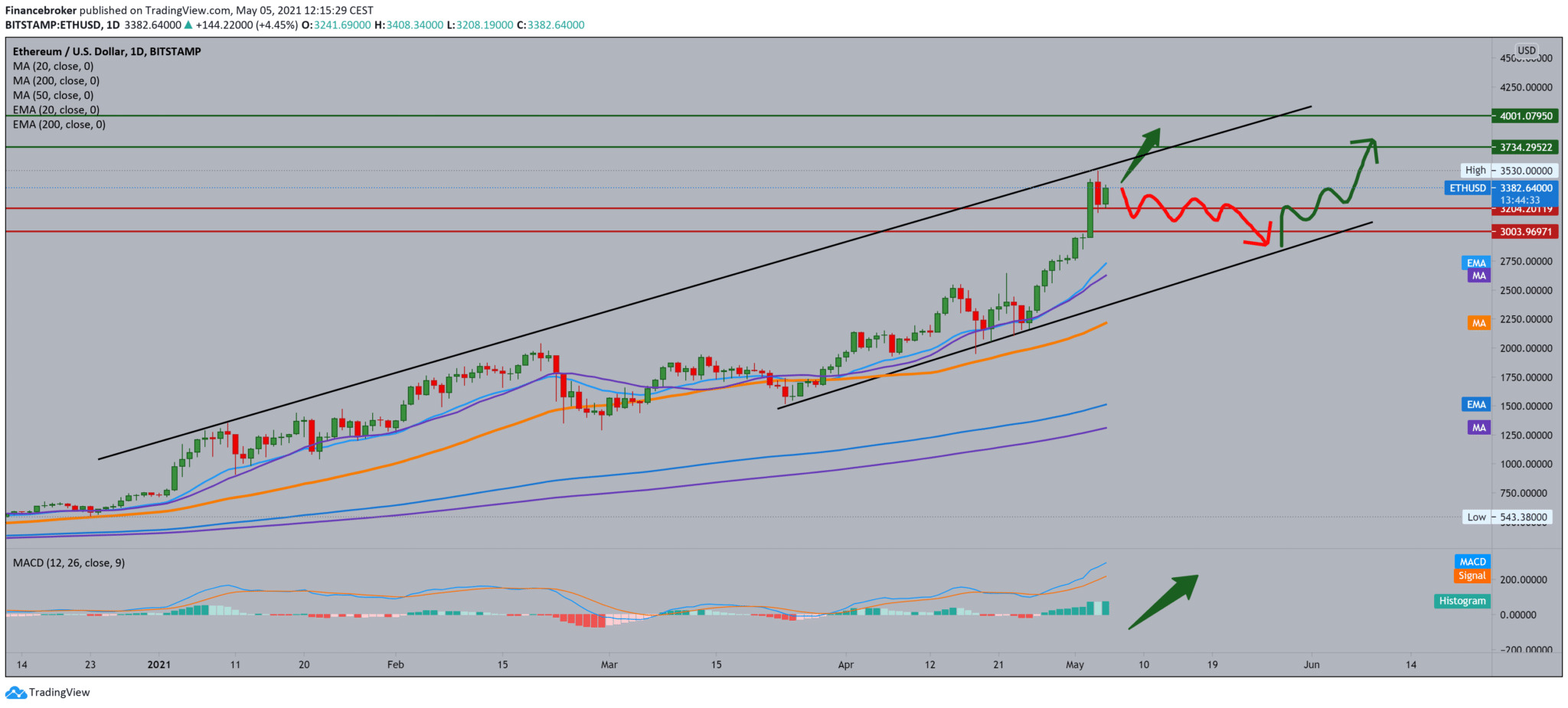

Ethereum analysis for May 5, 2021

Looking at the chart on the daily time frame, we see that we are bullish today and that the chart is making a potential FLAG pattern, and for better confirmation, we need a break above $ 3530 current historical high. We can also form a growing channel on the chart, and as such a scenario and reaching the top line, and we now expect consolidation before the next bullish momentum. Moving averages move parallel to the bottom line of the channel, and it will likely attract the price of Ethereum closer to them. If we ignore the channel, then our expectations are purely bullish without any consolidation. We are just waiting for the next bullish impulse to raise Ethereum to new historic highs on the chart.

Looking at the MACD indicator, the signal is also pure bullish without any weaknesses, and based on it, and we continue in the bullish trend. The rapidly growing pace of Defi has reached the point where it is starting to struggle with centralized financial institutions.

The price of Ethereum has been the subject of debate in the cryptocurrency ecosystem since it reached a new all-time high of $ 3,524 on May 4. Contrary to popular belief, a look at Ethereum’s chain metrics suggests that the recent rise is just the beginning of parabolic progress. Although the fees required for transactions on the Ethereum blockchain are relatively high, most users stick to ETH. There are many reasons for that, but it is primarily due to the first mover’s advantages. Ethereum is the first to popularize the concept of a “smart contract.”

The move has attracted curious developers and users who continue to build on ETH and are responsible for the ecosystems that communicate with it. Phenomenon explains why the community, be it investors, users, or developers, is attracted to Ethereum despite its inability to scale over the last few years, indicating an inherent demand for what it offers. This demand is tangible when you look at the seven-day average of total fees collected on the Ethereum blockchain, which reached $ 32.8 million in May 2021.

With Ethereum at the helm, Defi has seen tremendous growth, with the total locked-in value currently at $ 76 billion, an increase of 83% over the past year.

As a review of Ethereum, the total amount settled by the smart contracts platform in April 2021 is 216 billion dollars. While PayPal, the centralized payment processing giant, reported approximately 2.76 times smaller monthly transaction volume. Suffice it to say that Ethereum and its constituents, like Defi, are starting to struggle with participants in centralized finance.

-

Support

-

Platform

-

Spread

-

Trading Instrument