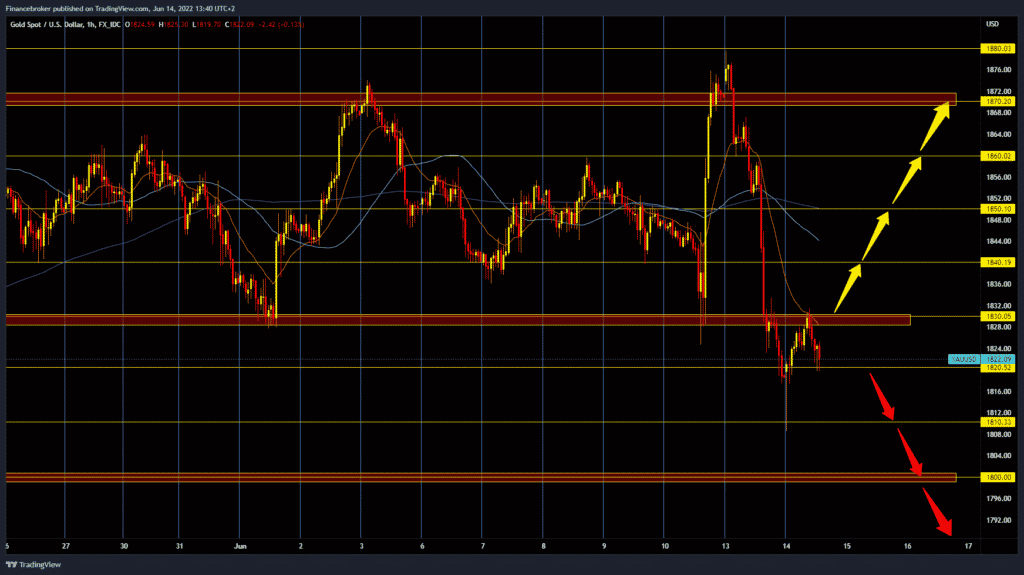

Gold chart analysis

At the beginning of today’s trading day, the price of gold dropped to the $ 1808 level. After that, we saw a quick withdrawal above $ 1820, and then the price climbed to $ 1830. Here, the price met with new resistance, and a new pullback started towards 1820 dollars. A strong dollar and high yields on US bonds are driving investors away from the precious metal. Yesterday, the price dropped from 1880 dollars to 1810 dollars, losing 70 dollars of its value or 3.75%. For the bullish option, we need a new positive consolidation and a return above $ 1830. After that, we could expect a further recovery until the next resistance at $ 1840. our potential following bullish targets are $ 1850, $ 1860 and $ 1870. We need to continue the current negative consolidation and titration of the $ 1,810 support zone for the bearish option. Break prices below would bring us down to the $ 1,800 psychological level.

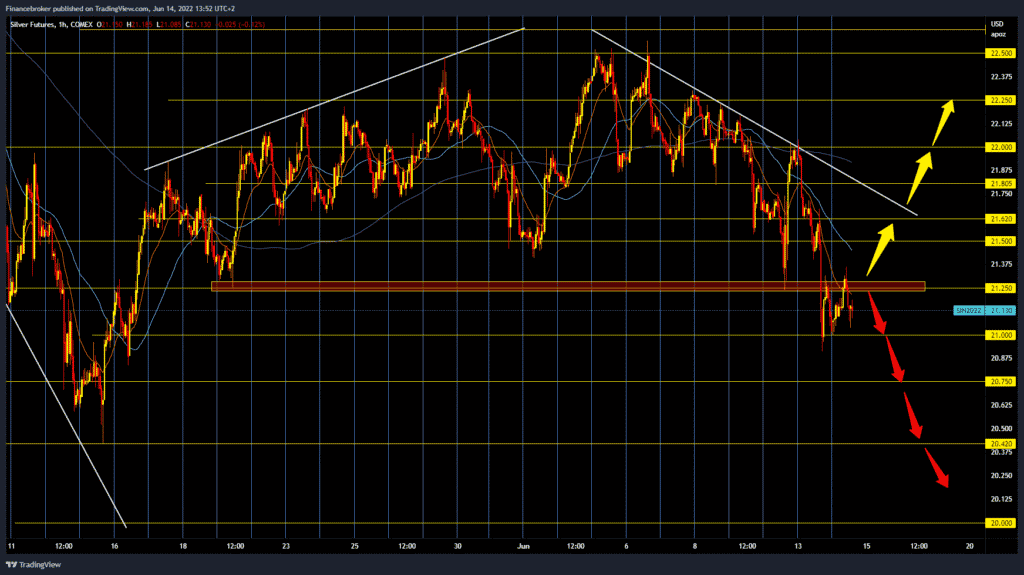

Silver chart analysis

During the day, the price of silver ranged from $ 21.00 to $ 21.37. We have been in the bearish trend for the eighth day, and the price formed a new lower low at $ 20.90 yesterday. We are now testing the 21.25 level, but the bearish pressure seems too great, and we will probably see the price continue to pull. Potential bearish targets are $ 20.75, $ 20.50 and the previous low at $ 20.42. For the bullish option, the price must stabilize above the $ 21.25 level. After that, we expect positive consolidation and continued recovery towards $ 21.50, $ 21.65 and the upper trend line. A price break above $ 21.80 would boost bullish optimism about the potential continuation of the silver price recovery.

Market overview

Yields on ten-year U.S. Treasury bonds have climbed above 3.4% for some time, their highest level in more than 11 years. As a result, real interest rates have also risen significantly and, at 0.68%, are now at their highest level in three years. This makes gold less interesting as a non-interest-bearing alternative investment.

According to the Wall Street Journal, the U.S. Federal Reserve will increase interest rates by 0,75% tomorrow, which the market immediately determined. The market now predicts an increase in rates by 2,00% by September.