EURUSD and GBPUSD – Bearish breakout

- During the Asian session, the euro weakened against the dollar.

- During the Asian session, the British pound weakened against the dollar.

- Germany’s consumer confidence is expected to improve slightly in June.

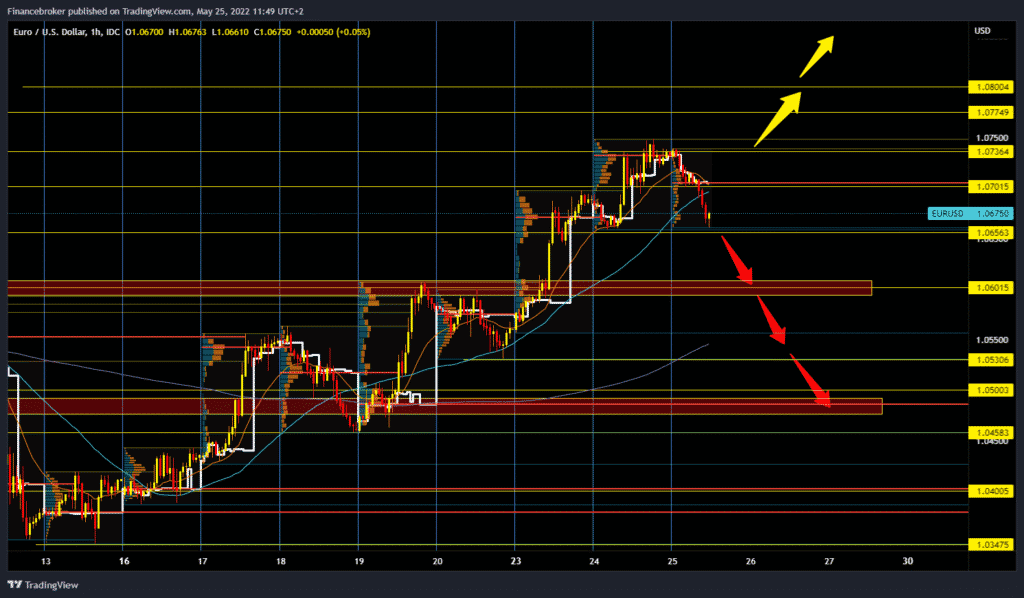

EURUSD chart analysis

During the Asian session, the euro weakened against the dollar. Some members of the European Central Bank’s board are dissatisfied with the timeframe for raising interest rates set by ECB President Christine Lagarde. Some of them prefer a faster variant of increasing interest rates. Currency traders have previously exerted sales pressure on the U.S. currency, lowering expectations of strengthening due to rising interest rates in the U.S. However, that pressure seems to be easing.

On the other hand, an embargo on Russian oil imports could be imposed by the end of this month. The euro is exchanged for 1.06745 dollars, which is weakening the common European currency by 0.52% since the beginning of trading tonight. ECB Chairman Christine Lagarde is expected to address Davos today, and notes from the last meeting of the U.S. Federal Reserve will be published tonight.

The euro is now seeking support at the 1.06500 level, and if we saw a break below the pair, it would then form a new lower low compared to yesterday. Pair EURUSD has been in the bullish trend for the last ten days, and maybe we could see a smaller retreat to the 1.06000 level. All within the framework of this bullish consolidation from May 13. For the bullish option, we need to return to the zone around 1.07500. After that, we need a break above to continue further towards the 1.08000 level.

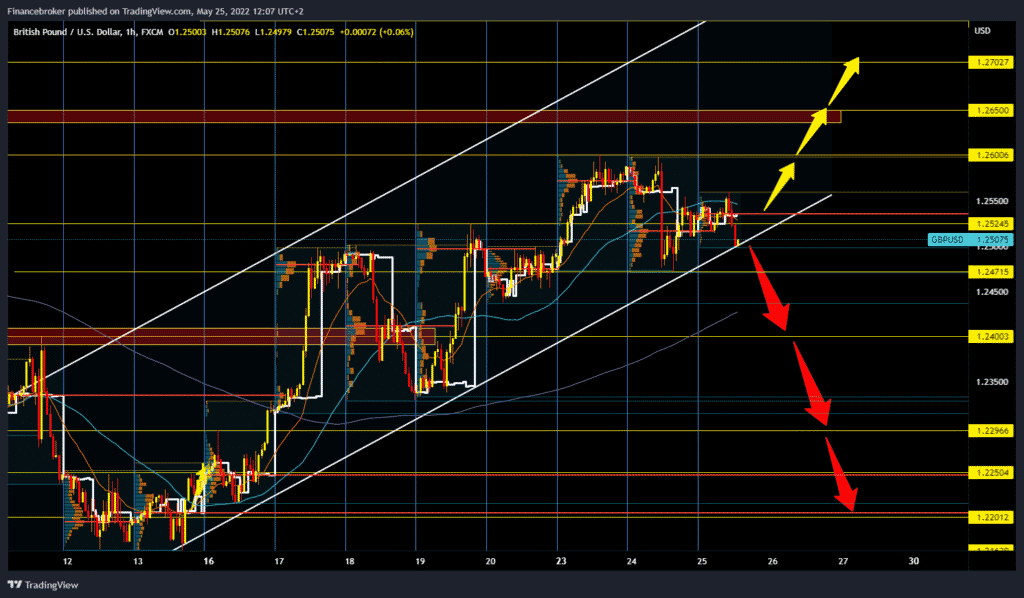

GBPUSD chart analysis

During the Asian session, the British pound weakened against the dollar. Yesterday’s extremely poor data from the UK services sector are still putting pressure on the island’s currency. The pound is exchanged for 1.25000 dollars, which is a weakening of the British currency by 0.18% since the beginning of trading tonight. Notes from the last meeting of the US Federal Reserve will be published tonight. Pair descended to the bottom line of the current rising canal.

The bottom line could support us, but due to the great pressure on the pound due to poor economic data, we could see a break below. After that, our first support was yesterday’s low at 1.24715 level. The potential following bearish targets are 1.24500, 1.24000, and 1.23000 levels. For the bullish option, we need to return to the previous resistance zone at 1.26000. A break above would increase the chances of a potential pound recovery. Potential above bullish targets are 1.26500 and 1.27000 levels.

Market overview

German Consumer Confidence

Germany’s consumer confidence is expected to improve slightly in June. However, it remained at a historically low level as high inflation and the war in Ukraine hit consumer sentiment hard, according to the GfK market research group on Wednesday.

The forward-looking consumer sentiment index rose to -26.0 from a revised -26.6 in May. The economist’s forecast was -26.0.

“Despite further easing of restrictions on the corona, the war in Ukraine and, above all, high inflation have a heavyweight on consumer sentiment,” said Rolf Burkle, GfK’s consumer expert.

Although consumer sentiment improved slightly in June, consumers still fear a recession, while supply chain problems and a lack of semiconductors are currently hampering the sustainable recovery of much of the German economy.