EUR/JPY analysis for April 23, 2021

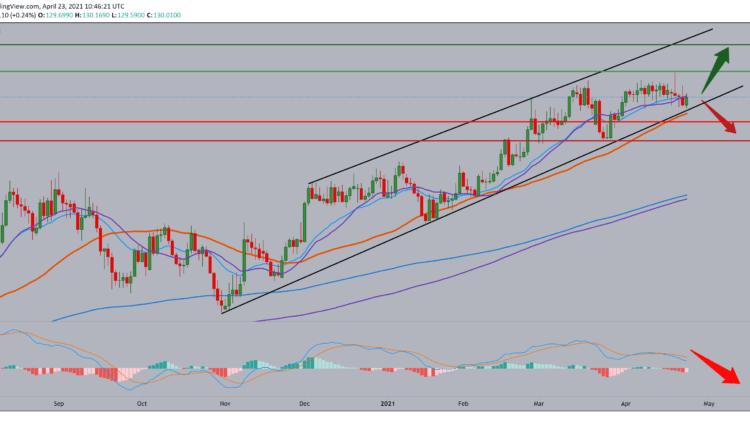

Looking at the graph on the four-hour time frame, we see that the EUR/JPY pair of aces in one wavy channel tends to head towards lower levels. In support of our running averages of the MA200 and EMA200, the break below gives us a clearer signal that we can expect a further pair of pairs to 129,500, with a view to 129,000 and 128,500 close to the previous low at 128,280. Following the MACD indicator, we see that the MACD is in the bearish zone, and as such, we can expect further consolidation of the EUR/JPY pair to lower levels.

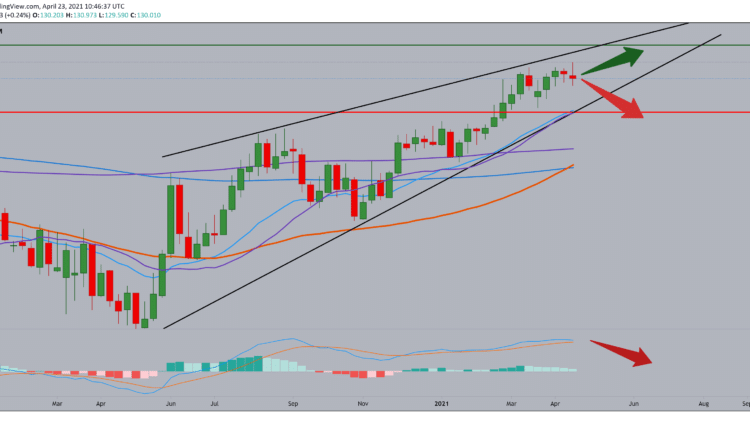

On the daily time frame, we see movement in a larger rising channel, and that we are currently testing the bottom line of the channel along with the moving average MA50. Here we can expect two options, the first is a bounce-up, and the continuation of the bullish trend above 131,000, while the second option is a break below the lower support line with a view of 129.00 and with it a view of the previous low at 128,300. The MACD indicator is in a bearish trend, with a tendency to continue in the coming period.

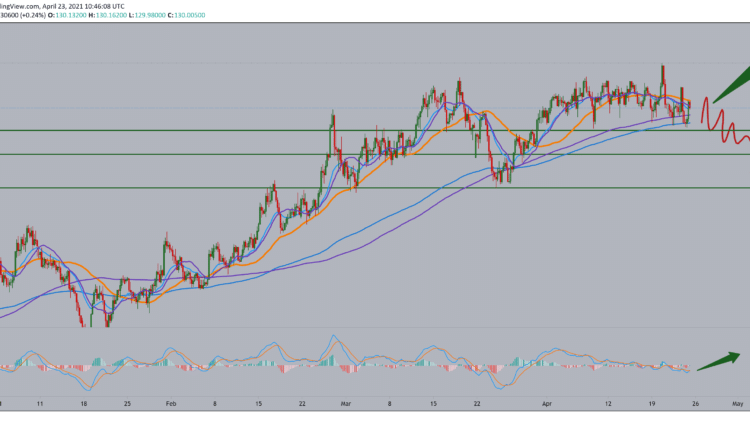

On the weekly time frame, we see that the EUR/JPY pair encounters resistance in the zone around 130.00, with the probability of going down, making a pullback to the first moving averages of MA20 and EMA20 at 128.00. According to the MACD indicator, we see a slowdown in the bullish trend over the last six weeks, and if we soon see the blue MACD line go below the signal line, we will get a safer confirmation of the bearish trend.

From the economic news for the EUR/JPY currency pair, we can single out the following:

Private sector growth in Germany was moderate in April. With a slowdown in service activities and a rise in manufacturing production, partly slowed by supply shortages, data from a quick survey by IHS Markit showed on Friday. The composite production index fell more than expected to 56.0 in April from 57.3 in March. The expected result was 56.8. Business activity in the service sector stalled in April as companies monitored the impact of the pandemic and tougher locking measures. The index of flash service procurement managers reached 50.1 in April, compared to 51.5 a month ago and expectations of 50.8. PMI in production fell to 66.4 from 66.6 in the previous month. Economists forecast the index to fall to 65.8.

The French private sector returned to growth for the first time since August 2020, driven by a new increase in service activity amid continued growth in the manufacturing sector, data from a quick survey by IHS Markit showed on Friday.

The composite flash output index unexpectedly advanced to 51.7 in April from 50.0 in March. The score was forecast to fall to 48.8. The new increase in service activity outpaced the slight slowdown in production growth. In this regard, the growth of production among producers of goods was far stronger than the growth in the production of their services.

The Japanese manufacturing sector continues to expand at a faster pace in April. A quick estimate by Jibun Bank with a PMI in production of 59.6 was announced on Friday. That’s more than 53.3 in March, and it moves further above the 50-point burst or crash line that separates the spread from the contraction.

Individually, both outbound and new orders expanded at the fastest rate since April 2018, while new export orders also accelerated.

Business sentiment improved in April, marking the 11th month in a row of optimism among Japanese producers.

-

Support

-

Platform

-

Spread

-

Trading Instrument