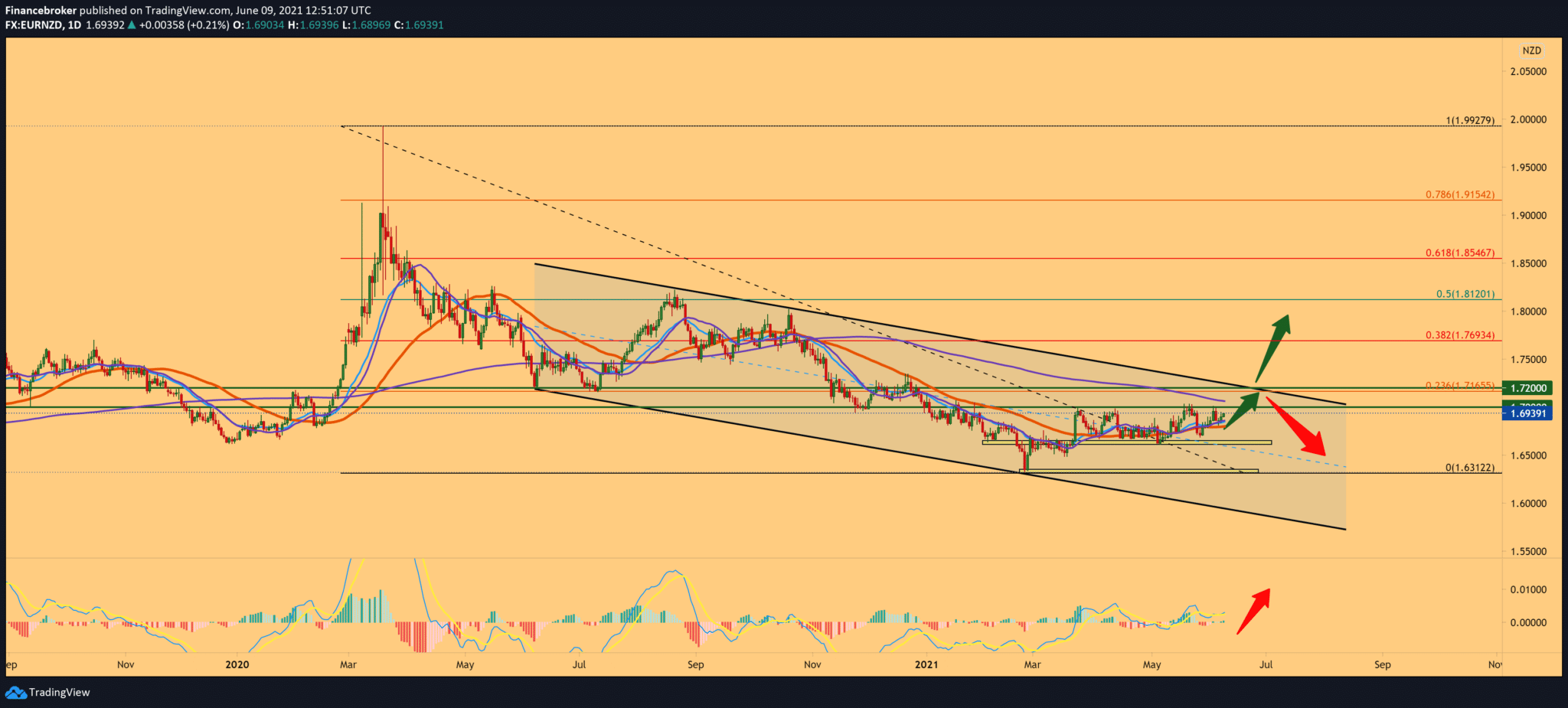

EUR/NZD in descending channel

The New Zealand Reserve Bank is always the first to issue its interest rate report in relation to other major currencies. This was also the case this time before the end of May. RBNZ left its interest rate at the spot level, which at that time gave strength to the New Zealand dollar in relation to other currencies. That power did not last long, and the NZD soon returned to the backbone of the main currency group. The euro has managed to make up for almost the loss since then, where we had a drop to 1.66800, and now we are at the current 1.69250 and are grabbing again towards 1.70000 psychological level.

Further, our movement is limited by a large falling channel, but we are slowly approaching the upper limit where we can expect the next resistance to 1.72000. By setting the Fibonacci retracement level, our goal is to first climb to 23.6% of the level at 1.71650, which coincides with the upper channel line. A break above that level opens the door to 1.75000, and then the potential to 38.2% Fibonacci level at 1.77000, where we were last seen in November last year.

Otherwise, if the euro falls, we will go back down closer to the previous low in the zone 0.63100-1.65000, looking for better support. Looking at the MACD indicator, we see that we are in bullish territory with a bullish signal. Together with the moving averages MA20, EMA20, and MA50, we support continuing the growing trend. And as potential resistance, we have MA200, which is in zone 1.70000-1.70500.

From the daily important economic news, we will single out the following:

German export growth slowed down more than expected in April, and imports fell for the first time in the last three months, data published by Destatis announced on Wednesday. Exports rose just 0.3 percent on a monthly basis in April, after rising 1.3 percent in March. According to economists, the monthly growth was 0.5 percent. Imports fell 1.7 percent in April, reversing the growth of 7.1 percent in the previous month. That was better than the economists’ forecast of -1.1 percent. As a result, the trade surplus rose to 15.9 billion euros in April from 14 billion euros in March; the expected level was 16.3 billion euros.

-

Support

-

Platform

-

Spread

-

Trading Instrument