Gold and Silver: Metal prices rise while the dollar falls

- After yesterday’s fall to the $1615 level, the price of gold started a bullish recovery.

- The price of silver has a new chance today to break above the $20.00 level.

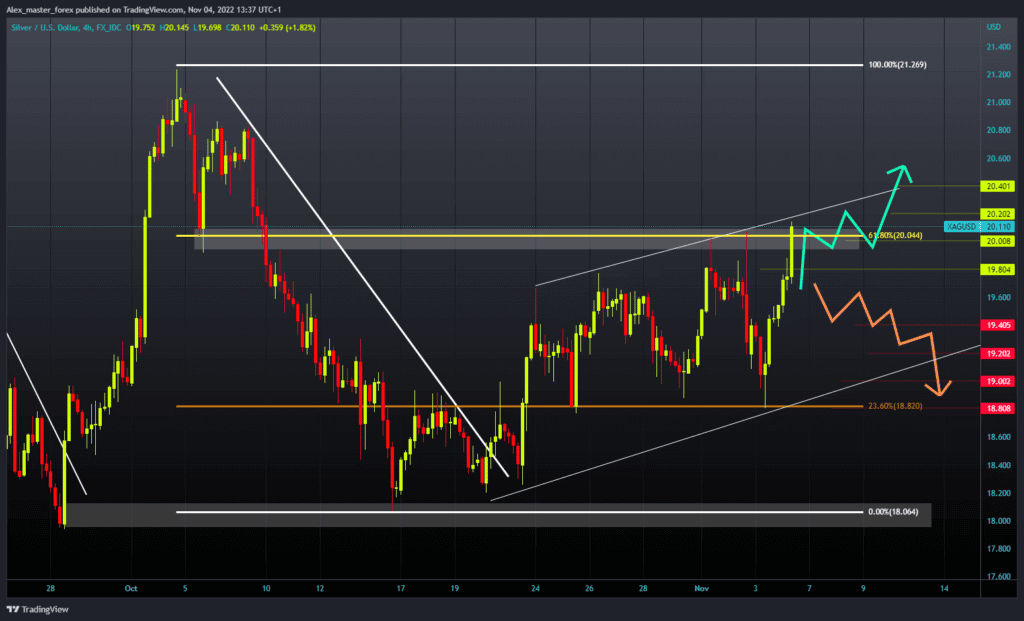

Gold chart analysis

After yesterday’s fall to the $1615 level, the price of gold started a bullish recovery. During the Asian trading session, the price of gold consolidated around $1,630 and later broke above and climbed to the $1,650 level. Today’s weak dollar has helped a lot with that. For a bullish option, we need a continuation of positive consolidation and a move toward the $1660 level. With that, we would rise above the upper trend line.

Then, we must stay above that and continue the recovery with a new bullish impulse. Potential higher targets are $1670 and $1680 levels. We need a negative consolidation and a pullback to the $1630 level for a bearish option. Below, we could see a further drop in the price of gold to a large support zone at the $1615 level. The potential lower target is the $1610 and $1600 levels.

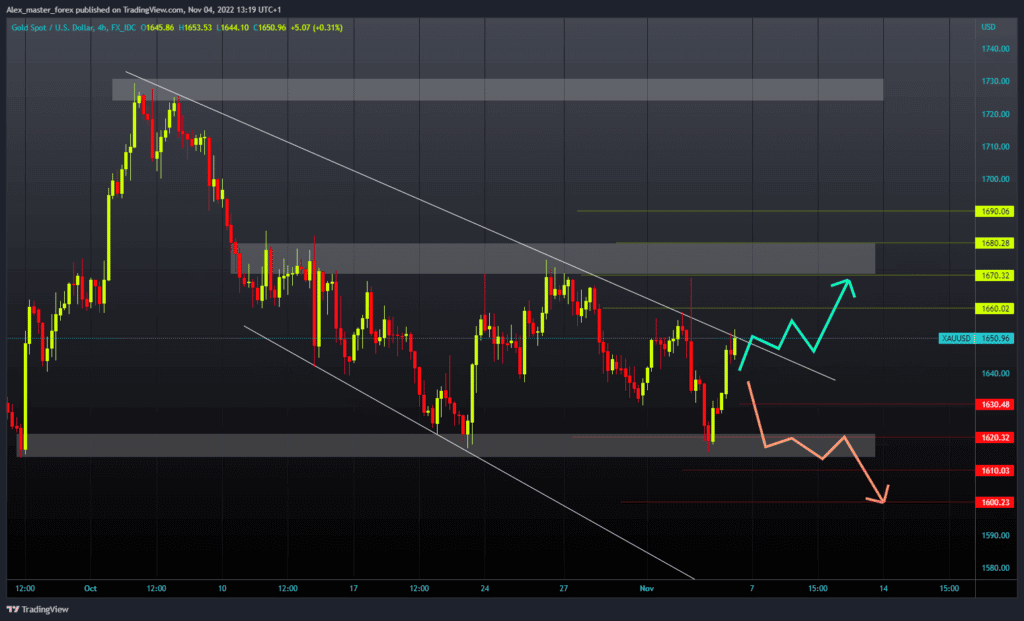

Silver chart analysis

The price of silver has a new chance today to break above the $20.00 level. This would form a new November higher high, and we would have good chances for further recovery. For a bullish option, we need a positive consolidation and a break above $20.00. Then it is necessary to maintain up there and, with a new bullish impulse, start to continue the growth. Potential higher targets are the $20.20 and $20.40 levels.

For a bearish option, we need a new negative consolidation. Then we could expect the price of silver to go into retreat. A potentially important support level is the $19.40 level. A breakout of the silver price below would add further pressure and could lead to a further decline in the silver price. Potential lower targets are $19.20, $19.00, and $18.80.