EUR/CAD analysis for April 22, 2021

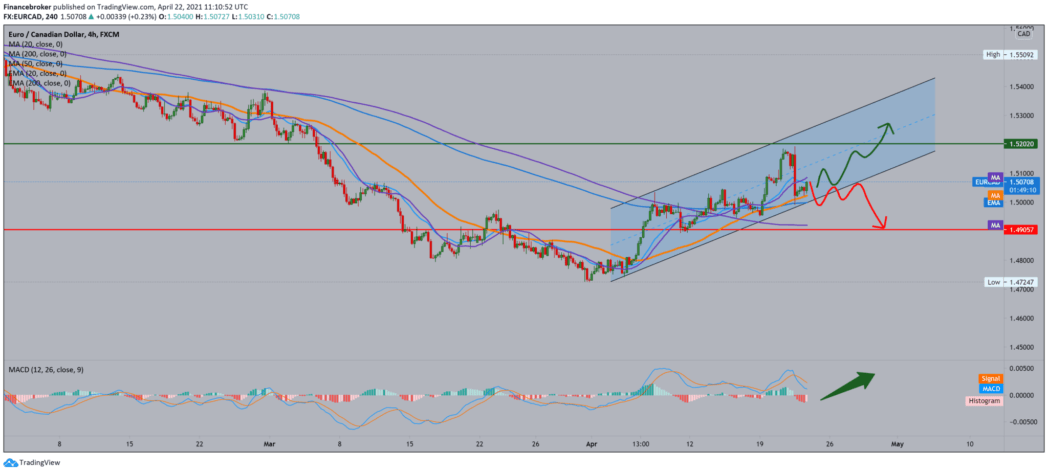

Looking at the chart on the four-hour time frame, we see that we are also moving in a growing channel. And let’s now test the bottom line of the channel with support with moving averages. Yesterday we had the news of the Bank of Canada on the interest rate, which the bank left at the same level, giving strength to the Canadian dollar, lowering the EUR/CAD pair from the April high from 1.52000 to 1.50000. If the EUR/CAD pair follows the channel, we can expect growth to the upper canal line and re-test the zone around 1.52000.

For the bearish scenario, we need a pullback below the channel’s bottom line, with the MA200 as potential support. The MACD indicator signals to us that there is a slowdown in the bearish trend and that we expect a possible pullback to the bullish side.

On the daily time frame, we see a bullish trend from the beginning of April, with the support of moving averages MA20, EMA20, and MA50. Based on that, we look towards MA200 and EMA200 at 1.52500 at 50.0% Fibonacci level. Our maximum target on this time frame is 1.53800 on the Fibonacci 61.8% level. Looking at the MACD indicator, we see that we are in a bullish trend, and we can expect continued growth towards higher levels.

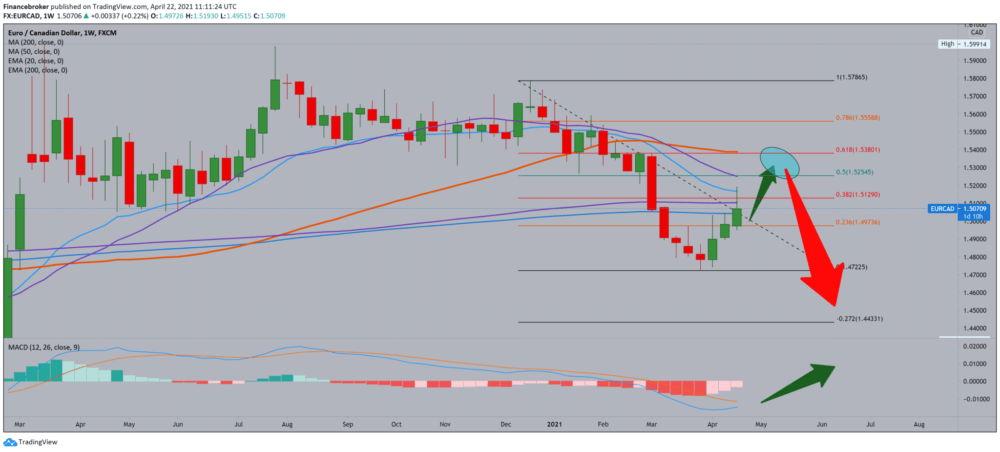

On the weekly time frame, we see that the EUR/CAD pair has come out of the bearish trend and now see a pullback. Support at 1.47225, and after that, we go up. As the first break, 23.6% Fibonacci levels, followed by 38.2% levels with testing of MA200 and EMA200 in the psychological zone around 1.50000. A break above 38.2% leads us to 50.0% at 1.52500, with a maximum view at 61.8% at 1.53800. The MACD indicator has turned to the bull’s side, and now we only need the blue MACD line to be above the signal line, which will be additional support for the current bullish trend.

-

Support

-

Platform

-

Spread

-

Trading Instrument