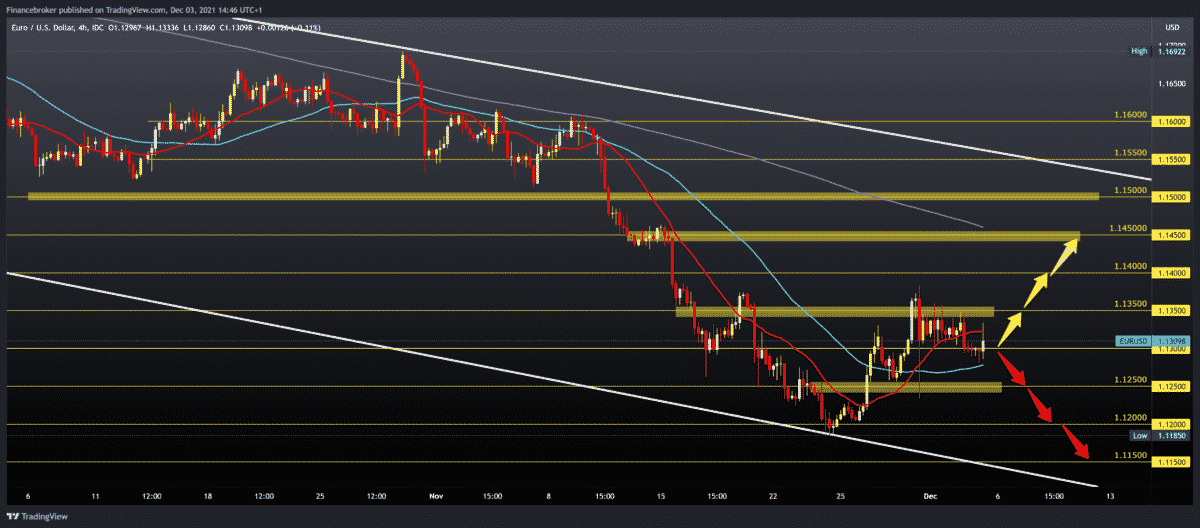

EURUSD, GBPUSD still in the red zone

Looking at the four-hour time frame chart, we see that EURSUD found support at 1.13000. We now expect consolidation to remain positive and the pair to continue to recover, and resistance at 1.13500 is our next hurdle to overcome.

Bullish scenario:

- We need continued positive consolidation and, with the support of MA20 and MA50, to make a break above the 1.13500 resistance zone.

- Then we expect the pair to continue towards 1.14000 and after up to 1.14500 previous bearish consolidations.

- At 1.14500, additional resistance is our MA200 moving average.

Bearish scenario:

- We need a negative consolidation below 1.13000 and a break below the MA50 moving average to try to test the zone at 1.12500.

- The next series of support is at 1.12000, and then the potential formation of a new minimum this year.

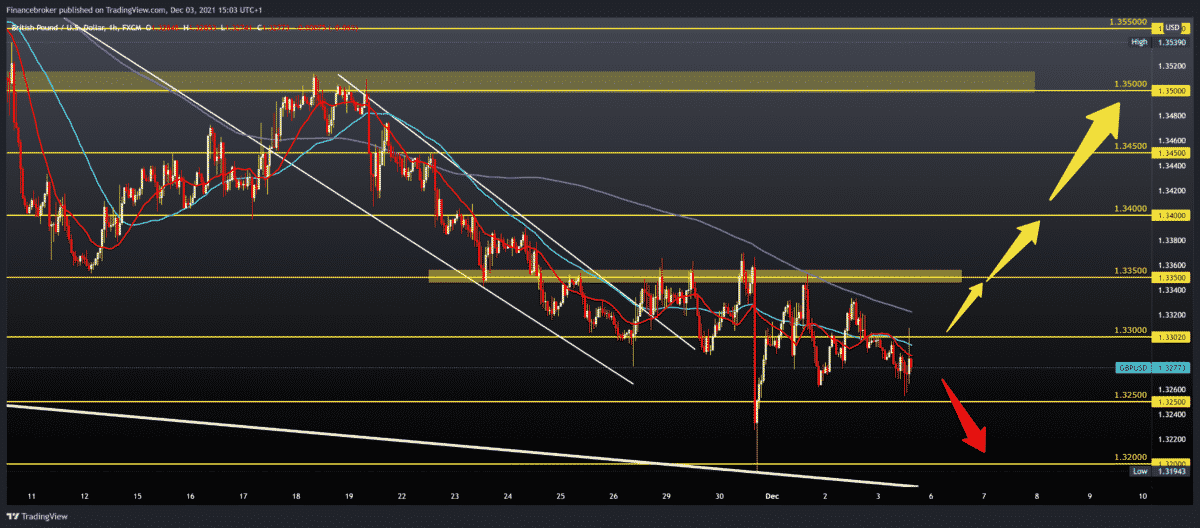

GBPUSD chart analysis

The GBPUSD pair is still under a lot of pressure to slide even lower. The GBP had terrible economic news today, the same as the dollar on the Non-farm payrolls report. Only 210,000 new employees were added to the US market in November. The impact on the chart is likely to be reflected next week. Based on this report, the pound should recover and move from this year’s low.

Bullish scenario:

- We need new positive consolidation and growth of GBPUSD above MA20 and MA50 moving averages and 1.33000 levels.

- Our next possible resistance is the MA200 moving average of about 1.33200, and if we skip it, we climb to 1.33500 the previous resistance zone bullish try.

- Below the next target is 1.34000, then bearish consolidation at 1.34500, then 1.35000 psychological level.

Bearish scenario:

- We need negative consolidation with pressure MA20 and MA50 from the top.

- Then we ask for support at 1.32500, and if it doesn’t last, we go down to test the previous lower low at 1.31943.

- The further decline of GBPUSD introduces us to new lower targets on the chart.

Market overview

Private sector growth in the eurozone rose again in November, primarily reflecting the resilience of the service sector as severe supply constraints strained production activity, the final results of an IHS Markit survey showed on Friday.

Private survey data revealed that the final composite production index rose to 55.4 in November from 54.2 in October. Faster growth ended a three-month series of slowdowns by November.

Although the reading was below the expected 55.8, the index remained above the neutral mark of 50.0, signalling expansion in the private sector.

The service sector in the UK continued to record a strong recovery in November, driven by the fastest growth in new business in the last five months, final data from the IHS Markit showed on Friday.

The Chartered Institute of Procurement & Supply Services procurement manager index fell to 58.5 in November from a three-month high of 59.1 in October. The flash reading was 58.6.

As a result, output growth in the last quarter of 2021 remained well on track to surpass that seen in the third quarter.

Since June, new business growth was highest, supported by solid business and consumer spending. Export sales have gained momentum, with the highest growth rate in more than four and a half years.

On Friday, a report released by the Ministry of Labor shows that employment in the United States rose by much less than expected in November. The report states that employment outside agriculture employment rose by 210,000 jobs in November after rising by 546,000 in October.

Economists expected employment to rise by 550,000 jobs compared to a jump of 531,000 jobs originally reported for the previous month. The unemployment rate dropped to 4.2 percent in November from 4.6 percent in October.

-

Support

-

Platform

-

Spread

-

Trading Instrument