EUR/GBP forecast for January 12

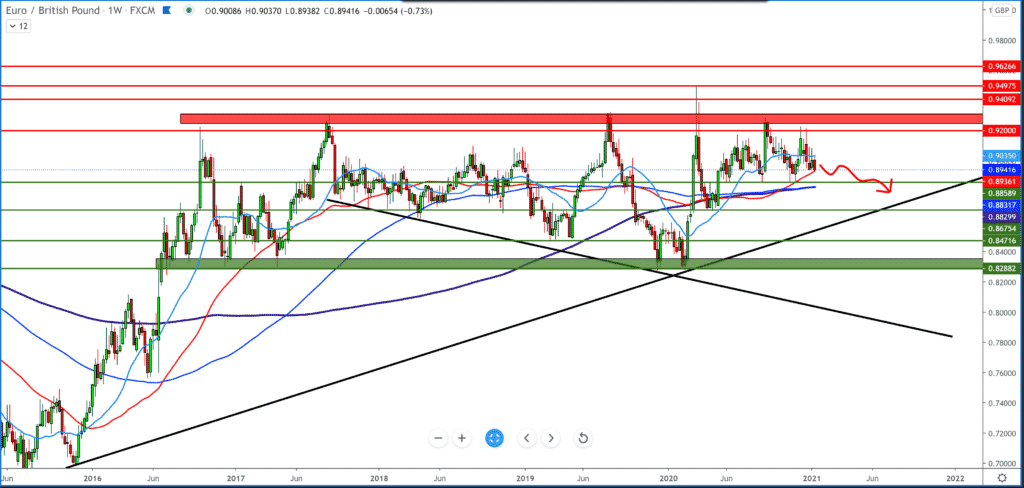

Looking at the graph on the weekly time frame, we see that the pair fails to cross the 0.92000 limits and that when that resistance occurs, it plummets. The current situation is more in favor of the pound, while the euro is under pressure, and we can probably see this pair below 0.89000, and maybe later to 0.88000. The break was made below the moving average of the MA20 and is currently testing the MA50 at 0.89300. We have better support down on the MA200 at 0.88200. Otherwise, if the MA50 lasts, then we go up towards 0.90000 and MA20 at 0.90300.

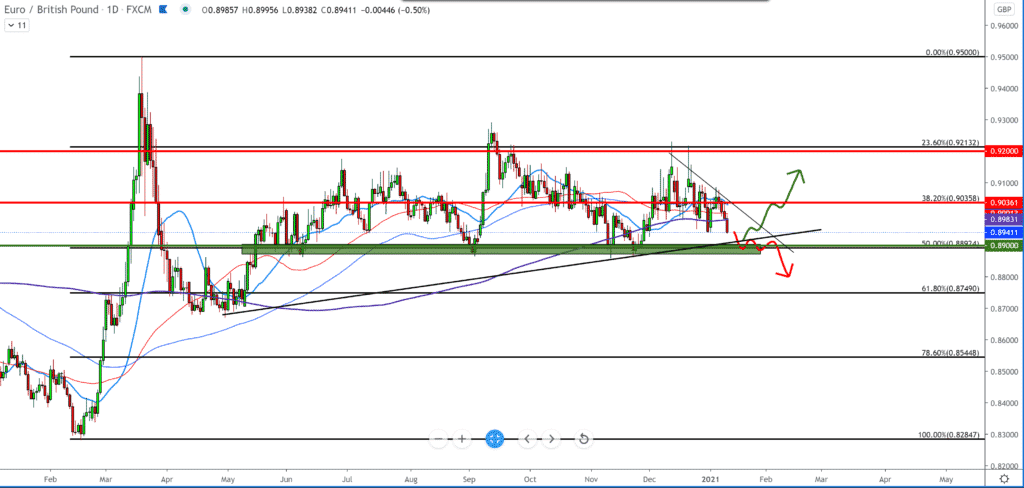

We can follow the Fibonacci level on the daily time frame, where the pair fell below 38.2% to 0.90300. Thus, we can ask for support at 50.0% at 0.89000. the pair is below all moving averages, and therefore the bearish scenario on the daily chart is very likely.

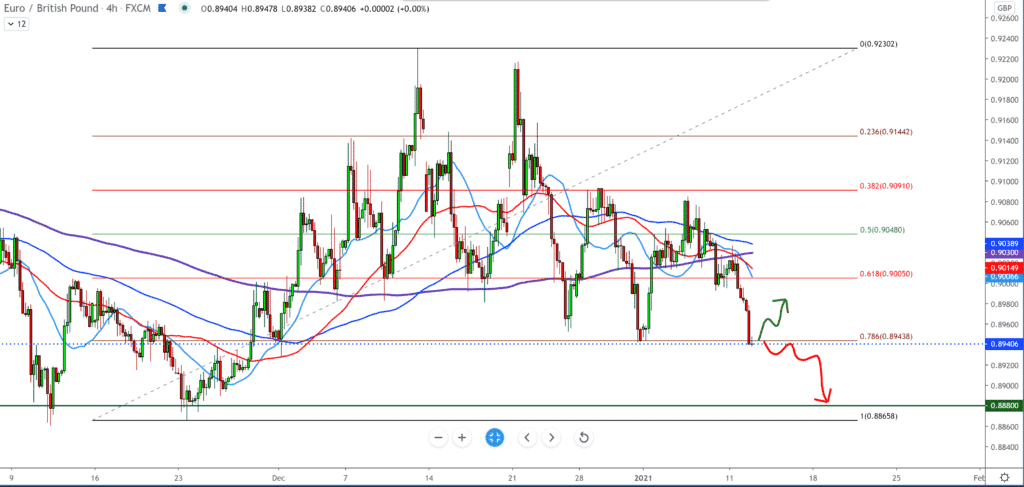

On the four-sided time frame, we can again follow the Fibonacci retracement level. The pair is now at 78.6% level, and last time we had a rejection at the same level. Now the bearish momentum is a shade stronger, and there is a chance that the pair will break below that level and continue further down at lower levels. Looking at the moving averages, we see that the break below them is made at 0.90200 and that after that, the pair falls towards lower levels. If we now look at the bullish option to start at this level, the target can be 0.9000, where the pair will encounter Moving Averages and potential resistances.

From today’s news, we can single out: retailers in the UK that recorded the worst record year for sales growth due to the Covid-19 pandemic, data released by the British Retail Consortium or BRC showed Tuesday. In 2020, total retail sales decreased by 0.3 percent, which is the worst annual change since the beginning of the records in 1995, BRC said. The EMA also said earlier that they had received an application for the AronaZeneca vaccine against coronavirus, with an opinion on the authorization possible to be issued by January 29. So that’s a timeline that needs to be monitored in the coming weeks. The early optimism of the vaccine raised a lot of hope that things could be better by the first half of 2021, but now most of it is moving back to the second half of 2021.

-

Support

-

Platform

-

Spread

-

Trading Instrument